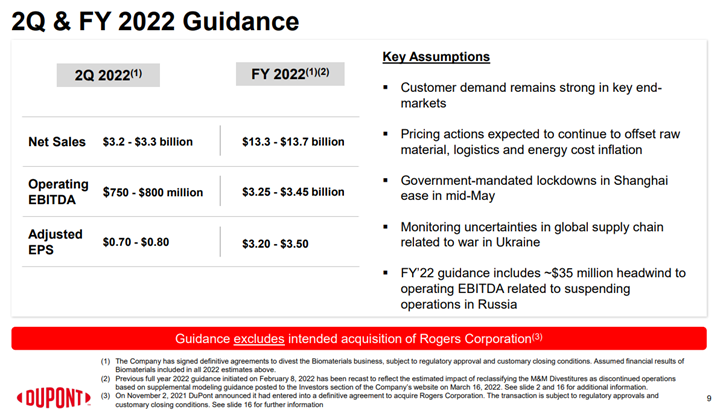

Like many of the European producers, DuPont has taken a risk in our view by holding guidance flat in the face of inflation, weakness in China, and a potential further economic slowdown in Europe and the US. We struggle with what an alternative approach should be for DuPont and others, given that it would be challenging to map out a credible downside scenario today. What we would note, however, is that when things turn negative for the materials industries they tend to fall quickly and sharply. For all of the base chemical and specialty chemical companies what might upset things for 2022 are largely outside of their control, and it is hard to second guess cutbacks in customer demand until they happen, especially in an environment where all are looking at volatile costs from energy and consumer spending uncertainty because of inflation. For more see today's daily report.

DuPont: Too Optimistic But Hard To See An Alternative

May 4, 2022 2:20:10 PM / by Cooley May posted in Chemicals, Energy, Inflation, Base Chemicals, specialty chemicals, chemical producers, materials, DuPont

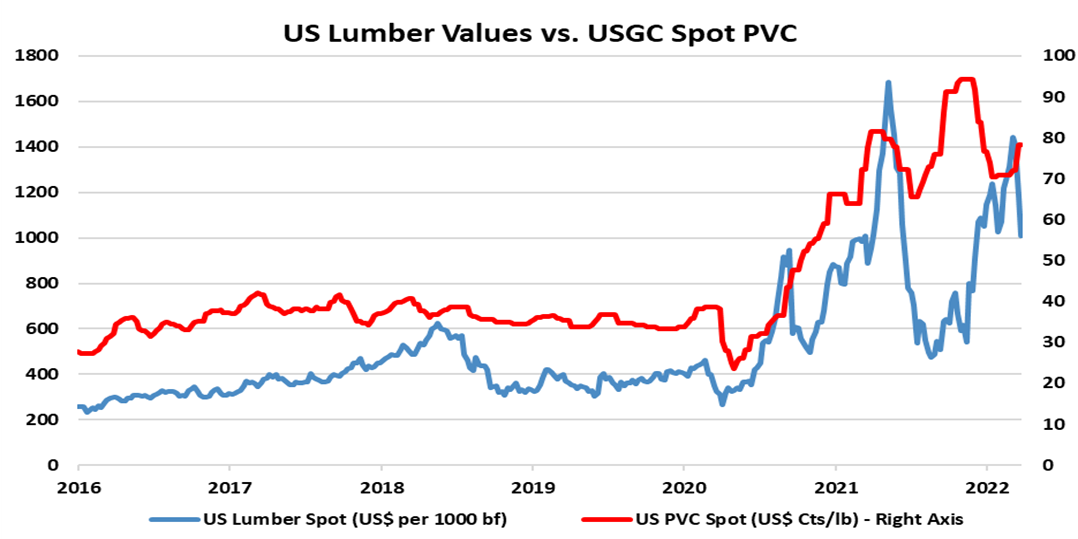

Building Products Mostly Strong Despite Rising Rates

Mar 30, 2022 12:09:01 PM / by Cooley May posted in PVC, Polyethylene, recycled polymer, Lumber, Base Chemicals, Westlake, Building Products, S&P, footprint

We focus on the building products industry today and it is interesting to note the convergence of the S&P Building Products index and Westlake over the early part of this year, as Westlake has been recognized for its building products footprint, partly aided by the company’s re-segmenting with the last quarterly earnings. The company has reached an all-time high stock price over the last few weeks and has certainly been a great preferred pick for us over the last two years. As interest and mortgage rates rise, we may see a slowdown in home buying as there is generally a good correlation, but this often leads to more home projects as consumers choose not to move and improve what they have.

