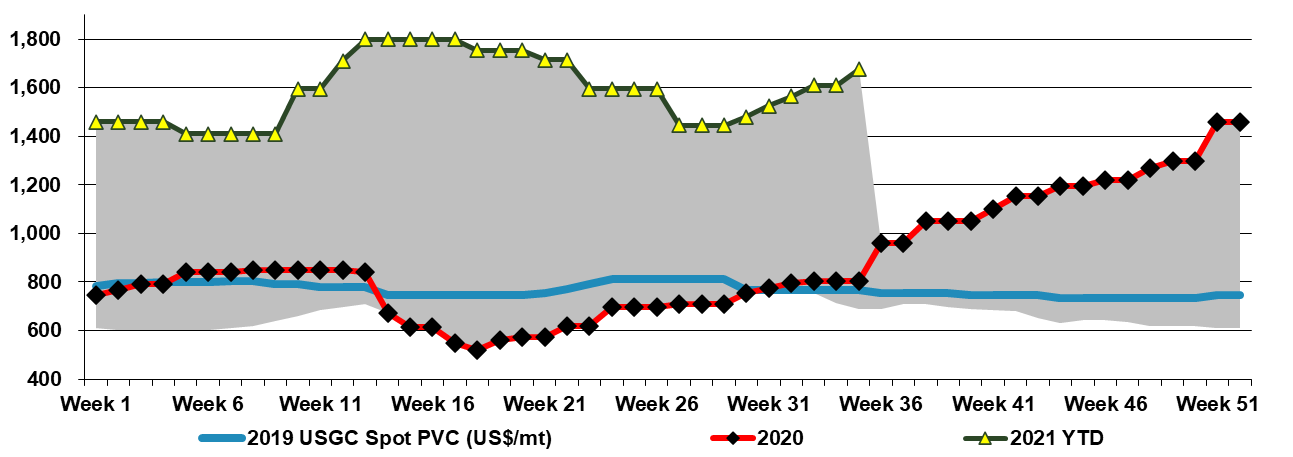

It is increasingly likely that Hurricane Ida will add another leg of strength to US chemical pricing more broadly, with a host of prolonged production outage news and force majeure notices, giving momentum to some price increase announcements for September, some of which looked very speculative at the time they were made. Buyers will have an eye on continued pockets of supply chain disruption, strong demand in general, particularly for those levered to holiday spending, and the not insignificant fact that we still have almost three months of hurricane season to go! Note that two of the more disruptive storms of 2020 hit in October. We talk specifically about PVC in today's daily - See price chart below.

More Examples Emerge Of US Chemical/Polymer Market Tightness Post Ida

Sep 3, 2021 1:18:43 PM / by Cooley May posted in Chemicals, Polymers, Polyolefins, PVC, US Polymer, Ethylene, US Chemicals, olefins, US polyethylene, Hurricane Ida, Chemical pricing, ethylene prices

US Ethylene - Spot Market Shows Strength WoW, Likely To Remain Volatile in 2H21

Jul 7, 2021 3:03:39 PM / by Cooley May posted in Chemicals, Polypropylene, Ethylene, propane, Lotte Chemical, US Chemicals, Ethylene Surplus, US ethylene, US ethylene surplus, NGL, LPG cracking capacity

