The Venture Global LNG contracts with Sinopec are likely the big energy news of the day, as is the expectation that the West Louisiana terminal is close to completion and could begin shipping as soon as late 2021, according to a report in the Financial Times today. This would be earlier than prior guidance and will add demand pressure to a US natural gas balance that is already tight (distracted in the immediate term in our view by a wave of mild weather). With Venture Global now likely to go ahead with its second LNG facility, as well as other capacities under construction, we will likely see greater inflation in US natural gas prices without increased E&P spending.

Recent Posts

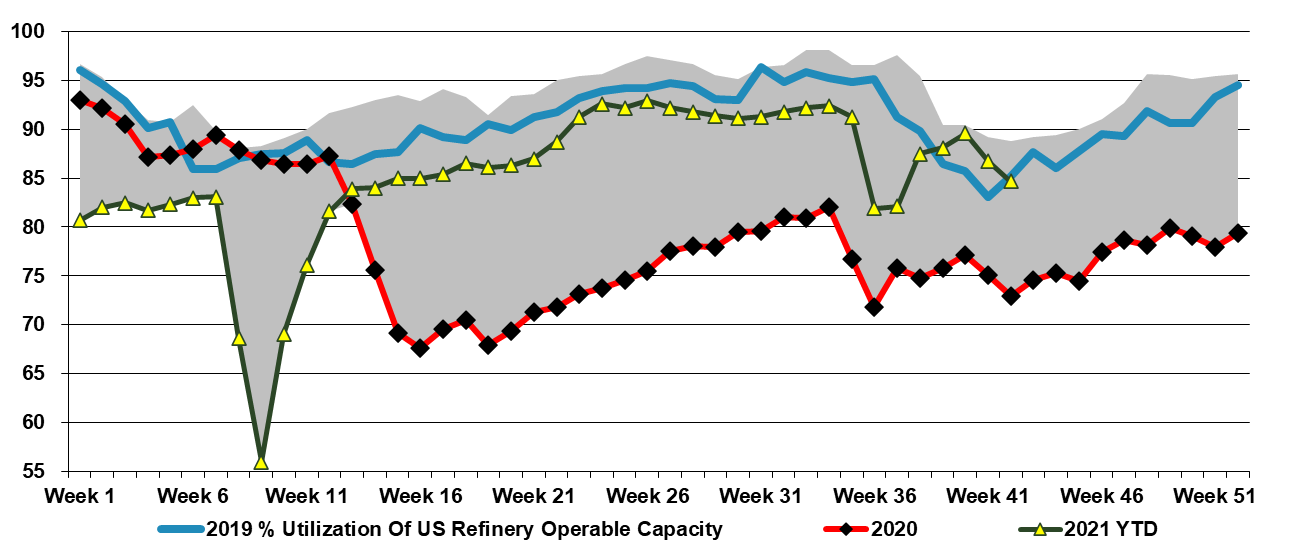

More LNG For The US, But Less Gasoline!

Oct 21, 2021 2:20:32 PM / by Cooley May posted in Chemicals, LNG, natural gas, Sinopec, energy shortages, US refining rates, gasoline, refinery capacity

