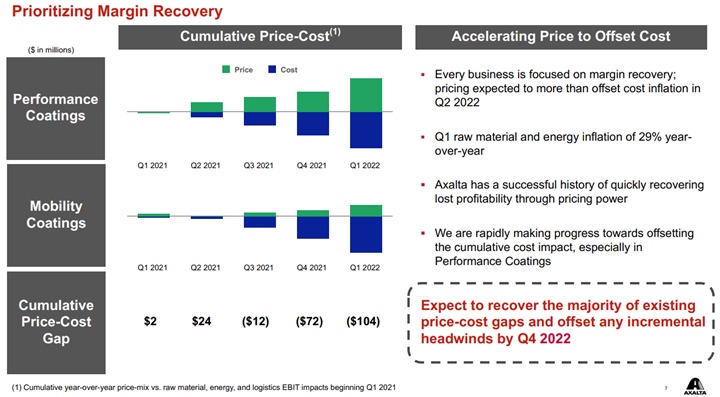

Axalta shows a helpful picture below of how pricing and costs are moving. All coatings producers are seeing the same cost inflation, some of it energy/hydrocarbon input related and some of it supply chain-related – either for inputs such as pigments or higher costs of getting products to markets. How pricing looks relative to costs is very customer dependent, as shown in the chart below. Auto OEM customers have long lead times on price adjustments and this is why Axalta is signaling the end of the year before prices will be aligned with costs. This of course assumes that costs do not rise again in 2H 2022 as they will also drive a lag in price increases and create a further gap as shown in the “Mobility” bar below. In the more consumer-facing coatings, it is easier to raise prices more quickly and Axalta and others have managed to keep pace with costs. We see the pricing versus costs issue as a much greater headwind for the specialty chemical companies than for the commodity companies and the industrial gas companies – the commodity chemical companies can raise prices more quickly and most industrial gas pricing is on a cost pass-through basis.

Some Prices Are Keeping Up With Costs But Shipping Remains Challenging

Apr 26, 2022 1:42:08 PM / by Cooley May posted in Chemicals, Polymers, Axalta, Inflation, Prices, shipping, specialty chemicals, basic polymers, container freight rates, logistic constraints, Costs, Mobility

The US Is Benefiting From Strong Growth And A Significant Cost Advantage

Feb 1, 2022 12:18:39 PM / by Cooley May posted in Chemicals, Polymers, Ethylene, Axalta, US Chemicals, polymer producers, ethane, US Ethane, US Polymers, exports, chemical producers, OEM, cost advantage, Auto OEM, Ethylene cracker

