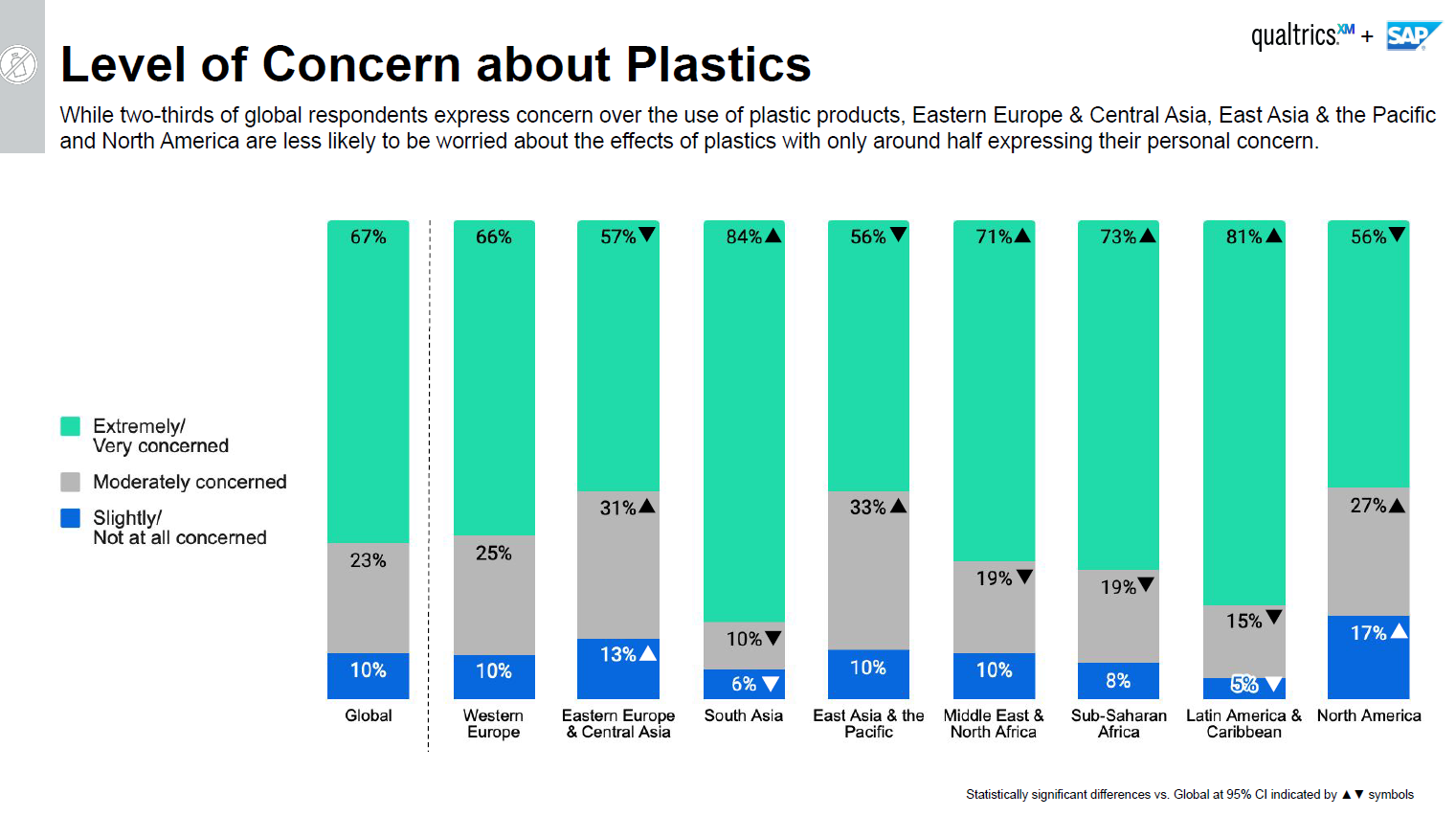

The linked headline is interesting and accurate, but the “civilian” education around plastics has just begun – and will need to be continuing education. Plus, the agenda for plastics producers likely changed with COP26. On the first point, while consumers have been made more aware of plastic waste issues and recycling in 2021, it is still very mixed by geography, with some countries and some US states making major pushes in 2021 while others have lagged. There remains a significant level of skepticism and disinterest in recycling in the US as we discussed in a recent ESG and Climate report – linked here (See chart below). The continuing education comment is based on the likely significant evolution of plastics over the next ten years. If we introduce more biodegradable polymers into the mix, these will have to be dealt with differently by consumers. Also, as packagers move towards more “recyclable” packaging, more materials will move from a waste stream to a chemically recyclable stream and ultimately to a mechanically recyclable stream – as this evolves, consumers will need constant updates is they are expected to play a part.

Will Consumers Become Experts In The Plastics They Use?

Dec 23, 2021 12:41:17 PM / by Cooley May posted in Chemicals, Recycling, Polymers, Plastic Waste, Plastics, Emissions, packaging, plastics industry, COP26, biodegradable polymers, Climate Goals, carbon footprints, recyclable packaging

Many Adjustments Ahead For LyondellBasell

