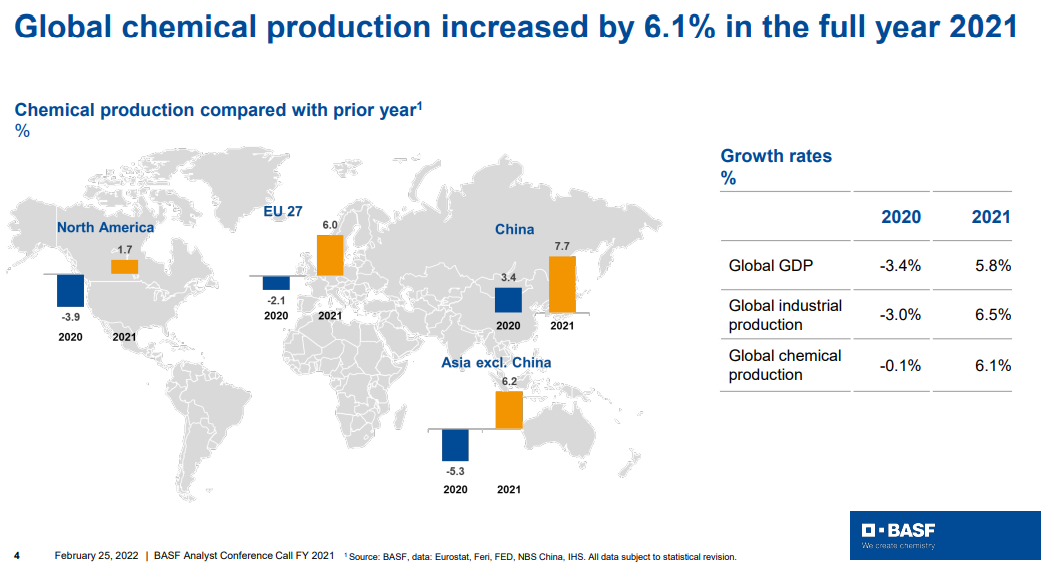

Fear of shortages is the one factor that is most supportive in terms of helping to push through pricing and the events in Europe and their associated impact on energy prices should be all the support that the chemical and polymer industry needs to push pricing through that will cover cost inflation. Buyers of raw materials and intermediate products will naturally look to buy a little more than they need in the near term, both to ensure that they get something ad to try to build a bigger inventory cushion. This will have the effect of pushing apparent demand higher, making the pricing initiatives easier. Few will push back on pricing if their primary concern is availability. Looking at the BASF results summarized in the chart below, demand is already very robust and this will lead to higher utilization rates and higher volumes for chemical producers as well as high pricing. The commodity producers are likely more interesting here as they can move prices much more quickly than the specialty companies who might see margins squeezed over the next couple of months. None of this is good for inflation. See more in today's daily report.

Chemical And Polymer Prices Are Moving Higher

Feb 25, 2022 1:59:11 PM / by Cooley May posted in Chemicals, Commodities, Energy, Raw Materials, Inflation, Chemical Industry, intermediates, specialty chemicals, commodity producers, chemical producers, materials, shortages, intermediate chemicals, energy prices, European energy prices, polymer industry

US Commodity Chemical Producers Face More Margin Pressure

Oct 6, 2021 2:32:43 PM / by Cooley May posted in Chemicals, Propylene, Ethylene, petrochemicals, feedstock, US Chemicals, specialty chemicals, commodity producers, downstream producers

