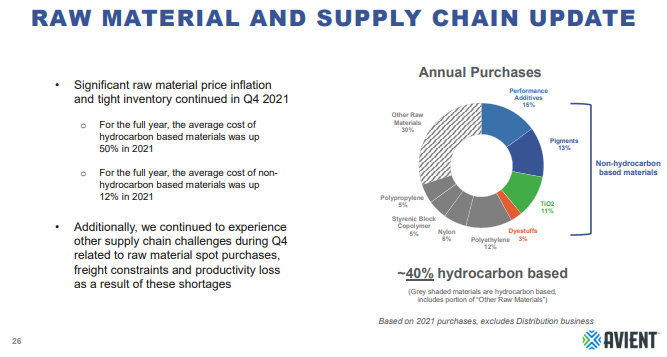

As Avient and the linked paint article remind us, there are sectors of the US chemical industry that rely on imported products – in these cases pigments, and the supply chain challenges and logistic delays have caused production problems in the US and price increases in 2021. The automotive segment of the paint industry has seen lower demand because of the auto OEM production slowdown, and pigment shortages and price spikes would likely have been worse if automakers had been running at full rates. There is no sense of impending relief in the logistic issues as we go through 4Q earnings reports and we could continue to see issues for a while. This should be good for US-based pigment suppliers, but while Chemours, Venator, and Tronox all have capacity in the US, they also have capacity outside the US which likely faces some supply chain challenges.

Raw Materials Inflation Not Over For Specialty Materials

Feb 8, 2022 3:04:30 PM / by Cooley May posted in Chemicals, Polymers, Plastics, Raw Materials, raw materials inflation, Chemical Industry, petrochemicals, US Chemicals, Avient, US Polymers, specialty chemicals, materials, DuPont, plasticsindustry, supply chain challenges, logistic inflation

Higher Ag Commodity Prices Are Helping Crop Protection Demand

Feb 4, 2022 1:25:18 PM / by Cooley May posted in commodity prices, materials, crude oil, crude prices, Agriculture, fuels, agriculture commodities, soy prices, Soy, Corn, Canola, Corteva, Crop demand

