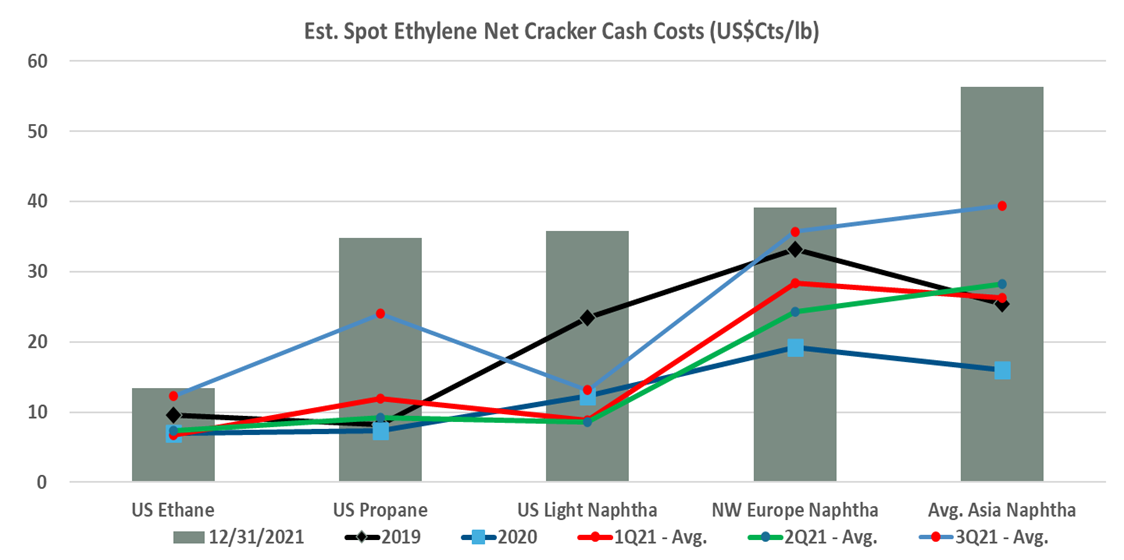

Given the higher prices of natural gas in the US, the shape of the current cost curve for ethylene in the exhibit below goes very much against traditional thinking and anyone looking at a historic crude oil to natural gas ratio as a proxy for the US competitive edge would be underestimating the advantage today. The major factor driving the change is the oversupply of ethylene co-products and their derivatives in Asia following a wave of new capacity in China and relatively lackluster growth locally during the Pandemic. As China and the region swung from net-short propylene and butadiene derivative markets to net-long, the price of derivatives declined and the price of the underlying monomers also fell – note that in our Daily Report today we show very positive margins for ethane based ethylene in the US and naphtha based margins in Europe, but negative margins in Asia and on top of that positive polyethylene margins in the US versus more break-even in Europe and negative in Asia. The exception in Asia is low-density polyethylene where there is extremely strong growth for solar panels, both for domestic markets and also for export.

The US Cost Advantage For Basic Chemicals Remains Significant

Jan 4, 2022 2:09:46 PM / by Cooley May posted in US Polymer, Asia prices, ethylene cost curve, Asia polyethylene, trade

Butadiene in Asia: Too Much Supply & Not Enough Demand

Sep 23, 2021 1:32:20 PM / by Cooley May posted in Chemicals, Butadiene, Asia prices, ethylene capacity, butadiene supply

