It will be interesting to see how US propane prices track this winter as we have low inventories in the US and there will likely be a step up in year-on-year export demand because of investments in Asia to consume imported propane. At some prices level, there will be demand destruction as ethylene and propylene economics are close to break-even in Asia and the region looks over-supplied enough for some producers to consider cutting back or even shutting down – if propane is the least attractive feedstock then the propane-based units will close first. Those producers in the US that have propane flexibility are unlikely to be anywhere near the market today as declining propylene prices in the US only make the feedstock less attractive. We wonder whether some of the traditional propane users in the US Gulf are experimenting with light naphtha/condensate as an alternative, but these feedstocks will also become less attractive as propylene prices fall. See more in today's daily report.

Propane: Pricing Itself Out Of The Chemical Feedstock Market

Sep 8, 2021 2:35:28 PM / by Cooley May posted in Chemicals, Propylene, supply and demand, propane, feedstock, propane prices, feedstock market

Reasons To Short US Propylene Mount! (If Able To Push Recent History Aside)

Aug 19, 2021 12:32:30 PM / by Cooley May posted in Chemicals, Propylene, propane, PGP, US propylene

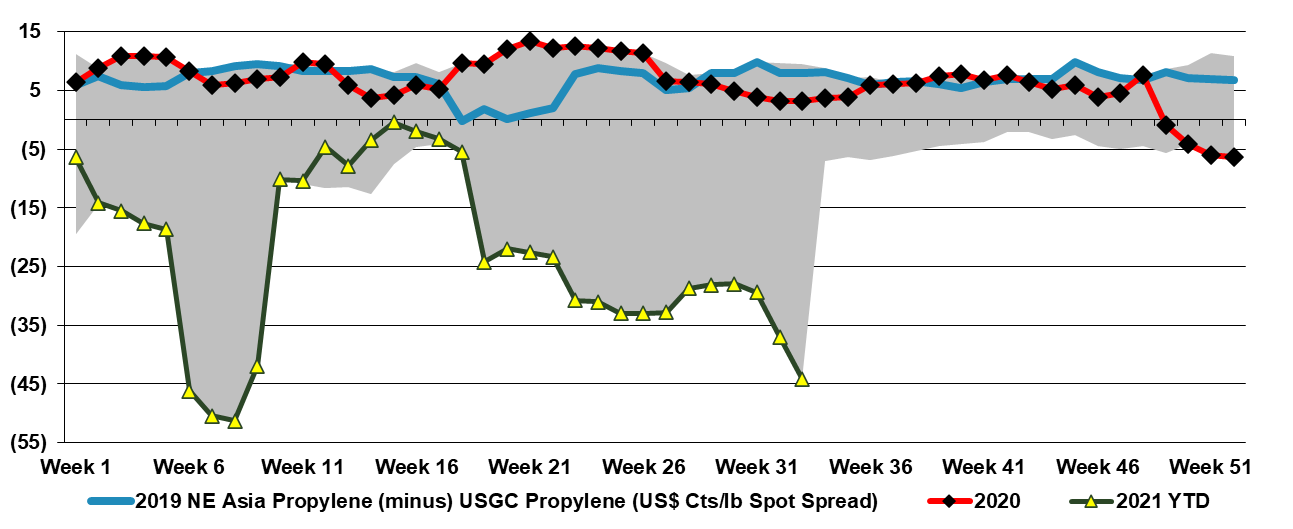

The propylene charts in today's daily and below, show the extreme nature of the US market today – both relative to costs and prices internationally. Despite the very high cost of propane, the US propylene price is high enough to justify shipping propane to Asia – running it through local PDH capacity and shipping the propylene back to the US! This is the definition of unstable, but the logistics would be a constraint as the US does not have ship-based LPG import capability whee it would be needed. While we think propylene (polymer grade) is a compelling “short”, the markets over the last year have been so volatile and unpredictable and the US Hurricane season is far from over, so we would likely not put our money at risk today.

Could Propylene Lose Market Share To Ethylene?

