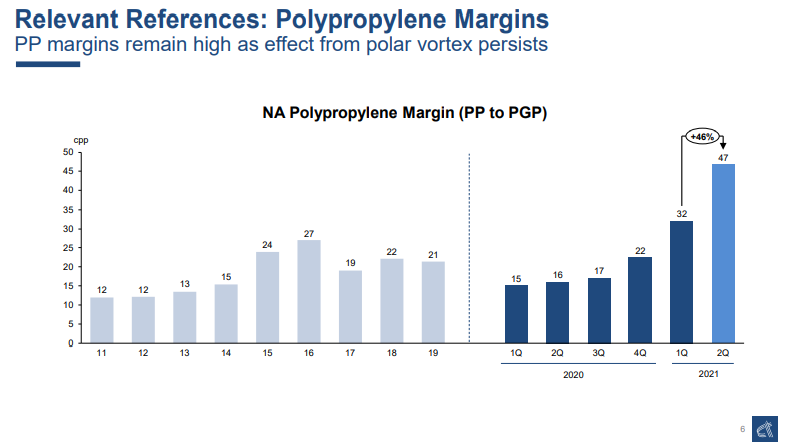

The much higher polypropylene margins in the US come despite very high propylene pricing, and the whole chain did well in the first half of the year. Demand for polypropylene has been significantly stronger than most expected year to date, although production outages have helped the market, and what we had expected to be a surplus in the US in 2021, precipitated by the Braskem start-up has turned out to be production coming online just in time and prices might have been higher still had the Braskem plant not been there. We see some of the demand as cyclical - in response to consumer durables, though there has been lower use in the auto industry because of the production cutbacks. See more in today's daily report.

Great North American Polypropylene Margins Despite New Capacity

Jul 22, 2021 12:07:14 PM / by Cooley May posted in Chemicals, Propylene, Polypropylene, Supply Chain, Capacity, cyclical demand, polypropylene margins, Braskem