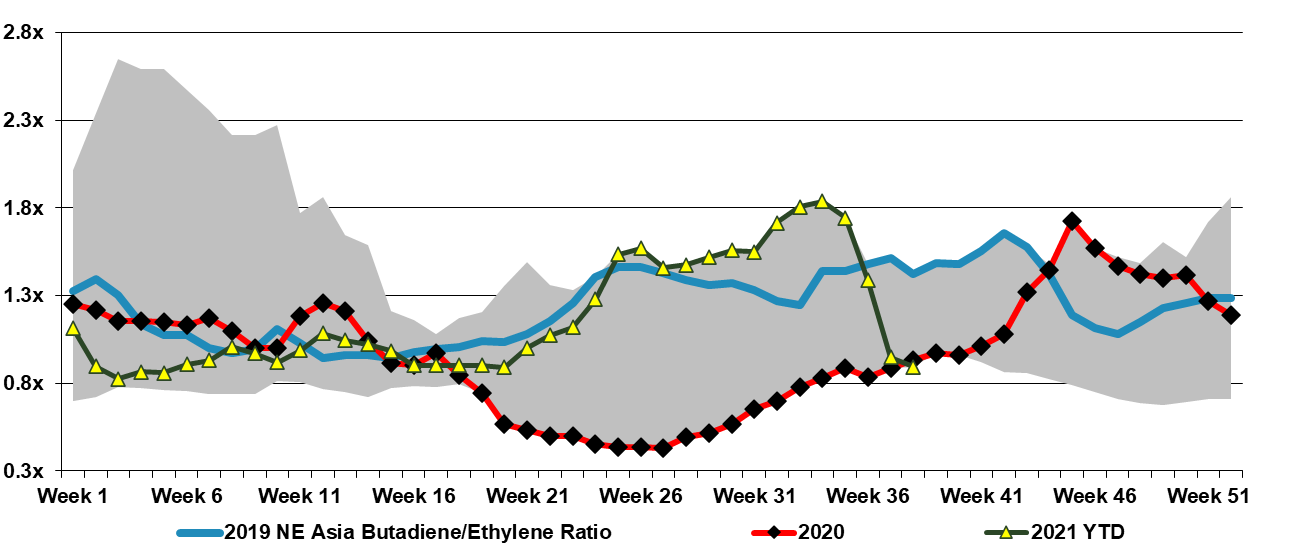

The recent collapse in Asia butadiene prices, as implied in the charts below is likely mostly supply-driven, given all the new heavy feed ethylene capacity that has been added in China and its impact on associated butadiene supply. On the demand side, there are negative impacts both from the overall slower growth in China and from the forced cutbacks in auto production because of the semiconductor shortages – ultimately this feeds back into tire demand. Further, with the Delta variant slowing consumer activity in Asia this has likely resulted in below trend tire replacement. See more in our daily report.

A Dramatic Change In Fortune For Ethylene

Jun 24, 2021 2:16:00 PM / by Cooley May posted in Chemicals, Ethylene, Ethylene Price, Asia prices, US ethylene

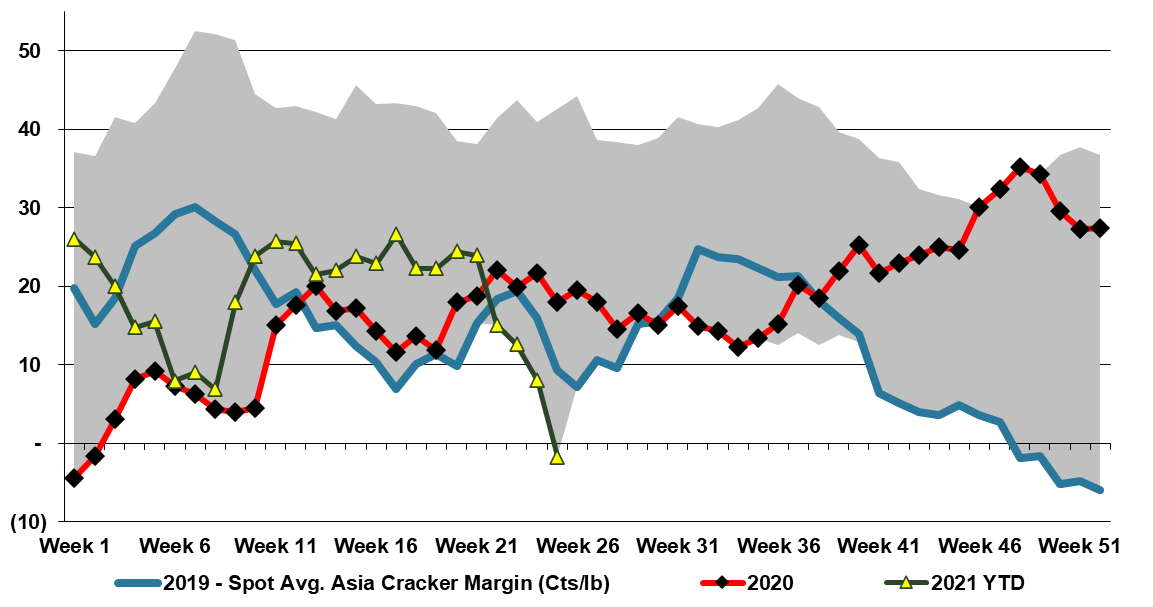

The charts below focus on ethylene and the significant decline in Asia prices, now to levels that suggest negative cash margins. While we may see some cutbacks in production, especially if ethylene from the US can be secured at prices that are even lower than we see in Asia today, most producers will run until they cannot cover variable costs, and given that some of the imbalance, in China especially, might be short term in nature, it is unlikely that we will see any drastic production decisions yet. While the capacity additions in China have been extreme, demand is subdued domestically as consumer spending has not returned to its pre-pandemic trend and the shipping and port problems are hindering export demand.