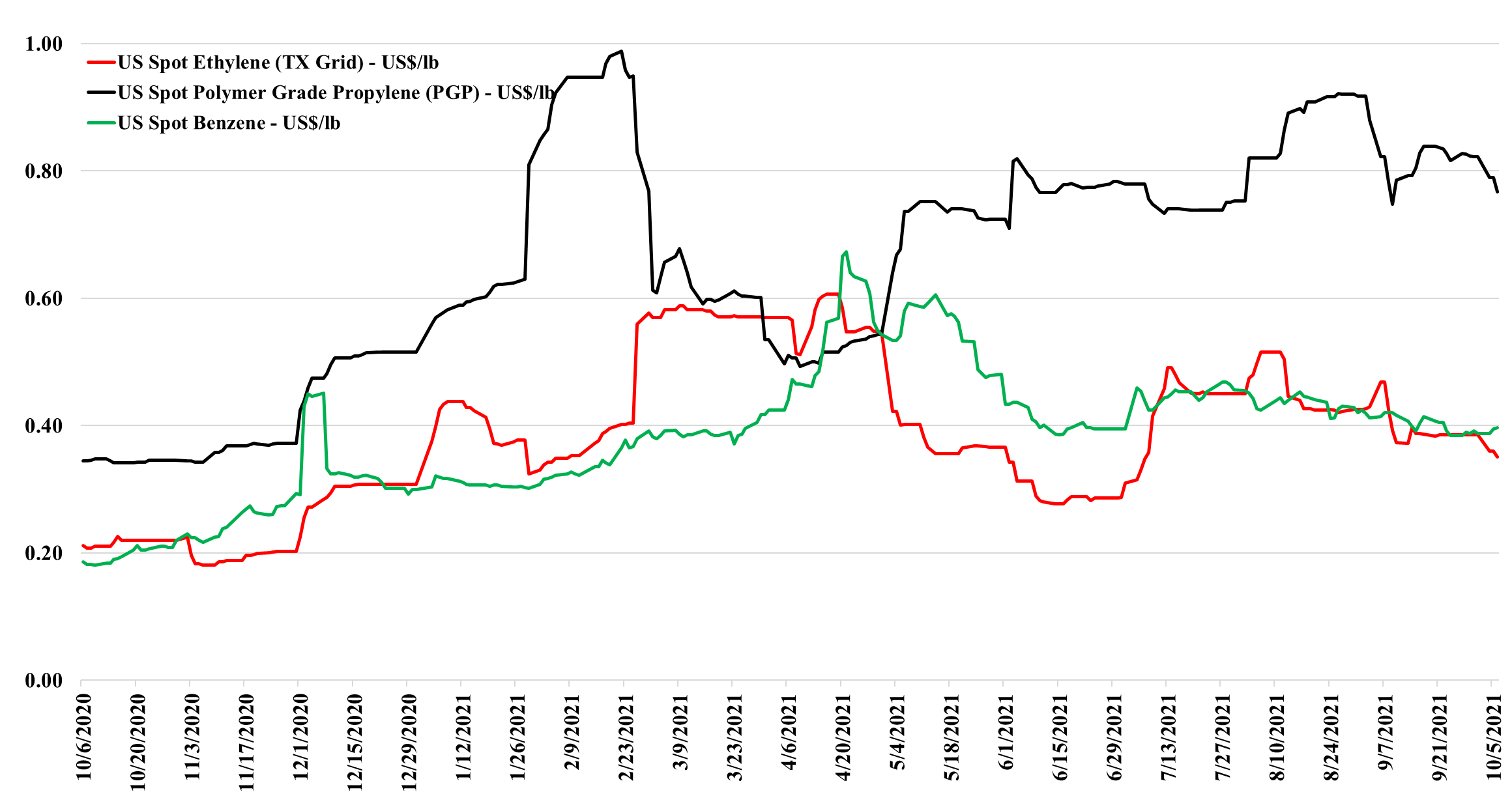

The decline in propylene and ethylene values is worth consideration today as it provides proof, along with the feedstock comments in today's daily report, that US commodity chemical producers are on average facing margin pressure WoW. We noted in yesterday's research that China prices were rising amid production cuts, but demand remains a notable concern. As production rises from current levels in 1H22, this will put downward pressure on Asia chemical prices and also translate into lower US export values.

Operating Leverage Spurs Downstream Profits, Combats Raw Material Cost Inflation

Aug 12, 2021 2:15:14 PM / by Cooley May posted in Chemicals, Propylene, Raw Materials, raw materials inflation, downstream, Basic Chemicals, Kuraray, specialty chemicals, commodity prices, basic chemical markets, commodity producers

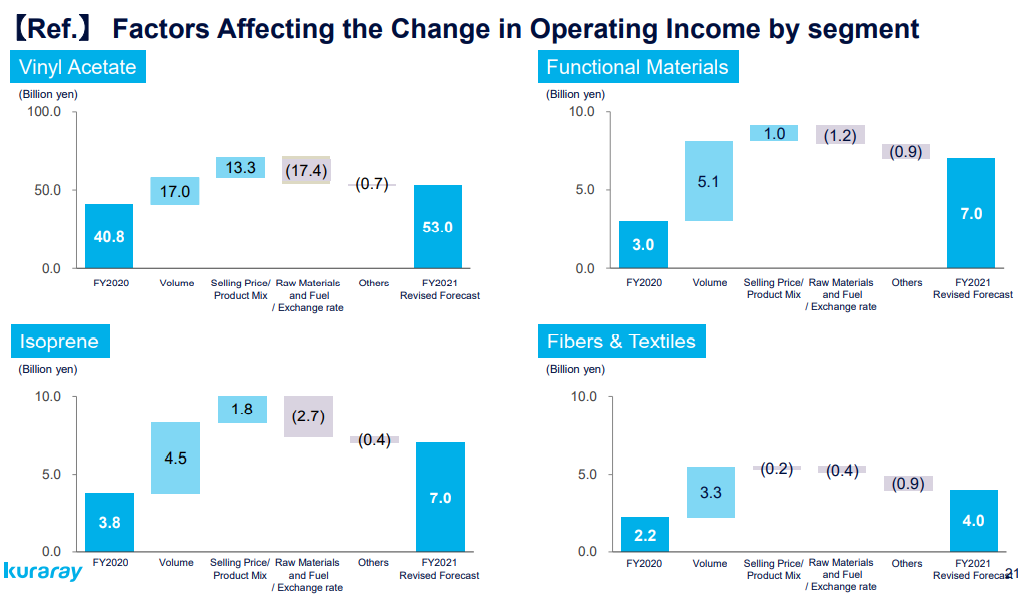

The 2Q volume driver of Kuraray’s earnings recovery was substantial, partly because end-market demand is strong and because this more mid-stream and specialty portfolio has significant operating leverage, much more than you would see from the commodity producers. We find this as a notable downstream sector trend to keep in mind. As seen below, increased selling prices are an important driver of Kuraray full-year profit growth expectations, but the volume piece is the most critical component, in our view. As discussed in our daily report today available in LINK, we continue to see volatile but elevated basic chemical prices.