Dec 14, 2021 1:27:36 PM / by Cooley May posted in Chemicals, Recycling, Polymers, Propylene, Polyethylene, Polypropylene, LyondellBasell, Chemical Industry, energy transition, US Exports, specialty chemicals, Polyethylene Capacity, US polyethylene, US polypropylene, commodity chemicals, refinery, commodity polymer

Following on from the LyondellBasell commentary in today's daily report, we would make one further, but very important point. With its refinery (granted the company is exploring opportunities to exit) and its huge commodity polyethylene, polypropylene, and propylene oxide business, any attempt to pursue a “specialty” strategy that encompasses the whole portfolio will be seen (crudely) as trying to put some lipstick on a pig! This rarely works in the chemical sector and the real transformation stories involve wholesale portfolio shifts, many of which have taken notable periods of time to develop. We still believe that the right path for LyondellBasell is to spin off the good piece – recycling, licensing, and compounding, or even better, find someone they can sell the business to through a Reverse Morris Trust. This strategy would likely allow the company to pay down (or shift) a significant amount of debt. The commodity business can then focus on the best strategy for a commodity polymer business in the face of energy transition, which might involve taking the business private or merging with another.

Will High Propane Prices Limit Propylene Demand Growth?

Jun 9, 2021 1:39:34 PM / by Cooley May posted in Chemicals, Recycling, Polymers, Polypropylene, Chemical Demand, Chemical Industry, propane, polystyrene, paint additives, ethane

