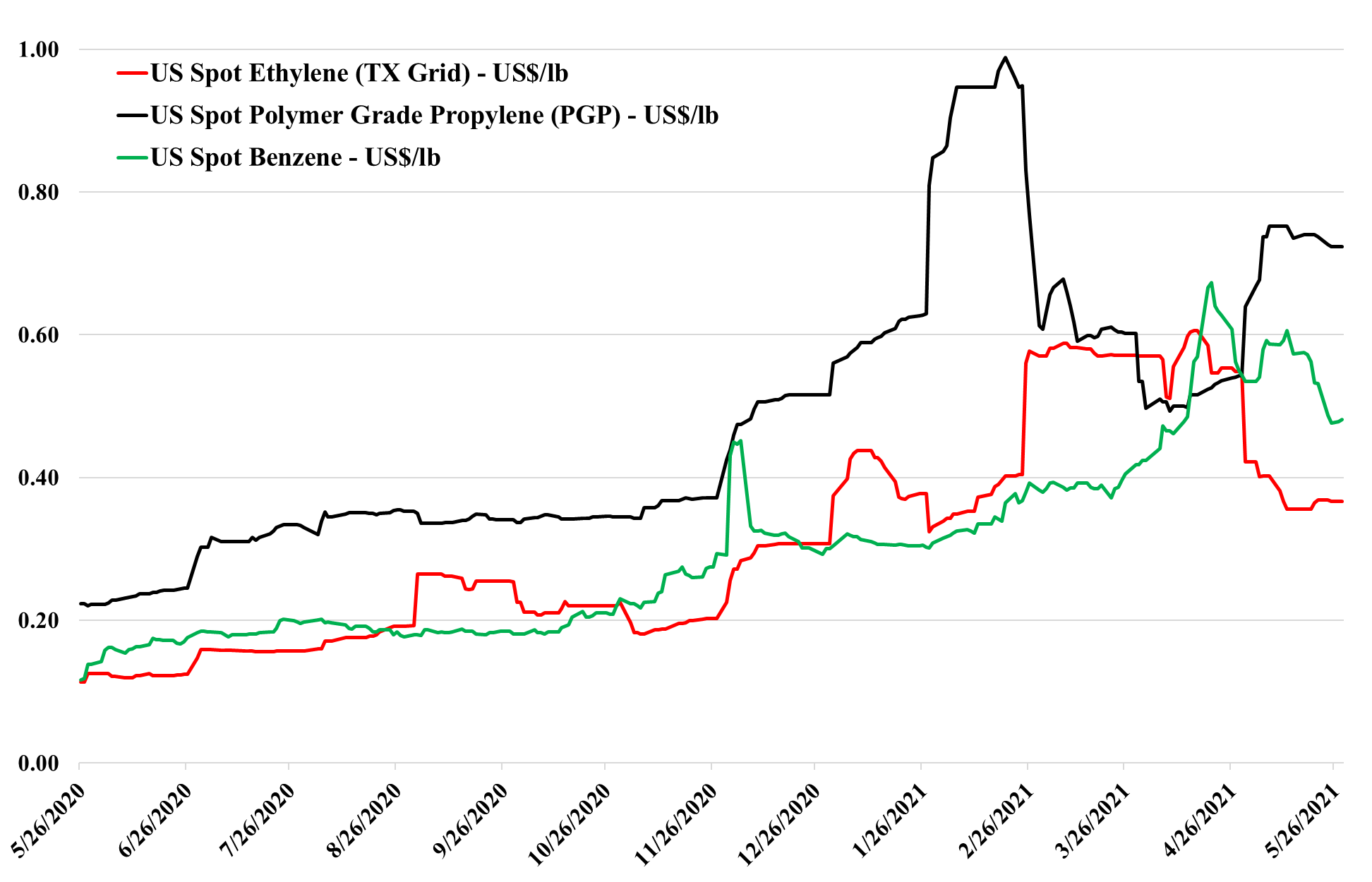

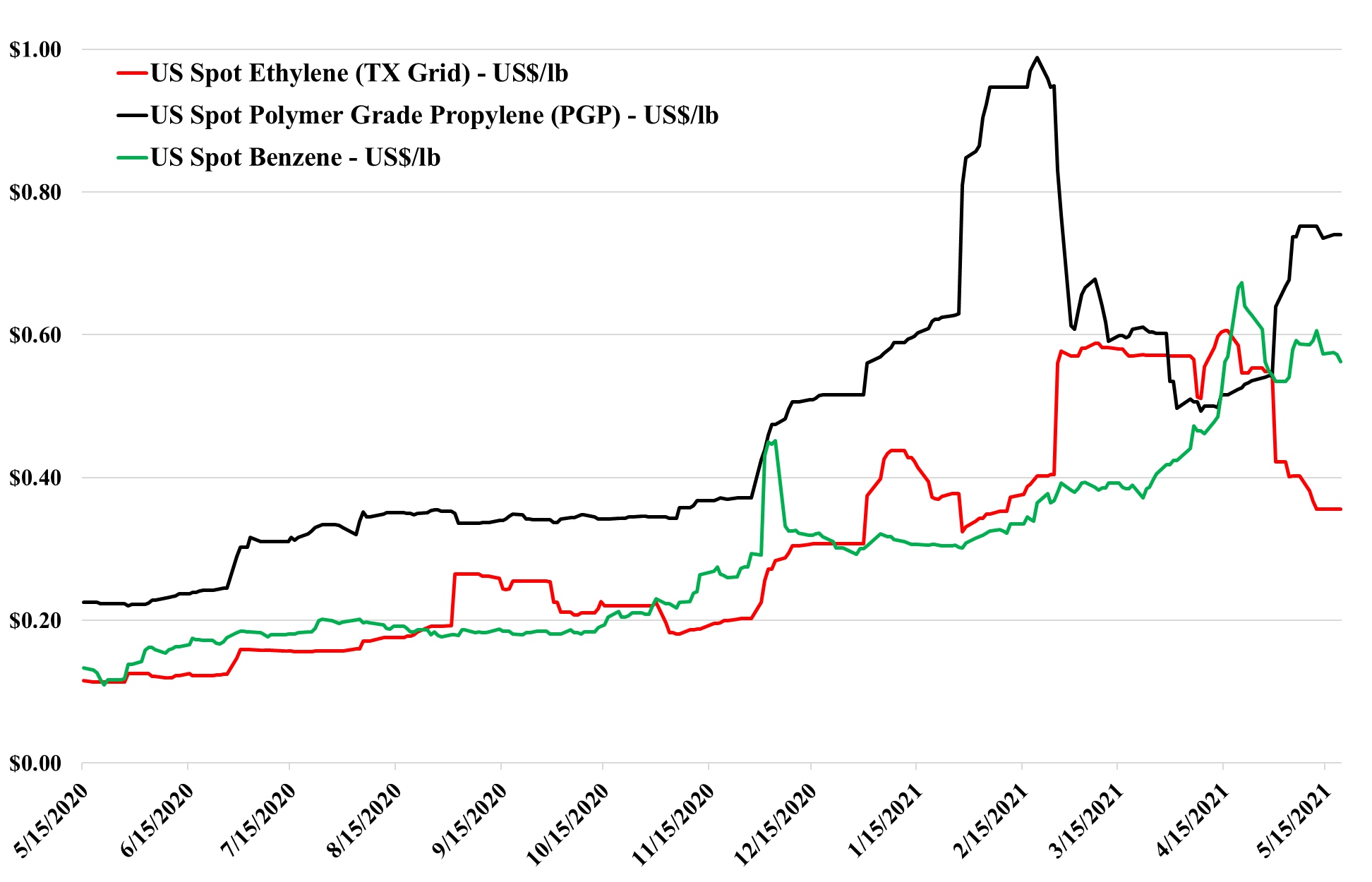

The weakness in US monomer pricing has stalled this week, and buyers and sellers may be exploring marginal export or derivative export opportunities at these levels. Further weakness will come if attempts to export only serve to undermine pricing in the markets they are targeting. Underlying demand remains very strong and this is a supply-driven issue as US ethylene plants run back towards full rates and incremental refinery supply impacts the benzene and propylene markets. See today's report which includes detailed commentary on methanol in addition to the products in the chart.