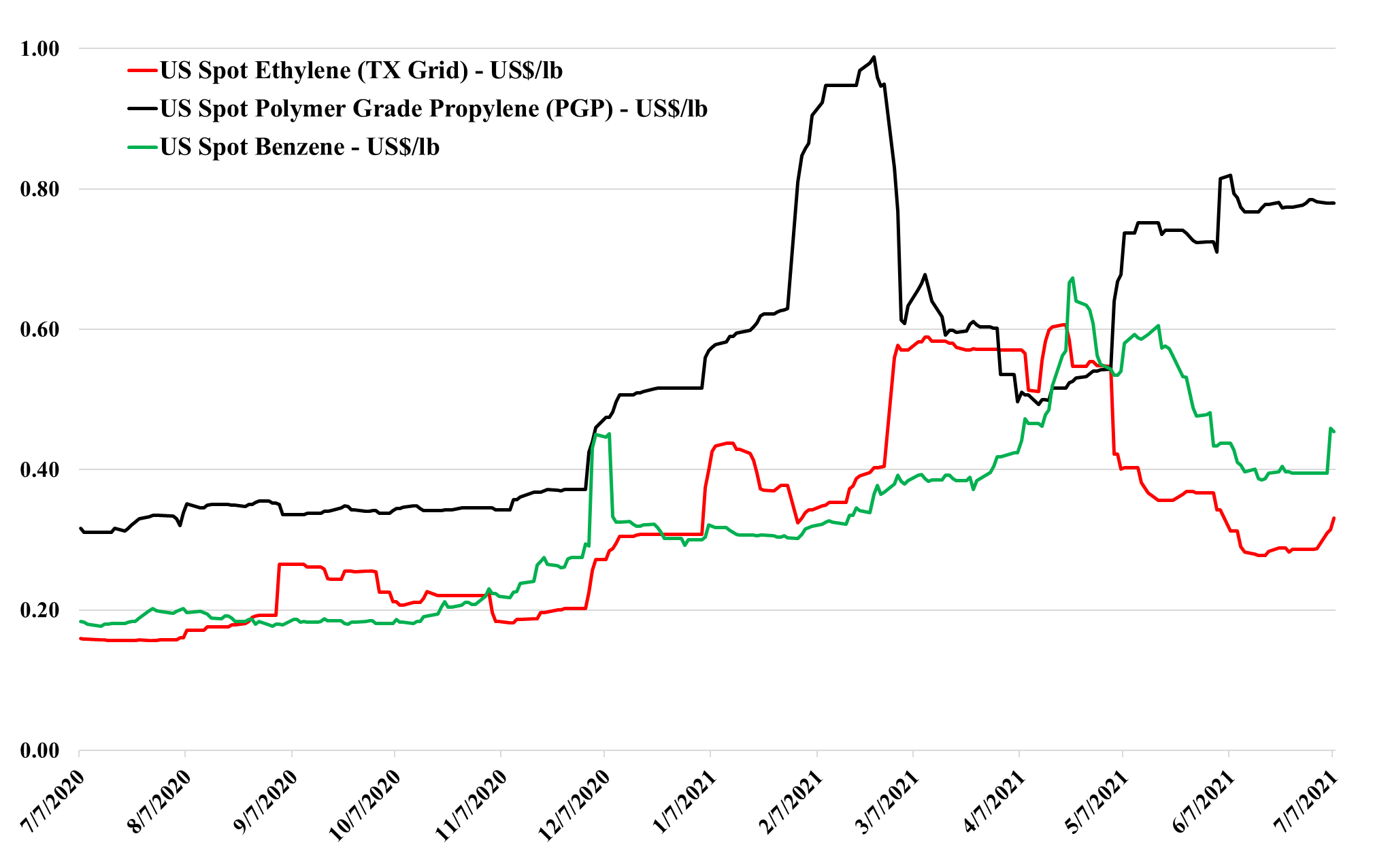

US Ethylene - Spot Market Shows Strength WoW, Likely To Remain Volatile in 2H21

Jul 7, 2021 3:03:39 PM / by Cooley May posted in Chemicals, Polypropylene, Ethylene, propane, Lotte Chemical, US Chemicals, Ethylene Surplus, US ethylene, US ethylene surplus, NGL, LPG cracking capacity

The US ethylene market strengthened slightly in early July, most likely because of supply disruptions as it is hard to see how domestic demand could improve from here. There is not much room to increase prices further if the export market is the balancing mechanism through July and August, as prices remain depressed in Asia and any arbitrage would close quickly if prices in the US moved any higher. Despite the rising NGL prices discussed in today's daily report and on Sunday, the US has plenty of margin left in ethylene, and prices could go lower if that is necessary to move additional volume. While we talk in the opening paragraph about increased inventories of finished goods in anticipation of the year-end holiday season and continued supply constraints, and how this is leading to a shortage of warehouse space, we suspect that everyone upstream of the finished good suppliers is also looking at adding or maintaining a larger inventory cushion than they have in recent years. We still believe that it is a tough call today as to whether you should sell surplus ethylene or store it as we head into hurricane season in the US.

Propylene Too Expensive, Ethylene Cheap Enough

Jun 15, 2021 2:18:27 PM / by Cooley May posted in Chemicals, Propylene, Polyethylene, Polypropylene, Ethylene, Auto Industry, polymer pricing, consumer spending

The weakness in polymer pricing in Asia and the drag that auto sales had on US consumer spending in May (spending was up ex-autos) should begin to undermine the very strong polypropylene market in the US, and the fall may happen at a reasonable clip. Polypropylene is more fungible than polyethylene, in that much more of the customization of polypropylene comes post-production rather than during production. There are several unique polyethylene technologies, especially for linear-low where the process drives the properties and adds value. For polypropylene, while there is some of this, most product is compounded and consequently, there is more fungibility before compounding and less risk from experimenting with suppliers. If freight rates were not so high as discussed in today's daily, we believe that we would have seen a notable amount of polypropylene moving from Asia to the US by now.

