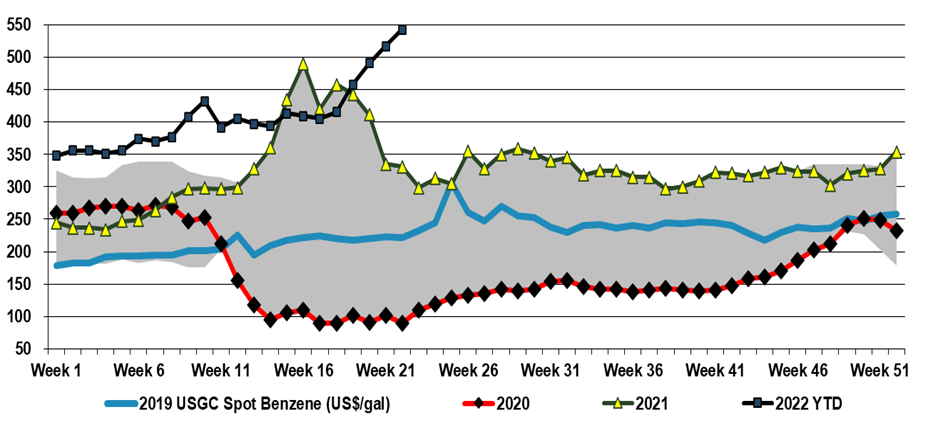

US benzene prices reflect both the net short market in the US but also the alternative value of reformate as a gasoline feed. While benzene is very limited in terms of how much can be left in fuel streams, its refinery-based feedstock, reformate, is a key component in gasoline – albeit low octane – prior to reforming and even during reforming the benzene conversion can be limited if the gasoline value is higher and volumes are constrained. In the US, as well as in many other parts of the world, we are facing gasoline shortages and today more than 13 US states have gasoline prices above $5 per gallon. While that may be shocking to Americans, the car ride from Heathrow yesterday was in a very popular make in the US that currently costs more than $200 to fill up in the UK! So benzene is getting squeezed – its feedstocks are more expensive and some of the alternatives to making benzene currently offer better netbacks. While we see all polymer costs rising in the US and elsewhere, this US benzene surge is not good for US polystyrene producers at a time when the industry is trying to justify polystyrene’s existence in a “circular” world, and it is also inflationary for the epoxy businesses, and other consumers of both styrene and phenol.

Benzene: Tightness Persists, Derivatives Mixed

Jun 7, 2022 2:47:09 PM / by Cooley May posted in Styrene, Benzene, Inflation, feedstock, polystyrene, polyurethanes, gasoline, US benzene, MDI, gasoline shortage, epoxy, phenol

Runaway Trains Into Weaker Demand?

May 13, 2022 1:40:50 PM / by Cooley May posted in Chemicals, Polymers, Propylene, Ethylene, Styrene, Benzene, US Chemicals, natural gas, manufacturing, EDC, ethylene glycol, demand, US chemical rail, ethylbenzene

The US chemical rail volumes should be considered in the context of some of the slowing demand that has been indicated by companies downstream of chemicals, and we see this as further evidence for possible inventory build through the chain. Earlier in the year these builds would have been justified by supply chain issues that have plagued all segments of retail and manufacturing for close to two years, but today we should be at or above inventory comfort levels. We are calling for weakness in demand and some margin erosion in US chemicals and polymers in 2H 2022, before a strong rebound as early as 2024, but if buyers of polymers and chemicals and their customers look to reduce inventories more quickly, the landscape could change quickly. While this is possible, with the threat of higher energy prices very real, we would be surprised in anyone was interesting in dramatically lowering inventories today.

US Ethylene Decoupled From Global Costs

Mar 8, 2022 2:05:18 PM / by Cooley May posted in Chemicals, Propylene, Ethylene, Benzene, propane, natural gas, Ethylene Surplus, ethylene exports, US propylene, crude oil, crude prices, Global Costs

