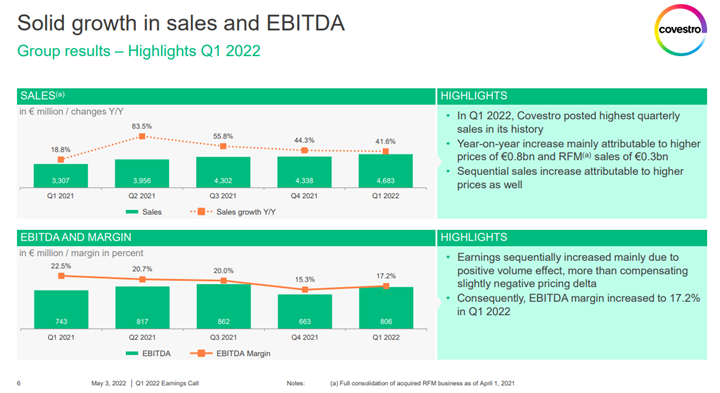

We reflect back on our BASF comments of last week and see Covestro falling into the same trap, by underestimating the potential slowdown in discretionary spending in Europe (and the US) and consequently putting too much hope into revised guidance. At the same time, we are not sure what would be gained by painting a picture of doom and gloom, but we would hedge much more overtly if we were offering guidance around the business outlook today.

Good Results But Too Much Optimism In Europe

May 3, 2022 1:24:48 PM / by Cooley May posted in Chemicals, Westlake, nitrogen, Covestro, materials, commodity chemicals, Agriculture, fuels, Building Products, corporate guidance, crops, Nutrien, fertilizers

Is Current Enthusiasm Justified Or Preceding A Collapse?

Apr 6, 2022 12:46:26 PM / by Cooley May posted in Chemicals, PVC, Ethylene, Energy, Metals, Auto Industry, Chemical Demand, Chemical Industry, clean energy, materials, Building Products, RPM, MDI

