We are seeing some monomer price weakness in the US, despite the rising costs. For ethylene, this is likely because of increased supplies (new capacity and turnarounds ending) and all capacity to consume running at full rates, including the export terminals. There is plenty of margin in exporting ethylene today and US prices are not falling because they need to find another buyer internationally. We could see some opportunistic buying for inventory at these prices, especially if you believe that the conflict in Ukraine is not ending soon and also if you are concerned about more extreme weather as we move through the summer in the south of the US.

Evidence Of Oversupply For Ethylene. Not The Case For Propylene

Mar 31, 2022 2:33:16 PM / by Cooley May posted in Chemicals, Propylene, Ethylene, propane, PGP, Propylene Derivatives, PDH, monomers, propylene prices, monomer prices

US Ethylene Decoupled From Global Costs

Mar 8, 2022 2:05:18 PM / by Cooley May posted in Chemicals, Propylene, Ethylene, Benzene, propane, natural gas, Ethylene Surplus, ethylene exports, US propylene, crude oil, crude prices, Global Costs

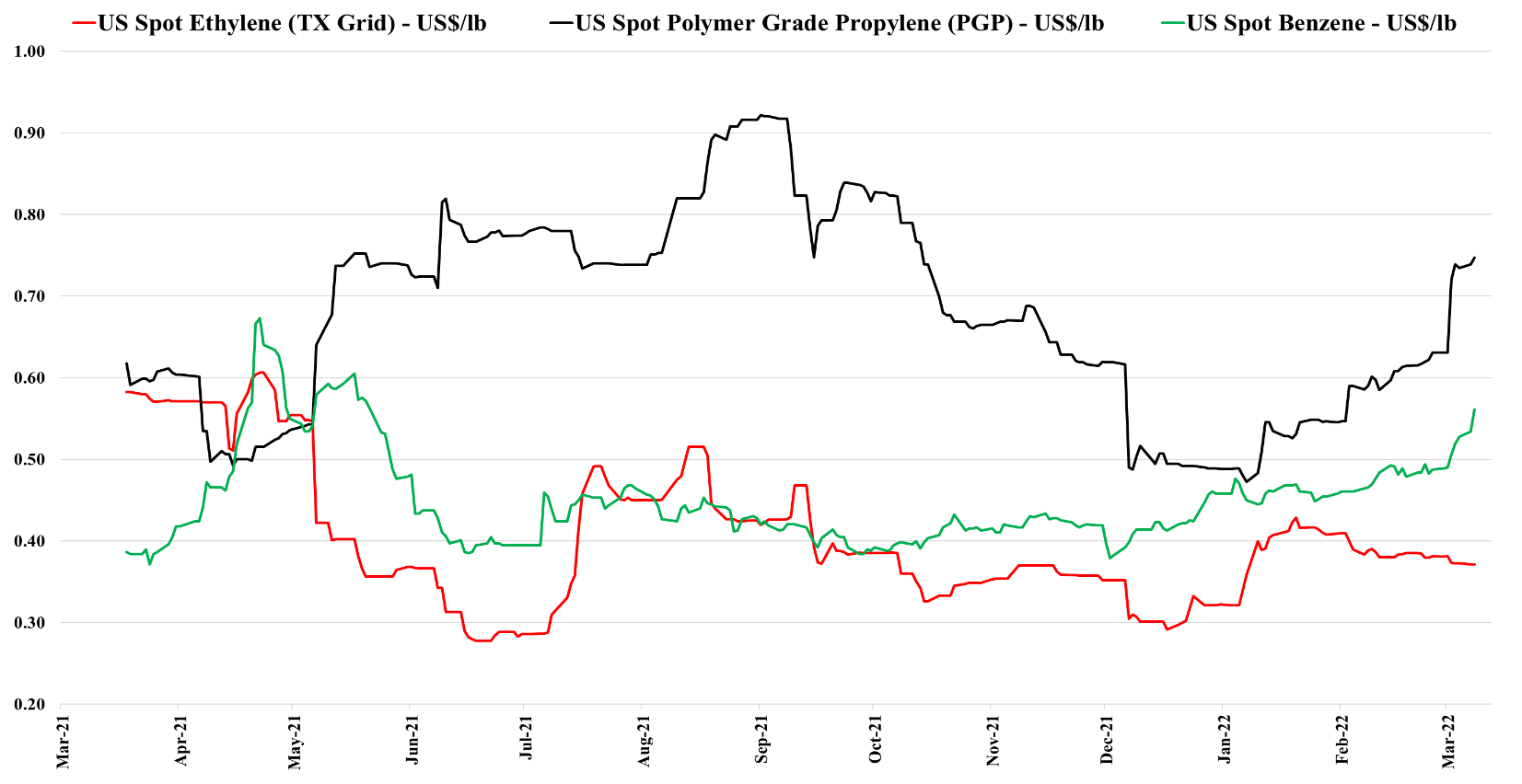

It is interesting to note the rapid rise in US propylene (and benzene) values as they follow propane and crude prices (propane is following crude because of its heating value and export opportunities). Ethylene is not moving as US natural gas is in surplus and is not following international natural gas prices. The US is surplus ethylene and derivatives, but we would expect to see ethylene and ethylene derivative prices jump up in the US if Europe is physically unable to make ethylene and derivatives or if the costs in Europe become so high that supplying incremental volumes from the US becomes even more compelling. For more see today's report titled "Into The Mystic – Ex-US Energy Price Surge Favors US Producers; Low Visibility Keeps Capex In Check".

