The closure of the Russian oil pipeline and export terminal as well as the move to want payment in Roubles, are all likely tactics from Putin to cause more market chaos in an attempt to hit back over sanctions. While Russia likely needs the oil and gas revenues, sending oil higher is likely intended to see whether the West cracks, which seems unlikely. The Rouble payment is also meant to inconvenience the West but at the same time maybe support the Rouble as West Europe needs the gas and will need to buy Roubles to may payments.

US Refiners Profits Rise On Margin And Roubles

Mar 24, 2022 3:02:20 PM / by Cooley May posted in Chemicals, Oil, natural gas, gasoline, refinery, Russia, oil and gas, refining margins, refiners

Refinery Propylene Remains A Cheap Source, If You Can Find It...

Dec 15, 2021 2:09:46 PM / by Cooley May posted in Hydrogen, Chemicals, Polymers, Propylene, Polypropylene, Emissions, CP Chemical, carbon footprint, ethane, PDH, ethylene capacity, polypropylene demand, refinery, Refinery Propylene, ethylene demand, surplus refinery propylene, polymer recycling, propylene splitter

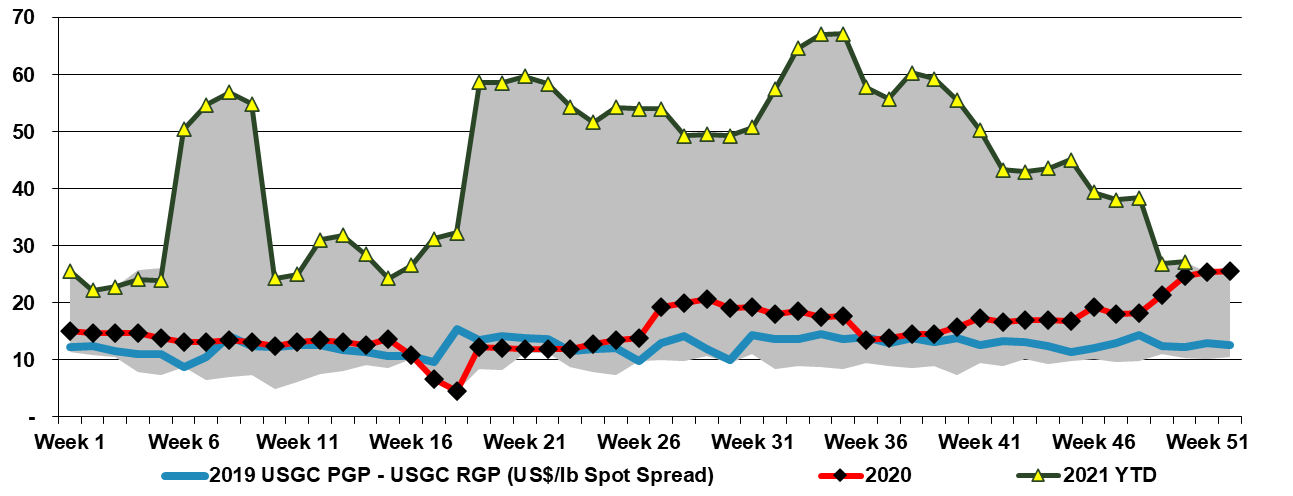

The CP Chem propylene splitter announcement linked suggests that CP Chem expects surplus refinery propylene to be around for the long-term, and likely has supply lined up from the parent companies. However, this is still a bit of a gamble unless both parents see a scenario where they would change catalysts on FCC units longer-term and run at higher severity for more propylene and more hydrogen. This project looked a lot better only a few weeks ago than it does today – based on the spread in the Exhibit below, but propylene demand continues to grow faster than ethylene demand in the US and with all incremental ethylene capacity based on ethane, propylene consumers either have to choose the path from refineries or invest in on purpose PDH. PDH is an energy-intensive process with a large carbon footprint, and splitting refinery propylene likely looks far less problematic from an emissions perspective, especially if there is surplus process heat on-site. In our ESG report today we talk about polymer recycling into new end markets, but polypropylene may see more direct substitution, especially if we see consumables related polypropylene recycled into durable polypropylene markets. This might dent demand growth for polypropylene going forward, but probably not meaningfully.

Many Adjustments Ahead For LyondellBasell

Dec 14, 2021 1:27:36 PM / by Cooley May posted in Chemicals, Recycling, Polymers, Propylene, Polyethylene, Polypropylene, LyondellBasell, Chemical Industry, energy transition, US Exports, specialty chemicals, Polyethylene Capacity, US polyethylene, US polypropylene, commodity chemicals, refinery, commodity polymer

Following on from the LyondellBasell commentary in today's daily report, we would make one further, but very important point. With its refinery (granted the company is exploring opportunities to exit) and its huge commodity polyethylene, polypropylene, and propylene oxide business, any attempt to pursue a “specialty” strategy that encompasses the whole portfolio will be seen (crudely) as trying to put some lipstick on a pig! This rarely works in the chemical sector and the real transformation stories involve wholesale portfolio shifts, many of which have taken notable periods of time to develop. We still believe that the right path for LyondellBasell is to spin off the good piece – recycling, licensing, and compounding, or even better, find someone they can sell the business to through a Reverse Morris Trust. This strategy would likely allow the company to pay down (or shift) a significant amount of debt. The commodity business can then focus on the best strategy for a commodity polymer business in the face of energy transition, which might involve taking the business private or merging with another.