Aug 18, 2021 12:28:03 PM / by Cooley May posted in Chemicals, Propylene, Ethylene, propane, Propylene Derivatives, exports

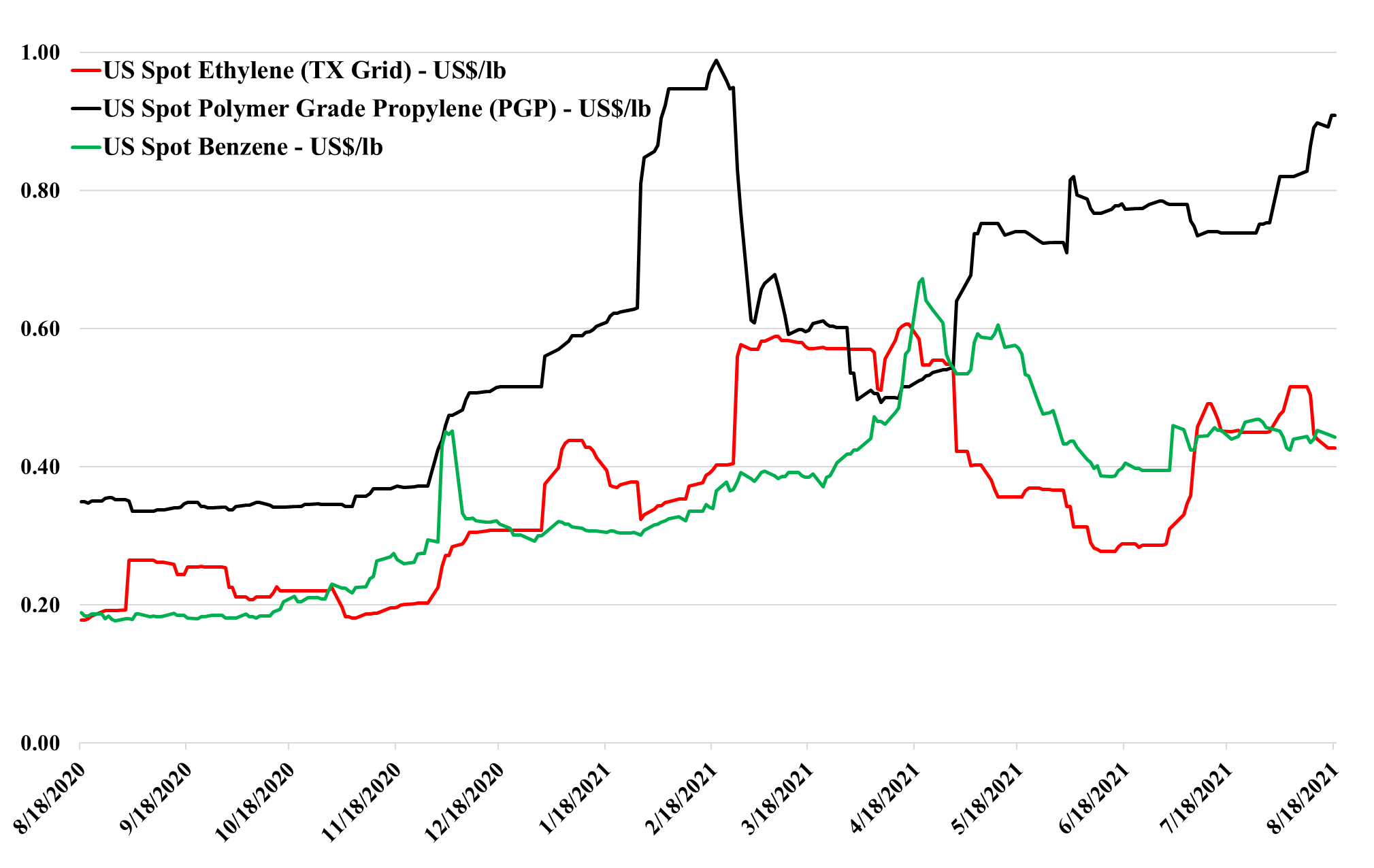

Propylene prices are rising again in the US, in part because of the propane price increase discussed in today's daily, but also because of reduced availability from other sources. These higher prices maintain upward pressure on propylene derivative pricing and we have to question how markets will adapt to much higher propylene and derivative pricing than ethylene and derivatives. There are several areas of potential overlap, where ethylene derivatives could take share from propylene derivatives and if the price deltas remain high and users become convinced that this could be the norm, it is reasonable to expect that propylene demand growth slows incrementally and ethylene demand growth benefits. In the immediate term, some quick switches could happen, but just as propylene demand marched ahead in the 1990s and 2000s because investments were made to use propylene derivatives instead of ethylene derivatives, we could begin to see investment to reverse the process. This was an incremental process for propylene over decades and we would not expect to see anything less incremental in the other direction, but ultimately this could be good for the more focused US ethylene and derivative markets if it accelerates growth in onshore demand and decreases the reliance on exports.

Polypropylene: Surpluses In Asia May Have To Stay In Asia

Aug 6, 2021 2:30:51 PM / by Cooley May posted in Polypropylene, Ethylene, propane, carbon emissions, polypropylene margins, PDH, Polypropylene Surplus, PP

