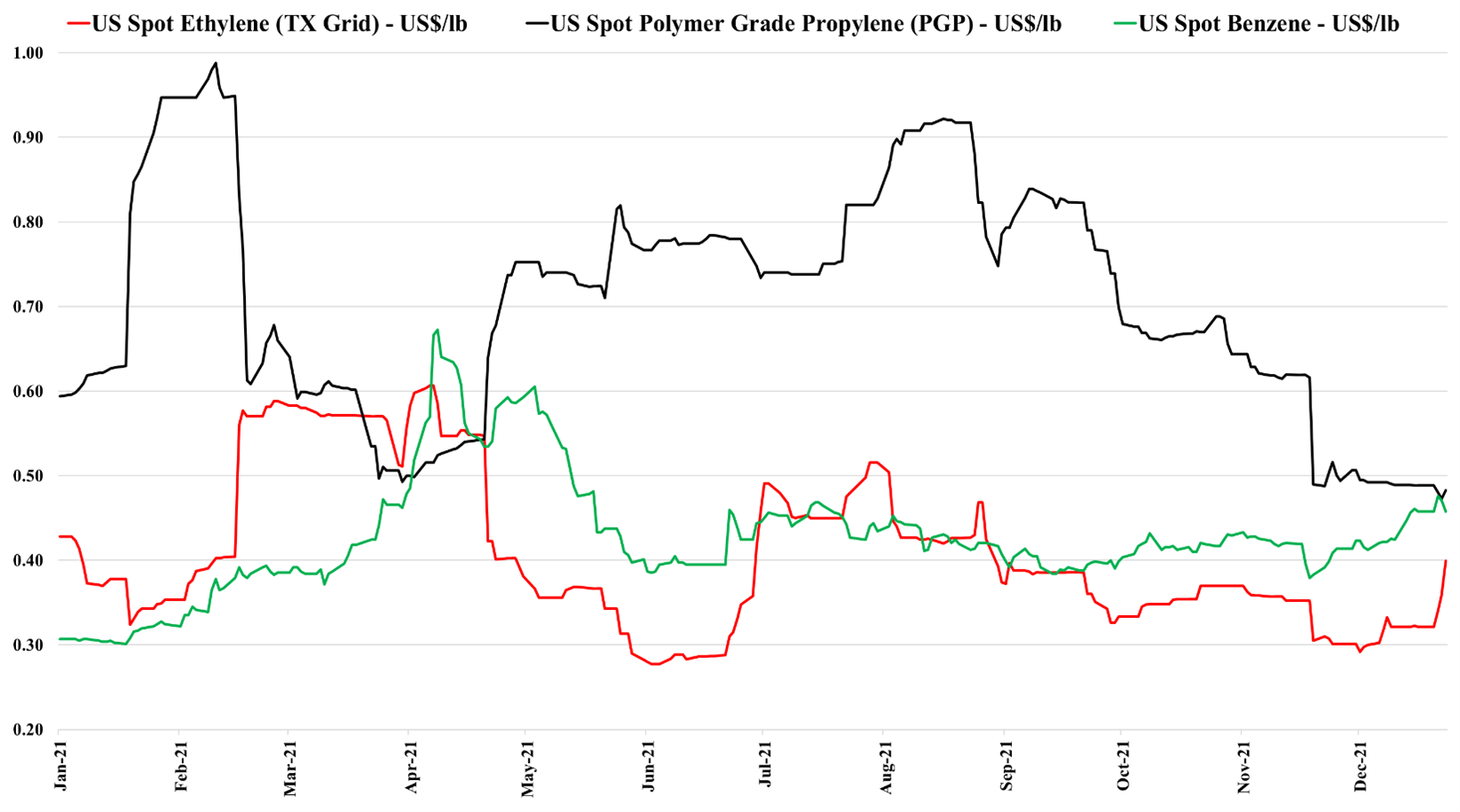

The run-up in ethylene spot prices in the US is interesting because it takes away most of the export arbitrage to Asia, as summarized in the charts below. Our margins models suggest that Asis is losing money making ethylene from imported naphtha today – especially in China and the arbitrage looks more interesting for US exporters of ethylene if you look at China costs as opposed to China prices for ethylene. The US remains a preferred supplier of ethylene to parts of Asia that would otherwise import from more local producers as our local cost analysis does not include a freight component. For example, an ethylene buyer in Southeast Asia could still get material from the US cheaper – even with higher US prices – than from China or other local exporters. For more on ethylene and propylene markets see our Daily