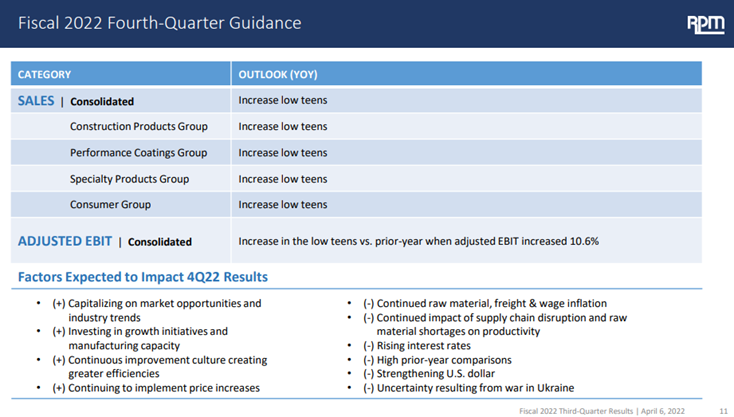

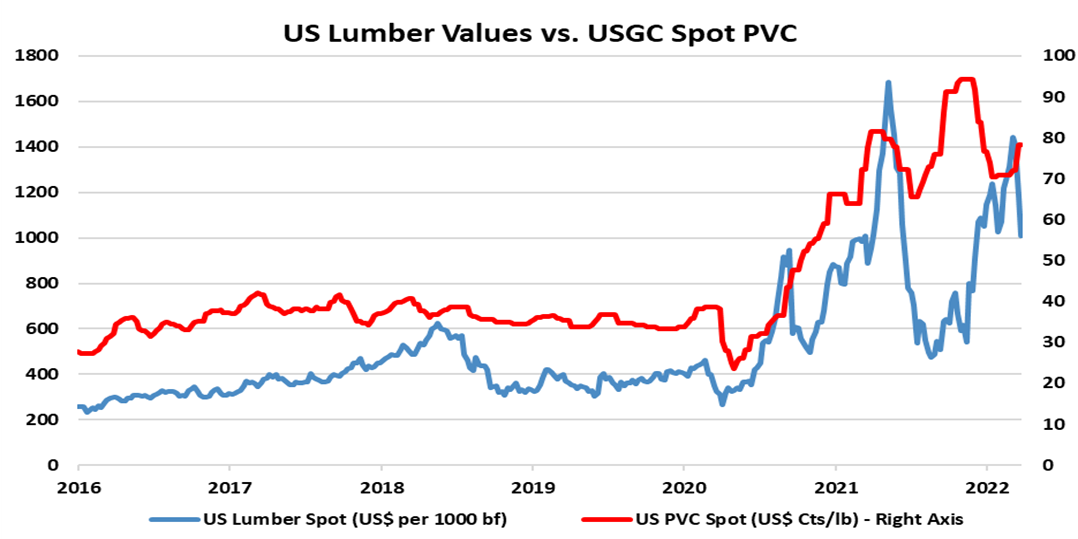

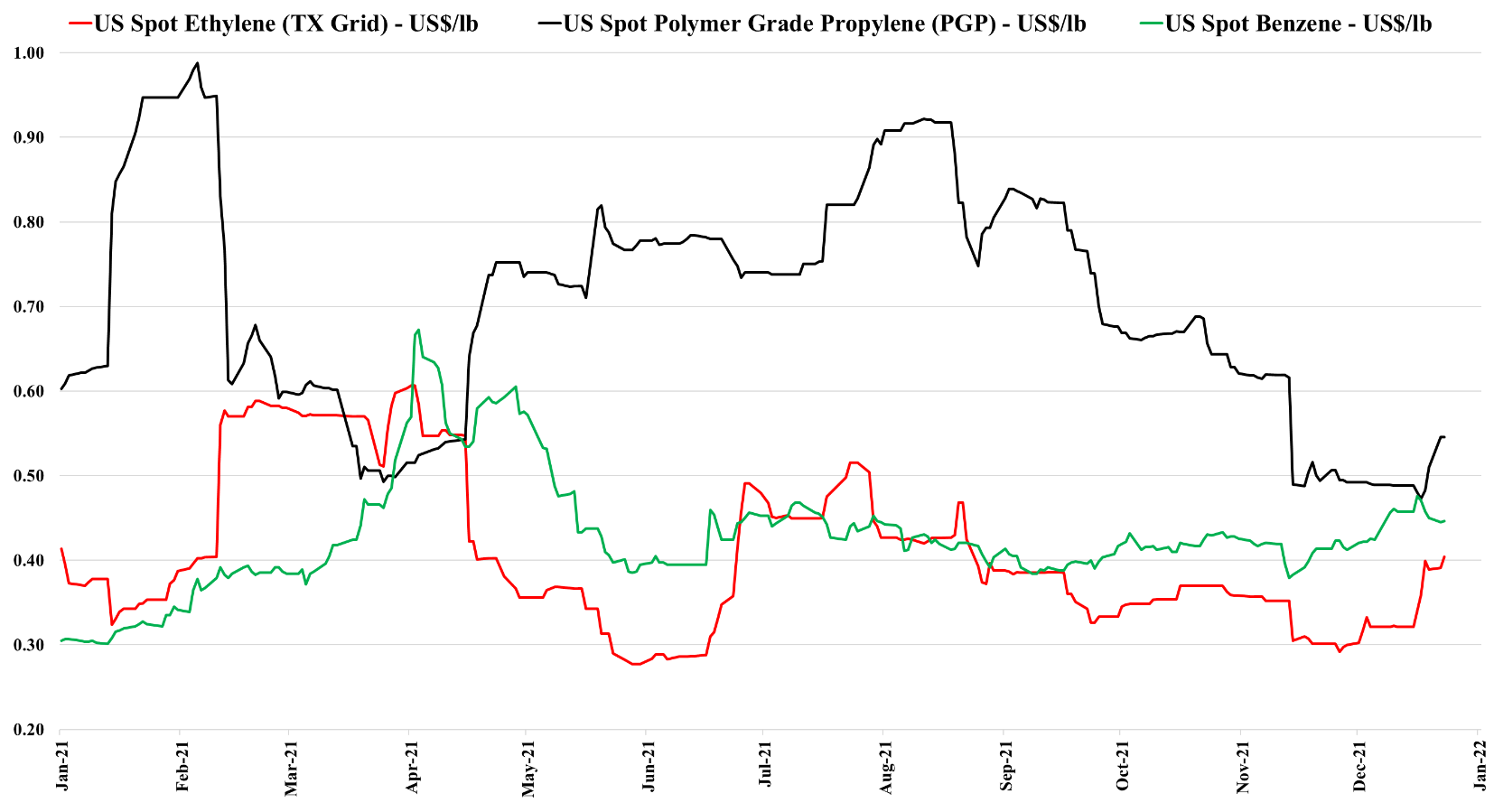

While we remain advocates of “stronger for longer” with respect to chemical demand and pricing in the US, the auto data does suggest that the US consumer may be cooling off a bit in reaction to higher prices and higher borrowing rates. Historically, the chemical industry has a habit of running headlong into a downturn while waving an “everything is great” flag, and the RPM results and outlook have a vague “deja vu” feel to them. We also note some surprise at the robustness of the MDI market in the chart below, and it would be wrong not to admit that our cautionary antennas are rising. The auto exposed products should still see some upside from higher auto production in the second half of the year, but otherwise, a possible consumer pullback to take the wind out of the sector sales, especially if the US is constrained moving out products because of container and shipping issues. The significant cost advantage remains in the US but the ethylene market over the last week is a reminder of what can happen when you struggle to find someone who can take the last pound. Given infrastructure, energy, and clean energy investment, as well as reshoring, many materials could see significant offsets to consumer spending pullbacks and our focus would remain on PVC and building products, as most of the hit would be in consumer durables. Metals demand should remain strong regardless. For more see today's daily report.