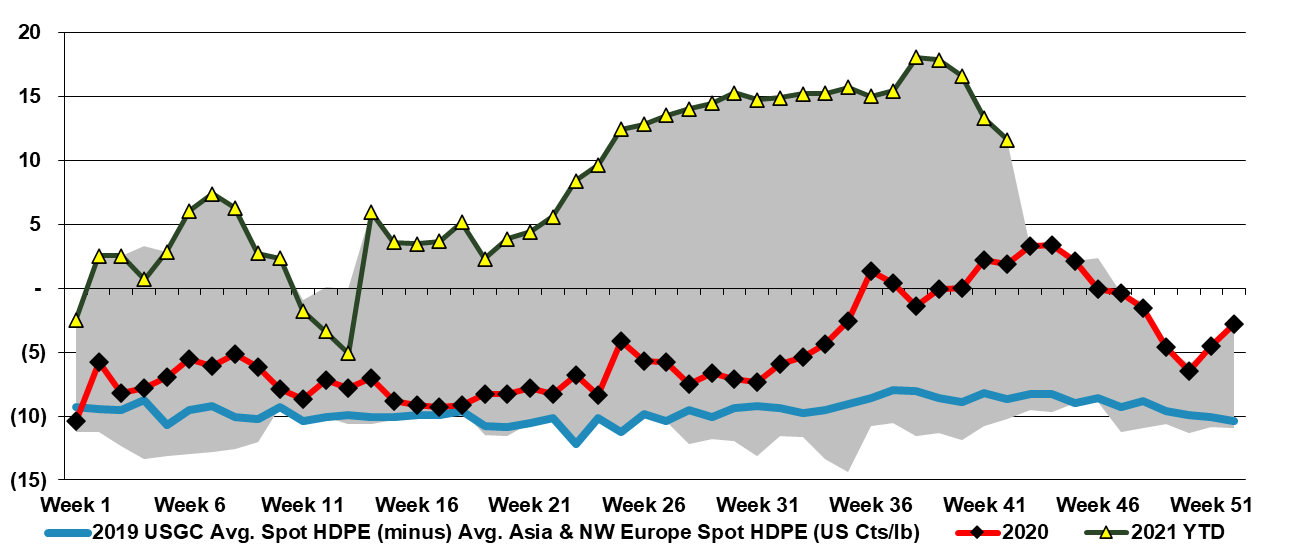

US Polyethylene Producers Strive For Contract Price Support

Oct 20, 2021 2:44:52 PM / by Cooley May posted in Polyethylene, Ethylene, polyethylene producers, polymer, US polyethylene, conventional polymers, contract prices, crude oil prices, transportation cost, alternative polymers

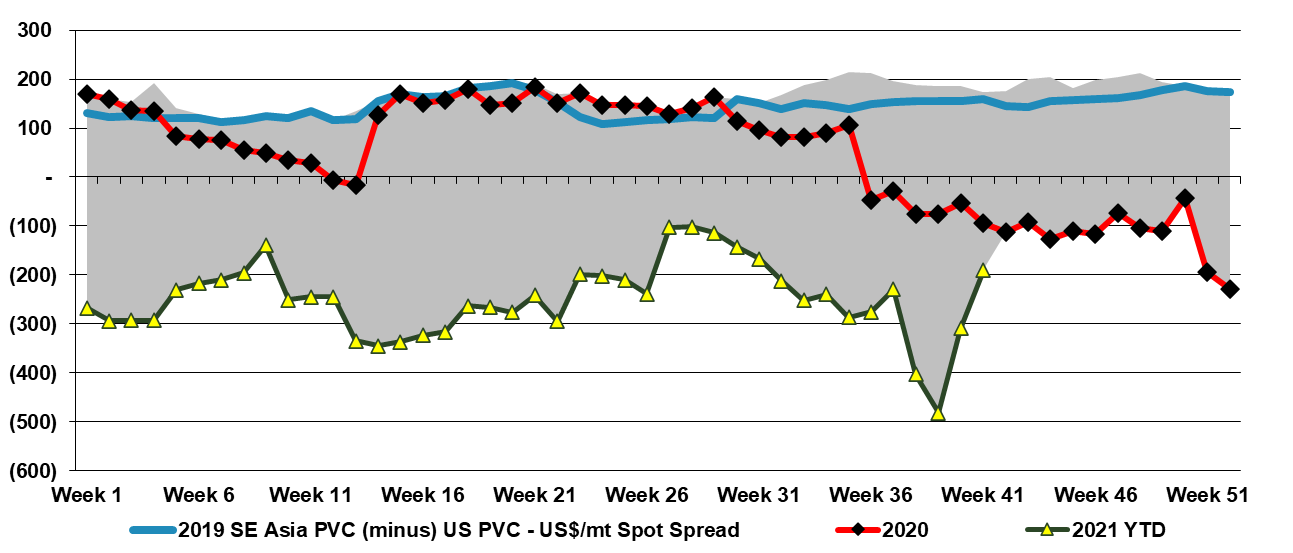

We talk about the US producer’s pressure to keep polyethylene contract prices flat in October earlier in today's daily report but the exhibit below helps to show some of the potential longer-term consequences of that behavior. The desire to keep pricing high by the producers is obvious as they will continue to make outsized margins if they do and carry some of the good 3Q profitability into 4Q – it will still not be as good as 3Q as costs are up for ethylene and every polyethylene producer is integrated back to ethylene in the US. The large gap in pricing with Asia is declining, in part because Asia prices are at costs and costs as rising as crude oil prices strengthen.