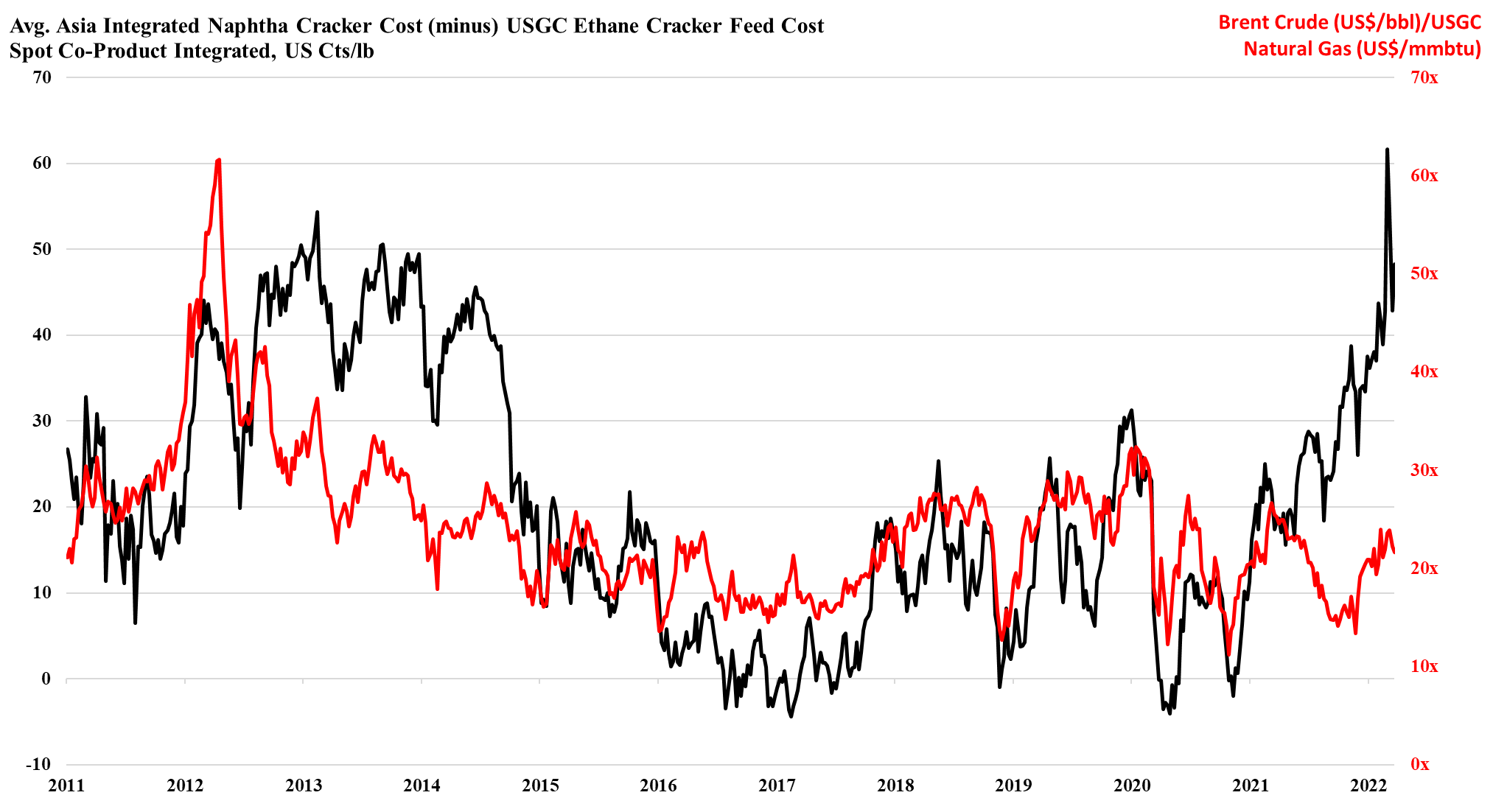

Some Chemical Plants May Not Survive This Feedstock Squeeze

Mar 29, 2022 2:25:44 PM / by Cooley May posted in Chemicals, Polyethylene, Emissions, Carbon Price, decarbonization, Base Chemicals, polymer, chemical companies, feedstock costs, feeedstock

We noted in today's daily report the number of shutdowns that are taking place in Asia and in Europe as feedstock costs become unmanageable, and the assumption is that these units will restart when economics recover. This may not be the case as companies factor in the costs of operating smaller units in an emission-constrained world, and the decision to shut down for economic reasons today may be the final nail in the coffin for some older and generally less economic base chemical units. Many smaller facilities in China were built in the 80s and 90s and these might not come back online if there is no easy way to lower emissions, but the harder decisions will likely be in Europe.