The Friday Question: What is Next for US Monomers?

May 28, 2021 3:36:36 PM / by Cooley May posted in Chemicals, Propylene, Methanol, Ethylene, Benzene, Monomer, supply and demand, Lotte Chemical, US Chemicals, marginal export, derivative export, MEG

Polyethylene: A Really Compelling Disconnect

May 27, 2021 2:56:45 PM / by Cooley May posted in Chemicals, Polymers, Polyethylene, US Polymer, arbitrage, freight, HDPE, polyethylene industrial sheet, imported polymer

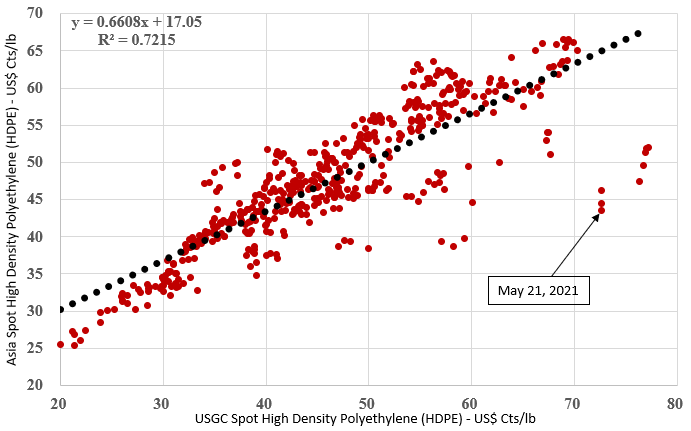

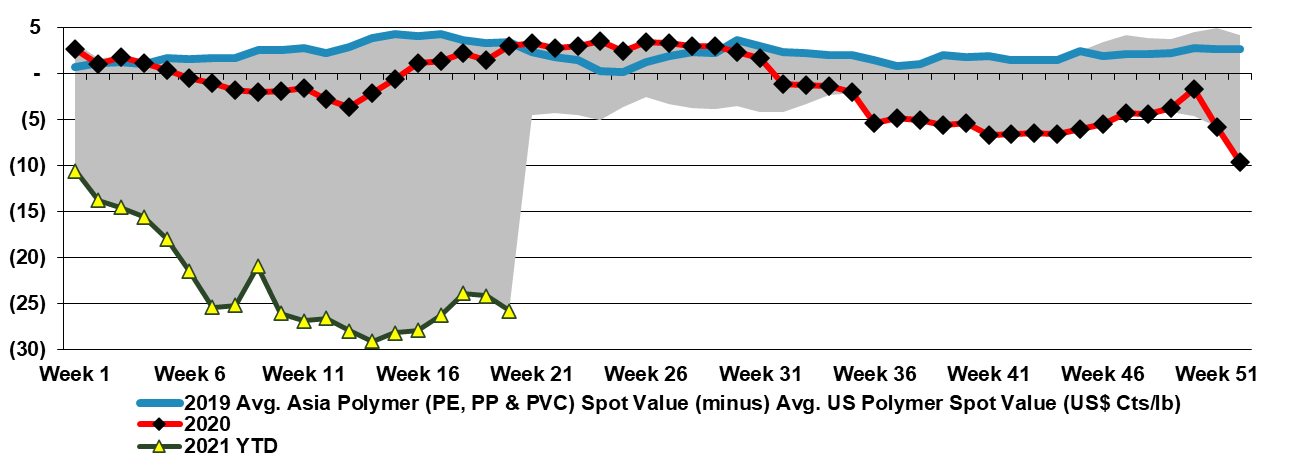

Scatter charts with significant outlying points are always eye-catching and the exhibit below is no exception. The extremes of the chart are interesting as they show that when US polymer prices are low, Asia generally trades at a premium, and when US prices are high Asia trades at a discount. But today’s discount is several standard deviations from the norm, and it is too compelling a trade to ignore. If the US was short polyethylene we would be less focused on this arbitrage but that is not the case. Unilateral decisions from US producers to keep production in line with contract demand could maintain pricing support, but the competitive disadvantage that this places on US consumers – especially in durable applications (where the polymer is a larger part of the finished product cost) is significant. It is also a major cost headwind for the packaging companies in the US, and tough to pass through in most cases on staples and household products, because of the buying power of the major food and drug retailers.

