The US chemical rail volumes should be considered in the context of some of the slowing demand that has been indicated by companies downstream of chemicals, and we see this as further evidence for possible inventory build through the chain. Earlier in the year these builds would have been justified by supply chain issues that have plagued all segments of retail and manufacturing for close to two years, but today we should be at or above inventory comfort levels. We are calling for weakness in demand and some margin erosion in US chemicals and polymers in 2H 2022, before a strong rebound as early as 2024, but if buyers of polymers and chemicals and their customers look to reduce inventories more quickly, the landscape could change quickly. While this is possible, with the threat of higher energy prices very real, we would be surprised in anyone was interesting in dramatically lowering inventories today.

Runaway Trains Into Weaker Demand?

May 13, 2022 1:40:50 PM / by Cooley May posted in Chemicals, Polymers, Propylene, Ethylene, Styrene, Benzene, US Chemicals, natural gas, manufacturing, EDC, ethylene glycol, demand, US chemical rail, ethylbenzene

US Chemicals: Some Signs Of Continued Strength, But Mostly Lagging Indicators

Apr 20, 2022 2:33:11 PM / by Cooley May posted in Chemicals, Polyethylene, Ethylene, Polyurethane, Inflation, US Chemicals, ethane, natural gas, naphtha, polymer, US polyethylene, MDI