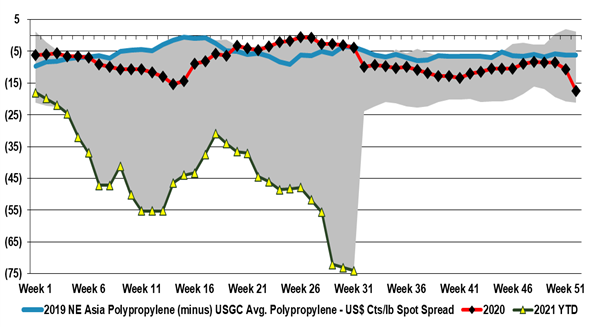

The ICIS polypropylene analysis in the linked headline is interesting in that it shows the vulnerability of the traditional exporters of polypropylene to China if China goes ahead with the longer-term capacity announcements that local producers have made to date. The analysis suggests that this development will move China moves from deficit to surplus in PP.. Where the analysis may be wrong in our view is that the current high price of propane, low ethylene margins, and low local polypropylene margins could put portions of the planned capacity on hold, and while it may come eventually, the phasing of additions may be different. Current economics make any ethylene (and associated propylene) investments hard to justify and the same with PDH. In the past, we have seen China pull back investments when economics have not worked – most notably in the early part of the last decade when oil prices were very high. At that time China moved to projects based on coal, and while that may re-emerge, local oversupply, in general, will slow things down in our view, and pushing back towards coal may not fit with whatever carbon emission targets China will set ahead of the COP26 meeting.

US Ethylene - Spot Market Shows Strength WoW, Likely To Remain Volatile in 2H21

Jul 7, 2021 3:03:39 PM / by Cooley May posted in Chemicals, Polypropylene, Ethylene, propane, Lotte Chemical, US Chemicals, Ethylene Surplus, US ethylene, US ethylene surplus, NGL, LPG cracking capacity