US Competitive Advantage Pushing Ethylene Exports

Dec 1, 2021 12:43:50 PM / by Cooley May posted in Chemicals, Ethylene, petrochemicals, propane, arbitrage, ethylene producers, Ethylene Surplus, US ethylene, manufacturing, naphtha, ethylene exports, exports, chemicalindustry, ethane imports, petrochemicalindustry, Navigator Gas

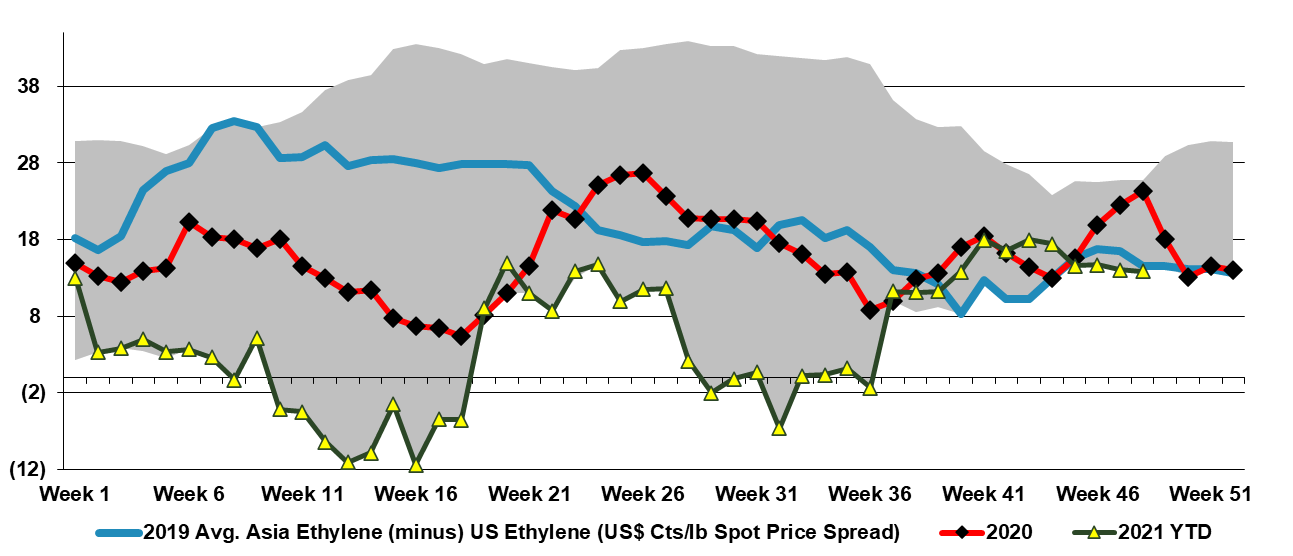

The Navigator Gas announcement should not be a surprise as the ethylene export arbitrage reopened in the US in September (Exhibit below) and since the terminal opened there has been a demand for ethylene exports each time the numbers have made sense. There are ethylene consumers in Asia that are net short and will buy incremental volumes from the US when the price is right relative to local suppliers and there is incremental demand in countries and regions that appear to be in surplus, including Europe, where a buyer can leverage an import to try to push local prices lower. In China, some of the facilities that require either propane or ethane imports might be better off buying ethylene versus making it today, and this is certainly the case for naphtha importers, as we highlighted in our Weekly Catalyst report on Monday. Today a US exporter can buy spot ethylene in the US and deliver it to China for less than the cost of manufacture in China, before the cost of getting the local ethylene to any consumer that is not on site.

Is A Feedstock Shock In The Cards For US Chemicals?

