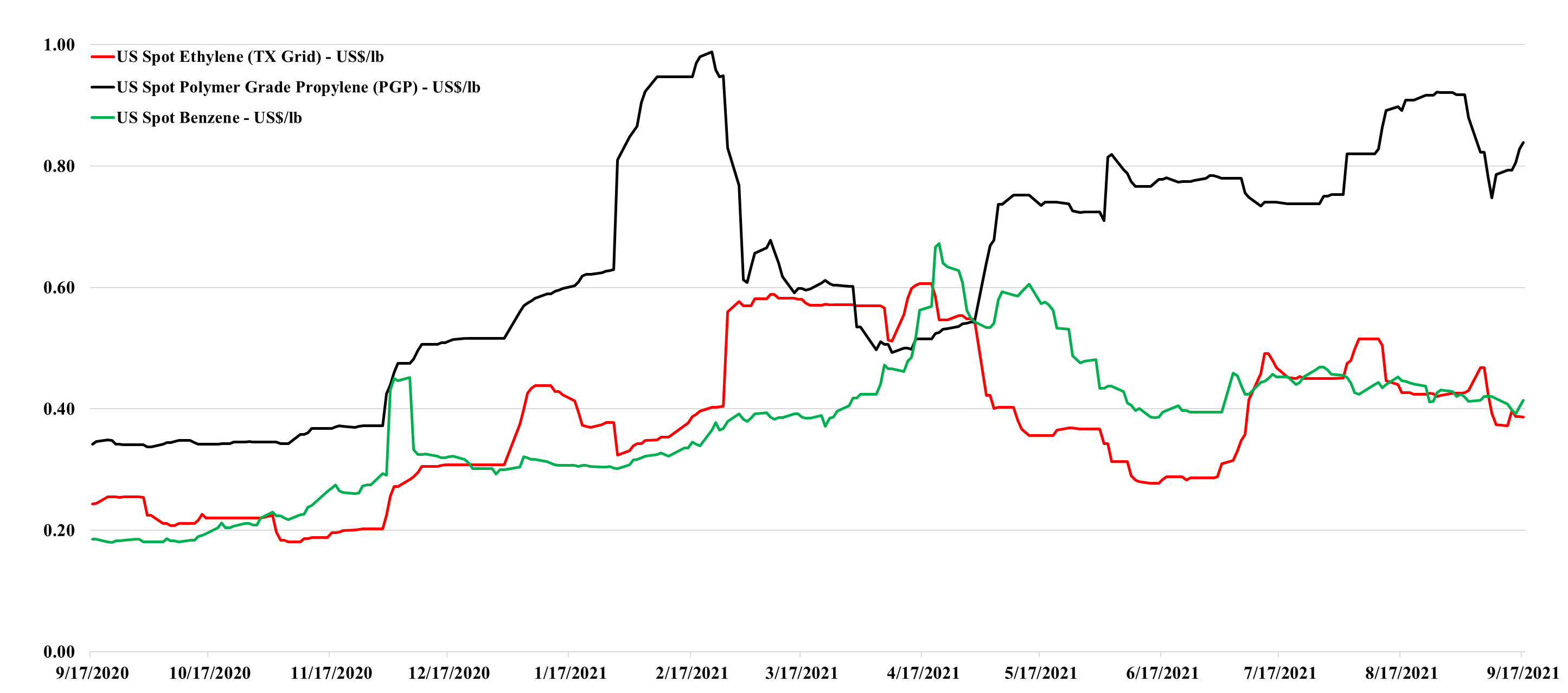

We continue to see significant volatility in US product prices, and this increases uncertainty around the underlying direction of the markets for the balance of the year. The recent storms have likely created enough production interruptions to take any slack that had been developing in August out of play, and while we see that in the most recent moves for ethylene and propylene – Exhibit below - it is likely more interesting to see what happens with polymer pricing as we move through the balance of September – as this will determine profits for most. While we focus on the high prices in the US more than we do the prices in Europe, it is also worth noting that European polyolefin margins remain very high, with one local producer confirming this week that records continue to be set in terms of cash flows and unit profitability. The frustration for the US producers impacted by the storm is that while their plant closures may be contributing to the tight markets, they do not get the benefit of the higher margins on the impacted facilities. While we would expect many to produce extremely high numbers for 3Q – a handful will likely lament how much they could have made had their plants operated fully. See more in today's daily report.