Building Products Mostly Strong Despite Rising Rates

Mar 30, 2022 12:09:01 PM / by Cooley May posted in PVC, Polyethylene, recycled polymer, Lumber, Base Chemicals, Westlake, Building Products, S&P, footprint

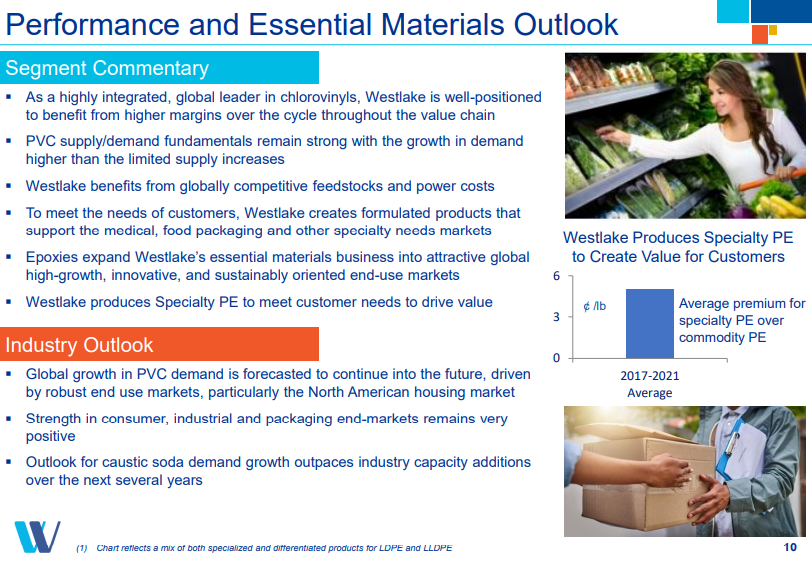

We focus on the building products industry today and it is interesting to note the convergence of the S&P Building Products index and Westlake over the early part of this year, as Westlake has been recognized for its building products footprint, partly aided by the company’s re-segmenting with the last quarterly earnings. The company has reached an all-time high stock price over the last few weeks and has certainly been a great preferred pick for us over the last two years. As interest and mortgage rates rise, we may see a slowdown in home buying as there is generally a good correlation, but this often leads to more home projects as consumers choose not to move and improve what they have.

Demand Growth Continues To Favor Strong Corporate Results

Feb 23, 2022 3:56:50 PM / by Cooley May posted in Chemicals, Polyolefins, PVC, Energy, Supply Chain, manufacturing, Westlake, Building Products, construction, housing, diversification, construction market, Element Solutions