Nov 23, 2021 1:39:28 PM / by Cooley May posted in Chemicals, Polymers, Crude, LNG, Energy, Emissions, petrochemicals, propane, carbon footprint, feedstock, ethane, natural gas, ethylene capacity, E&P, NGLs, exports, shortages, chemicalindustry, Brent Crude, butane, Mexico, fuels

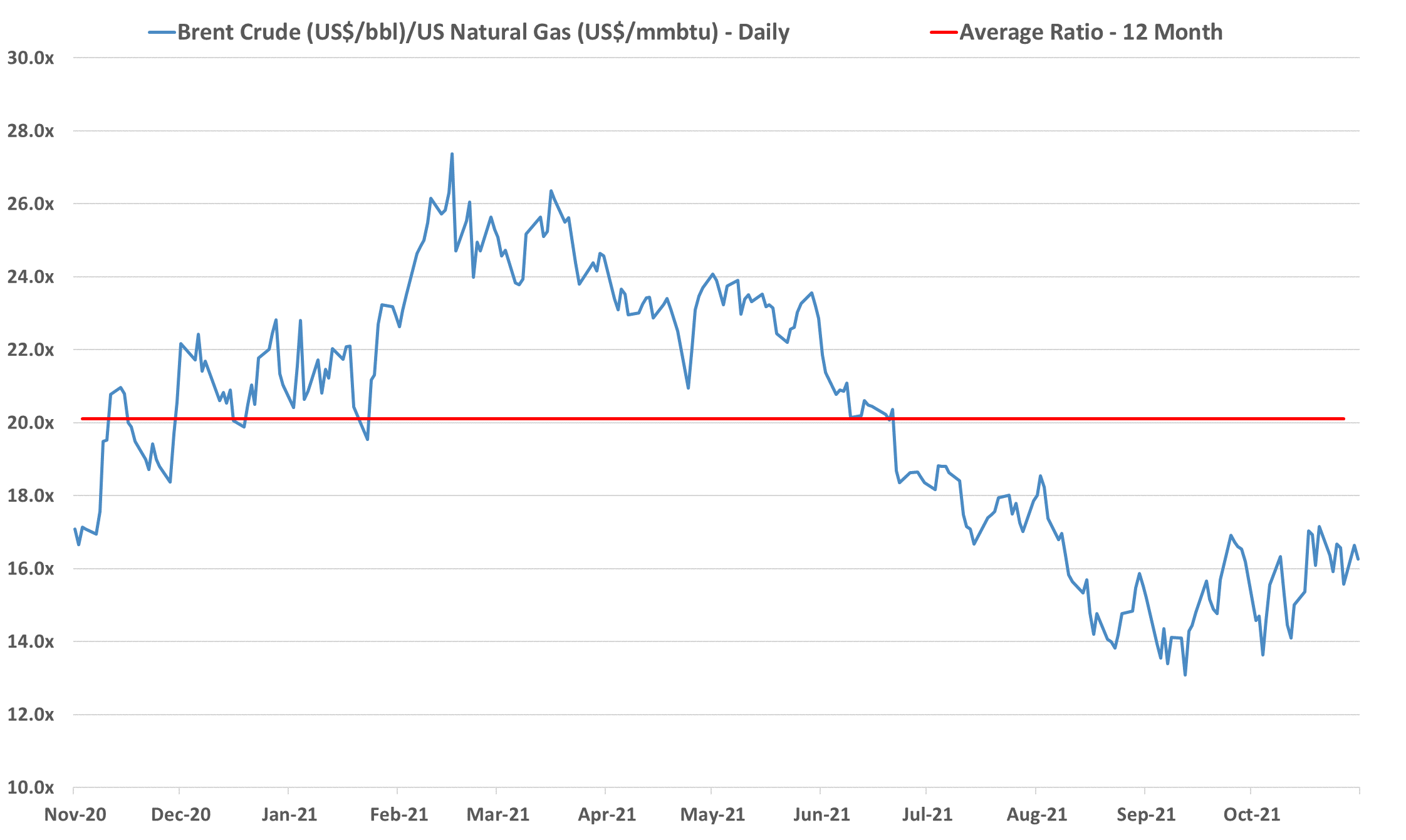

We remain concerned that natural gas E&P investment in the US remains too low to meet expected demand increases, especially for natural gas-fired power stations and LNG, but also possibly for NGLs, especially ethane, given new ethylene capacity and a fresh export market in Mexico. Near-term, natural gas prices are showing some easing relative to crude, albeit a very volatile trend – Exhibit below – but we see medium and longer-term shortages unless E&P spending increases. The new power facilities shown in the bottom Exhibit will all need incremental natural gas, and the international LNG market is so tight that as new capacity comes online in the US we would expect it to run as hard as is possible. This sets up for a market where the clearing price of natural gas in the US is at risk of being set by the marginal exporter. The price jump for domestic consumers would be dramatic and it would cause all sorts of headaches in Washington and probably intervention. We showed the incremental natural gas price in the Netherlands in our Daily Report on November 18th, and if the US price were to reflect the netback from this level, they would rise close to $30 per MMBTU. The