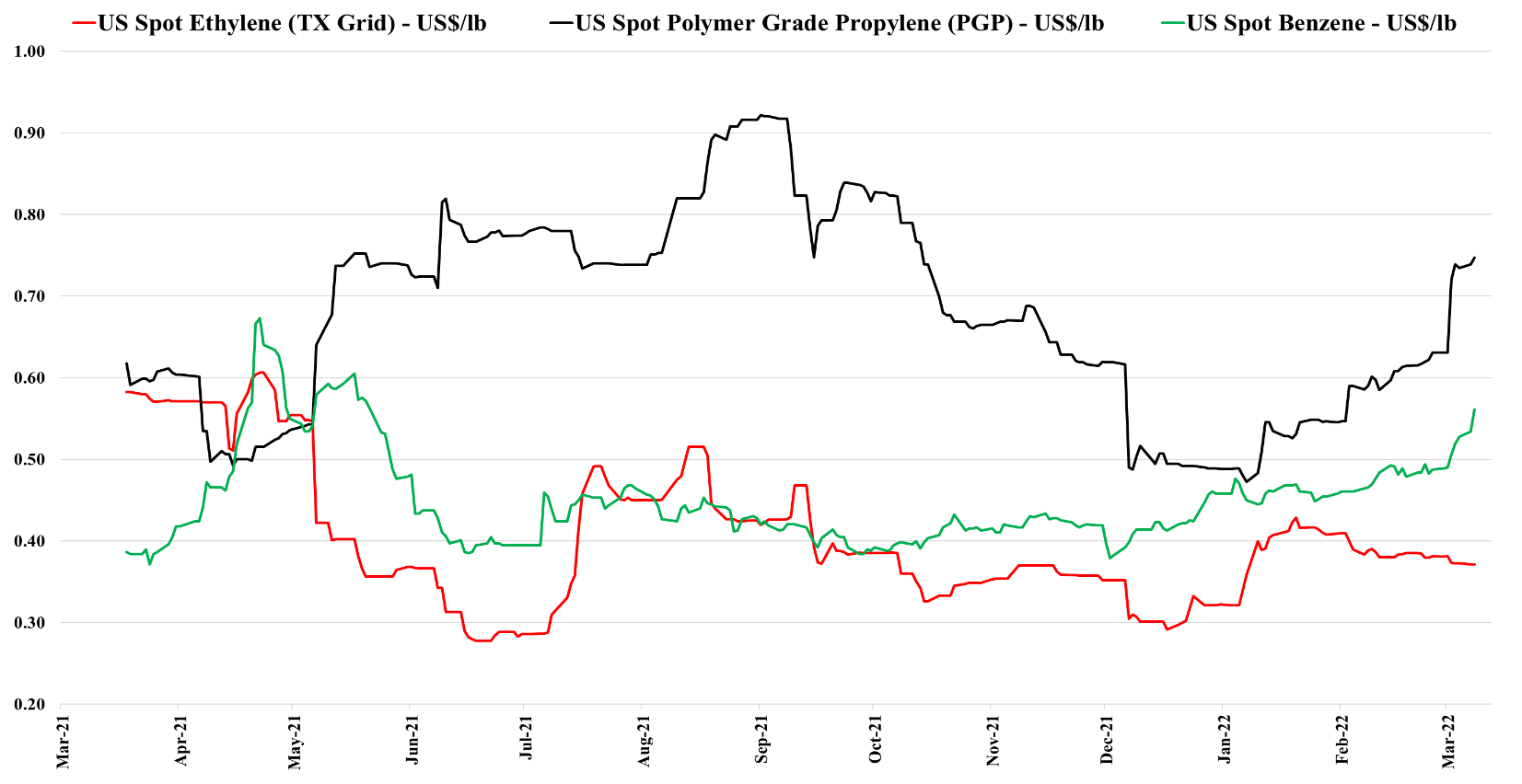

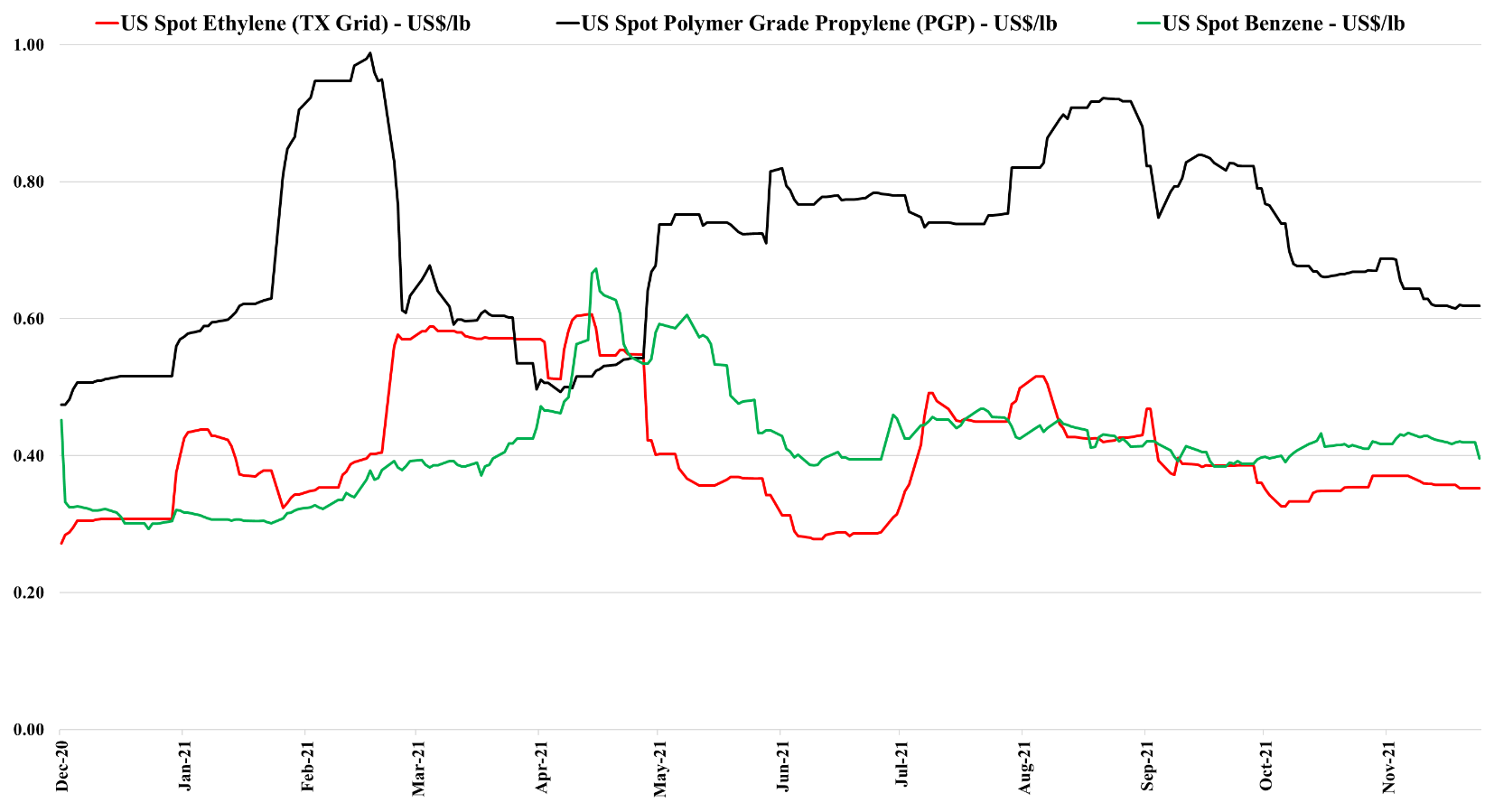

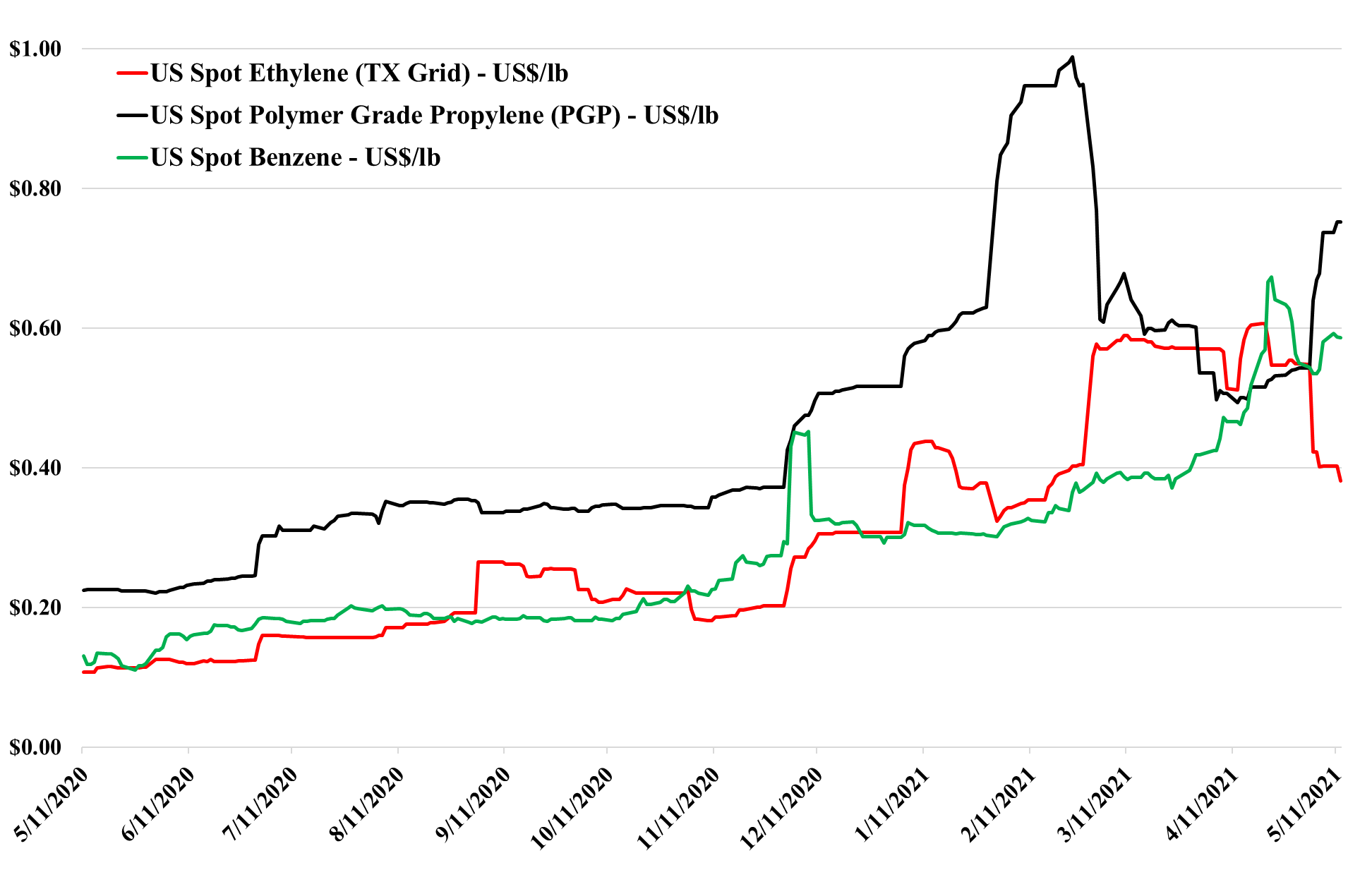

It is interesting to note the rapid rise in US propylene (and benzene) values as they follow propane and crude prices (propane is following crude because of its heating value and export opportunities). Ethylene is not moving as US natural gas is in surplus and is not following international natural gas prices. The US is surplus ethylene and derivatives, but we would expect to see ethylene and ethylene derivative prices jump up in the US if Europe is physically unable to make ethylene and derivatives or if the costs in Europe become so high that supplying incremental volumes from the US becomes even more compelling. For more see today's report titled "Into The Mystic – Ex-US Energy Price Surge Favors US Producers; Low Visibility Keeps Capex In Check".

A Quieter End To A Volatile Chemical Year

Dec 31, 2021 12:15:57 PM / by Cooley May posted in Benzene, Chemical pricing, ethylene prices, propylene prices