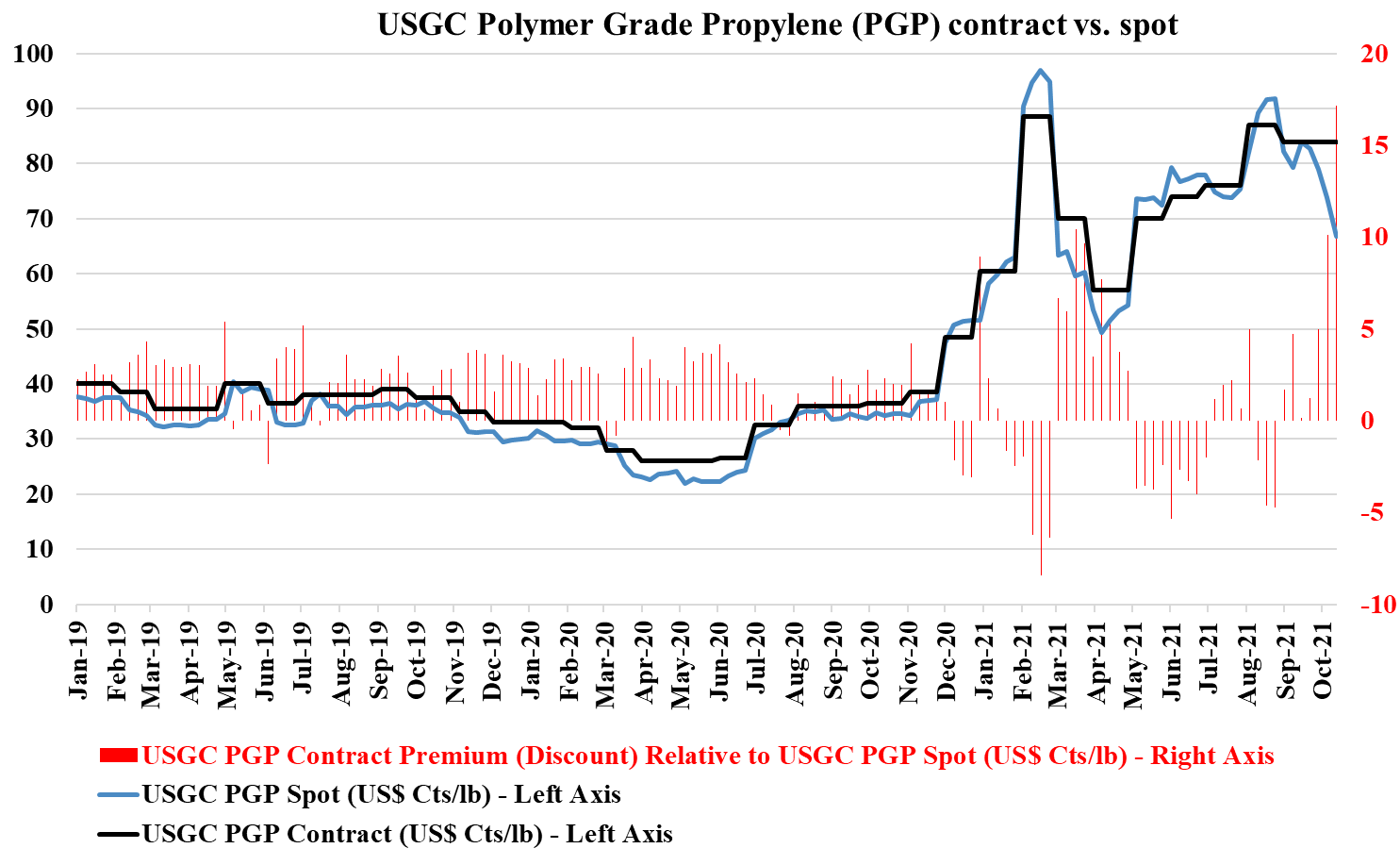

US Propylene Contract Prices Under Pressure

Oct 19, 2021 2:14:12 PM / by Cooley May posted in Chemicals, Polyolefins, Propylene, Ethylene, olefins, US propylene, ethylene prices, energy inflation, energy costs, contract prices