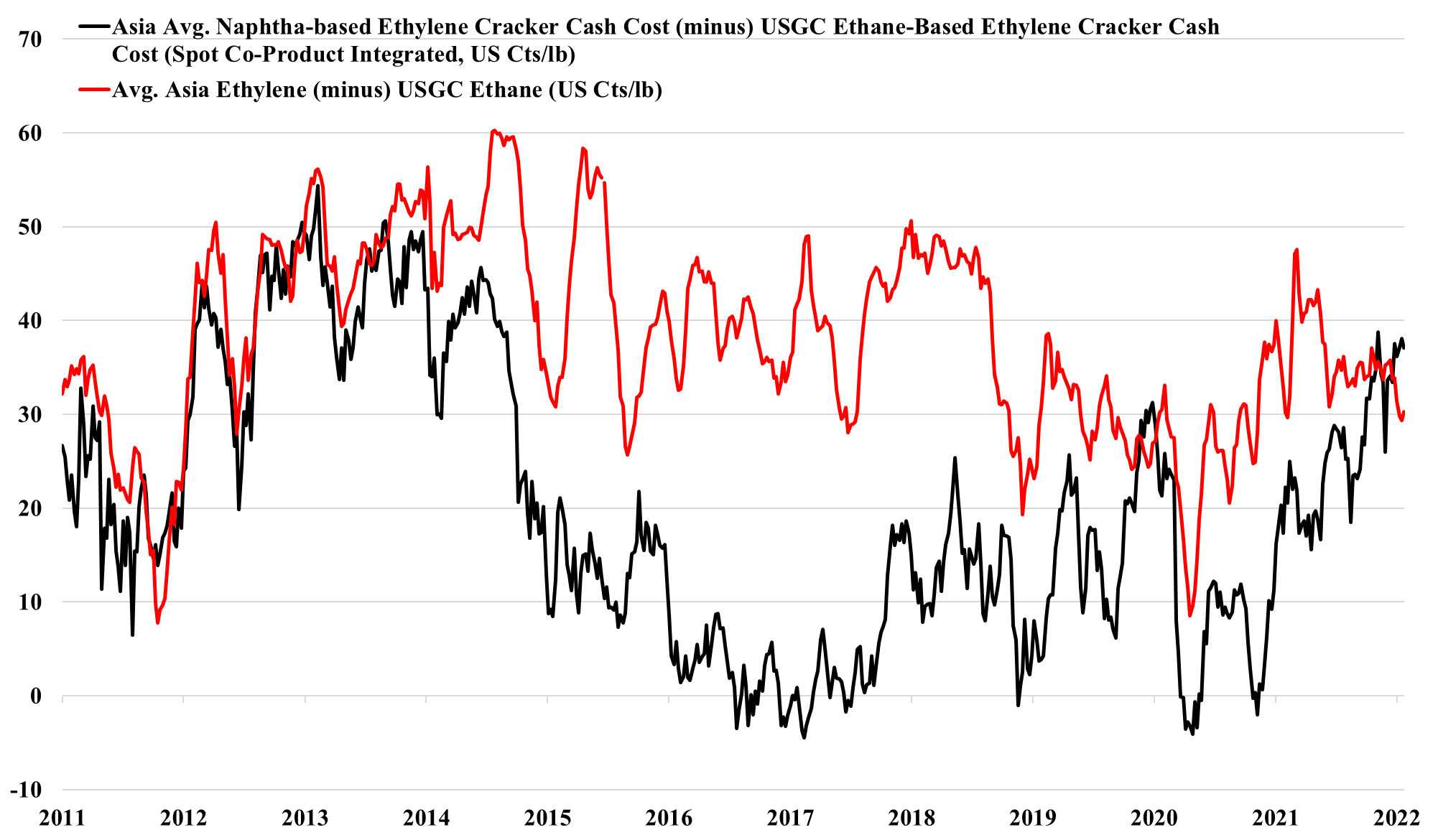

2022 has started very strongly for US chemical and polymer producers, in part because demand growth remains very robust based on early reads from those that have reported earnings, and in part because of the ever-increasing competitive edge that the US is enjoying over Asia – see exhibit below. US producers can maintain strong margins in the US, while easily pushing any surpluses into export markets where local suppliers cannot compete. At the same time, higher production costs and very high logistic costs make it almost impossible for those regions with capacity surpluses to move products into the US, and it is challenging also to move products into Europe. If this production and logistic cost environment persist, not only should US prices stabilize, but for select companies – those with a strong US production bias – we should see estimates for 2022 start to rise.

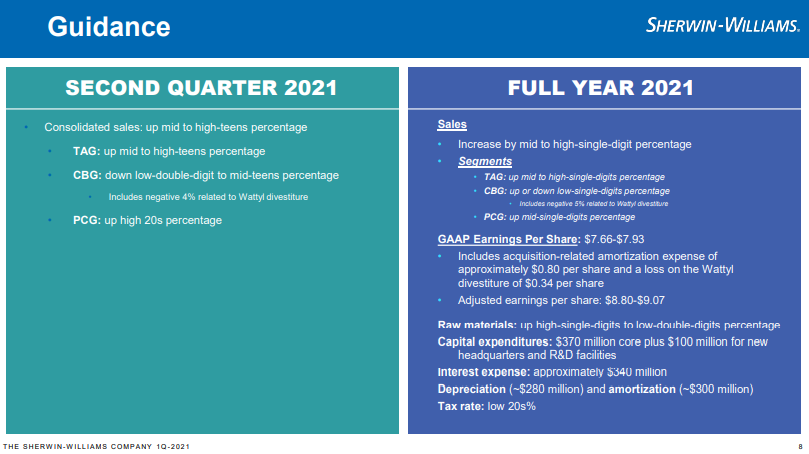

Painting By Numbers; Some Numbers Are Better Than Others

Apr 27, 2021 12:26:09 PM / by Cooley May posted in Chemicals, Paint Companies, Axalta, Sherwin-Williams