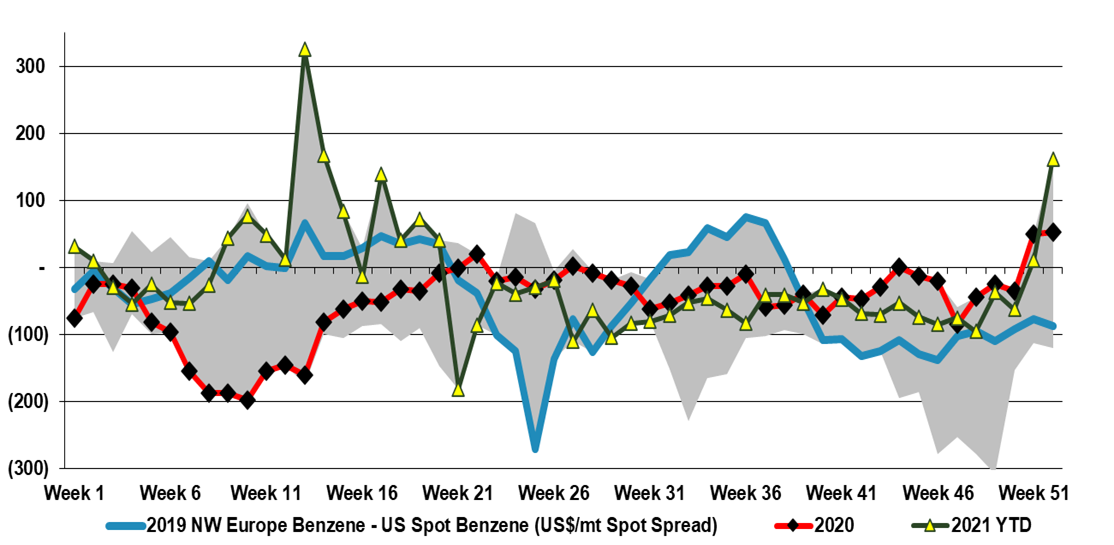

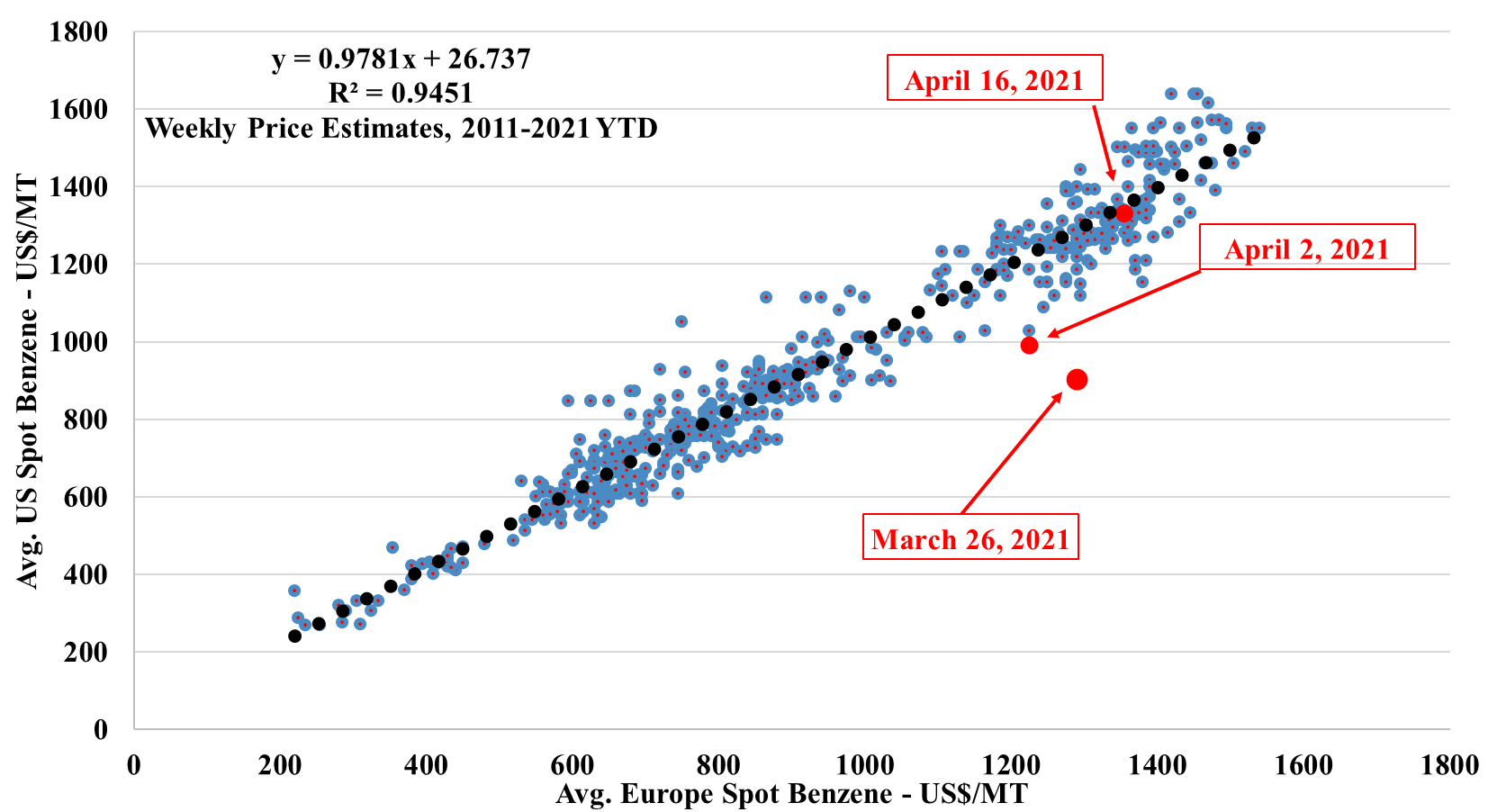

The surge in European benzene pricing (first chart below) is likely a function of lower production as refiners adjust to account for the new COVID restrictions in the region, lowering short-term demand for jet fuel and gasoline. Prices in Europe are high enough today to justify shipments from the US but are more likely to result in shipments that were bound for the US heading to Europe instead. By contrast, US refining rates are edging higher, as the holiday season has created more demand for air travel and gasoline, despite the rise in COVID.

Energy Moves Could Drive US Chemical Price Volatility

Nov 30, 2021 1:46:26 PM / by Cooley May posted in Chemicals, Polymers, Propylene, Ethylene, Energy, Benzene, PGP, Oil, US Chemicals, ethane, natural gas, US ethylene, Basic Chemicals, naphtha, polymer, polymer production, NGLs, ethylene feedstocks, crude oil, chemicalindustry, US benzene

The drop in US benzene pricing is likely a function of lower crude oil pricing and the overall impact this is having on oil product values. As the US has moved to much lighter ethylene feedstocks, the proportion of benzene that is coming from refining is overwhelming and alternative values for benzene or reformate in the gasoline pool are a strong driver of US and international pricing. Lower naphtha pricing for ethylene units outside the US will also hurt benzene values. By contrast, the stronger natural gas market – through the end of last week - supported ethane pricing in the US and we saw a step up in propane pricing – which have provided support for ethylene and propylene – also note that the analysis we published yesterday in the weekly catalyst suggests that the US can export ethylene to Asia at current prices – delivering ethylene into the region below current local costs. This should keep a floor under US ethylene pricing although any further decline in crude oil prices relative to US natural gas and NGLs will close this arbitrage.

The Friday Question: What is Next for US Monomers?

May 28, 2021 3:36:36 PM / by Cooley May posted in Chemicals, Propylene, Methanol, Ethylene, Benzene, Monomer, supply and demand, Lotte Chemical, US Chemicals, marginal export, derivative export, MEG