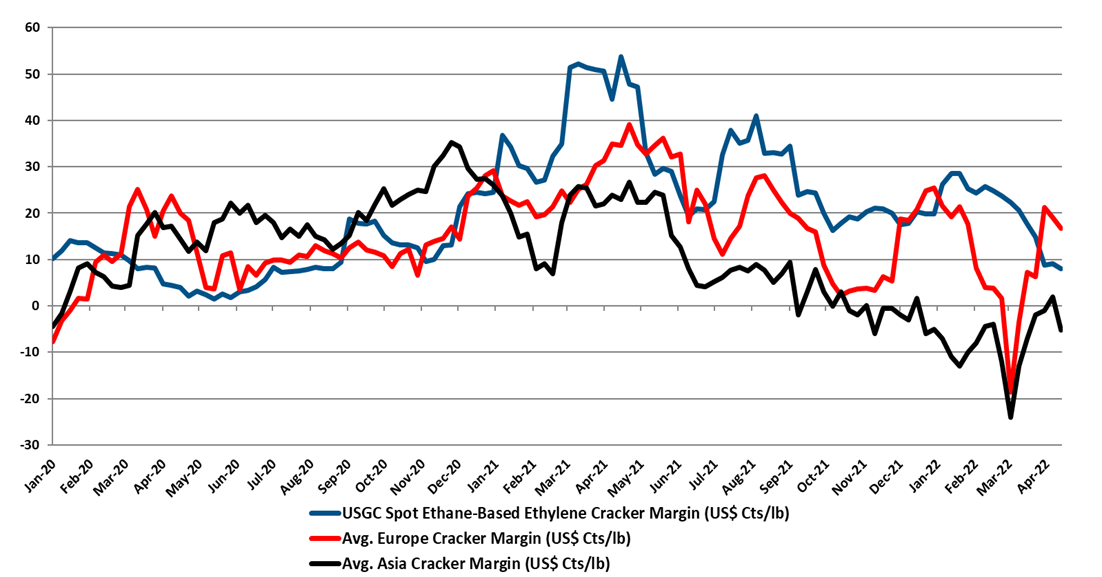

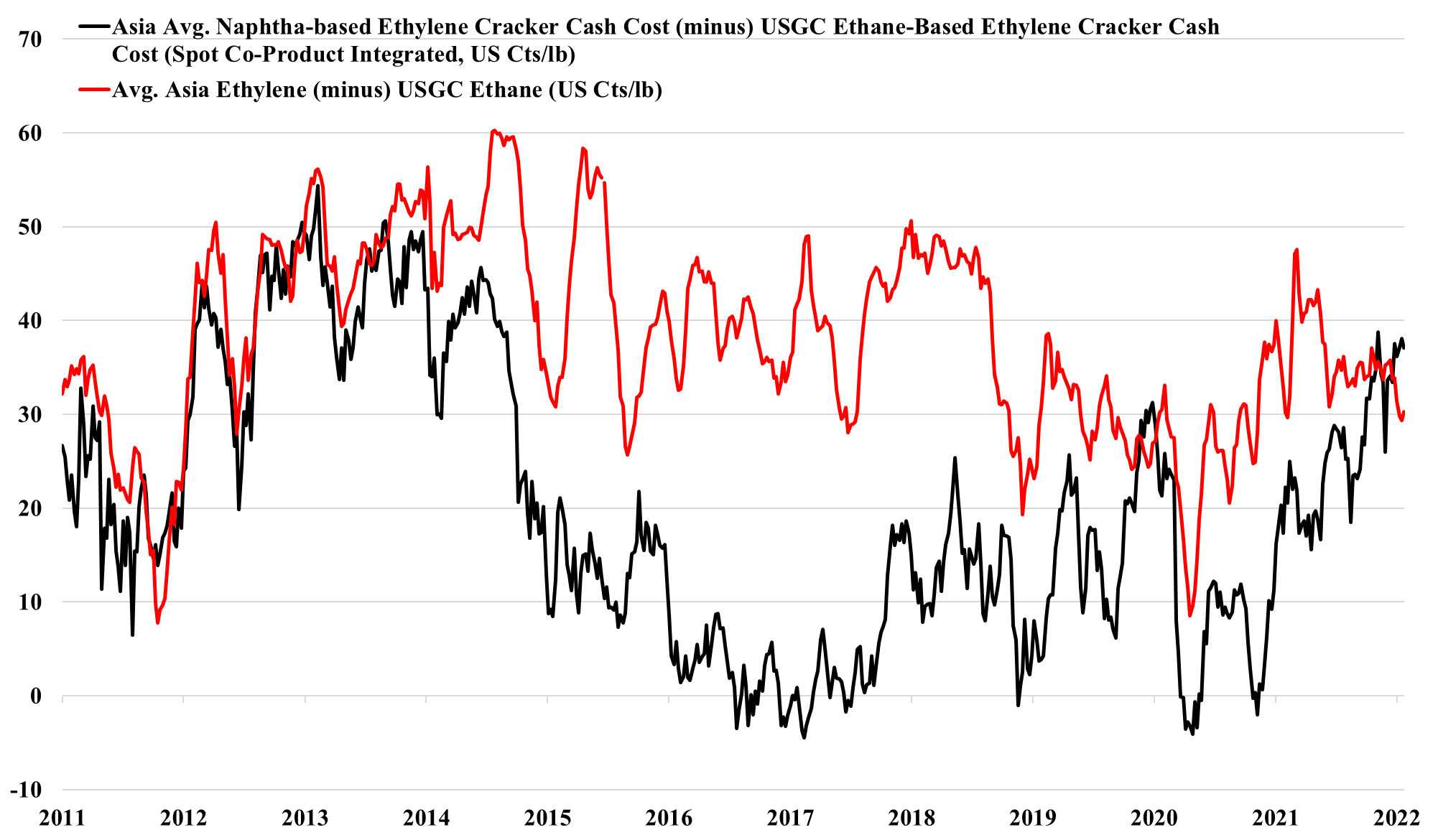

We note the polyethylene price nominations in the US, timed by some to coincide with earnings releases this week and next, and would remind clients that there is always price momentum in commodities, one way or another. In our view, the price increase moves aim to maintain directional momentum (upwards) while giving the polymer producers some cover should natural gas prices spike further. US ethane prices are now tracking natural gas more closely and have moved up meaningfully over the last few weeks, and US ethane-based ethylene margins have fallen around 80% since the start of the year, with at least half of that coming from cost increases. All polyethylene producers are integrated back to ethylene, and the price nominations will be attempts to recoup some of the cost increases. This is against a backdrop of still very strong polyethylene margins in the US, which although way off their 2021 highs remain much higher than in 2019 and 2020 and the longer-term average. This is covered in our Weekly Catalyst report each Monday. Ethylene margins are summarized in exhibit below and the chart shows the impact of higher costs in the US and falling spot ethylene prices as the US now has more surplus ethylene capacity and is looking for export homes for ethylene and easy to ship derivatives. As we have noted before, the jump in margins in Europe and Asia is because of extreme volatility in naphtha markets over the last couple of weeks. We would expect margins to be lower next week based on naphtha moves this week.