natural gas industry needs some sort of global blessing to continue to operate as what will likely be the core transition fuel. It will be necessary to clean up the emissions footprint of natural gas, but the industry should be encouraged to invest on this basis. For those who doubt whether the US natural gas price can rise to $30/MMBTU – note that the Europeans did not think $30 was possible either.

Chemical Supply Increases And US Prices Weaken

Nov 19, 2021 12:35:27 PM / by Cooley May posted in Chemicals, Polymers, PVC, Polyethylene, Plastics, Polypropylene, ExxonMobil, polymer buyers, railcar shipments, Supply Chain, Dow, propane, PDH, ethylene capacity, US polymer prices, US Polymers, propylene prices, energy prices, chemicalindustry, plasticsindustry, spot market, cost arbitrage

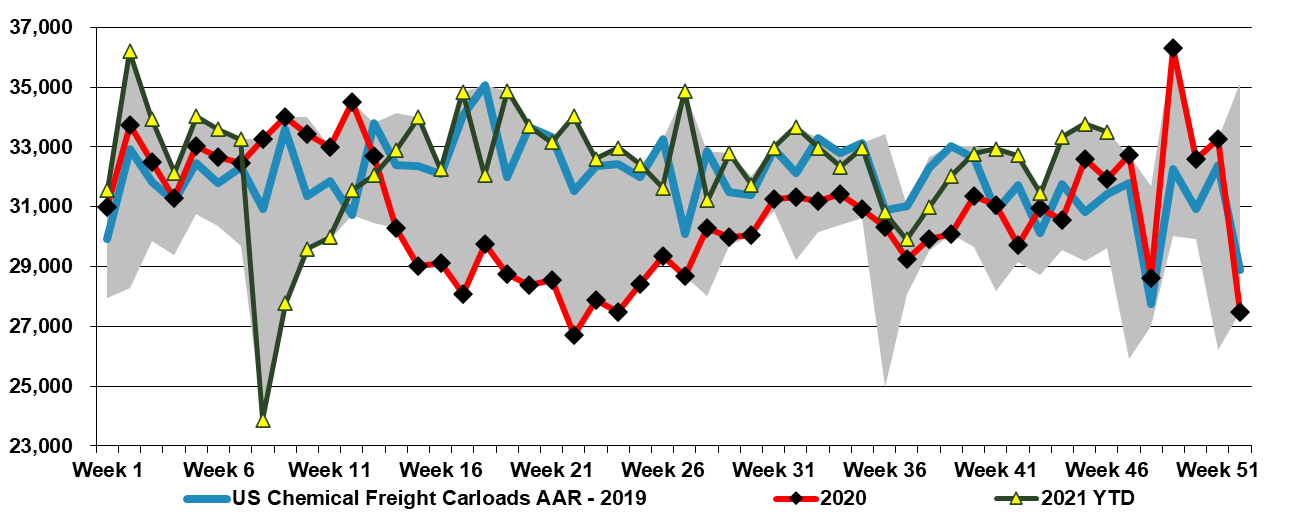

US rail data for chemicals remain at the 5-year highs and have been there for almost 2 months. This is working its way into the supply chain and we are seeing weakness in US polymer prices across the board, except for PVC. US spot polymer prices are in a bit of a “no man's land” right now as they would need to drop significantly to find incremental demand offshore, given US premiums to the rest of the world. We believe that most of the volume leaving the US is doing so within company-specific businesses – ExxonMobil supplying ExxonMobil customers, Dow supplying Dow customers, etc, and consequently, these shipments do not show up in the spot market.

