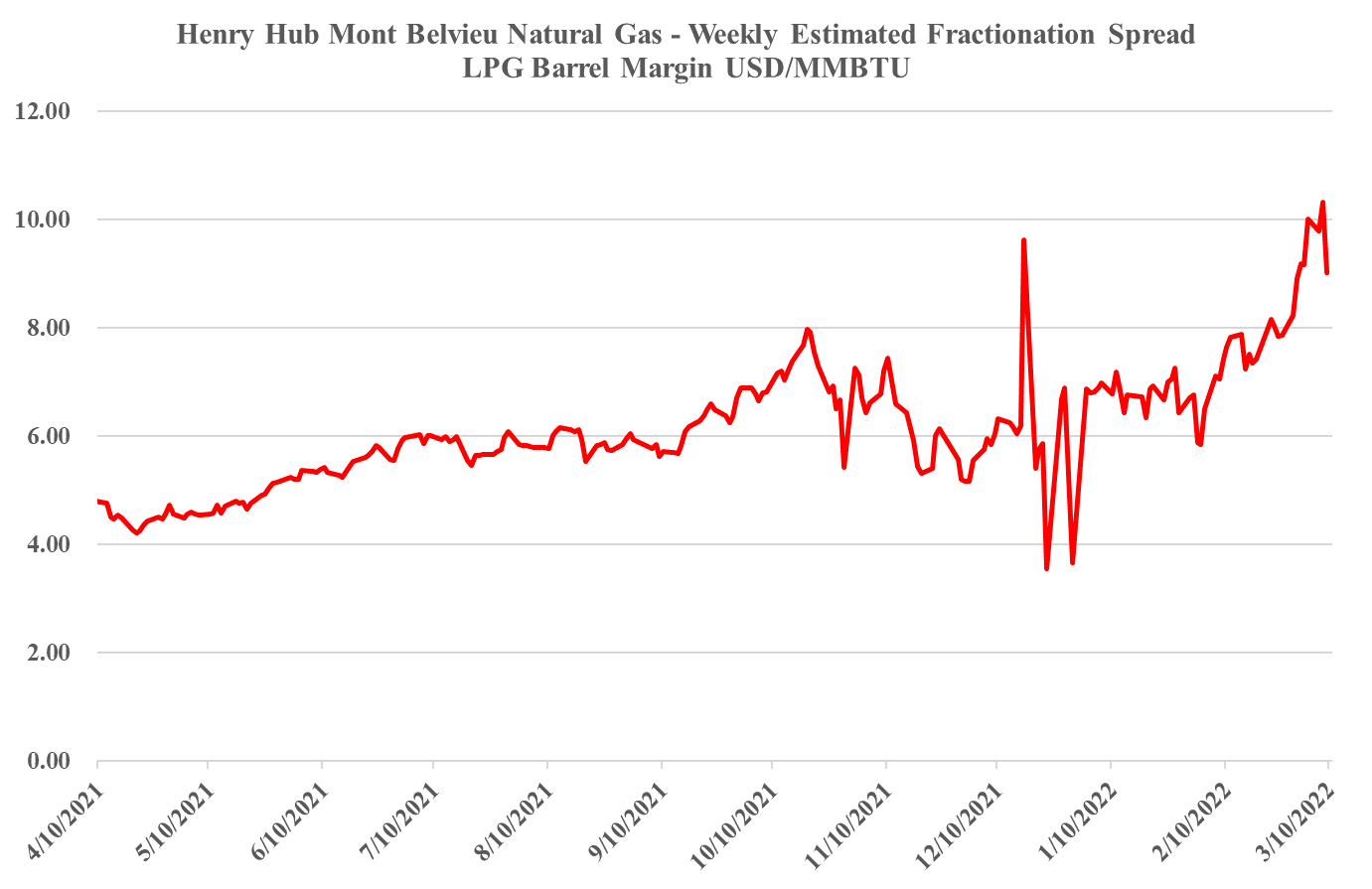

As noted in Exhibit 1 from today's daily report, the jump in oil prices has plunged the European polyethylene producers into the red and pushed Asian polyethylene producers further into the red. This will inevitably result in price increases as basic chemical and polymer producers will shut down at negative margins, and these price rises offer an opportunity for the US, Middle East, and select other producers.

