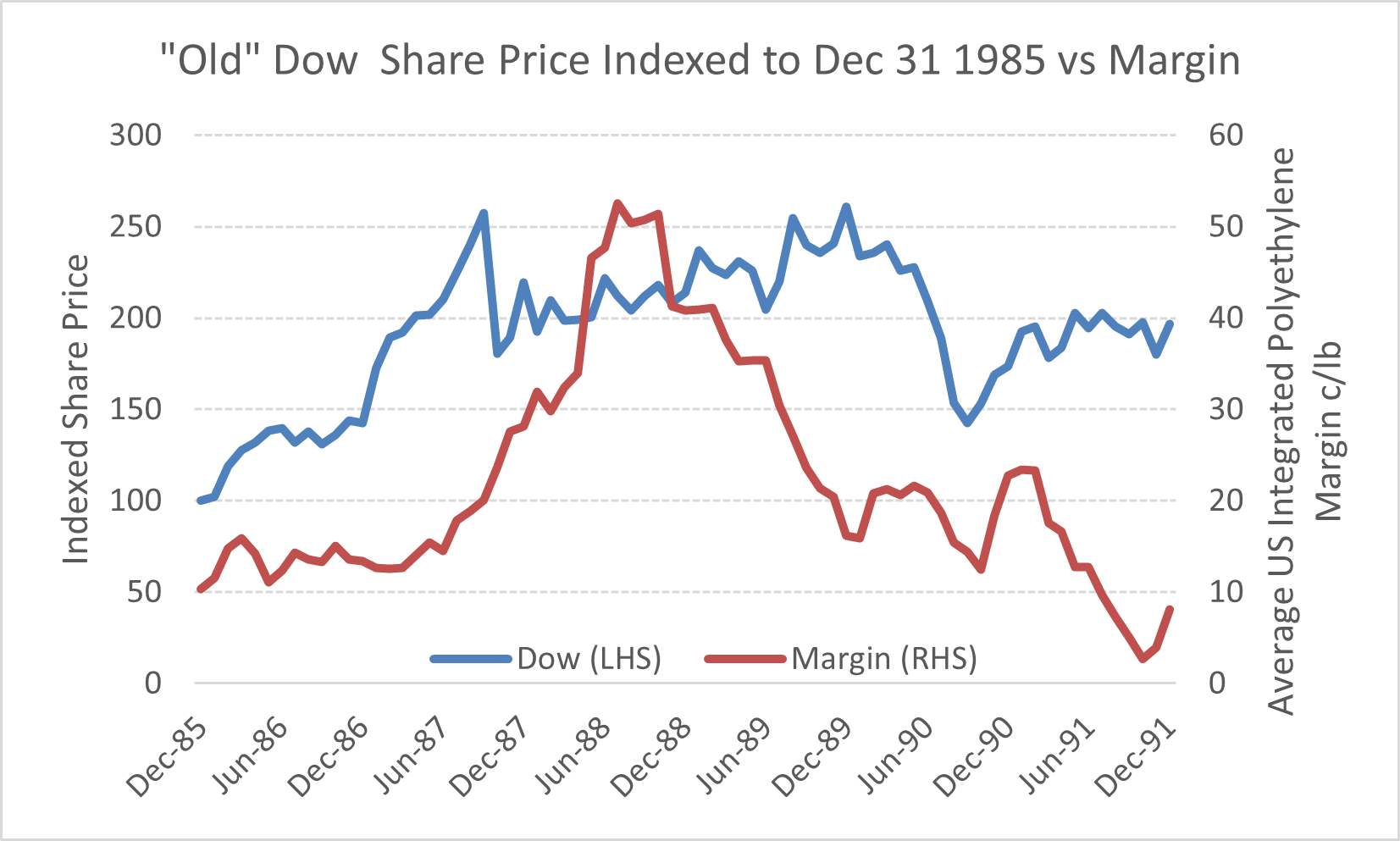

In yesterday's Sunday thematic and weekly recap report titled "Waiting For The Big One – Is A Chemical Mega-Cycle Ahead?", we referenced the global shortage of basic chemicals and polymers in the late 80's. We think this could repeat because of limited capital spending to grow basic chemical capacity due to cost and long-term demand uncertainties and this could cause a mid-decade global profit mega-cycle. Emission abatement initiatives and concerns with feedstock prices/availability will work against the justification of capacity expansions in every global region. Demand growth mitigation from plastic bans, renewables, and increased like-for-like recycling is unlikely to impact materially pre-2026/27.