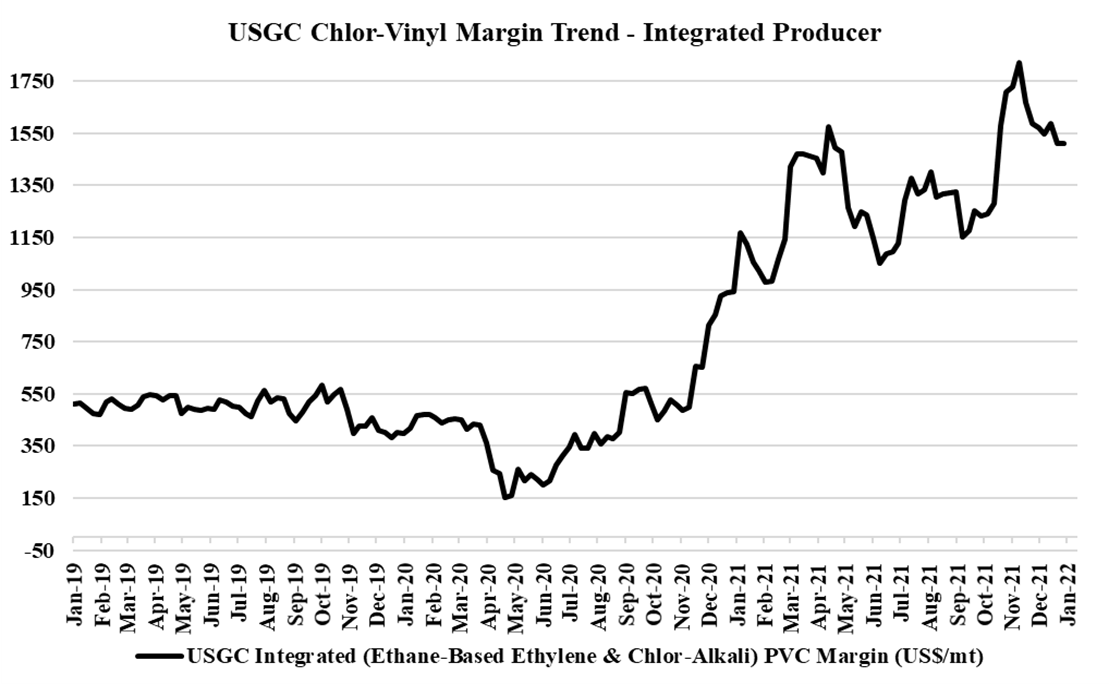

Westlake Chemical began today at a 52 week high on the back of very strong earnings but has retreated with the market. Westlake has been one of our favorite ideas since founding C-MACC in part because we believe in the diversification strategy into building products and in part because the PVC market has not seen the same level of overinvestment as polyolefins globally over the last 3 years. Westlake’s view of the housing and construction market aligns with ours and by breaking out this segment of the business Westlake should see some valuation benefit from the more stable earnings that this segment should provide. Note that the focused building products companies trade at significantly higher multiples than chemicals. We expect Westlake to get earnings and multiple boosts from here.

Some Chemical Producer Price Initiatives Will Fare Better Than Others

Jan 11, 2022 3:10:34 PM / by Cooley May posted in Chemicals, Polyolefins, Polyethylene, Raw Materials, LyondellBasell, Chemical Industry, polyethylene producers, oversupply, Basic Chemicals, Westlake, chemical producers, Huntsman, Building Products, price initiatives, demand strength, Sika, monomer prices

We are seeing pockets of real demand strength in some areas of chemicals, such as building products, and this is allowing producers to push through price increases to reflect higher costs and most likely add some margin. In other areas where the fundamentals might not be quite as supportive, we are still seeing attempts to pass on higher costs. Sika has supported what we have heard from many over the last few weeks, which is that the building products chain remains tight, as demand is strong, capacity is running hard and logistic issues continue to cause problems in some cases from a raw materials perspective and in others from getting finished products to market. Where there is limited ability to increase supply, those selling into the building products space are likely to make more money as they should have strong pricing power – in the US chemical space, we would favor Westlake as a potential big winner from this trend, but Huntsman should also be on the list.

Some US Polymer Markets Are Much Better Positioned Than Others - Watch PVC

Jan 7, 2022 1:51:14 PM / by Cooley May posted in PVC, Shell, Lumber, PVC Margins, Westlake, PVC prices, Building Products

While the Shell headlines today are probably the biggest news, it should not be a surprise to anyone that earnings are lower in 4Q than they were in 3Q, as all of the market indicators have been telling us this for months, and Dow made a statement to this effect in early December. Given the location of Shell’s Norco facility, it took a full hit from Hurricane Ida and the company made several statements at the time regarding delays to restarts. We expect other chemical companies to post meaningful declines in earnings for 4Q relative to 3Q 2021, but unless, like Shell, they experienced meaningful production outages, we would still expect 4Q results to be above “normal” and higher than earnings in 2019. We still see share prices for the public companies as very low looking at values relative to 2019 and earnings relative to 2019, but the negative momentum in earnings is more important to investors today than the absolute level of earnings. As we have stated in prior work, we need to get through negative revisions before the sector could look interesting. The exception, as noted in our Daily Report today, could be PVC, where pricing could look better than is already implied in 2022 estimates and valuation. A positive tone in upcoming conference calls may be a turning point for the PVC-related stocks – Westlake primarily. We could see the trend in the chart below reverse.