US Ethylene Prices Higher But Some Exports Still Work

Jan 6, 2022 12:04:25 PM / by Cooley May posted in ethylene cost curve, ethylene exports, ethylene prices

The US Cost Advantage For Basic Chemicals Remains Significant

Jan 4, 2022 2:09:46 PM / by Cooley May posted in US Polymer, Asia prices, ethylene cost curve, Asia polyethylene, trade

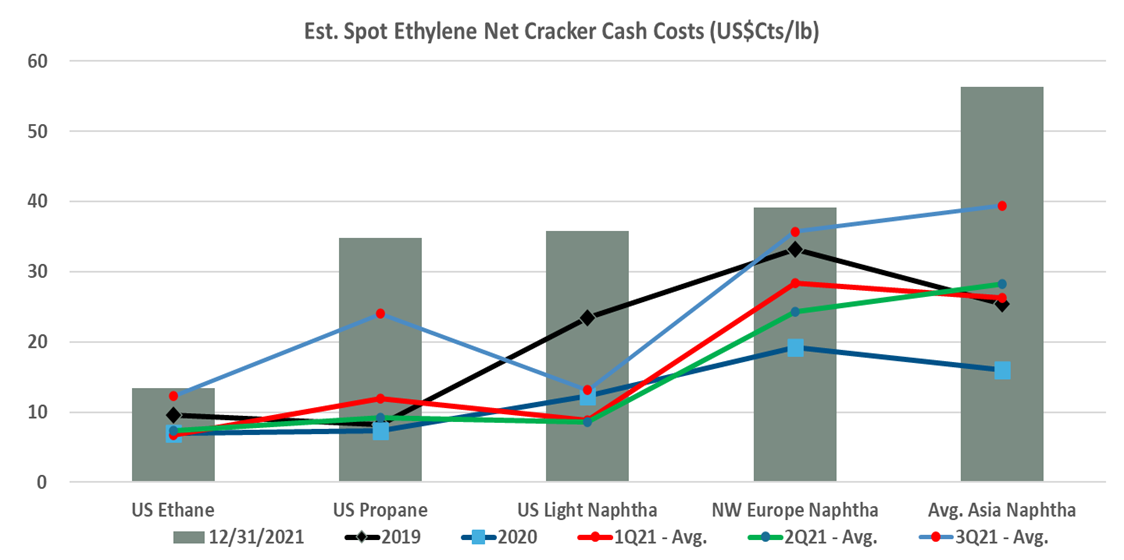

Given the higher prices of natural gas in the US, the shape of the current cost curve for ethylene in the exhibit below goes very much against traditional thinking and anyone looking at a historic crude oil to natural gas ratio as a proxy for the US competitive edge would be underestimating the advantage today. The major factor driving the change is the oversupply of ethylene co-products and their derivatives in Asia following a wave of new capacity in China and relatively lackluster growth locally during the Pandemic. As China and the region swung from net-short propylene and butadiene derivative markets to net-long, the price of derivatives declined and the price of the underlying monomers also fell – note that in our Daily Report today we show very positive margins for ethane based ethylene in the US and naphtha based margins in Europe, but negative margins in Asia and on top of that positive polyethylene margins in the US versus more break-even in Europe and negative in Asia. The exception in Asia is low-density polyethylene where there is extremely strong growth for solar panels, both for domestic markets and also for export.