US Competitive Advantage To Offset Some Ex-US Polyethylene Producer Losses

Mar 10, 2022 2:50:46 PM / by Cooley May posted in Chemicals, Polymers, Crude, LNG, PVC, Polyethylene, LyondellBasell, HDPE, polyethylene producers, polymer producers, ethane, natural gas, Basic Chemicals, NGL, Westlake, oil prices

Some Chemical Producer Price Initiatives Will Fare Better Than Others

Jan 11, 2022 3:10:34 PM / by Cooley May posted in Chemicals, Polyolefins, Polyethylene, Raw Materials, LyondellBasell, Chemical Industry, polyethylene producers, oversupply, Basic Chemicals, Westlake, chemical producers, Huntsman, Building Products, price initiatives, demand strength, Sika, monomer prices

We are seeing pockets of real demand strength in some areas of chemicals, such as building products, and this is allowing producers to push through price increases to reflect higher costs and most likely add some margin. In other areas where the fundamentals might not be quite as supportive, we are still seeing attempts to pass on higher costs. Sika has supported what we have heard from many over the last few weeks, which is that the building products chain remains tight, as demand is strong, capacity is running hard and logistic issues continue to cause problems in some cases from a raw materials perspective and in others from getting finished products to market. Where there is limited ability to increase supply, those selling into the building products space are likely to make more money as they should have strong pricing power – in the US chemical space, we would favor Westlake as a potential big winner from this trend, but Huntsman should also be on the list.

US Polyethylene Producers Strive For Contract Price Support

Oct 20, 2021 2:44:52 PM / by Cooley May posted in Polyethylene, Ethylene, polyethylene producers, polymer, US polyethylene, conventional polymers, contract prices, crude oil prices, transportation cost, alternative polymers