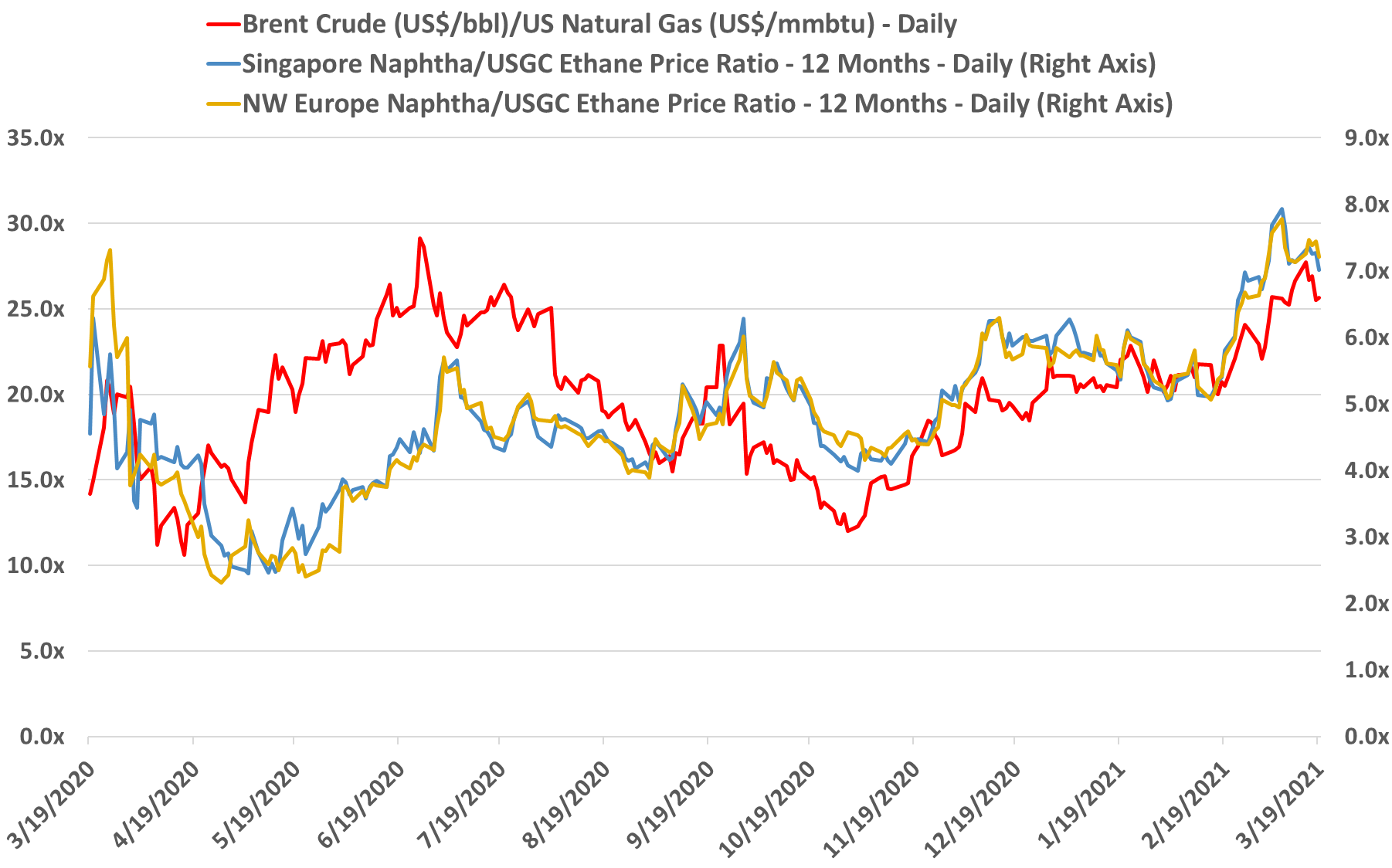

Will High Propane Prices Limit Propylene Demand Growth?

Jun 9, 2021 1:39:34 PM / by Cooley May posted in Chemicals, Recycling, Polymers, Polypropylene, Chemical Demand, Chemical Industry, propane, polystyrene, paint additives, ethane

The relative strength in US propane versus ethane is something we have talked about before, with the strong export pull on propane, pushing prices higher, despite equally strong demand for ethane in US ethylene units and for export. The projects to consume propane coming online in the next 12 months overwhelm the projects to consume ethane in our estimate and consequently, we believe that the delta (in chart below) will remain high and may widen further. On a cost basis, this could put US propylene and a distinct disadvantage to US ethylene and at the margin might help ethylene derivative demand relative to propylene derivative demand – most likely in paint additives, but also in some polymers where polypropylene can be substituted with other materials – it may provide a bit of a lifeline for polystyrene if the polystyrene recycling initiatives gain traction. See our daily report for more.