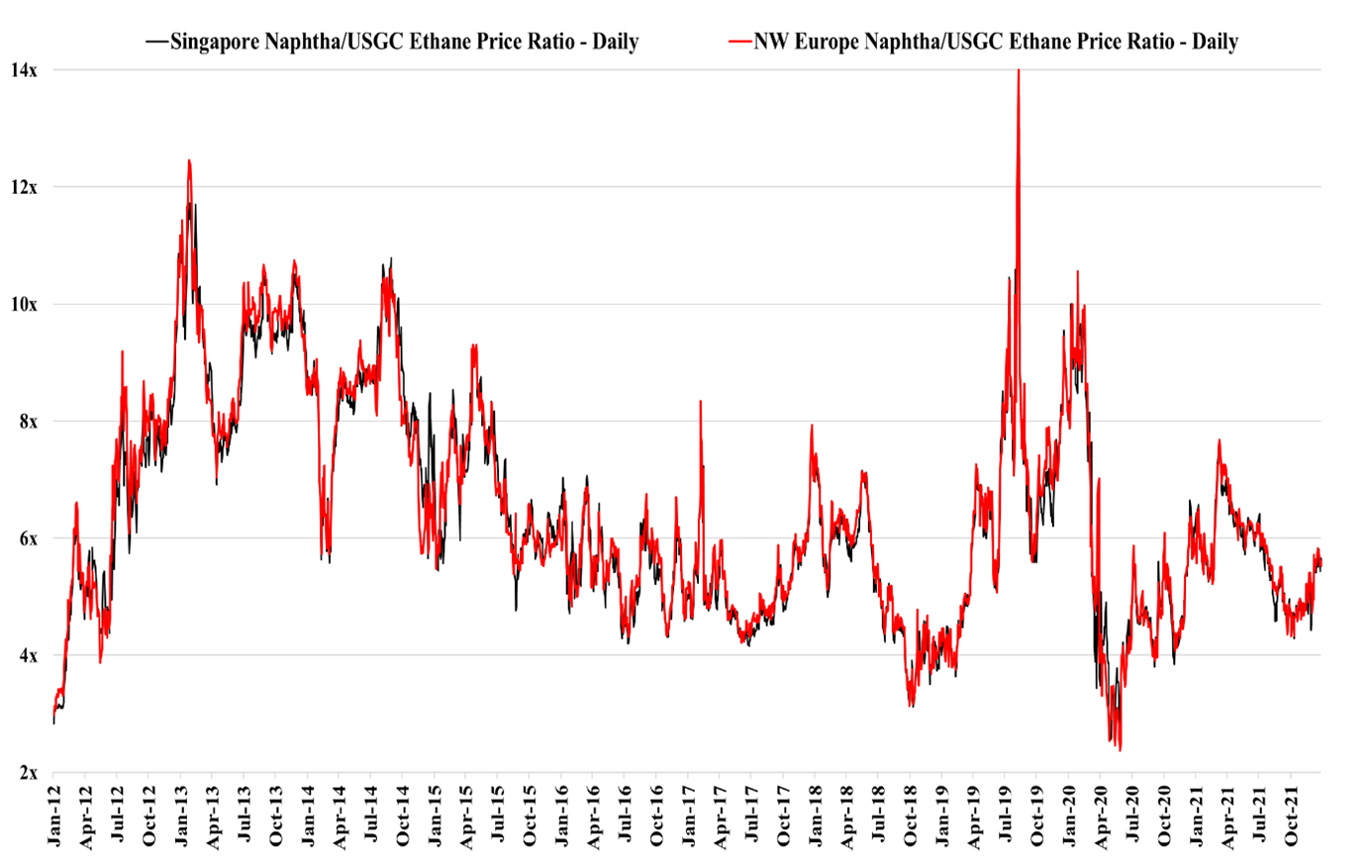

Feedstock Price Uncertainty WIll Likely Slow Chemical Investment

Dec 30, 2021 1:01:43 PM / by Cooley May posted in ethylene cost curve, feedstock cost, ethylene prices, energy costs

Looking at the exhibit below, it is clear that planning for consumers of hydrocarbon feedstocks is a challenge, and this is especially true for anyone looking at new projects, adding to our view that new project announcements will slow in basic chemicals, setting up for a major upcycle after 2023. The volatility in relative feedstock prices over the last ten years likely means that you would need to be able to demonstrate profitability under a wide range of possible feedstock price scenarios, while at the same time assuming that prices are set by marginal costs. Today global prices are set by marginal costs as parts of Asia are operating at break-even economics, with the much more profitable US and Europe impacted by feedstock advantages in the US and higher freight costs for polymers trying to enter the US and European markets. The US trade balance discussed in today's Daily is partly influenced by rising prices on some imported goods because of higher freight costs. While we continue to see some basic chemical expansion announcements, there have been periods of relative feedstock costs over the last 10 years where any project would have looked unprofitable. The volatility in the chart confirms that any producer will have better and worse times throughout a facility’s operating life, and consequently, start-up timing can be everything. Losing money for the first few years of any project’s life can destroy any ROI goals.

