ExxonMobil Chemicals has announced that its Corpus Christi JV project with SABIC is ahead of its original schedule – ExxonMobil is now targeting a start-up in 2H21, ahead of its previously targeted 1H22 expectation. It is unusual for projects in the US to be ready ahead of schedule these days, and start-up delays tend to be the norm. We also take a positive view of this development upon comparison to the Shell Pennsylvania project, which still has a vague 2022 start-up expectation though its construction began before ExxonMobil. One could argue that the remoteness of the location – well away from petrochemical infrastructure has been a constraint for Shell, but the Corpus Christi location is also a greenfield project for ExxonMobil/SABIC. This will be the largest ethylene plant built in the US, though it is likely that the recent 1.5 million ton units (Dow, ExxonMobil, CP Chem) are expandable to 2.0 million tons. Dow is already discussing such a move with a new polyethylene facility at Freeport. It will be interesting to see what impact this ExxonMobil/SABIC facility has on both the USGC ethane market and the polyethylene market – 1.3 million tons of polyethylene is a large increment and SABIC will have half of the capacity and will be a new market entrant with on-shore production. Aramco has ethylene, through Motiva’s purchase of Flint Hills, and SABIC owns half of the Cosmar styrene plant in Louisiana.

ExxonMobil, SABIC JV Petrochemical Project Runs Ahead of Schedule

Jul 27, 2021 3:41:21 PM / by Cooley May posted in Chemicals, Polyethylene, Ethylene, Styrene, ExxonMobil, petrochemicals, petrochemical capacity, Dow, Sabic, Gulf Coast Growth Ventures, Aramco, Motiva, NPV, chemical plant, ethylene plant

Could Big Oil Capital Reallocation Drive More Chemical Supply?

Jun 10, 2021 1:27:19 PM / by Cooley May posted in Chemicals, Polymers, Climate Change, Oil Industry, Ethylene, Carbon, ExxonMobil, fossil fuel, hydrocarbons, Dow, Base Chemicals, Sabic, JV, Engine No. 1

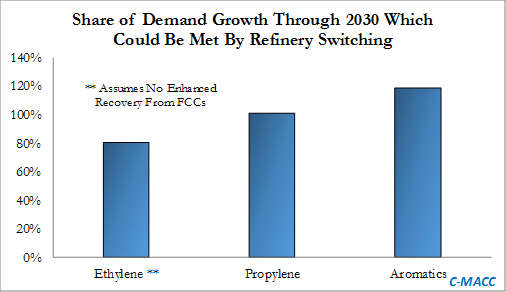

The ExxonMobil board headline linked has come up a couple of times since the Engine No.1 victory at the board meeting. There is no doubt that capital spending plans will be reviewed with the changes at the top, and we expect more management changes, which could also drive spending priorities. Over the last couple of years, several more macro studies have been done talking about oil demand in a climate change-centric world and all have highlighted chemicals as one of the likely longer-term growth avenues for fossil fuels. We would expect ExxonMobil and other oil majors to look at investments in chemicals as a route to more captive consumption of hydrocarbons and believe that this could ultimately keep basic chemical and polymer markets oversupplied through the balance of this decade – we have been writing about this risk consistently since early 2020. ExxonMobil is already building ethylene capacity in the US in a JV with SABIC, but more oil company investments could come in the US. The caveat is that, as Dow covered in its MDI press release yesterday, any new investment is likely to need a carbon plan to get stakeholder and regulatory approval.