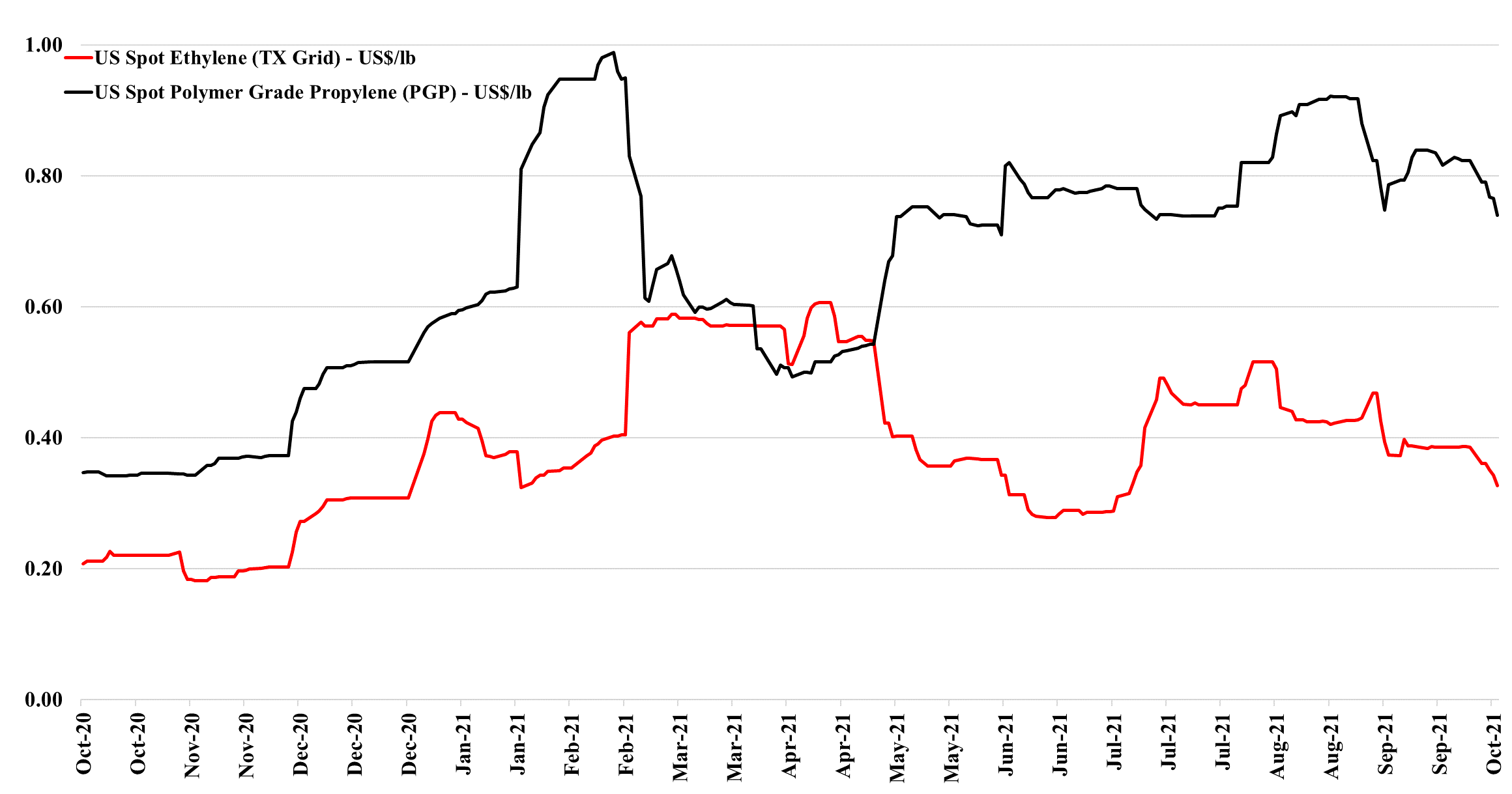

The propylene chart below shows a significant disconnect between spot and contract prices – more than at any point in recent history, and if the US contract price does not fall it will likely be an indicator that either discounts have increased or that more volume is moving against a spot price marker. The pressure is also on to lower ethylene contract prices, but the propylene spread is far more extreme.