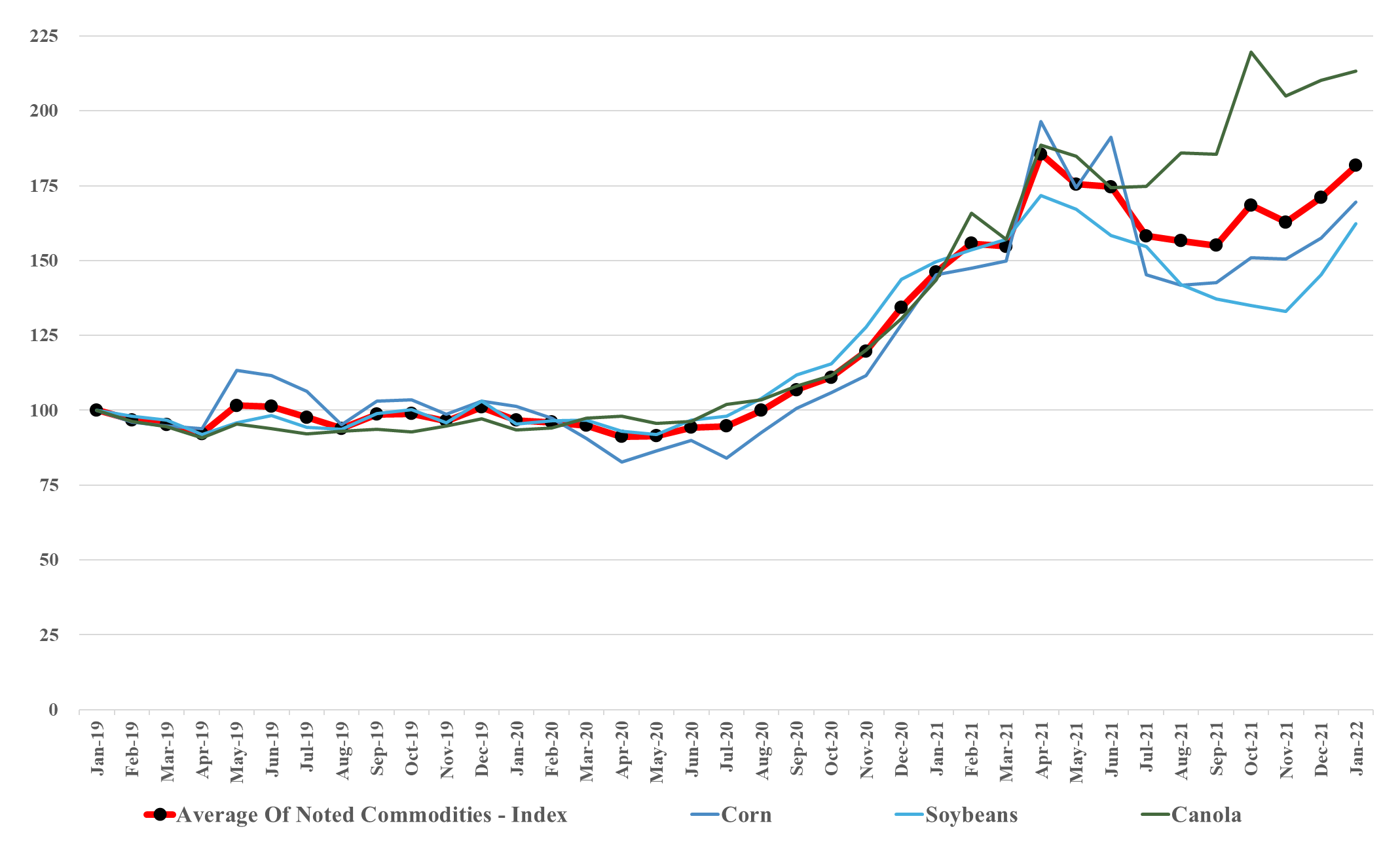

We show the correlation between soy prices and crude oil in Exhibit 1 in today's daily report, but note all the higher prices in the Exhibit below for corn, soy, and canola. This is providing a good backdrop for the crop protection industry, as seen in Corteva’s numbers. Farmers can afford to spend more to improve yields. We expect this trend to continue as demand for food will continue to grow and we will see incremental demand for fuels and materials.

Ashland's Results Provide Another Example of Materials Inflation

Feb 3, 2022 1:40:02 PM / by Cooley May posted in Chemicals, Materials Inflation, Inflation, Chemical Industry, Supply Chain, downstream, specialty chemicals, materials, downstream producers, Ashland, logistic constraints

With the linked Ashland release, we see another example of a downstream chemical maker struggling with higher input costs and general logistic constraints, and an inability to push through pricing quickly enough to avoid a margin squeeze. The opaqueness that Ashland discusses concerning some of the planning metrics for the near-term is impacting forecasts and estimates for many more companies than just Ashland but given the costs and the supply chain challenges, all are encouraged to push through pricing aggressively, and this suggests that we are far from done with the materials inflationary pressures that we have discussed at length in prior reports and the higher costs of some of these specialty chemicals will start to impact customer margins through 2022. Almost all the earnings reports that we see discuss strong end-market demand and whether this is final customer pull-through or a need to address chain inventory or both, it should support further price initiatives. For more on our inflation views see Inflation (Especially Energy Costs) – Biggest 2022 Wildcard.

More Signs That Shortages Of Chemicals Are Likely

Jan 28, 2022 3:27:25 PM / by Cooley May posted in Chemicals, Commodities, Polyethylene, Metals, solar, EV, wind, polymer demand, materials, shortages, Olin, ESG Pressure, mega-cycle, chemicals shortage, chlor-alkali, underinvestment