US Chemicals and Polymers Holding On, But Under Pressure...

May 26, 2021 1:45:58 PM / by Cooley May posted in Chemicals, Polymers, Ethylene, polymer pricing, polymer grade propylene, PGP, feedstock, arbitrage, ethylene producers

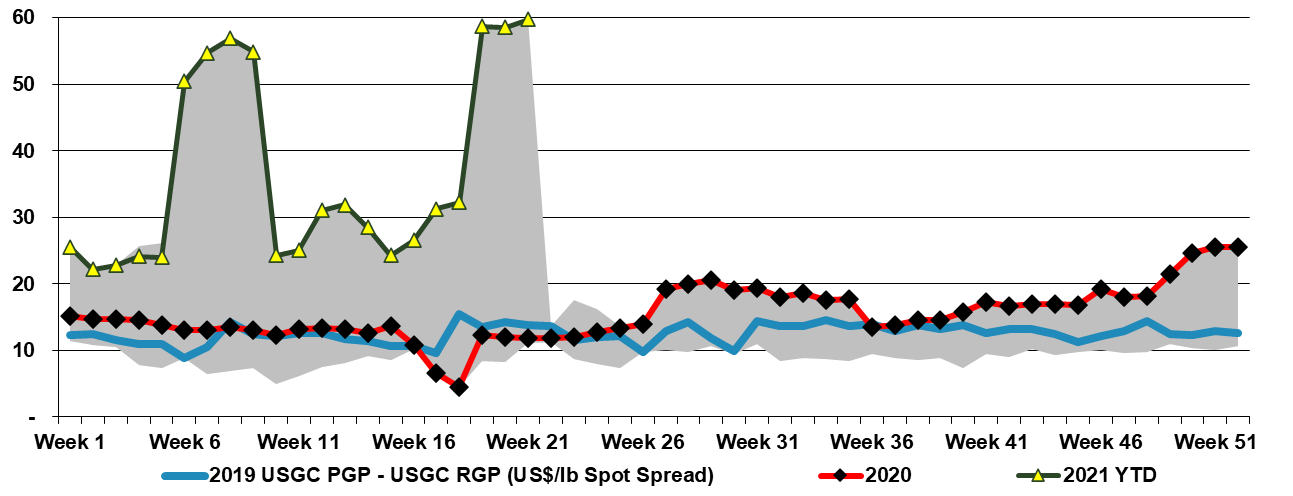

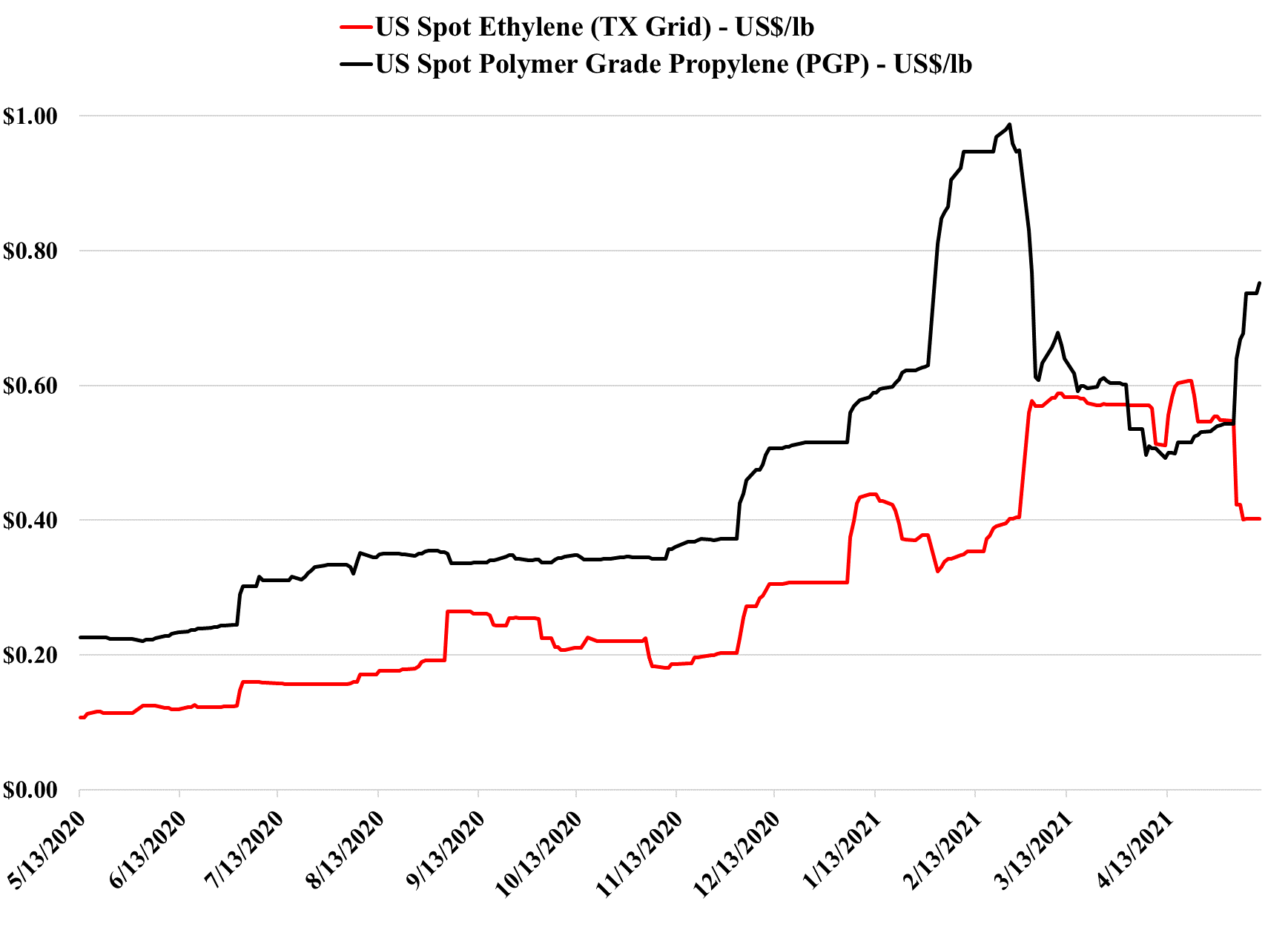

