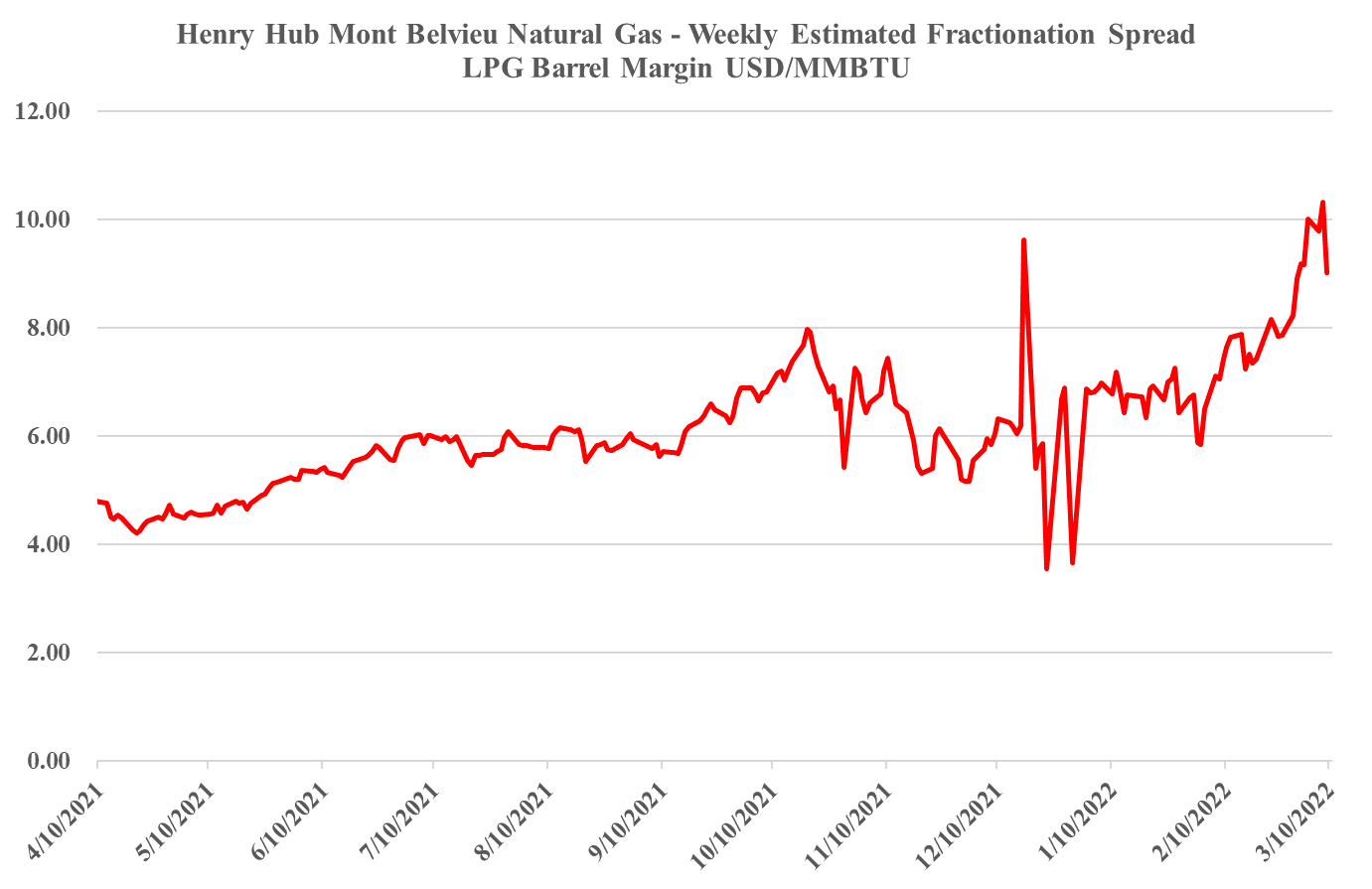

As noted in Exhibit 1 from today's daily report, the jump in oil prices has plunged the European polyethylene producers into the red and pushed Asian polyethylene producers further into the red. This will inevitably result in price increases as basic chemical and polymer producers will shut down at negative margins, and these price rises offer an opportunity for the US, Middle East, and select other producers.