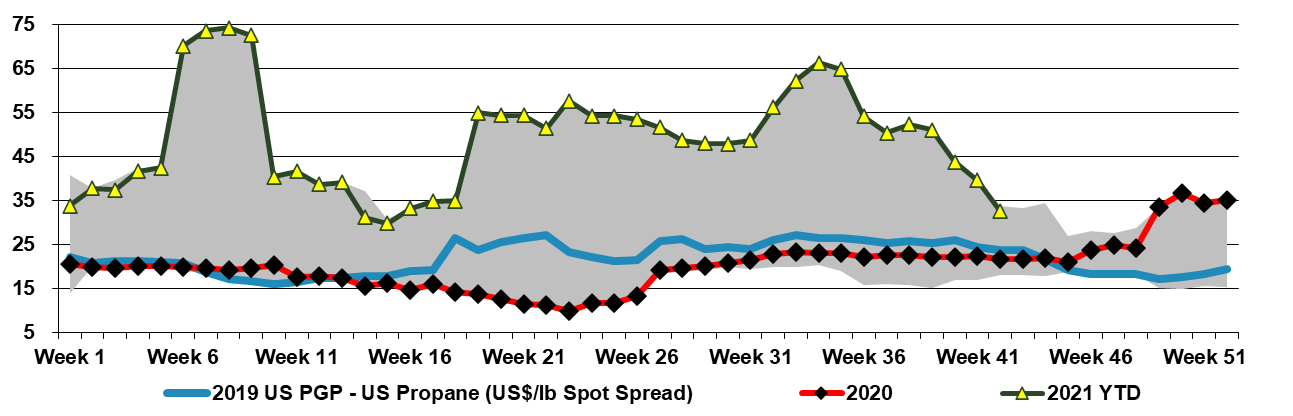

Propylene Producers Are Seeing Margins Shrink Quickly

Oct 15, 2021 3:03:36 PM / by Cooley May posted in Chemicals, Propylene, Polypropylene, propane, US propylene, PDH production, polyurethanes, Propylene margins