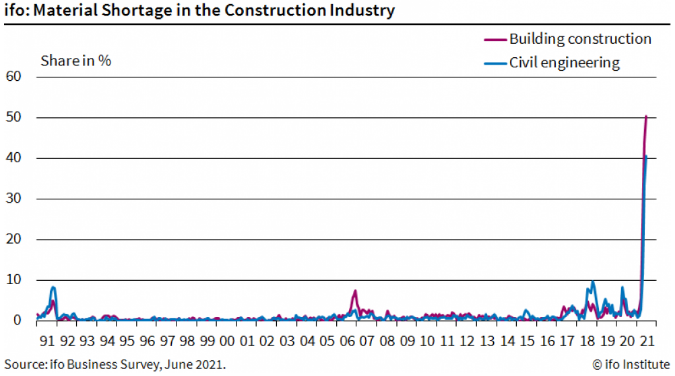

Construction Material Shortages Break Records

Jul 9, 2021 12:54:09 PM / by Cooley May posted in Chemicals, Polymers, Raw Materials, Supply Chain, freight, Base Chemicals, Basic Chemicals, construction material

The German materials shortage chart below is certainly eye-catching. There is nothing even remotely close in 30 years of history. We see this as further confirmation that we should continue to expect high shipping rates and congested ports until surveys like this show significantly better results and it is also further supportive of inflation. While it is extremely difficult to forecast from here, we would use the pendulum or spring metaphor – the further you pull either in one direction, the further they swing or spring back. The current dislocation is so extreme that everyone in the chain is likely acting instinctively and working to find greater supply and greater supply security. At some point, both end-demand and demand to fill inventories will normalize – either back to trend or back to a higher trend, but the inventory build piece will end and we will either get a gradual retreat in the scary data – such as the spike in the chart below – or we will see an equally quick collapse, at which point pricing will likely take a hit down the chain, with basic chemicals particularly vulnerable because the world has been adding substantial new capacity over the last several years in the US and China. More investment may be needed to keep up with higher trend demand in many intermediate or end-products that consume base chemicals and this could keep pricing supported, but basic chemicals and polymers look especially vulnerable to a reversal in the supply chain build we have seen for the last 9 months. For more see today's daily report.

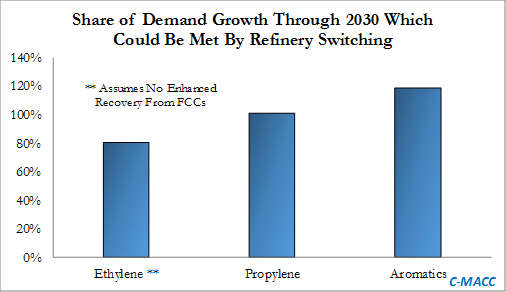

Could Big Oil Capital Reallocation Drive More Chemical Supply?

Jun 10, 2021 1:27:19 PM / by Cooley May posted in Chemicals, Polymers, Climate Change, Oil Industry, Ethylene, Carbon, ExxonMobil, fossil fuel, hydrocarbons, Dow, Base Chemicals, Sabic, JV, Engine No. 1

The ExxonMobil board headline linked has come up a couple of times since the Engine No.1 victory at the board meeting. There is no doubt that capital spending plans will be reviewed with the changes at the top, and we expect more management changes, which could also drive spending priorities. Over the last couple of years, several more macro studies have been done talking about oil demand in a climate change-centric world and all have highlighted chemicals as one of the likely longer-term growth avenues for fossil fuels. We would expect ExxonMobil and other oil majors to look at investments in chemicals as a route to more captive consumption of hydrocarbons and believe that this could ultimately keep basic chemical and polymer markets oversupplied through the balance of this decade – we have been writing about this risk consistently since early 2020. ExxonMobil is already building ethylene capacity in the US in a JV with SABIC, but more oil company investments could come in the US. The caveat is that, as Dow covered in its MDI press release yesterday, any new investment is likely to need a carbon plan to get stakeholder and regulatory approval.

Base Chemicals May Be Weaker, But Nothing Else Is

Jun 8, 2021 12:35:56 PM / by Cooley May posted in Chemicals, Polymers, Commodities, Ethylene, Base Chemicals, intermediates, downstream, Capacity shortages, derivatives

There is an interesting difference between the base chemicals markets and some of the other broad commodities and intermediates, and we have economic growth that is testing the capacity limits for many commodities and downstream products, but the overbuild in basic chemicals, most recently in China, is putting significant downward pressure on pricing, as we highlighted in yesterday’s Weekly Report. Capacity shortages in intermediates and some specialties, which are driving the investments we highlighted in today's daily report and which are a steady flow of news this year, are leading to some expanding margins over base chemicals in select areas where capacity has not kept pace with demand.