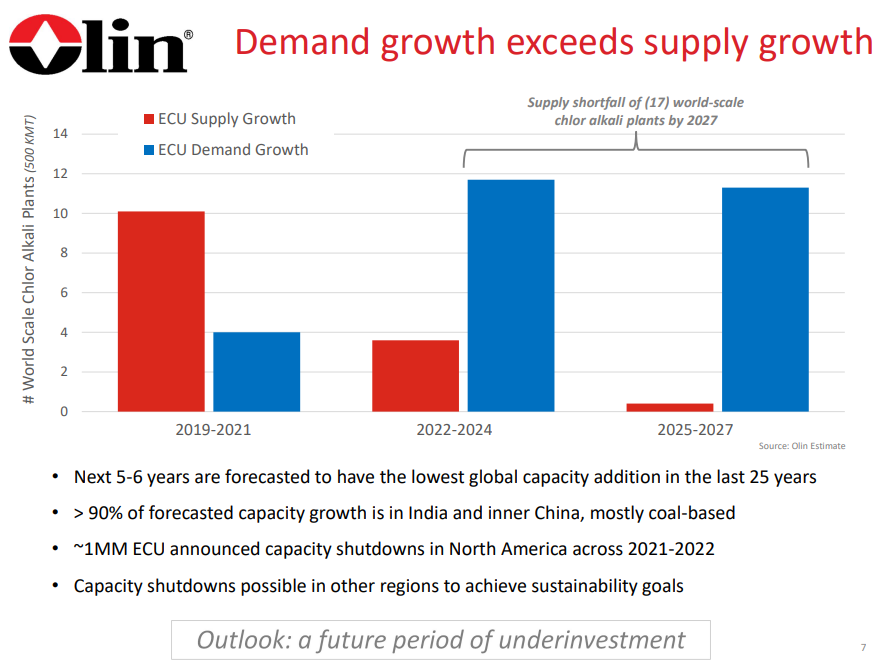

We are already seeing the impact of ESG-pressure related underinvestment in many commodities, and the picture that Olin paints around chlor-alkali is not dissimilar to some of the analyses that could be done around some metals today – especially those that are critically important to the EV, Solar, and Wind industries – this is a topic that we have covered at length. While chlor-alkali may be a pressing very near-term example of how underinvestment could impact chemicals, we suspect that the issue may be much broader, just not yet apparent in other sectors because of the wave of new investment from 2017 through 2022. The polyethylene equivalent chart to the one below would show more balanced supply/demand in the 22 – 24 period than for chlor-alkali but the same deficit thereafter. Many of the other base chemicals would look the same. This supports our expectation of an industry mega-cycle, possibly starting as early as 2023. Of course, there is time to add new capacity by 2025/26, but most companies are more focused today on how they comply with tighter environmental standards today than they are on their next expansion. Further hindering new expansion-driven capital investment decisions is the uncertainty around polymer demand (how much will be recycled, will there be more bans, will there be a substitution from other materials). Our view is that base polymer demand will continue to grow and that we will run short as a consequence of underinvestment. See our report titled - Waiting For The Big One – Is A Chemical Mega-Cycle Ahead?

Another Example Of Materials Inflation For Renewable Power - Good For Chemicals

Jan 26, 2022 3:56:25 PM / by Cooley May posted in Chemicals, Renewable Power, Materials Inflation, Inflation, natural gas, polysilicon, Wacker, silicon, solar module, materials, solar installations, US natural gas prices, solar panel, equipment supply

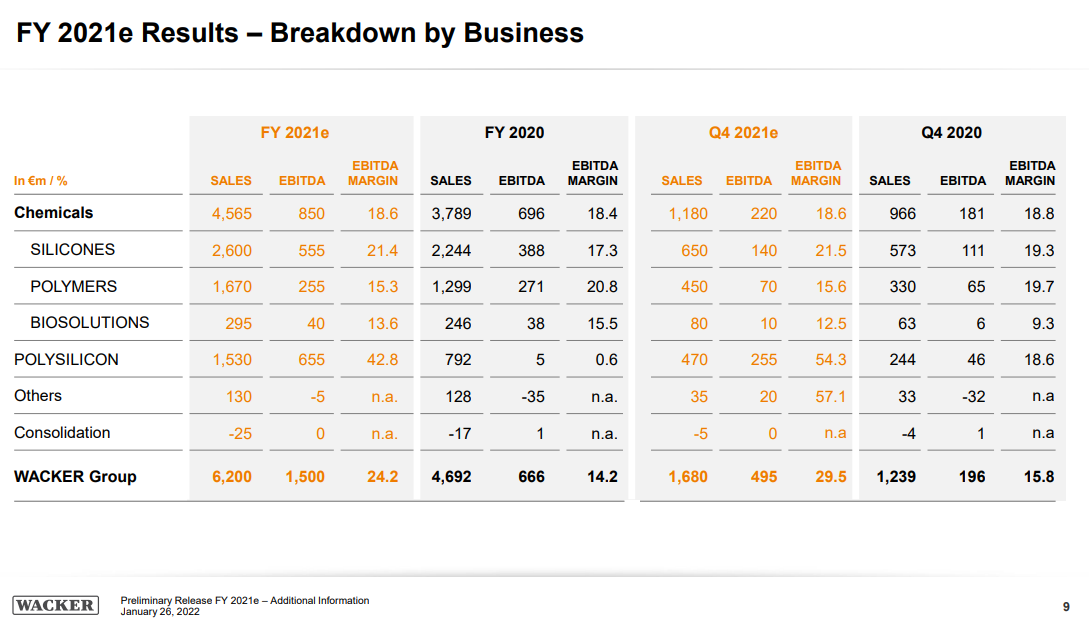

While this is covered in more detail in our ESG report today as well as our daily report, we highlight the Wacker results below. This confirms a key inflation fear for renewable power, as we see the rapid increase in silicon and polysilicon sales at Wacker – Exhibit below. Wacker has certainly seen significant volume growth between the periods highlighted, but the step-up in demand will have allowed the company to move prices up., something we have been noting for months, but it is good to have confirmation. This is additional cost pressure for the solar panel manufacturers and is driving solar module prices higher. Given the expected demand growth for solar installations, we see no reason why this demand-pull should ease any time soon. While this is a problem for the solar industry, their materials suppliers could do very well for many years.