Recent Posts

An 80's Re-Run - A Chemical Mega-Cycle

Nov 8, 2021 10:21:11 AM / by Graham Copley posted in ESG, Ethylene, propane, ethane, Basic Chemicals, basic polymers, feedstocks, global shortage, naptha

Deserving The Benefit Of The Dow’t - Access Our Latest Reports

Oct 11, 2021 3:48:13 PM / by Graham Copley posted in ESG, Chemicals, Carbon Capture, Polymers, Polyethylene, biodegradable, CCS, Emissions, Mechanical Recycling, ExxonMobil, Dow, carbon footprint, carbon abatement, renewable polymers, ethane, natural gas, carbon emissions, Capacity, low carbon polyethylene, polymer capacity, feedstocks

Our latest Sunday Thematic report, "Damned if you Dow and Damned if you Down’t. Hard to win", centers around Dow's announced development of a new net-zero carbon emissions site in Alberta, Canada. It discusses company-specific and sector ramifications for Dow's strategic move to produce low-cost low carbon polyethylene in Canada while also expanding capacity.

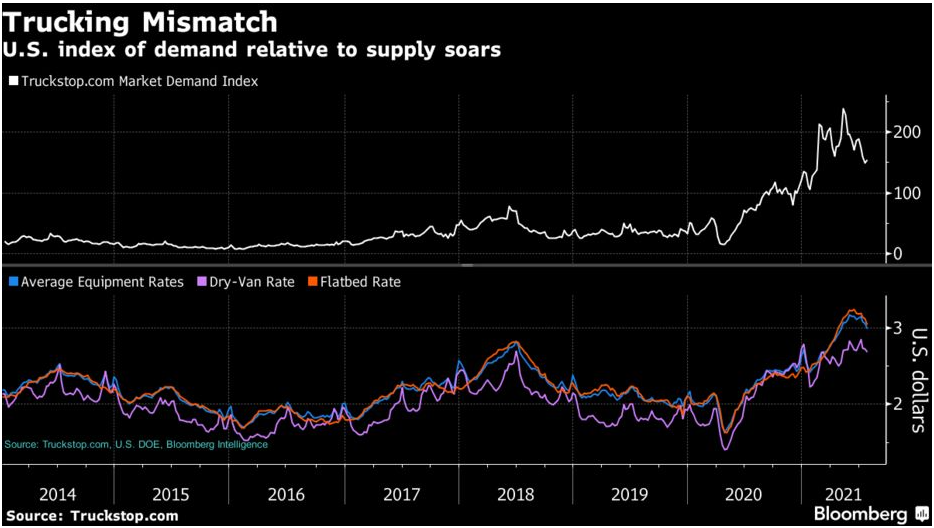

What's Contributing To Truck Driver Shortages & Why It Matters

Oct 5, 2021 8:31:12 AM / by Graham Copley posted in Chemicals, LNG, freight, Logistics, transportation, Shortage, truck drivers shortage, trucking

Our Sunday thematic and weekly recap report covers how the US is short of truck drivers (60,000) during a period when freight is struggling to move from congested ports – holiday buying will add more stress. This matters because we have record shipments of containers on the docks at US ports and record shipping backlogs waiting to unload as well as well documented shortages of durables in warehouses and at retailers.