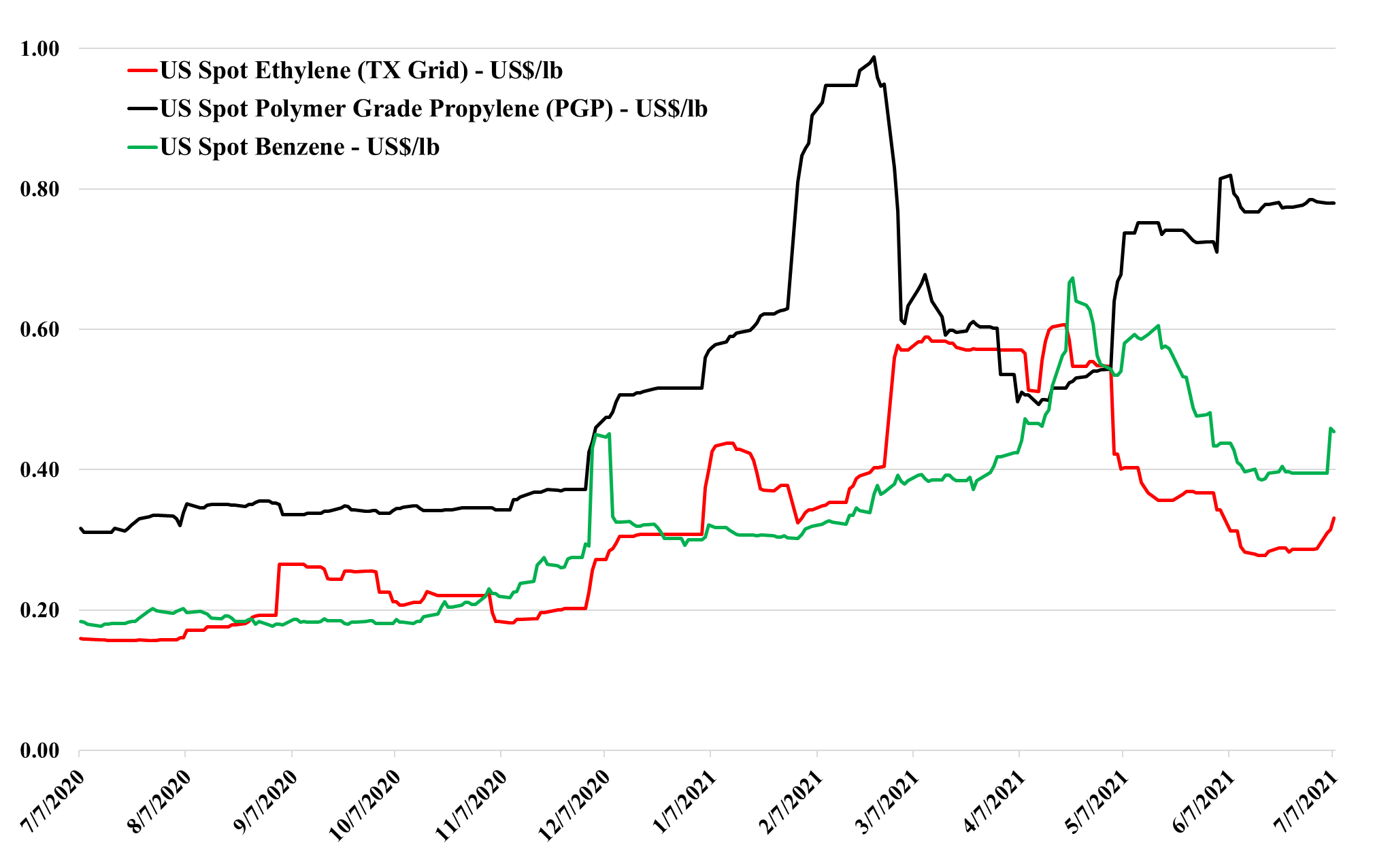

The US ethylene market strengthened slightly in early July, most likely because of supply disruptions as it is hard to see how domestic demand could improve from here. There is not much room to increase prices further if the export market is the balancing mechanism through July and August, as prices remain depressed in Asia and any arbitrage would close quickly if prices in the US moved any higher. Despite the rising NGL prices discussed in today's daily report and on Sunday, the US has plenty of margin left in ethylene, and prices could go lower if that is necessary to move additional volume. While we talk in the opening paragraph about increased inventories of finished goods in anticipation of the year-end holiday season and continued supply constraints, and how this is leading to a shortage of warehouse space, we suspect that everyone upstream of the finished good suppliers is also looking at adding or maintaining a larger inventory cushion than they have in recent years. We still believe that it is a tough call today as to whether you should sell surplus ethylene or store it as we head into hurricane season in the US.

Basic Chemicals Weakening In The US - Ethylene May Have More Risk

Jun 2, 2021 3:04:46 PM / by Cooley May posted in Chemicals, Ethylene, Ethylene Price, US Prices, polymer grade propylene, US Chemicals, Ethylene Buyer