Volatile Pricing Obscures Underlying Direction For Chemicals & Plastics

Sep 17, 2021 12:40:41 PM / by Cooley May posted in Chemicals, Polymers, Polyolefins, Propylene, Plastics, Ethylene, polymer pricing, volatility, US producers

US Ethylene: The Volatility Continues

Jul 20, 2021 3:29:38 PM / by Cooley May posted in Chemicals, Ethylene, supply and demand, volatility

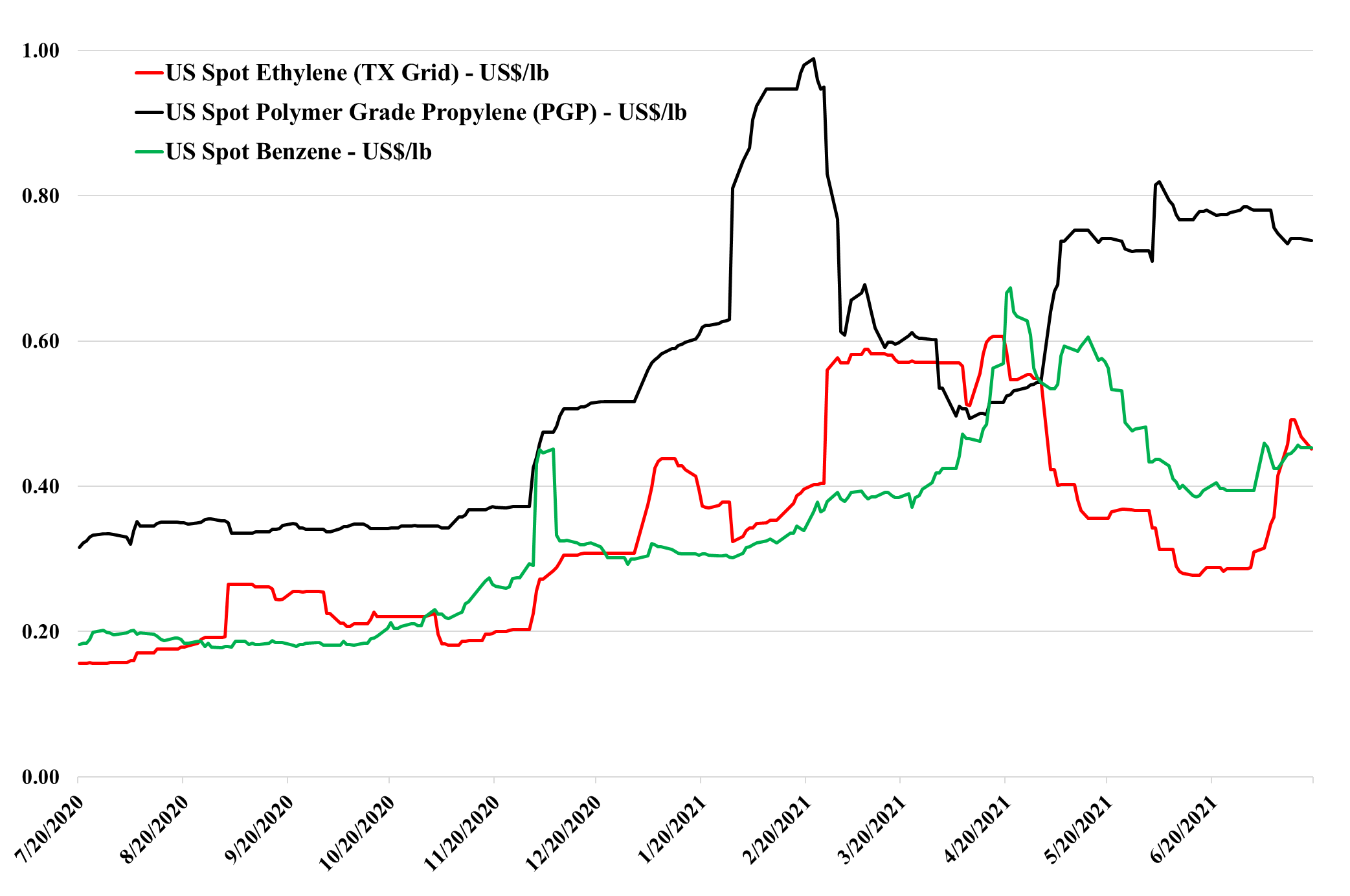

We note the volatility in ethylene in the chart below and point out that ethylene sits in a precarious no-mans-land in the US with pricing neither reflecting costs nor incremental value in use. The downside to generating buying interest in Asia is significant – more than 25% - but an incremental buyer in the US could pay much more than the current price – in many cases to meet export obligations, let alone for domestic sales. We would expect the volatility to continue, with a downside from better production rates and upside from more constraints – demand fluctuations are likely immaterial relative to the impact that supply moves could have. See more in today's daily report.