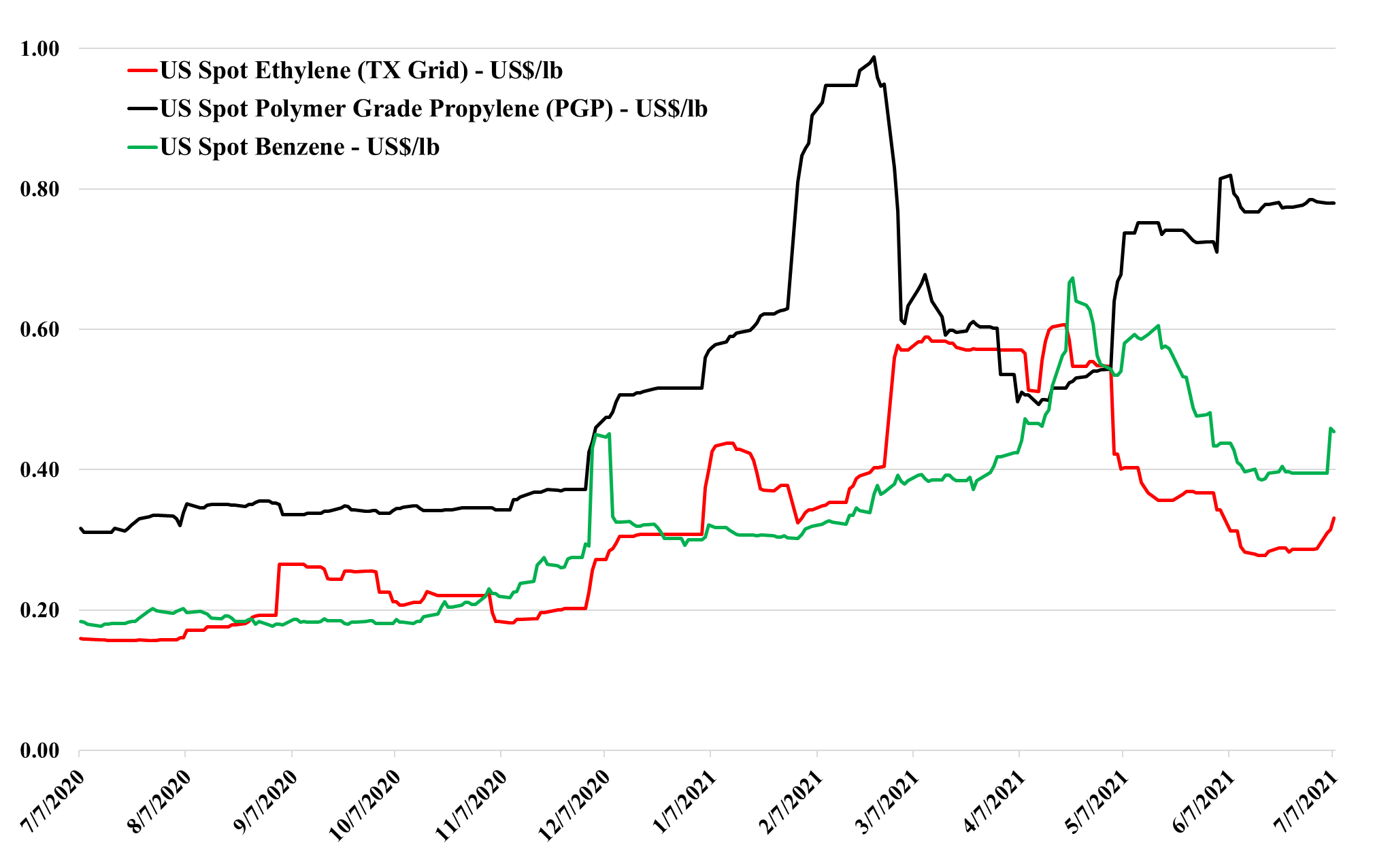

The US ethylene market strengthened slightly in early July, most likely because of supply disruptions as it is hard to see how domestic demand could improve from here. There is not much room to increase prices further if the export market is the balancing mechanism through July and August, as prices remain depressed in Asia and any arbitrage would close quickly if prices in the US moved any higher. Despite the rising NGL prices discussed in today's daily report and on Sunday, the US has plenty of margin left in ethylene, and prices could go lower if that is necessary to move additional volume. While we talk in the opening paragraph about increased inventories of finished goods in anticipation of the year-end holiday season and continued supply constraints, and how this is leading to a shortage of warehouse space, we suspect that everyone upstream of the finished good suppliers is also looking at adding or maintaining a larger inventory cushion than they have in recent years. We still believe that it is a tough call today as to whether you should sell surplus ethylene or store it as we head into hurricane season in the US.

The NGL Cost Advantage For US Ethylene Producers Remains Substantial

Jul 1, 2021 2:37:56 PM / by Cooley May posted in Propylene, propane, feedstock, ethylene producers, ethane, Ethylene Surplus, US ethylene, NGL, ethylene cost curve, feedstock cost, NGL cost curve, naphtha, ethylene plants

