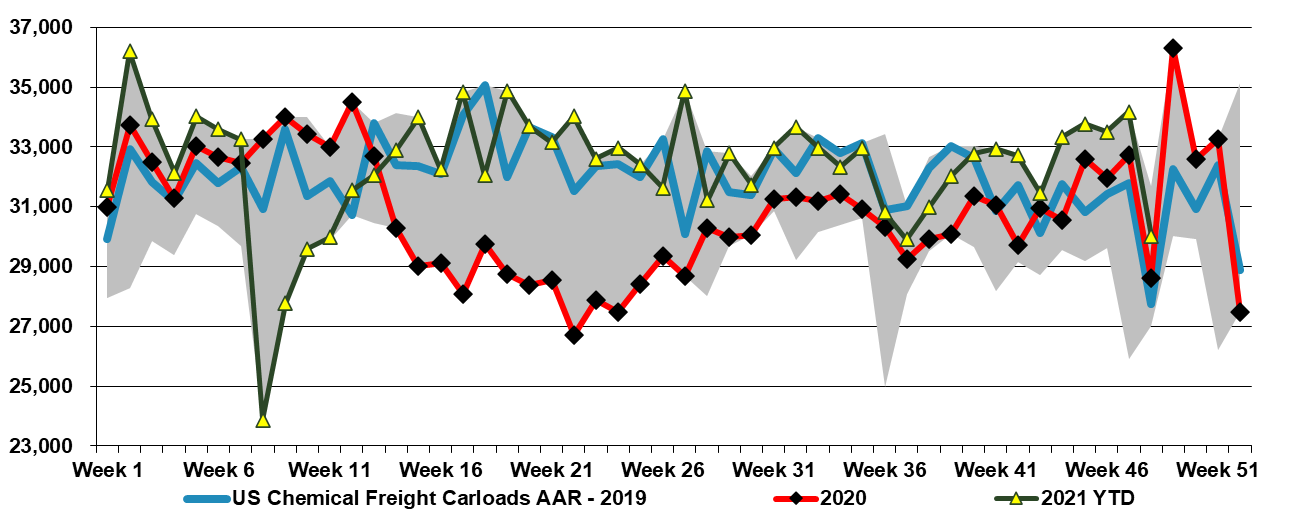

The decline in US and global chemical pricing this week (as discussed in today's daily) is a function of oversupply in the US and lower costs in the rest of the world. The US has had an incentive to produce everything for most of the year and has had essentially full capacity to do so since the beginning of the 4th quarter. This will have collided with seasonally weaker incremental demand in December and the recent abrupt drop in oil and gas prices to swing momentum very much in favor of buyers. Polymer prices have to date been more stubborn in the US, but we expect continued weakness here also through the end of the year.

US Polymer Price Weakness Inevitable Without Supply Issues, Despite Strong Demand

Dec 3, 2021 3:05:38 PM / by Cooley May posted in Chemicals, Polymers, Energy, polymer pricing, petrochemicals, US Polymers, Chemical pricing, Gas prices, energy prices, demand, chemicalindustry, plasticsindustry, petrochemicalindustry, oil prices, ISM manufacturing, US chemical rail, Supply

High Natural Gas Prices May Be Here To Stay Without More E&P Investment

Oct 1, 2021 1:54:55 PM / by Cooley May posted in LNG, Coal, Energy, ExxonMobil, natural gas, power, renewables, Gas prices, Venture Global

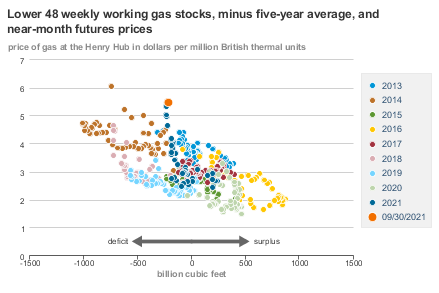

It is a gas, gas, gas! Every other story this week is about natural gas shortages and pricing – whether it is natural gas in the US or LNG everywhere else. The scatter diagram below from the EIA below is very interesting as it speaks of anticipation more than anything else. Gas prices are high given the level of US inventory relative to “normal”. There is speculation that demand is going to outstrip supply over the next few months. Whether much of this will be LNG-related remains to be seen as we may not be able to run the current capacity any faster – that said, through the end of July it looked like there was spare capacity at several of the US LNG facilities and maybe the constraint is shipping. Regardless, the current US price implies shortage, whether because domestic demand overwhelms supply this winter or because LNG steps up. The original timeline of the Venture Global facility at Calcasieu Pass in Louisiana has slipped and this facility will not impact demand for the next 12 months at least, with ExxonMobil’s Golden Pass project a year later and targeting a 2024 start.