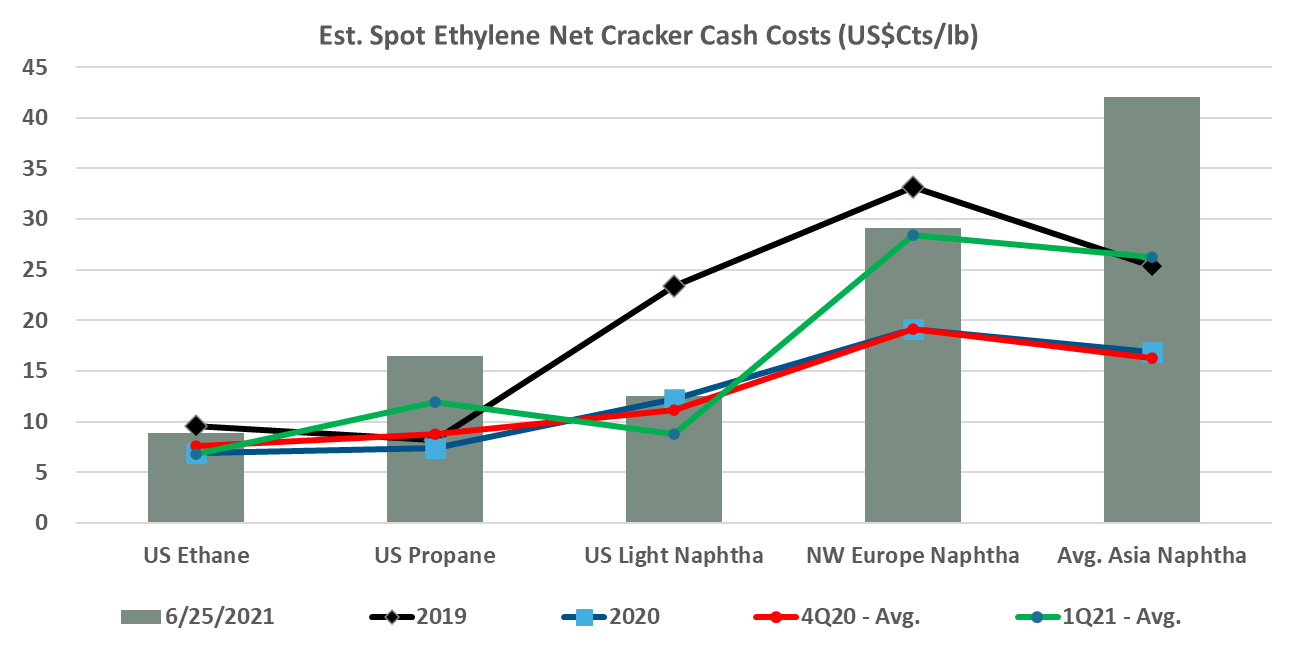

The NGL Cost Advantage For US Ethylene Producers Remains Substantial

Jul 1, 2021 2:37:56 PM / by Cooley May posted in Propylene, propane, feedstock, ethylene producers, ethane, Ethylene Surplus, US ethylene, NGL, ethylene cost curve, feedstock cost, NGL cost curve, naphtha, ethylene plants

The chart below focus on the ethylene cost curve and show that the US currently retains a distinct cost advantage despite escalating domestic feedstock costs. The current cost advantage in the US is sufficient to move ethylene derivatives into most markets profitably and while US spot prices for ethylene may not quite reflect the levels needed to stimulate exports today – US ethylene costs certainly do. The restart of the Nova unit in Louisiana may put some further downward on US ethylene prices but as we discussed yesterday, given the weather risks in 3Q it is an interesting dilemma today over whether you sell surplus ethylene or store it on the basis that spot prices will rise because of production outages – this time last year the “store it” decision would have been the right one as spot prices rose through 3Q.