If You Are In The Right Place With The Right Products, Times Are Good

Mar 18, 2022 12:19:25 PM / by Cooley May posted in Chemicals, Polymers, Polyethylene, Polypropylene, LyondellBasell, Inflation, Dow, US Chemicals, natural gas, Basic Chemicals, Westlake, Braskem, US Polymers, commodity chemicals, demand strength, raw material, silicone

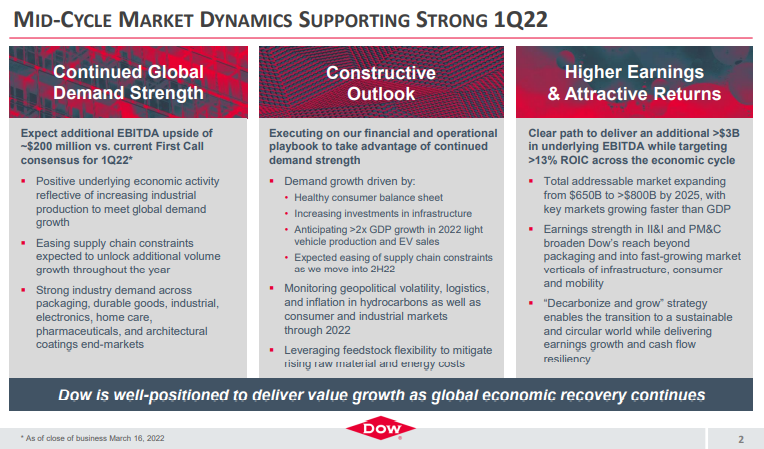

As we have been suggesting for some time, there are pockets of real strength in chemicals; identifying them is the hard part. It is not enough to have pricing strength in a market where raw material prices are volatile daily and we have seen plenty of examples of companies with very strong end demand dynamics missing earnings because of a cost squeeze. We continue to highlight the competitive strength in the US in basic chemicals because of the decoupled and relatively low natural gas price and this is likely a large piece of the Dow earnings strength – strong polyethylene demand against a backdrop of relatively stable and lower costs. While polypropylene (Braskem) remains extremely profitable in the US, it has seen more sequential weakness than polyethylene – as we show in Exhibit 1 of today's daily report. That said, both polyethylene and polypropylene margins in the US are significantly higher than was likely expected this year and certainly what has been reflected in stock valuations, even with the commodity chemicals rally. Dow is also seeing the benefit of a very strong silicones market – something that was covered in detail in Wacker’s release earlier this month.

Raw Materials Inflation Not Over For Specialty Materials

Feb 8, 2022 3:04:30 PM / by Cooley May posted in Chemicals, Polymers, Plastics, Raw Materials, raw materials inflation, Chemical Industry, petrochemicals, US Chemicals, Avient, US Polymers, specialty chemicals, materials, DuPont, plasticsindustry, supply chain challenges, logistic inflation

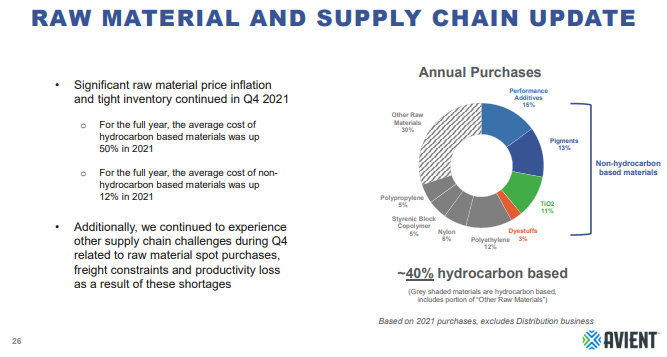

As Avient and the linked paint article remind us, there are sectors of the US chemical industry that rely on imported products – in these cases pigments, and the supply chain challenges and logistic delays have caused production problems in the US and price increases in 2021. The automotive segment of the paint industry has seen lower demand because of the auto OEM production slowdown, and pigment shortages and price spikes would likely have been worse if automakers had been running at full rates. There is no sense of impending relief in the logistic issues as we go through 4Q earnings reports and we could continue to see issues for a while. This should be good for US-based pigment suppliers, but while Chemours, Venator, and Tronox all have capacity in the US, they also have capacity outside the US which likely faces some supply chain challenges.

US Chemical Price Support Higher On Strong Demand

Feb 2, 2022 12:42:43 PM / by Cooley May posted in Chemicals, Polymers, Propylene, US Chemicals, Logistics, US propylene, propane prices, demand strength, propylene contract prices, propylene spot prices