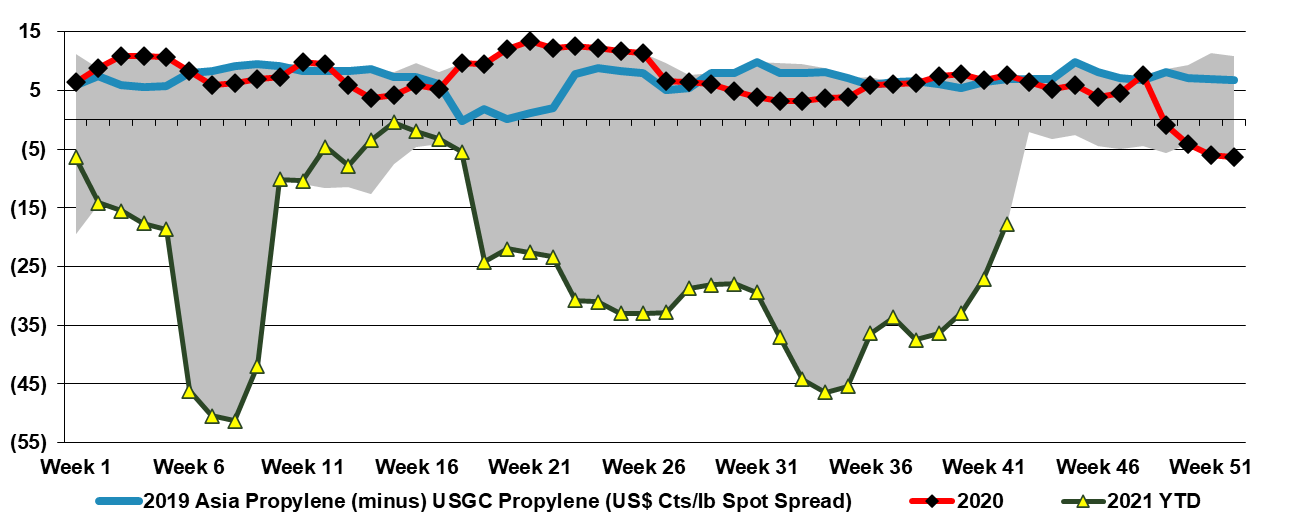

The US propylene to propane spread finished this week within the 5-year range, as opposed to setting the high end of the 5-year range, for the first time since December 2020. It still has a long way to go to reach seasonal 5-year averages and even further to reach seasonal lows, and there is plenty of margin left in PDH production in the US, even if the returns are now much lower than they were only a couple of months ago. Propylene pricing in the US is now low enough to encourage all derivative units to operate at high rates and we expect derivative price declines to follow – perhaps as steeply as propylene in the spot markets but more slowly in the contract markets.

Lack Of Consumer Goods Make Higher Energy Prices More Affordable…

Oct 14, 2021 3:42:08 PM / by Cooley May posted in Hydrogen, LNG, Air Products, natural gas, EIA, shortages, Consumer Goods, energy prices

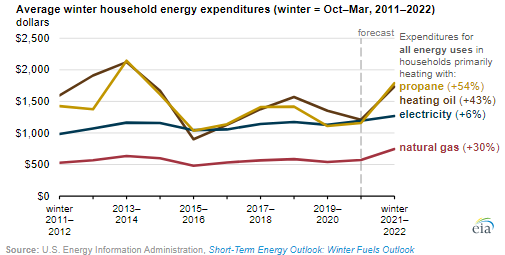

At this point, it has stopped being a story about how transient higher energy prices might be and instead become a story of how high could they go as well as how long the higher prices could last. With sentiment easing in the US because of an expected milder October, we also have the headline of the restart of Cove Point LNG, which should add to natural gas demand. The EIA, in the chart below, shows US prices peaking through the end of the year before falling again in early 2022. There remains an expectation that the rest of the world will be short of LNG and so we will either see the US natural gas competitive advantage remain strong, or the US LNG facilities will stretch their underutilized nameplate capacity and this could be supportive of higher US natural gas prices. New LNG capacity does not hit until late 2022 and how much is exported until them will be a function of the throughput of the existing terminals – which today look like they were very prudent investments.

Changes In US Chemical Fortunes Are Speeding Up

Oct 13, 2021 12:43:03 PM / by Cooley May posted in Chemicals, Polyolefins, Propylene, Ethylene, arbitrage, US propylene, ethane prices, propane feed, propylene prices