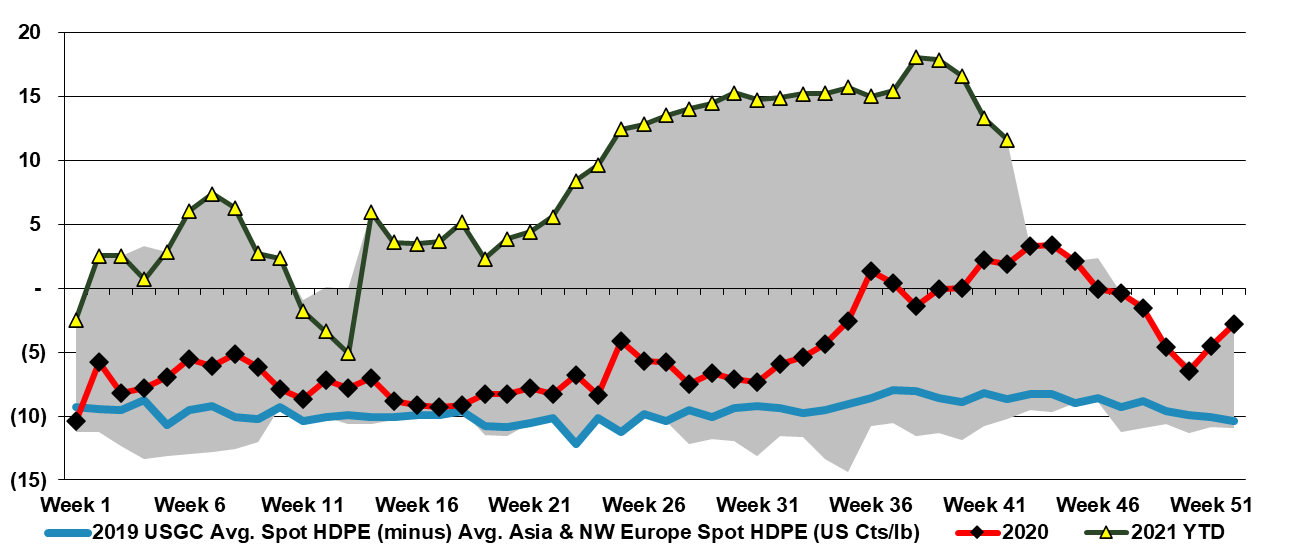

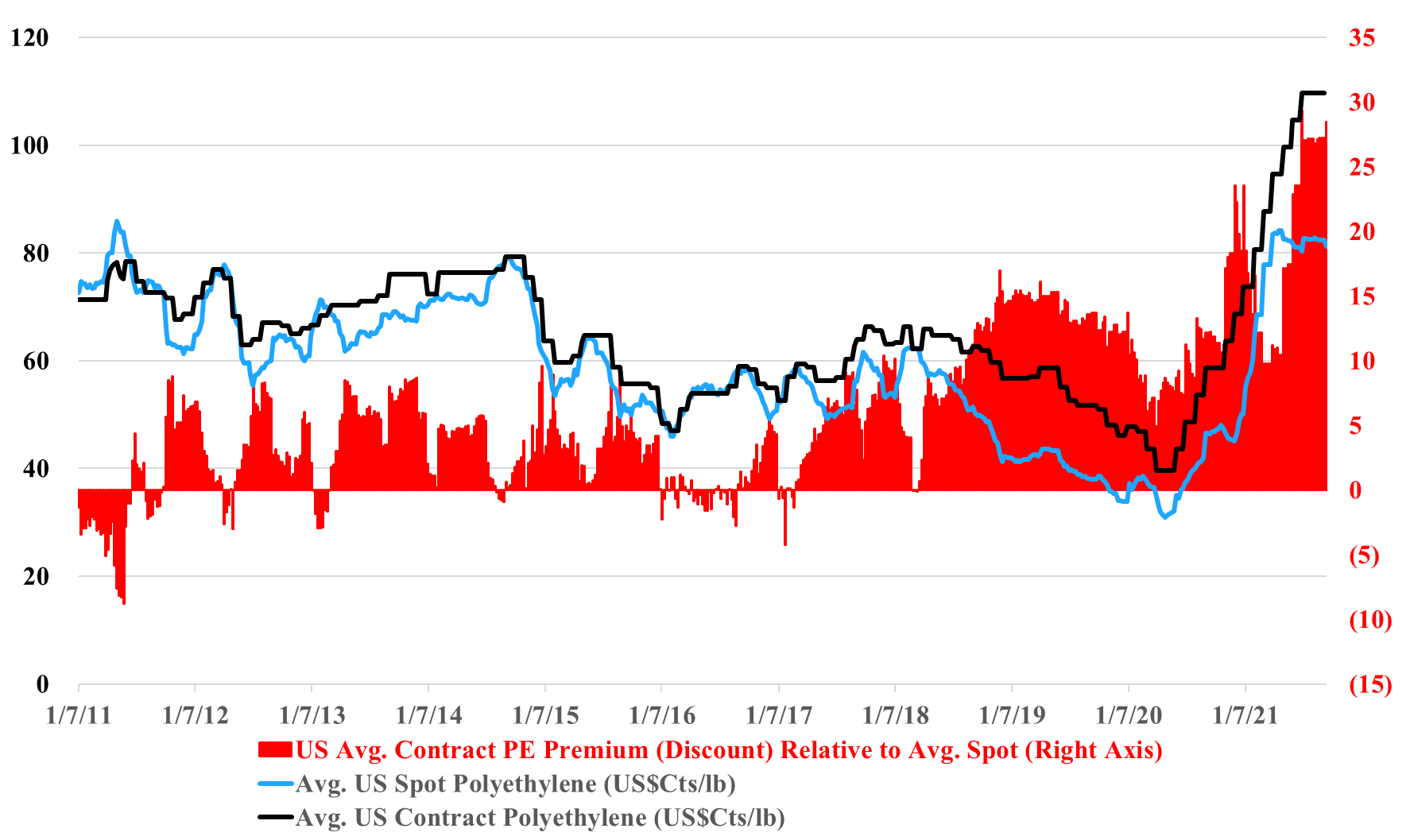

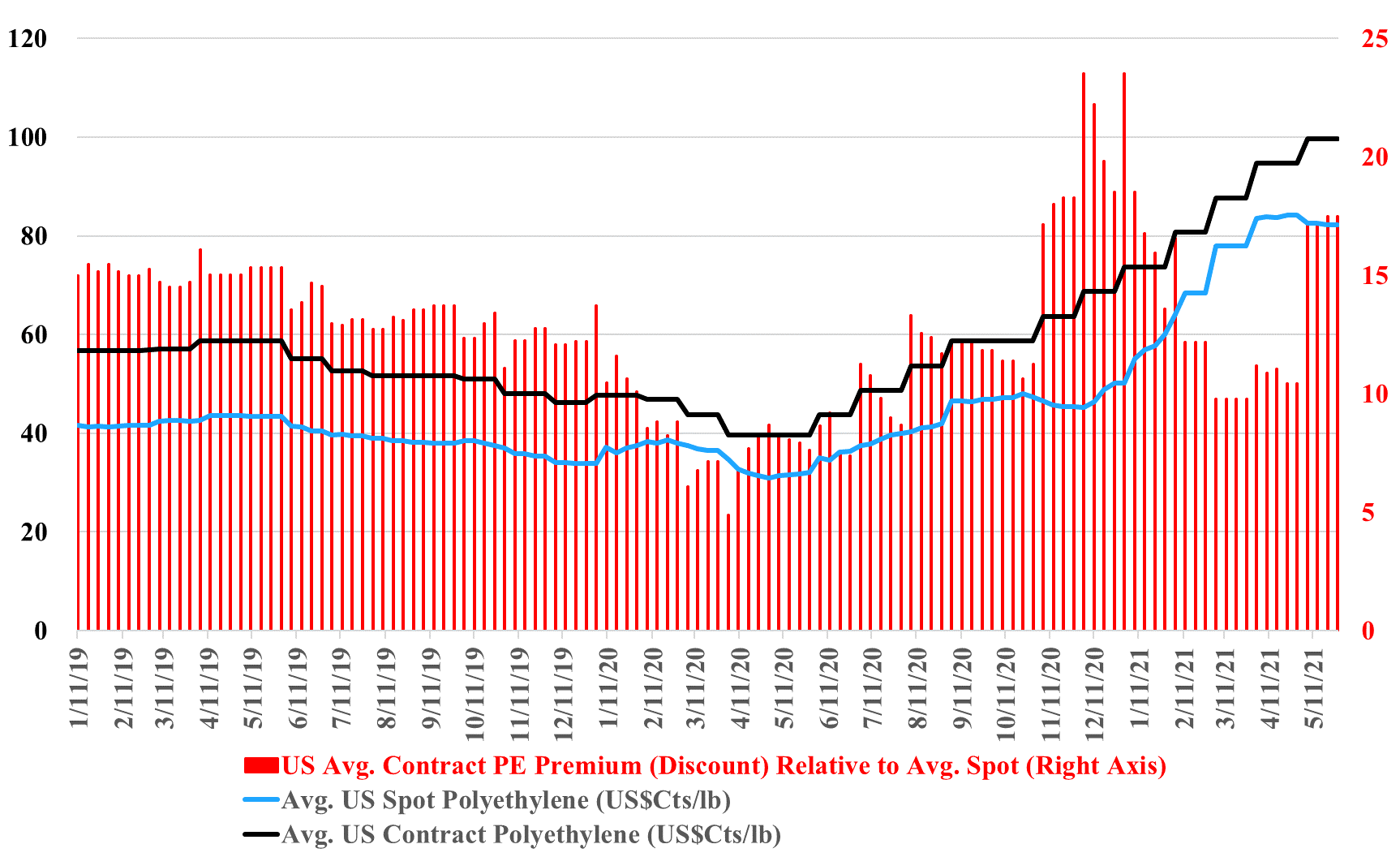

We talk about the US producer’s pressure to keep polyethylene contract prices flat in October earlier in today's daily report but the exhibit below helps to show some of the potential longer-term consequences of that behavior. The desire to keep pricing high by the producers is obvious as they will continue to make outsized margins if they do and carry some of the good 3Q profitability into 4Q – it will still not be as good as 3Q as costs are up for ethylene and every polyethylene producer is integrated back to ethylene in the US. The large gap in pricing with Asia is declining, in part because Asia prices are at costs and costs as rising as crude oil prices strengthen.