US Competitive Advantage To Offset Some Ex-US Polyethylene Producer Losses

Mar 10, 2022 2:50:46 PM / by Cooley May posted in Chemicals, Polymers, Crude, LNG, PVC, Polyethylene, LyondellBasell, HDPE, polyethylene producers, polymer producers, ethane, natural gas, Basic Chemicals, NGL, Westlake, oil prices

Inflation Drivers Are Everywhere, But Especially In Energy

Dec 10, 2021 12:10:15 PM / by Cooley May posted in Chemicals, Crude, LNG, Coal, Energy, Inflation, Chemical Industry, petrochemicals, hydrocarbons, natural gas, power, natural gas prices, energy transition, EIA, Emission abatement, petrochemicalindustry, clean fuels, natural gas production, oil production, low emissions fuel

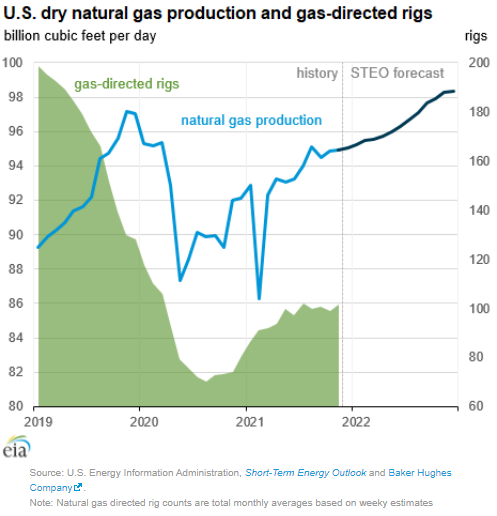

The theme of our Sunday report (to be found here) will be inflation this week and the signs that we are seeing across multiple industries which suggest it could be more problematic and worsen in 2022. One of the focuses is energy and how the pressures to be seen as good citizens is lowering investment in oil and natural gas production, while the world is not far enough advanced on energy transition to be able to substitute for the missing hydrocarbons. We would agree with many of the recent comments from some segments of congress, which is that the answer is not to curtail exports of LNG and crude, as by doing so we will starve the rest of the world of hydrocarbons and create worse shortages than Europe and China are seeing today. The better solution would be to support “clean” US production of the lowest emission fuels possible – especially for natural gas. As we have noted in prior research, with a global solutions hat on, the relatively low costs of natural gas F&D costs in the US, when combined with what we expect to be relatively low costs of emission abatement in the US, should drive more investment in the US, creating jobs and export income.

Is A Feedstock Shock In The Cards For US Chemicals?

Nov 23, 2021 1:39:28 PM / by Cooley May posted in Chemicals, Polymers, Crude, LNG, Energy, Emissions, petrochemicals, propane, carbon footprint, feedstock, ethane, natural gas, ethylene capacity, E&P, NGLs, exports, shortages, chemicalindustry, Brent Crude, butane, Mexico, fuels