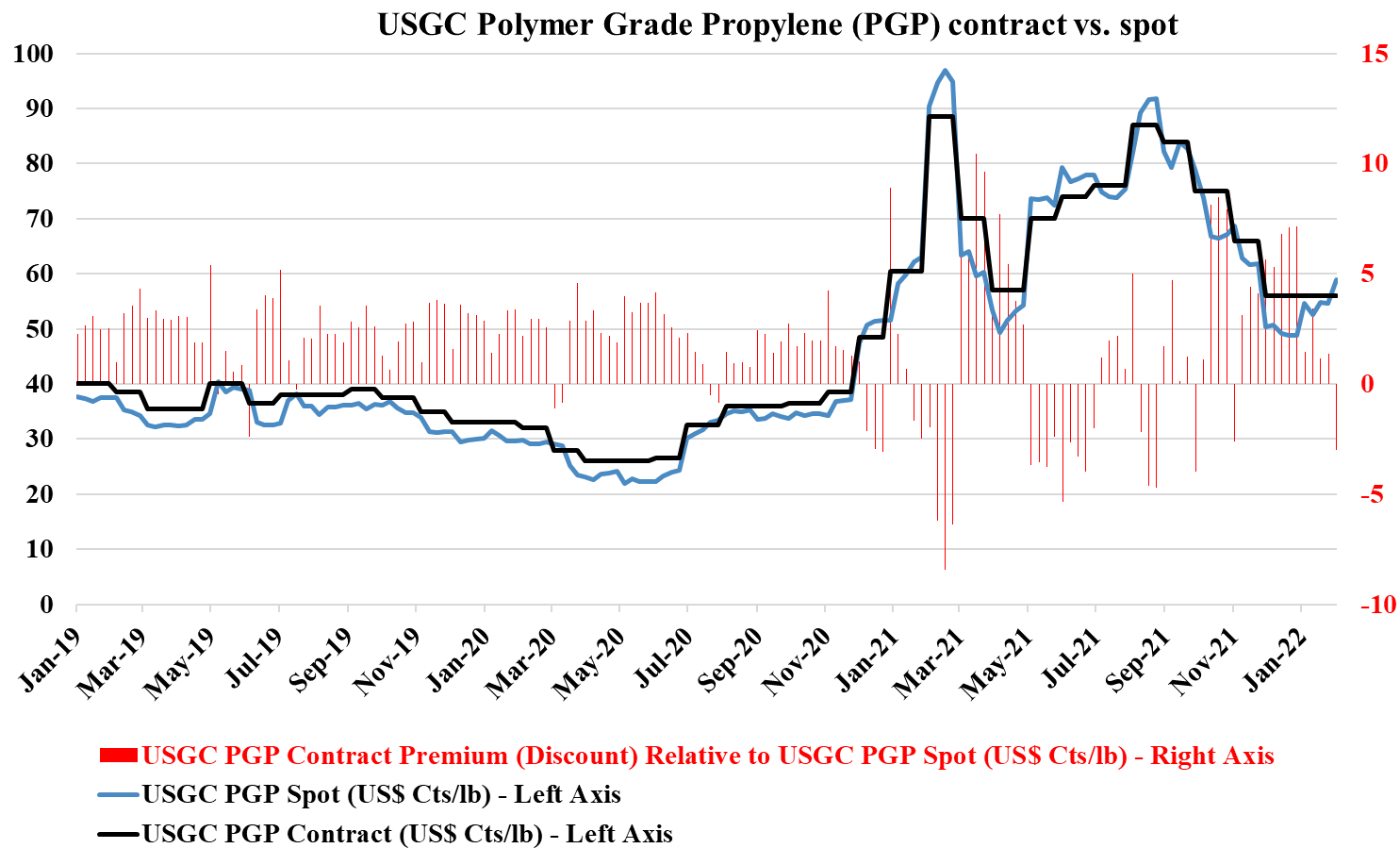

In a recent report, we discussed the relative demand strength in the US, as well as the high costs of importing chemicals and polymers into the US and suggested that higher energy and feedstock costs could arrest price declines in the US at levels that still drive significant profitability for US producers. With that in mind, it is interesting to note the upward move in propylene spot prices in reaction to higher propane prices and the resulting flat settlement in propylene contract prices.

The US Is Benefiting From Strong Growth And A Significant Cost Advantage

Feb 1, 2022 12:18:39 PM / by Cooley May posted in Chemicals, Polymers, Ethylene, Axalta, US Chemicals, polymer producers, ethane, US Ethane, US Polymers, exports, chemical producers, OEM, cost advantage, Auto OEM, Ethylene cracker

2022 has started very strongly for US chemical and polymer producers, in part because demand growth remains very robust based on early reads from those that have reported earnings, and in part because of the ever-increasing competitive edge that the US is enjoying over Asia – see exhibit below. US producers can maintain strong margins in the US, while easily pushing any surpluses into export markets where local suppliers cannot compete. At the same time, higher production costs and very high logistic costs make it almost impossible for those regions with capacity surpluses to move products into the US, and it is challenging also to move products into Europe. If this production and logistic cost environment persist, not only should US prices stabilize, but for select companies – those with a strong US production bias – we should see estimates for 2022 start to rise.