US Polymers Holding On To A More Fragile Premium, Mostly Storm Driven

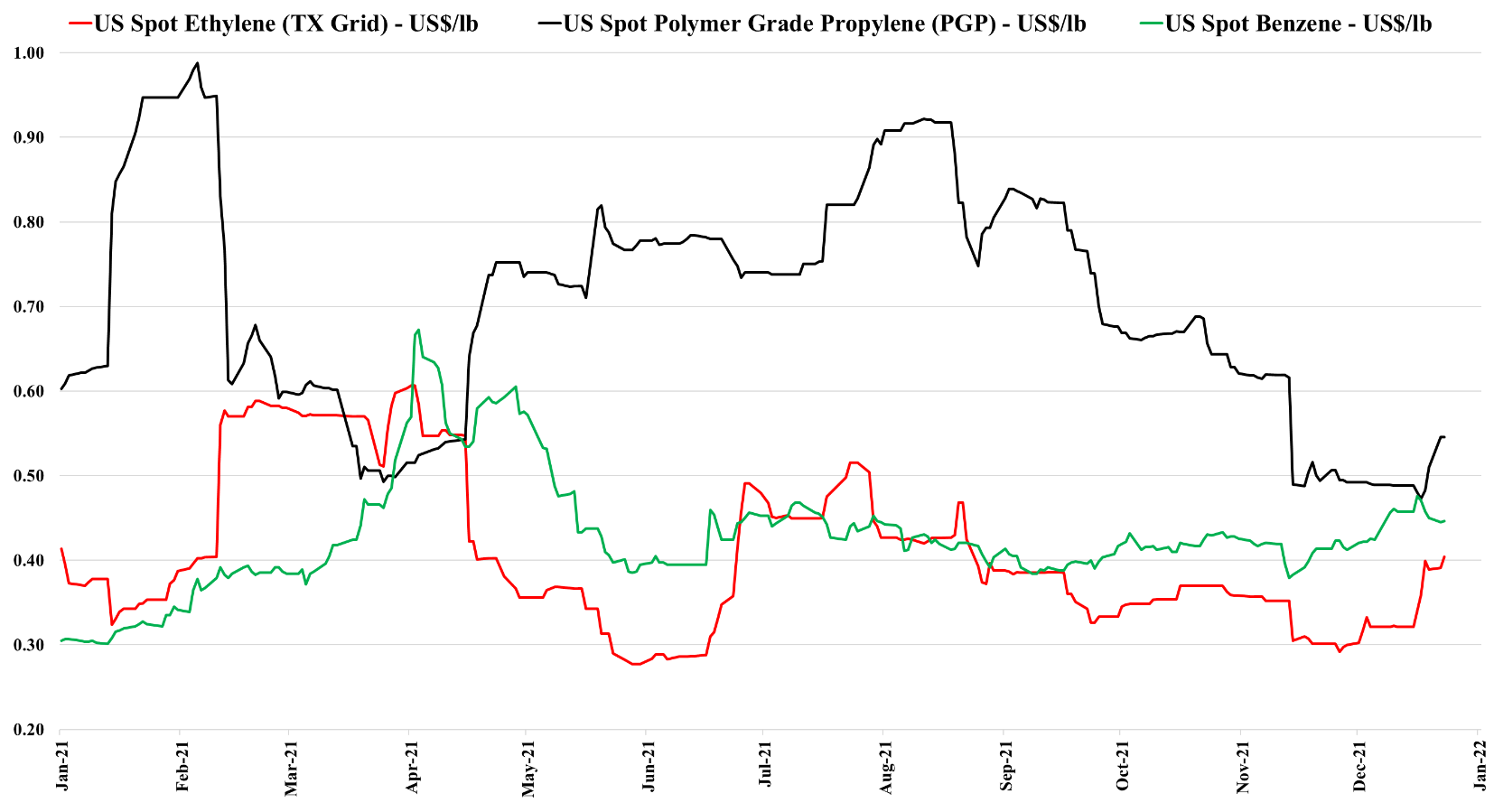

Sep 21, 2021 2:01:48 PM / by Cooley May posted in Polymers, Polypropylene, polyethylene producers, ethane, natural gas, US polyethylene, US polypropylene, polypropylene arbitrage, spot pricing

US polyethylene producers are pushing for September price increases and their arguments center around lost production, because of Ida and Nicholas, and rising costs because of the much firmer natural gas and ethane markets. Working against them are the very high margins and what appears to be a stubborn spot market, both covered in the charts below. A contract increase in September would maintain an unprecedented gap between US contract and spot pricing, and while it is likely that the spot market is very thin, it is a very strong push back against producers for a contract hike.

More Indicators Point To US Polyethylene Contract Prices Near A 2021 Peak

Jun 3, 2021 11:48:26 AM / by Cooley May posted in Chemicals, Polyethylene, Ethylene, US Prices, polyethylene producers, Polymer plants, Polyethylene prices

While we continue to see valiant efforts from the polyethylene producers to increase prices further in June, this is what we used to refer to as a “cow in front of a train” strategy. In that throwing a cow in front of a train was not going to stop it, but it might slow it down a bit! Barring weather, it is inevitable that US polyethylene prices shown in the chart below will start to give back some of their premium pricing over the coming months. One factor among several others pointed out on today's Daily Report is that Ethylene is much weaker and the international markets are materially out of line, and if freight rates have peaked, the arbitrage will undermine prices in the US. Producers will do their best to hang on to the high margins for as long as they can, and a few more cows may be sacrificed, but the weather is their only hope.