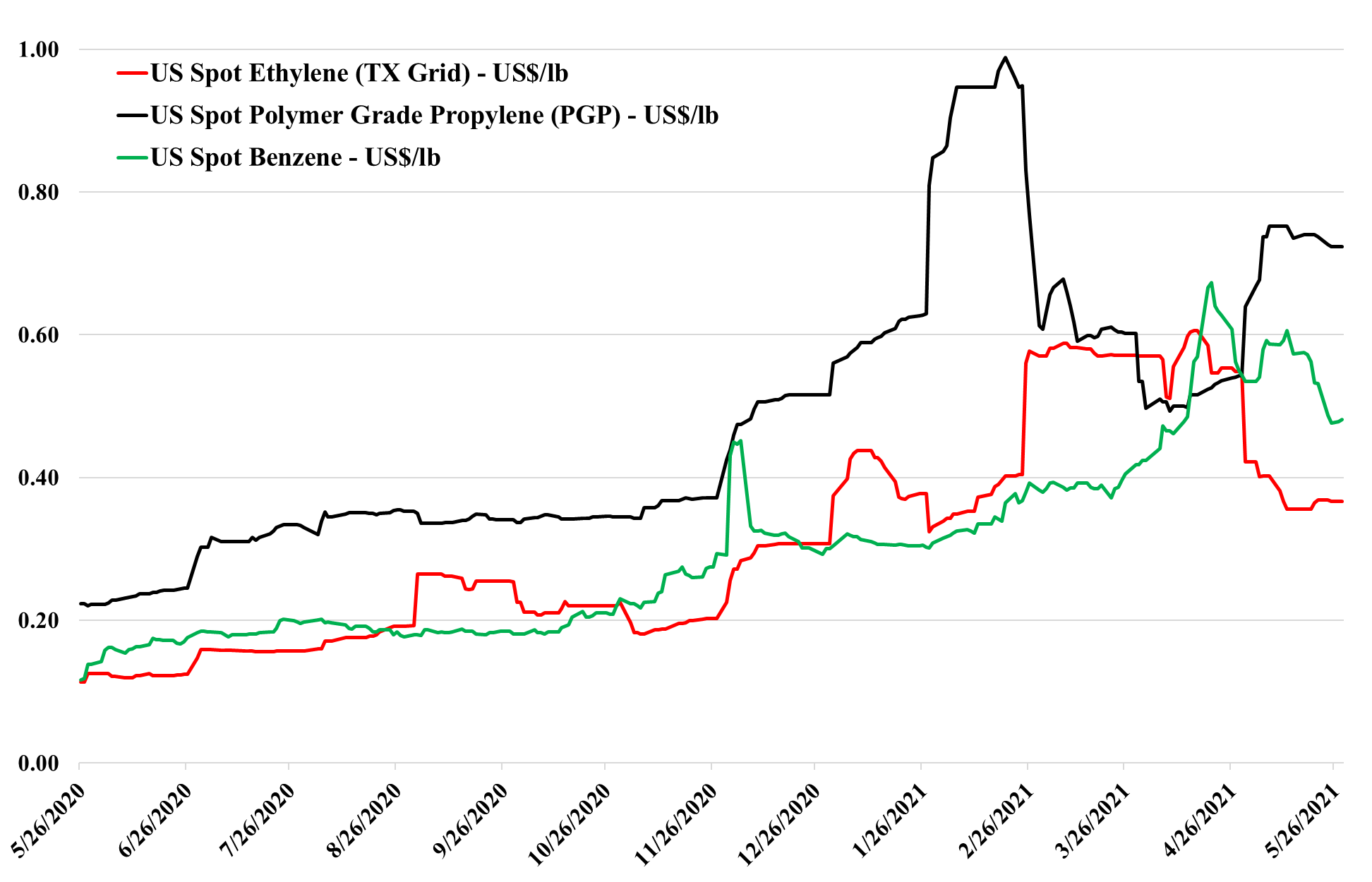

The weakness in US monomer pricing has stalled this week, and buyers and sellers may be exploring marginal export or derivative export opportunities at these levels. Further weakness will come if attempts to export only serve to undermine pricing in the markets they are targeting. Underlying demand remains very strong and this is a supply-driven issue as US ethylene plants run back towards full rates and incremental refinery supply impacts the benzene and propylene markets. See today's report which includes detailed commentary on methanol in addition to the products in the chart.

There May Be Limited Interest In Surplus US Ethylene

May 12, 2021 1:35:57 PM / by Cooley May posted in Propylene, Ethylene, Benzene, Ethylene Price, Sasol

As we highlighted in yesterday's report, ethylene continues to weaken (see chart below) in the US and it is the one product with a true supply/demand-driven problem today – there is simply more capacity to produce ethylene in the US than there is the capacity to consume it. This is a recent phenomenon and has been clouded by the various storm-related outages, the delay in the Sasol start-up. We began to see the length in the ethylene market lats last year and physical export volumes jumped dramatically – fully loading the terminal in Houston for loadings from November through January. This was based on pricing from October through December that created a significant arbitrage to ship to Asia – partly because a few of the China integrated projects had ethylene derivative projects complete before ethylene units were complete. The risk for US ethylene is that it could go much lower – barring outages – as there is no one left in the US who can take a marginal ton, most likely, and China seems well supplied. For more details please see today's daily.

US and European Benzene Prices Normalize as Expected

Apr 16, 2021 4:54:05 PM / by Cooley May posted in Chemicals, Polymers, Ethylene, Benzene

So, if you had been able to play the obvious arbitrage in the exhibit below when we published it first in March, you would have done quite well. You would have done better if you had just bought benzene on both continents, but you would have taken more risk. We like these scatter charts and we will use them more often when there are obvious regional arbitrages or just product arbitrages within a region. The overall benzene tightness has been caused by production outages in the US, shipping issues to Europe, and very strong demand for benzene derivatives. The start-up of the Shell POSM unit in the Netherlands has likely added to the imbalance as the facility is a major ethylbenzene consumer.