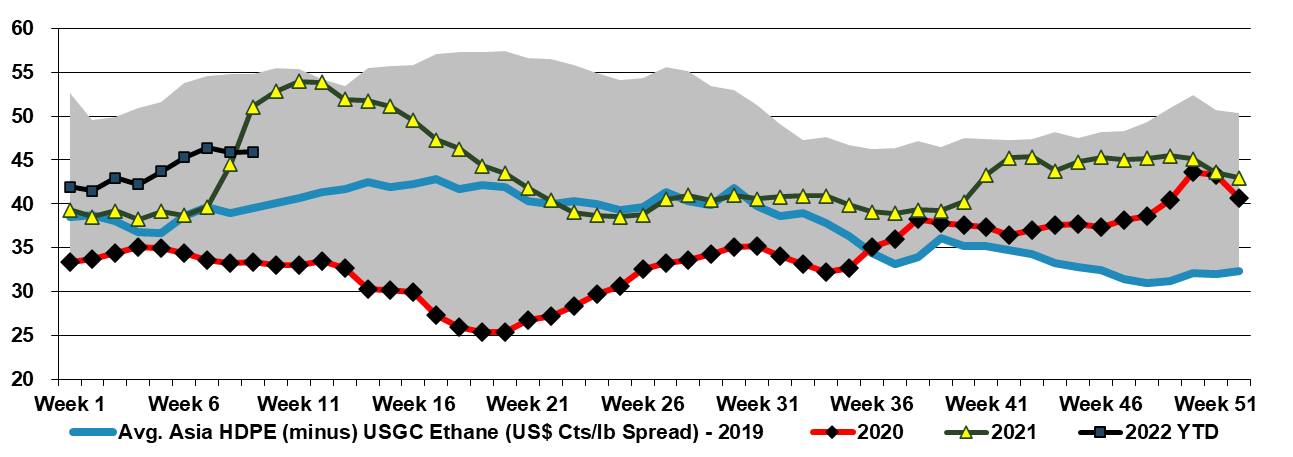

With the rapid jump in international natural gas and oil prices, we would see very concerted efforts to raise basic chemicals and polymer prices in Europe and Asia and will have a positive knock-on effect for the US. In our weekly catalyst report on Monday, we showed that ethylene producers outside the US were all losing money, especially in Europe and Asia. Some European demand will already be lower, because of curtailed product exports to Russia and Ukraine, but producers will want to cover costs at a very minimum and consequently, will be trying to match price increases with cost increases and if possible do a bit better than that. All of this will create a greater margin umbrella for the US, and US exporters selling directly into international markets will see export margins step up and may see incremental opportunities to export more, assuming that the freight rates are not too onerous for incremental containers.

All Eyes On Costs - Prices Going Higher

Mar 9, 2022 12:38:11 PM / by Cooley May posted in Chemicals, Inflation, Prices, feedstock, HDPE, Oil, polymer producers, ethane, natural gas, Basic Chemicals, manufacturing, polymer, exports, Global Costs, polymer prices

US Ethylene Decoupled From Global Costs

Mar 8, 2022 2:05:18 PM / by Cooley May posted in Chemicals, Propylene, Ethylene, Benzene, propane, natural gas, Ethylene Surplus, ethylene exports, US propylene, crude oil, crude prices, Global Costs