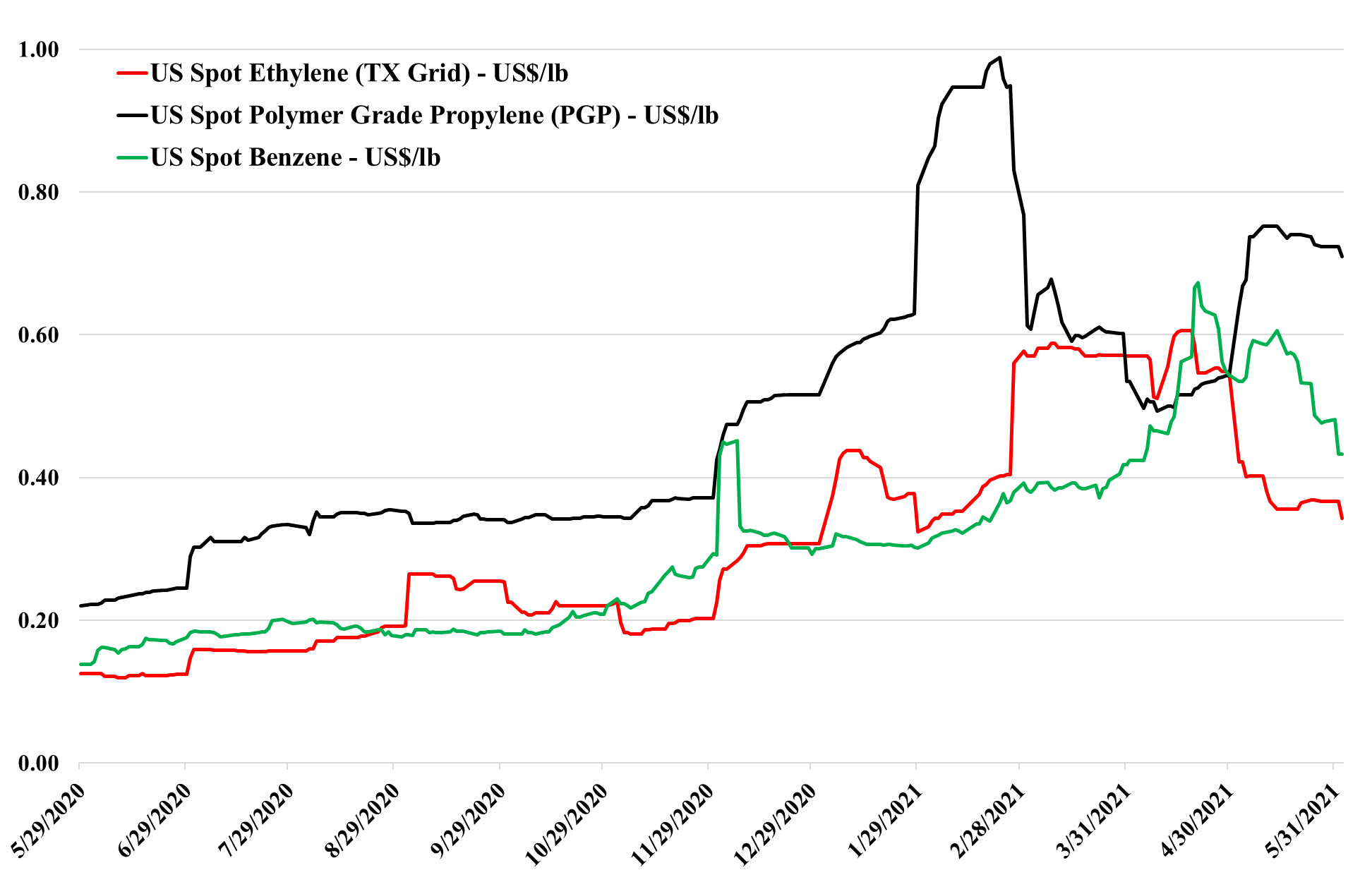

The easing of US base chemical spot pricing continues and has now spread, as expected to polymer grade propylene. Supply now appears to be back to levels that do not reflect weather-related interruptions and despite the very strong downstream demand in the US the inevitable monomer surpluses are appearing. The US is a net importer of benzene and consequently, we see a floor being reached pretty quickly here, and while propylene prices could drop much further, PDH economics will provide support, and with a higher propane price, that support will likely be much higher than the price support for ethylene.

The Friday Question: What is Next for US Monomers?