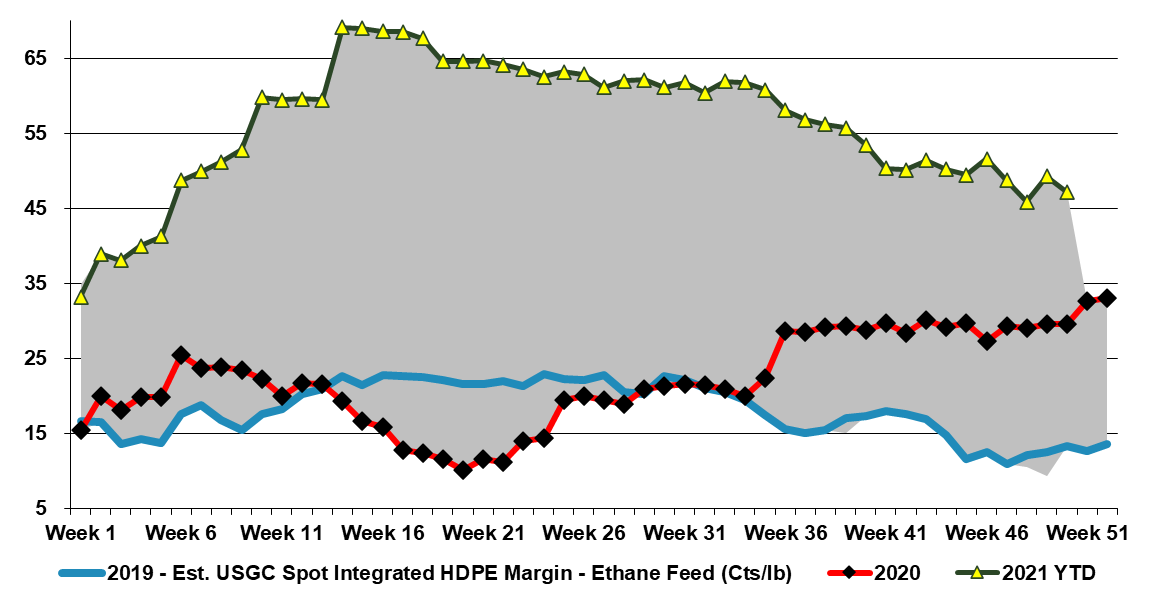

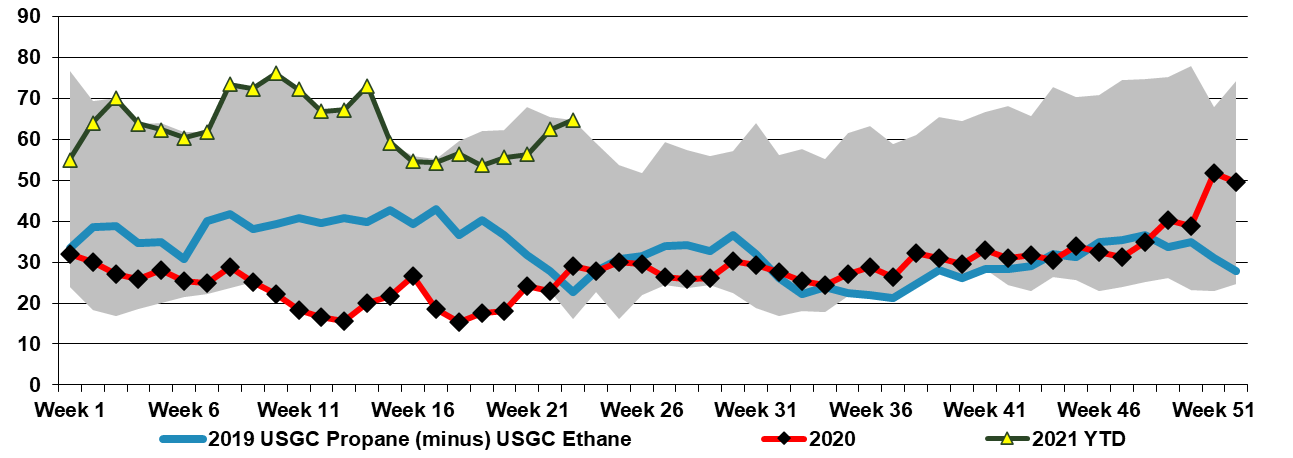

The relative strength in US propane versus ethane is something we have talked about before, with the strong export pull on propane, pushing prices higher, despite equally strong demand for ethane in US ethylene units and for export. The projects to consume propane coming online in the next 12 months overwhelm the projects to consume ethane in our estimate and consequently, we believe that the delta (in chart below) will remain high and may widen further. On a cost basis, this could put US propylene and a distinct disadvantage to US ethylene and at the margin might help ethylene derivative demand relative to propylene derivative demand – most likely in paint additives, but also in some polymers where polypropylene can be substituted with other materials – it may provide a bit of a lifeline for polystyrene if the polystyrene recycling initiatives gain traction. See our daily report for more.