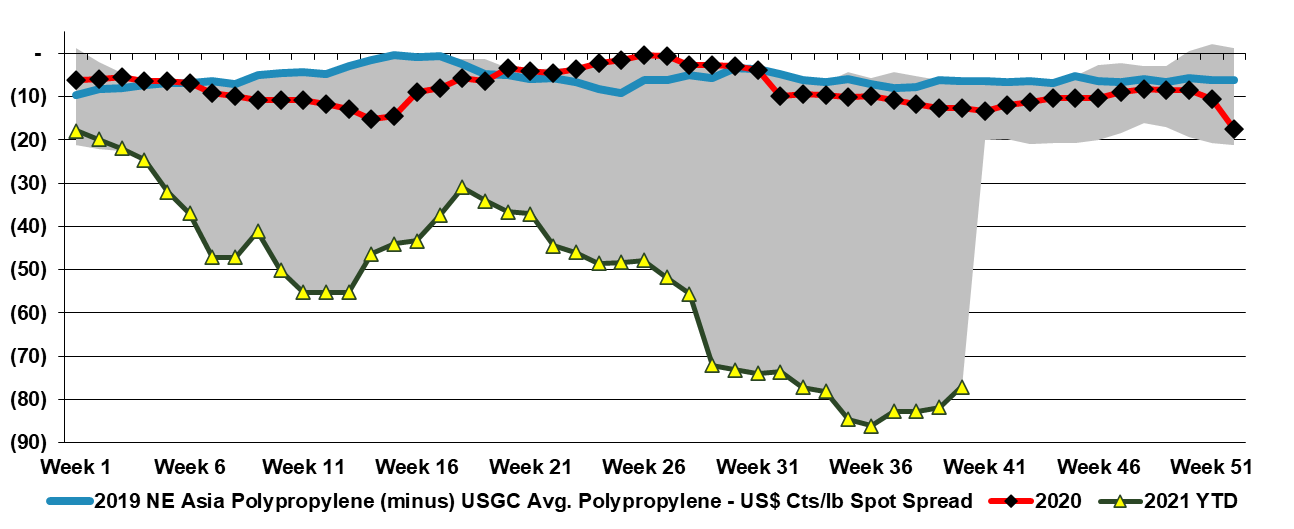

As we hinted in yesterday's report, the wheels are wobbling in the US market, especially for polyolefins and this comes at a time when Asia prices are finding some strength because of production and cost issues – it shows how quickly market dynamics can change in this industry and the closing of the gap between Asia and US propylene prices in the first exhibit below is perhaps the most dramatic example. We see a real opportunity for the wheels to stop wobbling and completely fall of the western wagons in the near term, and as the second exhibit below shows propylene continues lower, and with further to fall to hit PDH economics.

Higher Global Energy Costs - A Real Problem For Most

Oct 12, 2021 3:07:57 PM / by Cooley May posted in Chemicals, Polymers, PVC, Ethylene, Energy, natural gas, Westlake, PVC producer, energy inflation, Occidental, Formosa, Shintech, Olin

With the rapid rise in energy prices, we are seeing price increase announcements for many intermediate chemicals, especially in regions of the world where margins were already very slim. The energy inflation issue is hard to call, with more and more commentators suggesting that it could be prolonged (which generally means it will be short), but lots of dislocations support duration. We would certainly be pushing prices today on the back of energy costs that could move higher again, and given that many chemical and polymer buyers have price protection in their contracts (for at least a month), producers could face a margin squeeze and an uphill climb to get adequate price coverage. Seasonally, demand for chemicals and polymers is at its weakest for the next couple of months, so the price hikes may be difficult. However, because of supply chain constraints, buyers may feel less confident and concede more easily. We could see a significant swing in sentiment from the chemical companies on 3Q earnings calls over the coming weeks as they talk about how good results were in 3Q but throw up all sorts of cautionary statements concerning 4Q.

Petrochemical Margins Face More Downward Pressure

Oct 8, 2021 12:28:51 PM / by Cooley May posted in Chemicals, Polymers, Propylene, Polypropylene, Ethylene, Auto Industry, Monomer, petrochemicals, Dow, ethylene margins, shortages