The image below shows the mismatch in driver availability and trucking rates:

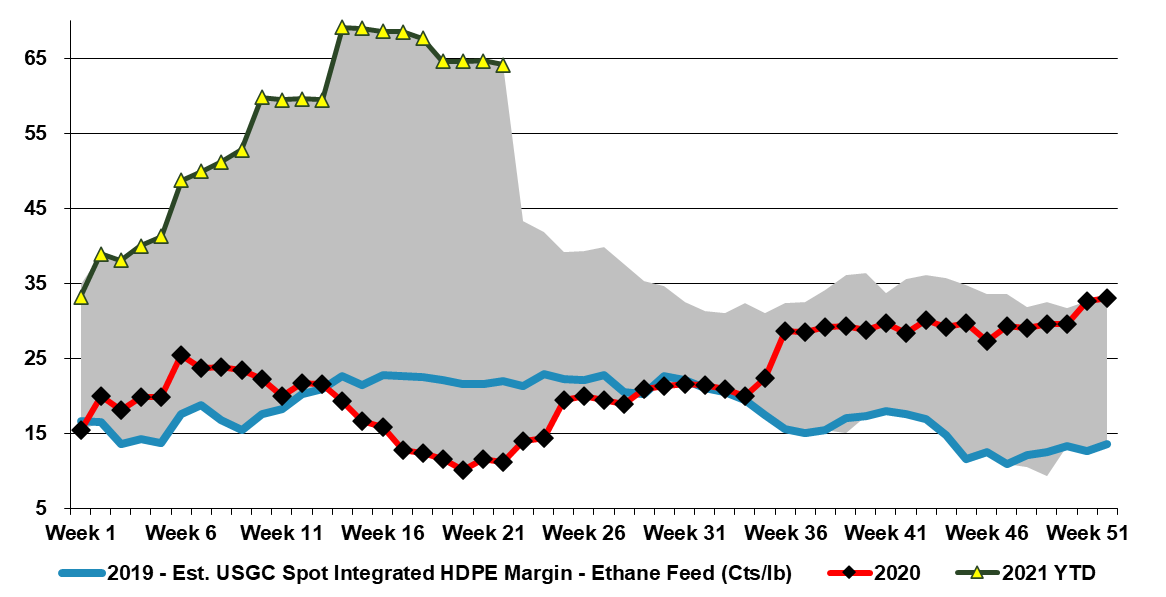

What Happens When The Sell-Side Runs Out Of Money - No Proactive Analysis

Jun 4, 2021 12:39:45 PM / by Graham Copley posted in Chemicals, Polyolefins, Commodities, Dow, Research, Buy-Side, Sell-Side, polymer producers, CDI, IHS, olefins

The Dow announcement yesterday speaks to a much larger issue within the investment community in our view, which is that research fees have come down so much over the last ten years that the sell-side gets paid very little for doing any real research. We talked about the upside in 2Q for the commodity polymer producers for months. Still, we know that we cannot get paid for maintaining the models needed to get to the numbers with enough confidence to publish estimates. The buy-side does not have the budget. In the past, as sell-side analysts, we would subscribe and talk to price discovery consultants, such as the predecessor companies of IHS (now in the middle of an acquisition by S&P) and CDI (in the middle of a merger with ICIS). This data and these dialogues would allow us to adjust earnings estimates during the quarter and keep up alongside our other work (e.g. corporate marketing/roadshows, etc.) as analysts. There is enough data in our weekly report – published each Monday to do this for many companies. (See an example in the chart below). Today, IHS has made its service so expensive that it is difficult for sell-side analysts to justify the cost when they are not getting paid by clients for real, fundamental research. The JP Morgan alleged base fee for research for an entire platform would not cover 25% of the IHS subscription cost for olefins and polyolefins data alone, per our estimate. Plus, all the merger activity at the data providers is causing some to question quality. The result is limited mid-quarter analysis from the sell-side and moves like Dow’s so that they can have realistic conversations with investors. In the case of Dow, it was to get the message out ahead of the Bernstein Conference.