Demand Momentum For Commodities In 2022 Could Exceed Expectations

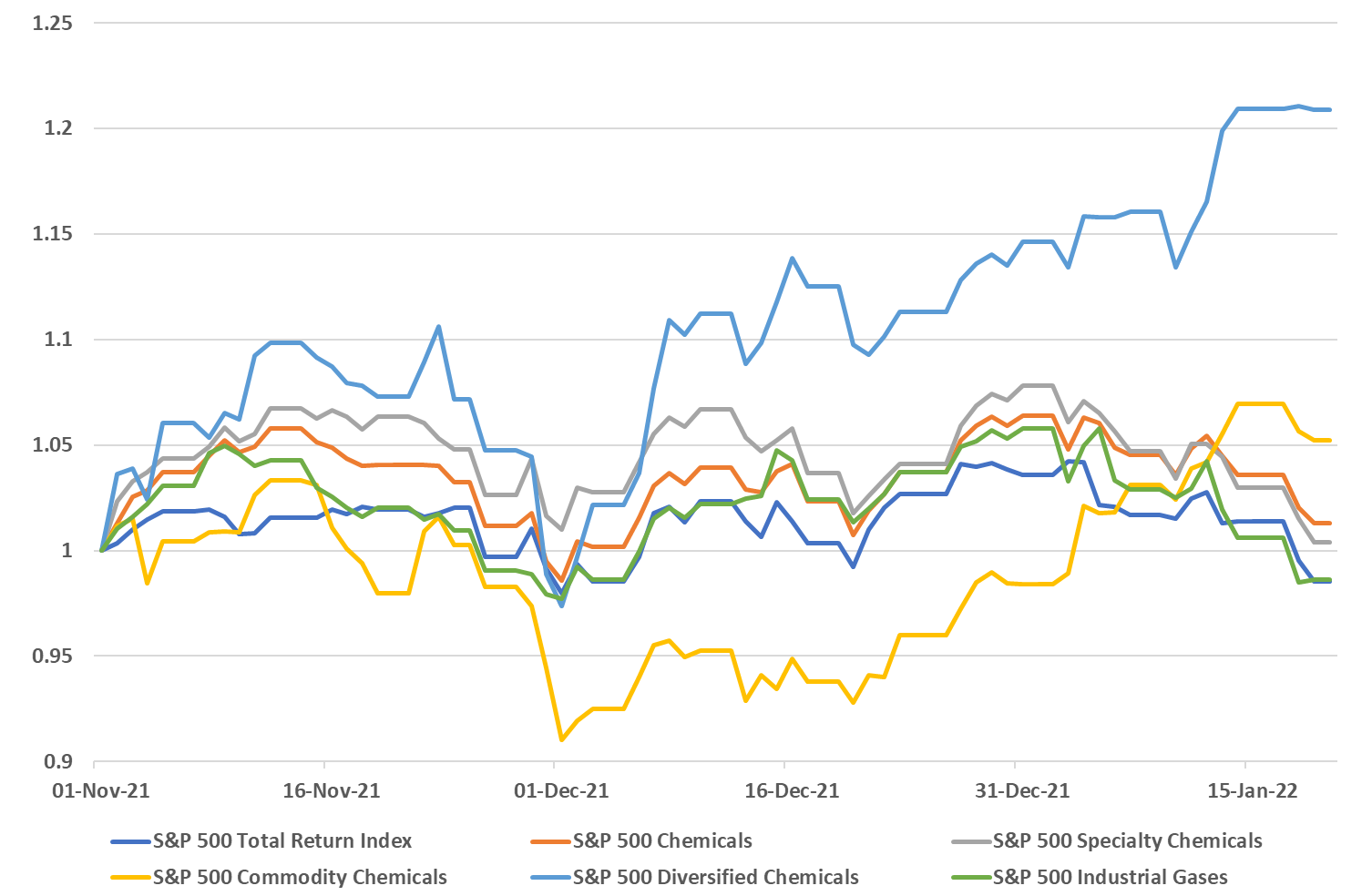

Jan 21, 2022 1:15:53 PM / by Cooley May posted in Chemicals, Auto Industry, Chemical Industry, US Chemicals, oversupply, specialty chemicals, commodity prices, semiconductors, commodity chemicals, automotive, demand, commodity stocks, PPG