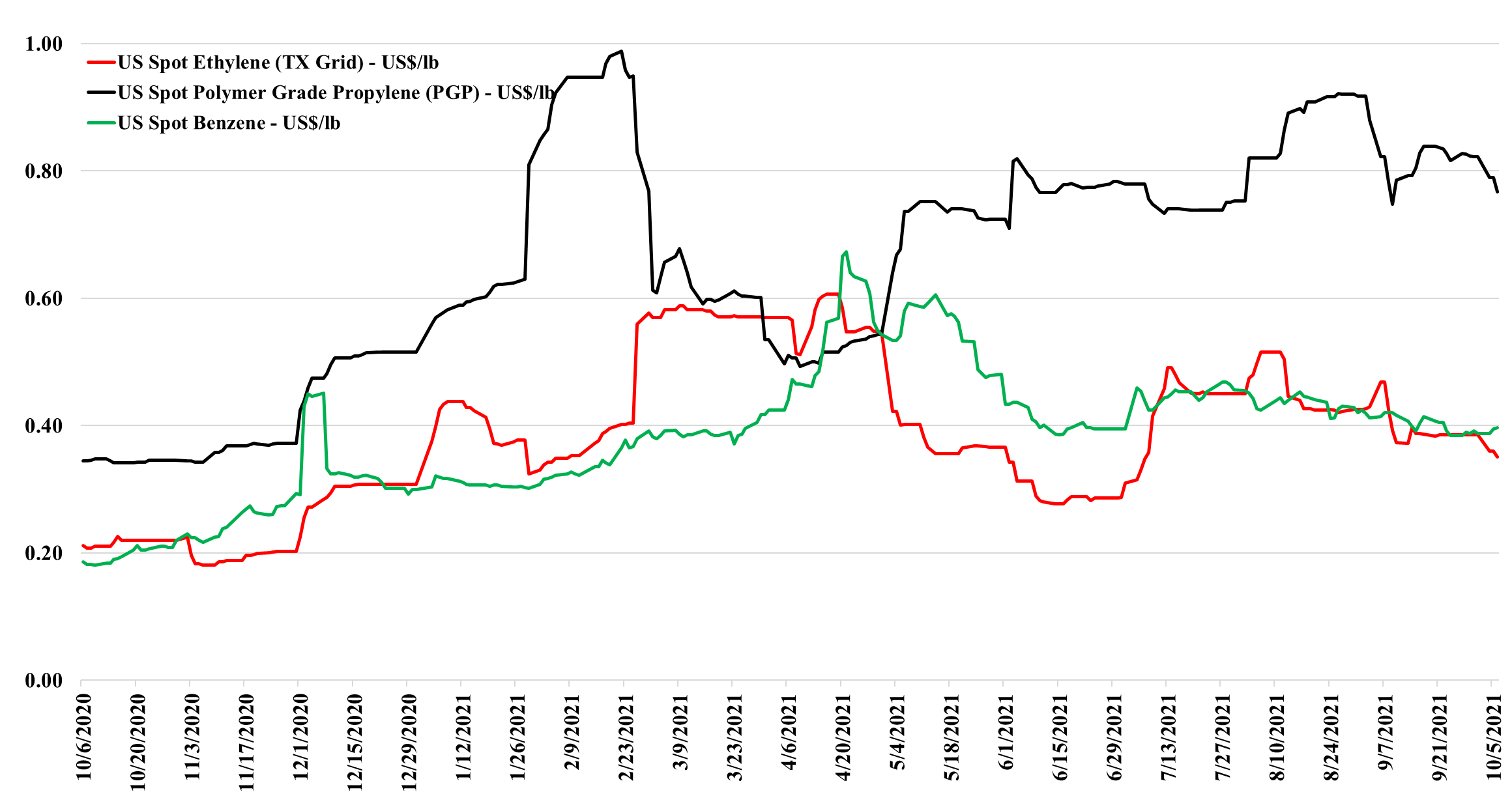

While we will talk more about the Dow project in Alberta on Sunday, one of the problems that the stock faces in the light of the announcement is largely unrelated, which is the growing expectation that margins in 2022 will be significantly lower than in 2021. This is the view coming out of the recent EPCA meeting and as the ethylene/propylene chart below shows, monomer pricing is already weakening in the US as production ramps back up following the recent storms – we note in Exhibit 1 from today's daily report the squeeze on ethylene margins as prices fall, while costs rise. But it is also worth noting that margins remain quite healthy, while well below their highs. Those companies who built new ethylene capacity in the US over the last 5 years would have had a margin similar to the current level shown in Exhibit 1 in an optimistic capital case.

Polypropylene Can Afford The Stiff Freight Costs From Asia

Oct 7, 2021 3:10:59 PM / by Cooley May posted in Chemicals, Polymers, Polyethylene, Polypropylene, container freight rates, polypropylene prices, sourcing

Even with the inflated container rates, the vast price difference between US and Asia polypropylene prices makes the opportunity too great to ignore. Even at their highest levels, container rates, and inland transport costs likely total no more than 35 cents per pound today, and as shown in the Exhibit below, you have plenty of room to maneuver. This is not the case with polyethylene or other polymers where the price delta between the regions, while high, does not cover the costs and the added risk of delays to sourcing. For more see today's daily.

US Commodity Chemical Producers Face More Margin Pressure

Oct 6, 2021 2:32:43 PM / by Cooley May posted in Chemicals, Propylene, Ethylene, petrochemicals, feedstock, US Chemicals, specialty chemicals, commodity producers, downstream producers

The decline in propylene and ethylene values is worth consideration today as it provides proof, along with the feedstock comments in today's daily report, that US commodity chemical producers are on average facing margin pressure WoW. We noted in yesterday's research that China prices were rising amid production cuts, but demand remains a notable concern. As production rises from current levels in 1H22, this will put downward pressure on Asia chemical prices and also translate into lower US export values.