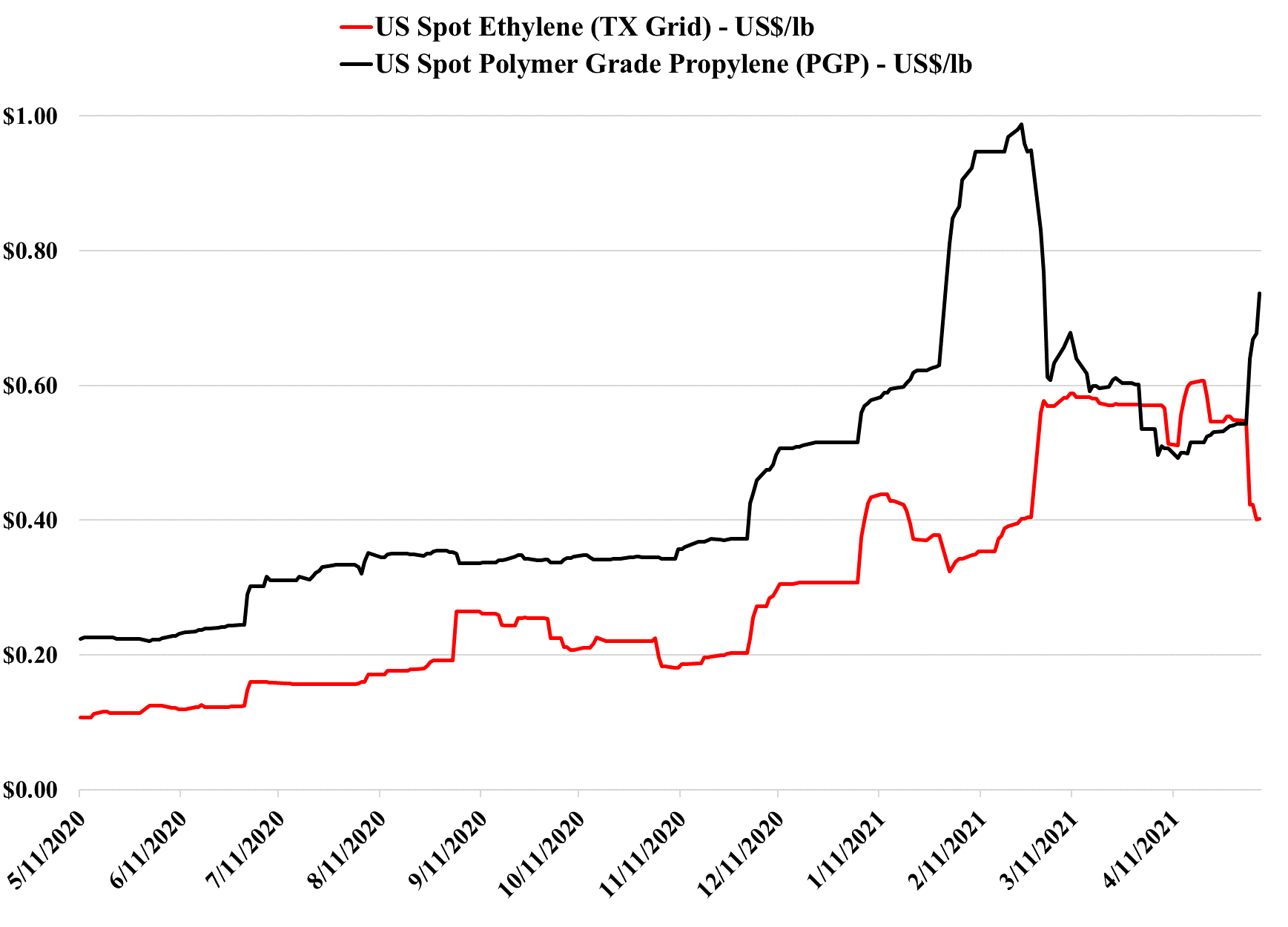

The chart below and the others in our daily report linked add more weight to our argument that polymer grade propylene prices in the US have some downside and that it could happen relatively quickly, especially if ethylene producers play the current propane feedstock arbitrage to their full extent. Given weaker propylene derivative markets outside the US, propylene derivative pricing would likely come under some negative pressure if propylene prices fell.

Chemicals Friday Question: How Long Can US Polyethylene Hold On?

May 21, 2021 1:08:55 PM / by Cooley May posted in Chemicals, Polyethylene, Ethylene, Ethylene Price, Surplus, US Prices