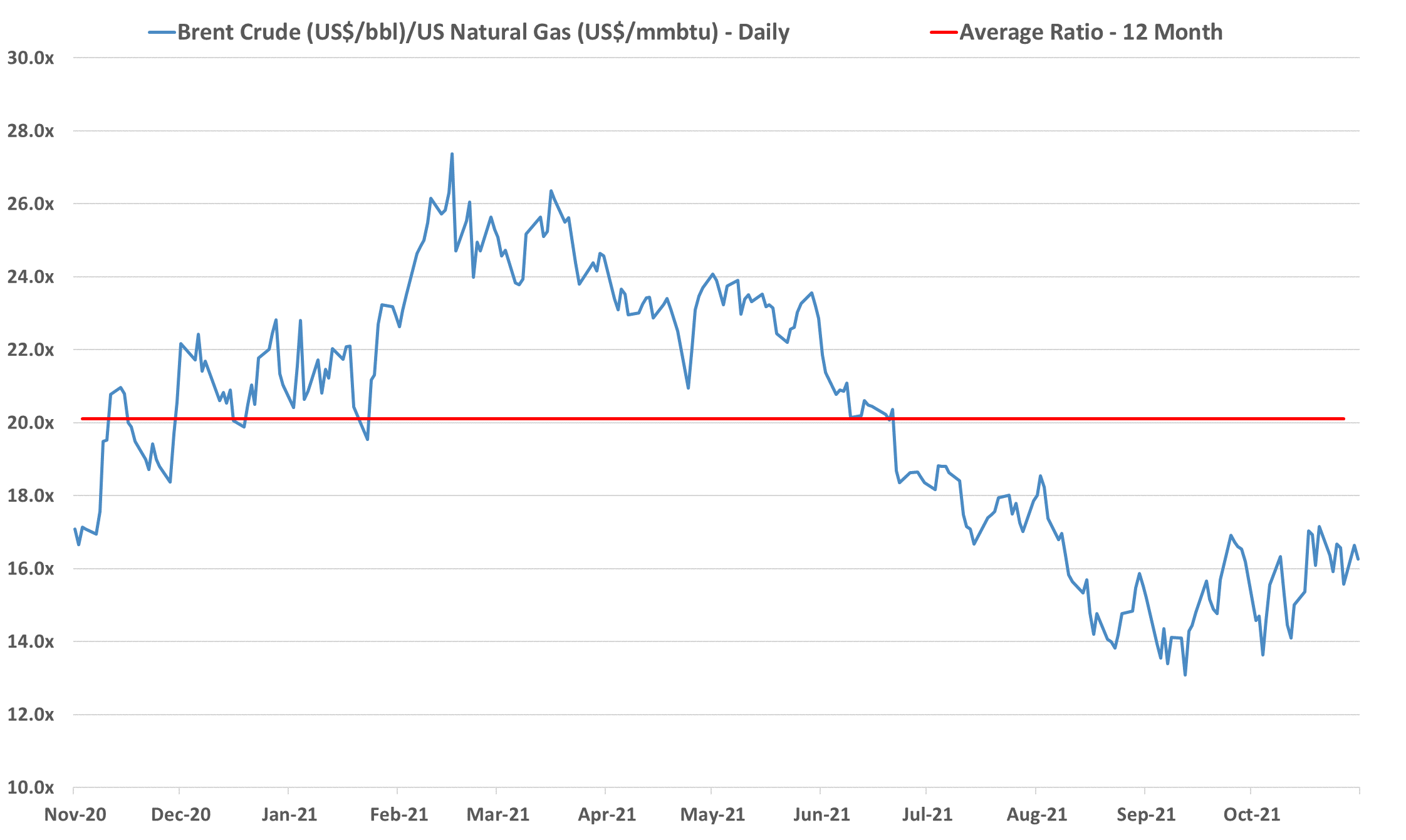

We remain concerned that natural gas E&P investment in the US remains too low to meet expected demand increases, especially for natural gas-fired power stations and LNG, but also possibly for NGLs, especially ethane, given new ethylene capacity and a fresh export market in Mexico. Near-term, natural gas prices are showing some easing relative to crude, albeit a very volatile trend – Exhibit below – but we see medium and longer-term shortages unless E&P spending increases. The new power facilities shown in the bottom Exhibit will all need incremental natural gas, and the international LNG market is so tight that as new capacity comes online in the US we would expect it to run as hard as is possible. This sets up for a market where the clearing price of natural gas in the US is at risk of being set by the marginal exporter. The price jump for domestic consumers would be dramatic and it would cause all sorts of headaches in Washington and probably intervention. We showed the incremental natural gas price in the Netherlands in our Daily Report on November 18th, and if the US price were to reflect the netback from this level, they would rise close to $30 per MMBTU. The natural gas industry needs some sort of global blessing to continue to operate as what will likely be the core transition fuel. It will be necessary to clean up the emissions footprint of natural gas, but the industry should be encouraged to invest on this basis. For those who doubt whether the US natural gas price can rise to $30/MMBTU – note that the Europeans did not think $30 was possible either.

Higher Crude Prices: Raise Interest in LNG and Help US Chemicals

Mar 5, 2021 12:25:56 PM / by Cooley May posted in Chemicals, Crude, LNG

As we anticipated (and have covered at length in our ESG and Climate service), we see a renewed increase in adding more US LNG capacity as global markets tighten again and as more emerging economies see LNG as a cleaner and potentially cheaper path to broader electrification. There is also talk of changing contract structures to share the pains and gains of LNG price volatility. This would be good for the buyers and is likely to generate more importer interest, but it will challenge some of the independent projects from a financing perspective if more variable price components become the norm in contract construction – this could create a competitive edge for the oil majors over the independents, as they would have less trouble raising the investment funds. One of the enabling factors of the early LNG projects was the fixed nature of contracts and the ability to lock in a largely fixed return for both equity and debt investors.