May 28, 2021 3:36:36 PM / by Cooley May posted in Chemicals, Propylene, Methanol, Ethylene, Benzene, Monomer, supply and demand, Lotte Chemical, US Chemicals, marginal export, derivative export, MEG

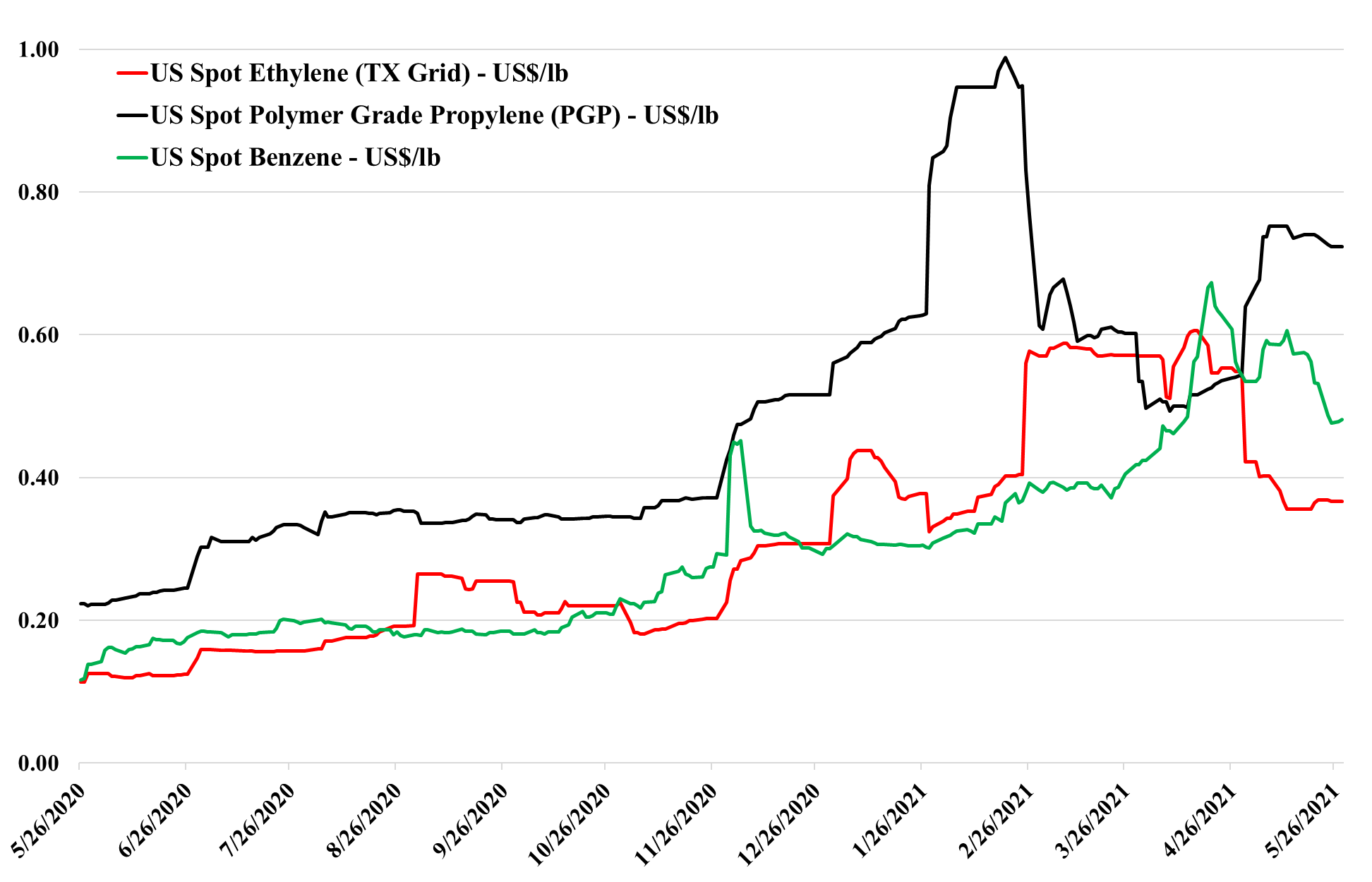

The weakness in US monomer pricing has stalled this week, and buyers and sellers may be exploring marginal export or derivative export opportunities at these levels. Further weakness will come if attempts to export only serve to undermine pricing in the markets they are targeting. Underlying demand remains very strong and this is a supply-driven issue as US ethylene plants run back towards full rates and incremental refinery supply impacts the benzene and propylene markets. See today's report which includes detailed commentary on methanol in addition to the products in the chart.