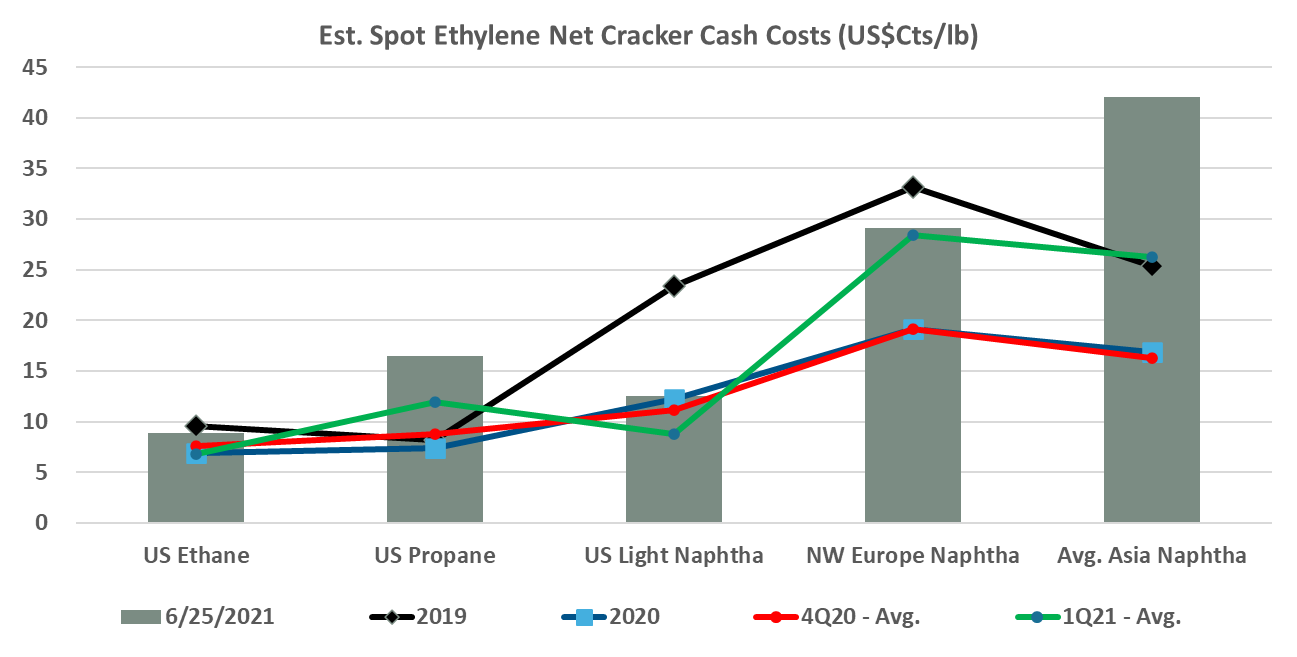

The chart below focus on the ethylene cost curve and show that the US currently retains a distinct cost advantage despite escalating domestic feedstock costs. The current cost advantage in the US is sufficient to move ethylene derivatives into most markets profitably and while US spot prices for ethylene may not quite reflect the levels needed to stimulate exports today – US ethylene costs certainly do. The restart of the Nova unit in Louisiana may put some further downward on US ethylene prices but as we discussed yesterday, given the weather risks in 3Q it is an interesting dilemma today over whether you sell surplus ethylene or store it on the basis that spot prices will rise because of production outages – this time last year the “store it” decision would have been the right one as spot prices rose through 3Q.

Will High Propane Prices Limit Propylene Demand Growth?

Jun 9, 2021 1:39:34 PM / by Cooley May posted in Chemicals, Recycling, Polymers, Polypropylene, Chemical Demand, Chemical Industry, propane, polystyrene, paint additives, ethane

The relative strength in US propane versus ethane is something we have talked about before, with the strong export pull on propane, pushing prices higher, despite equally strong demand for ethane in US ethylene units and for export. The projects to consume propane coming online in the next 12 months overwhelm the projects to consume ethane in our estimate and consequently, we believe that the delta (in chart below) will remain high and may widen further. On a cost basis, this could put US propylene and a distinct disadvantage to US ethylene and at the margin might help ethylene derivative demand relative to propylene derivative demand – most likely in paint additives, but also in some polymers where polypropylene can be substituted with other materials – it may provide a bit of a lifeline for polystyrene if the polystyrene recycling initiatives gain traction. See our daily report for more.