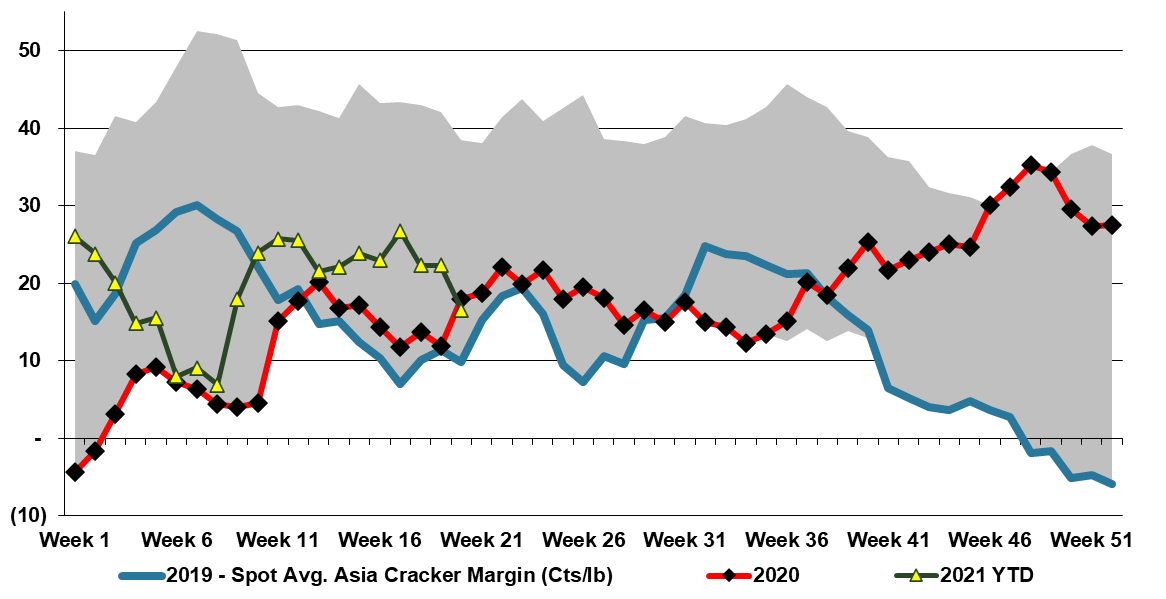

Referring back to our daily report today, can polyethylene hold on? Despite the strength in US polyethylene prices and the aggressive attempts by sellers to hold on through the quarter, there are couple of key factors working against them. Local supply may be tight in the US, but as we discussed yesterday, ethylene is moving towards a global surplus that could push US prices even lower than we are seeing this week and as the chart below shows clearly, how large the gap between Asian ethylene prices and those in the US. Unlike ethylene, polyethylene is harder to trade in to the US, partly because it is an unusual movement and the shipping costs are high, as would be the cost of getting from a US port to a consumer, but partly because US consumers serving the higher end of the market are very grade and quality conscious and would concerned about product quality and the risk of sending something to their customers that does not do the job as well.

US Ethylene Looks More Precarious Than Other Basic Chemicals

May 20, 2021 12:11:06 PM / by Cooley May posted in Chemicals, Ethylene, Monomer, Prices, Surplus, Export

Pessimism in the Asia ethylene market is a bad sign for ethylene vs. other US monomers. Those in the US with ethylene surpluses may need to fight a bit harder to find homes for the excess product in the US. We have not focused on the cost curve for a while as markets have been tight and global costs have not been an influence in the market for some time. The US has plenty of dry powder, in that export prices can fall significantly before they approach ethane-based costs, and can fall below production costs outside the US – especially in Asia – and still generate a margin for the US sellers. But that would mean more downside for US spot pricing and it may be enough to create some surpluses and some downward pressure on US derivative pricing. The caveat, of course, is that we had the same setup last year, albeit with less new capacity in Asia, and the summer hurricane season quickly wiped away any US surplus. A better understanding of the current cost curve and relative regional pricing can be found in our Weekly from Monday.

New Petrochemical Capacity In China Does Not Change The Dynamic Of The Cost Curve

May 18, 2021 12:00:39 PM / by Cooley May posted in Chemicals, Ethylene, Ethylene Price, supply and demand, petrochemicals, petrochemical capacity, global cost curve

This headline about China creating petrochemical deflation is largely based on the rate of capacity addition within China and that base chemical pricing in China still sits well above costs – but the argument may be flawed on a couple of levels. First, costs may not fall materially, given the increased thirst for imported naphtha and propane, as well as crude to fill new refining capacity. If crude prices fall, China will see lower costs, but then so will others. The margin issue is also in question because the wave of China’s new base chemical capacity is arriving amid a surge in demand growth, and this is why margins in Asia have not fallen closer to costs yet. China remains a meaningful importer of many base chemicals – less than two years ago for many products, but still meaningful, and it is the surpluses in the US and the Middle East that may drive deflation should supply chains stabilize and production rates remain high.