Following on from the core theme of today's daily report, demand could provide the lifeline that the US chemical industry needs to get through what looks like a potentially oversupplied 2022 – note the successful start-up of the ExxonMobil/SABIC facility in Texas, announced today. While we still think that the US market will be looser in 2022 than in 2021, barring any above-trend weather events, strong demand growth could offer some pricing protection for the industry – especially given the input inflationary pressures that we are seeing. If the customer base is looking for increases in deliveries, which we expect to be the case in 2022, it will be easier to defend pricing and gain pricing where costs are higher. Some of the momentum that we are seeing in the commodity stocks year to date is a function of a broader inflation trade, but some is likely in anticipation that 2022 will not be as bad as had been expected and on that basis, the sector looks particularly inexpensive – even today after the early year rally. It will be a little harder for the specialty and intermediate companies depending on how long they have to play a lagging catch-up game with costs. But if, and when, costs peak, they should see margin expansion as costs fall and will be able to keep some of the gains, especially if their demand is also growing.

Higher US Chemical Production In 2022 Could Be Weather Dependent Again

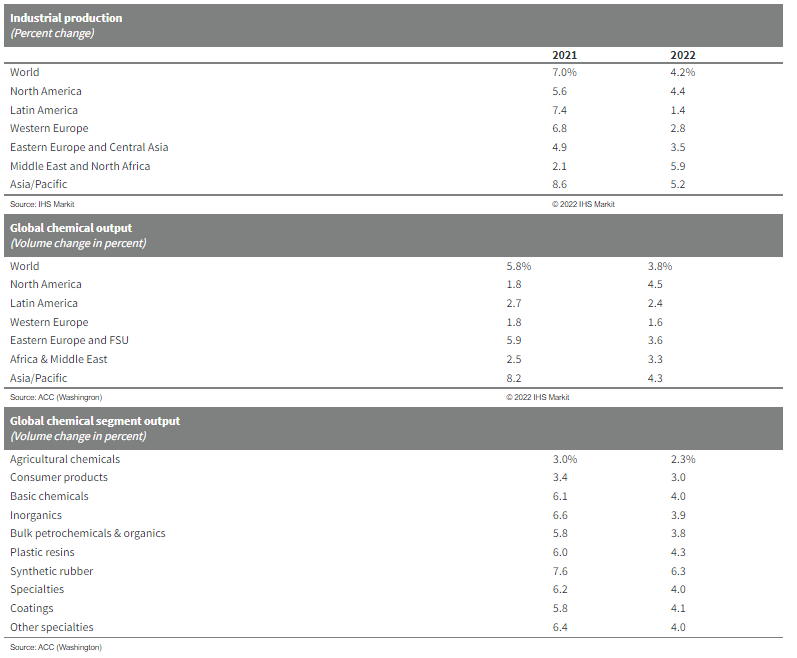

Jan 12, 2022 1:31:26 PM / by Cooley May posted in Chemicals, Polymers, Plastics, Raw Materials, Chemical Industry, US Chemicals, China, chemical production, COVID, forecasts, inventory planning, weather

The jump in expected US chemical production in 2022 versus 2021 and the more anemic growth in 2021, is in part due to new capacity in the US but is likely more a function of lost production in the US in 2021 because of the February freeze and the hurricane that hit the New Orleans area. These two weather events, especially the freeze, cause significant production cutbacks, and not only would production have looked better in 2021 without them, but the inventory decline shown in Exhibit 1 in today's daily might have been less severe. IF we assume that climate change is causing more severe weather, then perhaps it would be prudent to build more unplanned downtime into forecasting models and on that basis perhaps the production growth forecast in the exhibit below is too hopeful. However, if you model more unplanned downtime you are inevitably going to end up with a more volatile market as available capacity will swing around the forecast average by a larger amplitude, which would make production and inventory planning more complicated.

Energy Moves Could Drive US Chemical Price Volatility

Nov 30, 2021 1:46:26 PM / by Cooley May posted in Chemicals, Polymers, Propylene, Ethylene, Energy, Benzene, PGP, Oil, US Chemicals, ethane, natural gas, US ethylene, Basic Chemicals, naphtha, polymer, polymer production, NGLs, ethylene feedstocks, crude oil, chemicalindustry, US benzene