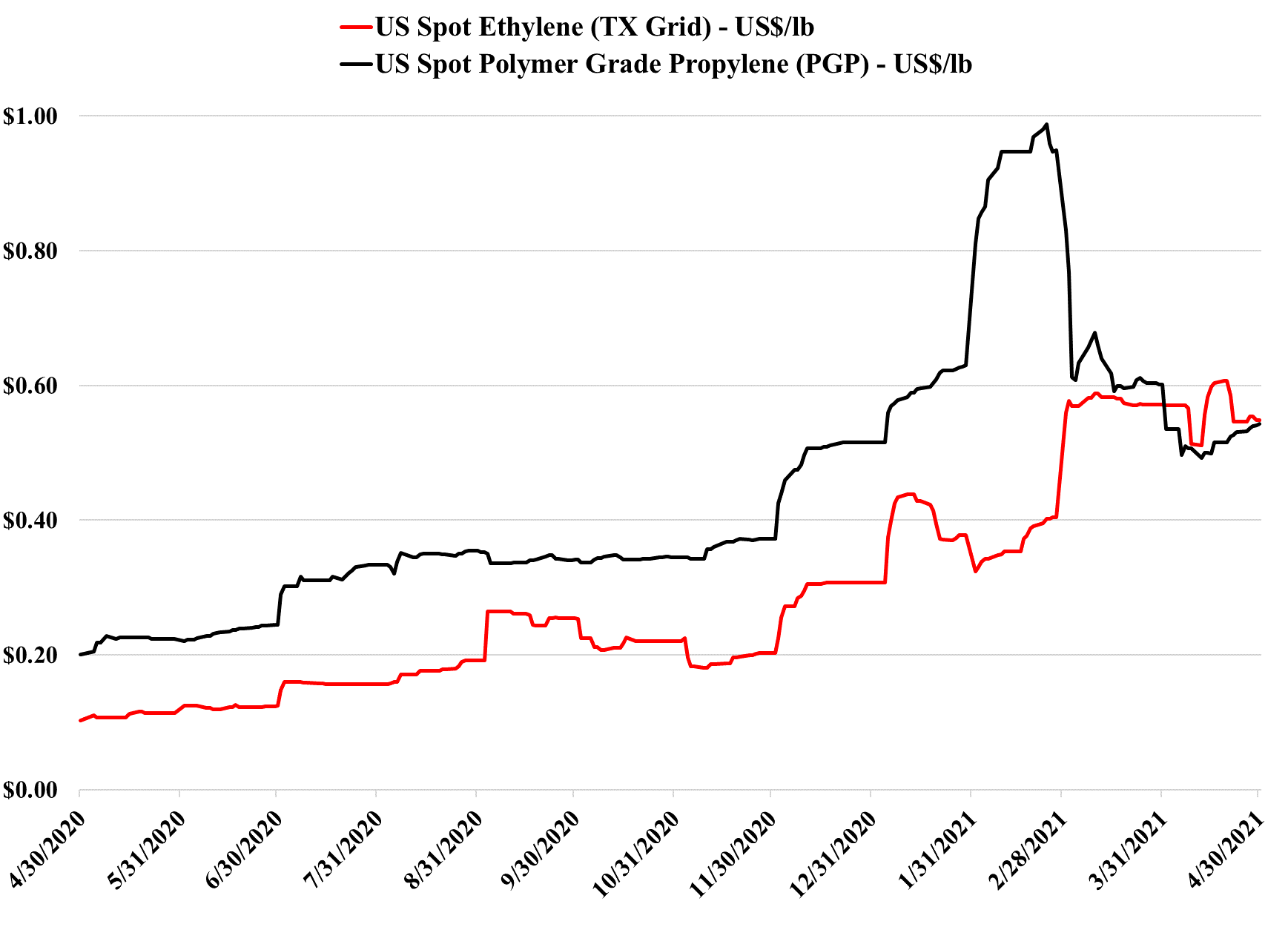

2Q-2021 Likely To Be The Polymer Profits Peak, Weather Permitting

Apr 30, 2021 1:54:54 PM / by Cooley May posted in Chemicals, Polymers, Propylene, PVC, Polyethylene, Polypropylene, Ethylene, Styrene, PET, PTA, Acetic Acid, Polyurethane, Glycol

We still believe that there is a good chance that 2Q 2021 is the peak for polymer profits in the US and Europe, but it very unclear how severe the downside could be, given the growth potential. Seasonal turnaround will keep markets more balanced in 2Q, and the major uncertainty beyond that will be weather in the US. A series of storms like last year could hold the market up through 3Q and into 4Q, but an absence of any weather events could expose US surpluses quite quickly, especially for ethylene and derivatives. The new builds in China have focused on ethylene and polyethylene (and some glycol), propylene and polypropylene, and PTA and PET, and this is where the potential weakness will emerge. There has been some new styrene capacity and that is also a vulnerable segment in our view. PVC, acetic acid, and large parts of the polyurethane chains look much more balanced to us and we have more faith in the projections being made by companies like Celanese, Olin, and Orbia than we do the major polyethylene producers. See today's daily report for more details.

Polypropylene Likely to See Competition From Other Materials

Mar 19, 2021 10:44:01 AM / by Cooley May posted in Chemicals, Polypropylene

The US polymer shortage is impacting supply in the rest of the world where the US is a major global supplier, but the benzene comments below suggest that this may not be the case where the US is not a major global player. Demand for styrene is high and prices of styrene and polystyrene are higher globally, but this alone is not enough to support benzene in Asia, where there has been a lot of new supply from ethylene units and where there has also been a strong pull on paraxylene to supply new PTA capacity. Reformer-based paraxylene has benzene as a co-product and the PTA expansion in China has been meaningful in the last few months. Separately, the phenol side of benzene demand is not looking as exciting as the polymer markets especially in some of the epoxy resin markets and in particular those facing the aerospace industry. This is a more significant demand impact in the US and Europe, but should also be felt in Asia.