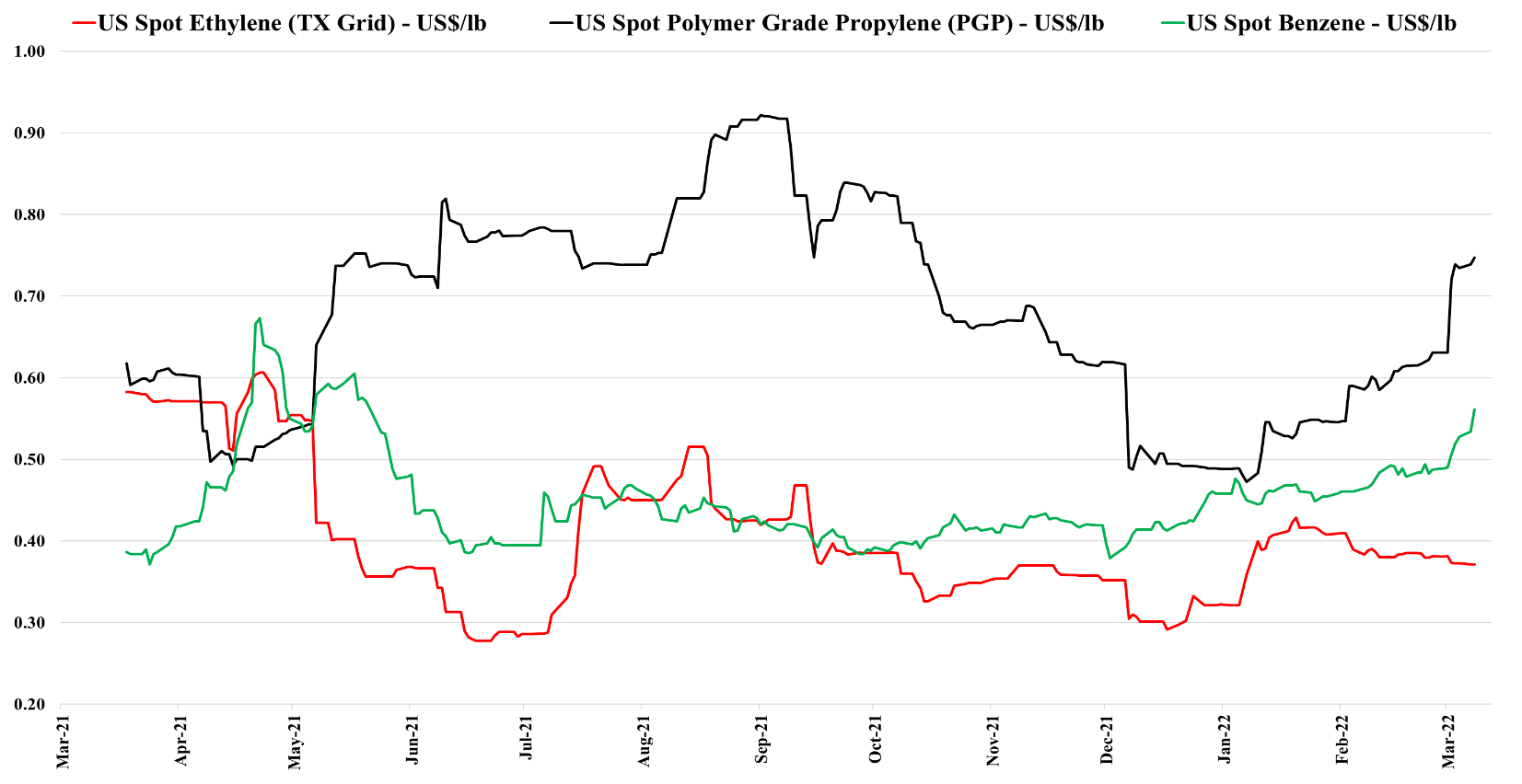

It is interesting to note the rapid rise in US propylene (and benzene) values as they follow propane and crude prices (propane is following crude because of its heating value and export opportunities). Ethylene is not moving as US natural gas is in surplus and is not following international natural gas prices. The US is surplus ethylene and derivatives, but we would expect to see ethylene and ethylene derivative prices jump up in the US if Europe is physically unable to make ethylene and derivatives or if the costs in Europe become so high that supplying incremental volumes from the US becomes even more compelling. For more see today's report titled "Into The Mystic – Ex-US Energy Price Surge Favors US Producers; Low Visibility Keeps Capex In Check".