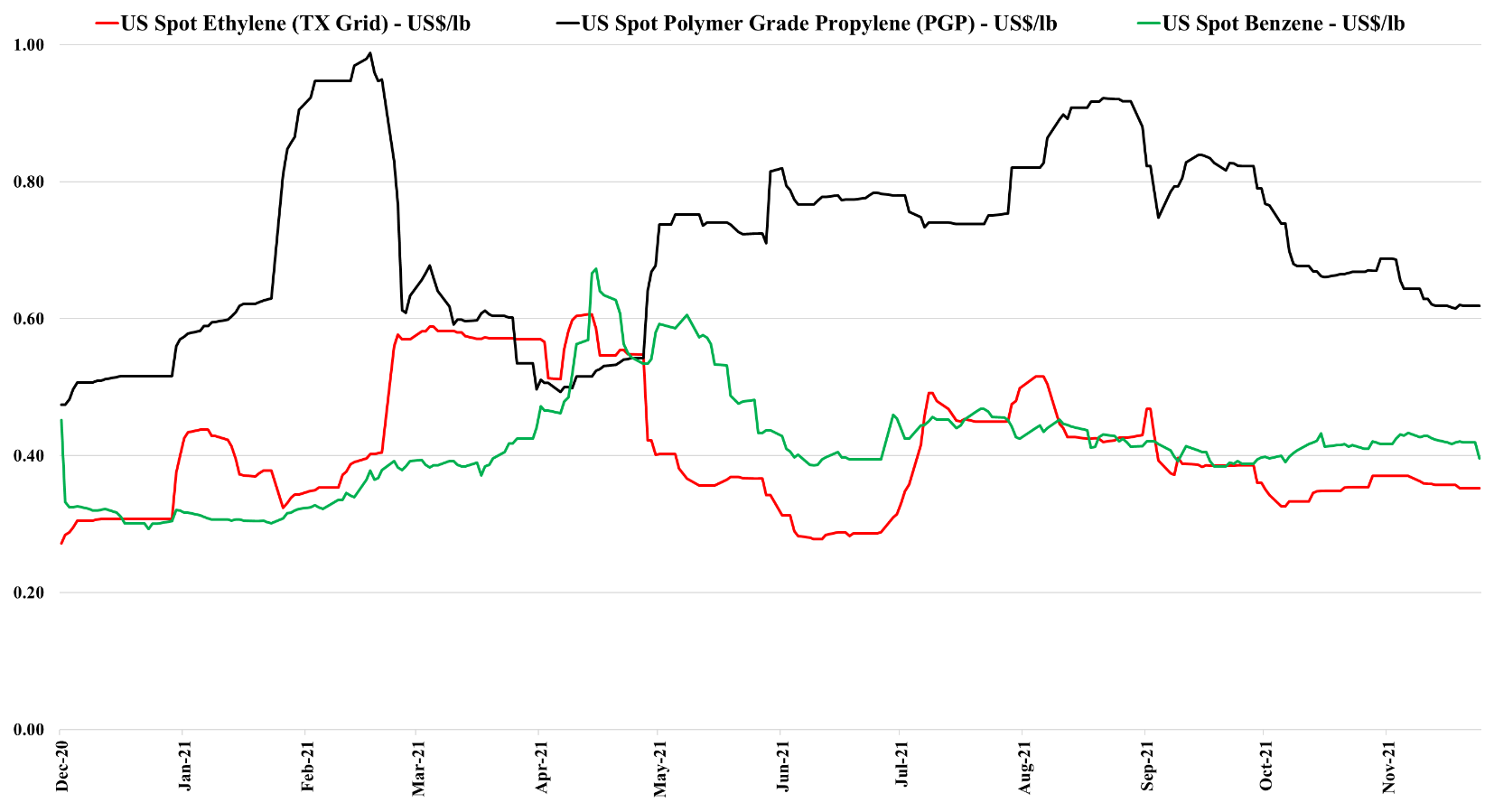

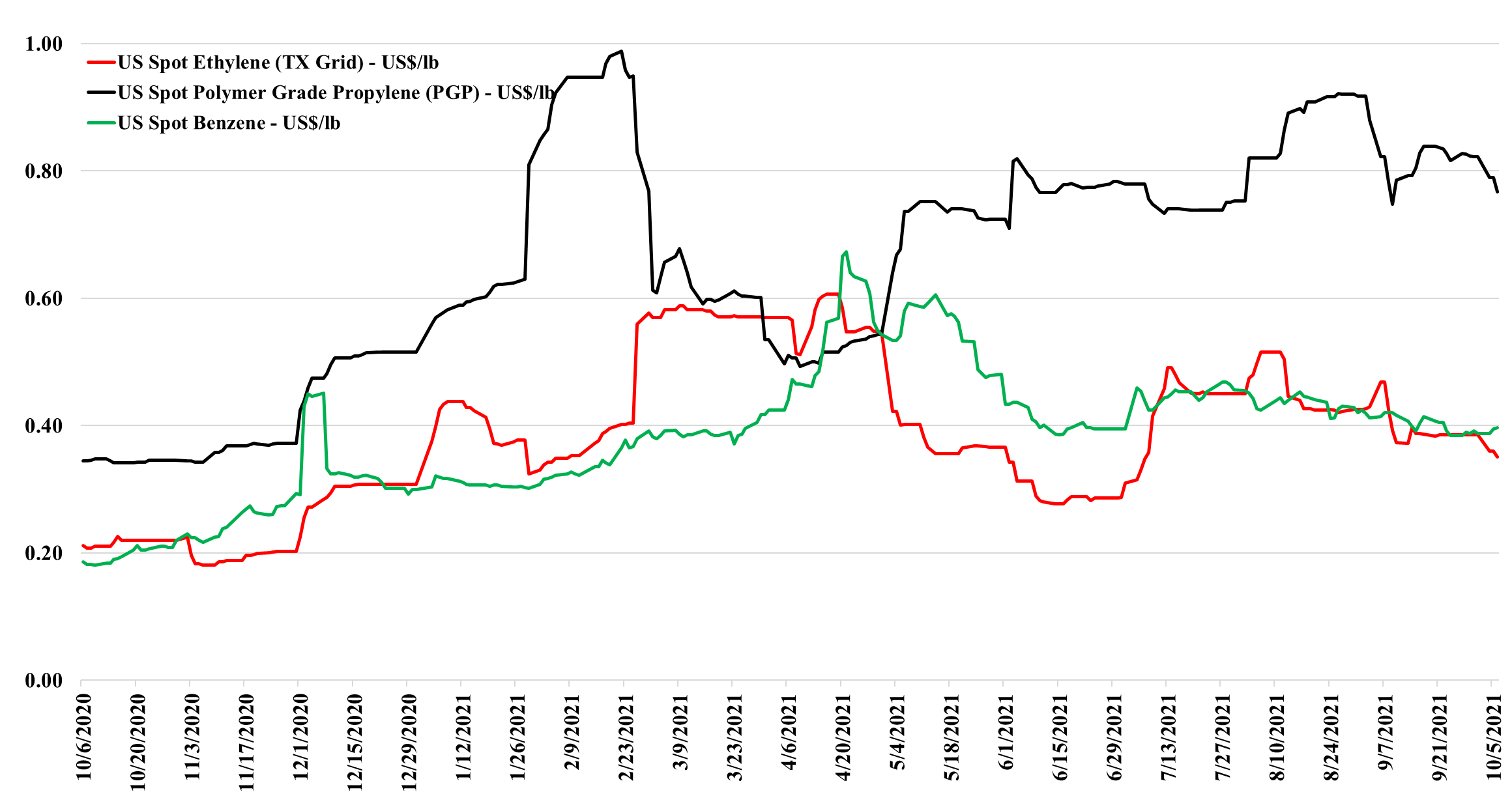

The drop in US benzene pricing is likely a function of lower crude oil pricing and the overall impact this is having on oil product values. As the US has moved to much lighter ethylene feedstocks, the proportion of benzene that is coming from refining is overwhelming and alternative values for benzene or reformate in the gasoline pool are a strong driver of US and international pricing. Lower naphtha pricing for ethylene units outside the US will also hurt benzene values. By contrast, the stronger natural gas market – through the end of last week - supported ethane pricing in the US and we saw a step up in propane pricing – which have provided support for ethylene and propylene – also note that the analysis we published yesterday in the weekly catalyst suggests that the US can export ethylene to Asia at current prices – delivering ethylene into the region below current local costs. This should keep a floor under US ethylene pricing although any further decline in crude oil prices relative to US natural gas and NGLs will close this arbitrage.

US Commodity Chemical Producers Face More Margin Pressure

Oct 6, 2021 2:32:43 PM / by Cooley May posted in Chemicals, Propylene, Ethylene, petrochemicals, feedstock, US Chemicals, specialty chemicals, commodity producers, downstream producers

The decline in propylene and ethylene values is worth consideration today as it provides proof, along with the feedstock comments in today's daily report, that US commodity chemical producers are on average facing margin pressure WoW. We noted in yesterday's research that China prices were rising amid production cuts, but demand remains a notable concern. As production rises from current levels in 1H22, this will put downward pressure on Asia chemical prices and also translate into lower US export values.