Friday Chemical Question: How will global PVC values develop during the next three months? Lower or higher?

May 14, 2021 12:00:54 PM / by Cooley May posted in Chemicals, PVC, supply and demand, PVC Values

US Ethylene Still Not Cheap Enough To Export, But Likely To Get There

May 11, 2021 11:45:06 AM / by Cooley May posted in Chemicals, Propylene, Ethylene, Ethylene Price

The relative moves in ethylene and propylene prices are not surprising given the news flow – propylene is likely being influenced by concerns around refinery cutbacks again – this time because of the colonial pipeline issues, while ethylene should continue to see downward pressure as the US oversupply emerges from all of the recent production difficulties. See our Daily Report for more.

Monomer Price Volatility Will Linger

May 7, 2021 1:25:37 PM / by Cooley May posted in Chemicals, Propylene, Monomer

The volatility in propylene was something we predicted months ago – there are simply too many moving parts in the market today to predict incremental supply/demand dynamics. We remain of the view that refining rates will improve further over the coming months to address the increasing demand for gasoline and this could swing propylene back in the other direction. See today's report for more on this.

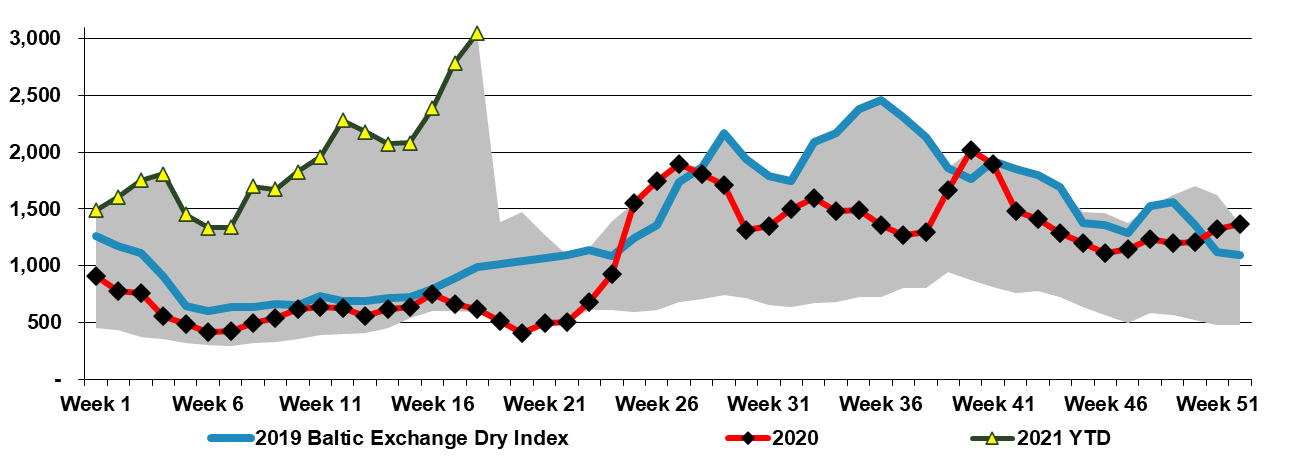

Much Of The Current Materials Inflation Is Likely Not Cyclical

May 5, 2021 12:19:24 PM / by Cooley May posted in Chemicals, Materials Inflation, Shipping Market

The headlines that are of most interest to us this week are the ones that continue the narrative of very strong demand, as they continue to point to materials inflation. While the auto producers have some raw material price protection in their contracts, the very strong results for 1Q 2021 suggest that they are not having to compromise much on pricing, as the demand is there, interest rates are low and consumer spending power is higher because of a year of incrementally adding to savings.