An 80's Re-Run - A Chemical Mega-Cycle

Nov 8, 2021 10:21:11 AM / by Graham Copley posted in ESG, Ethylene, propane, ethane, Basic Chemicals, basic polymers, feedstocks, global shortage, naptha

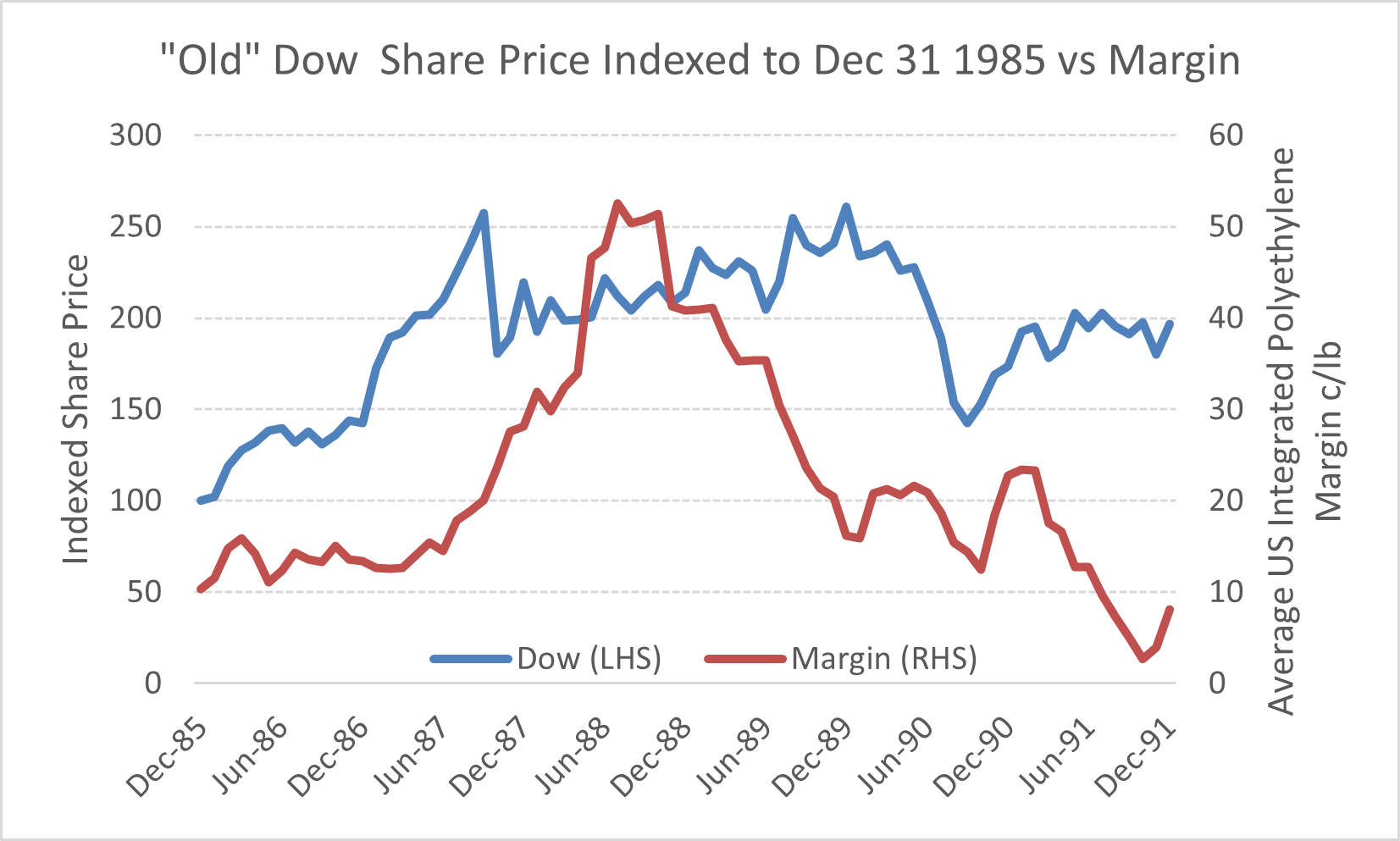

In yesterday's Sunday thematic and weekly recap report titled "Waiting For The Big One – Is A Chemical Mega-Cycle Ahead?", we referenced the global shortage of basic chemicals and polymers in the late 80's. We think this could repeat because of limited capital spending to grow basic chemical capacity due to cost and long-term demand uncertainties and this could cause a mid-decade global profit mega-cycle. Emission abatement initiatives and concerns with feedstock prices/availability will work against the justification of capacity expansions in every global region. Demand growth mitigation from plastic bans, renewables, and increased like-for-like recycling is unlikely to impact materially pre-2026/27.

Propylene Producers Are Seeing Margins Shrink Quickly

Oct 15, 2021 3:03:36 PM / by Cooley May posted in Chemicals, Propylene, Polypropylene, propane, US propylene, PDH production, polyurethanes, Propylene margins

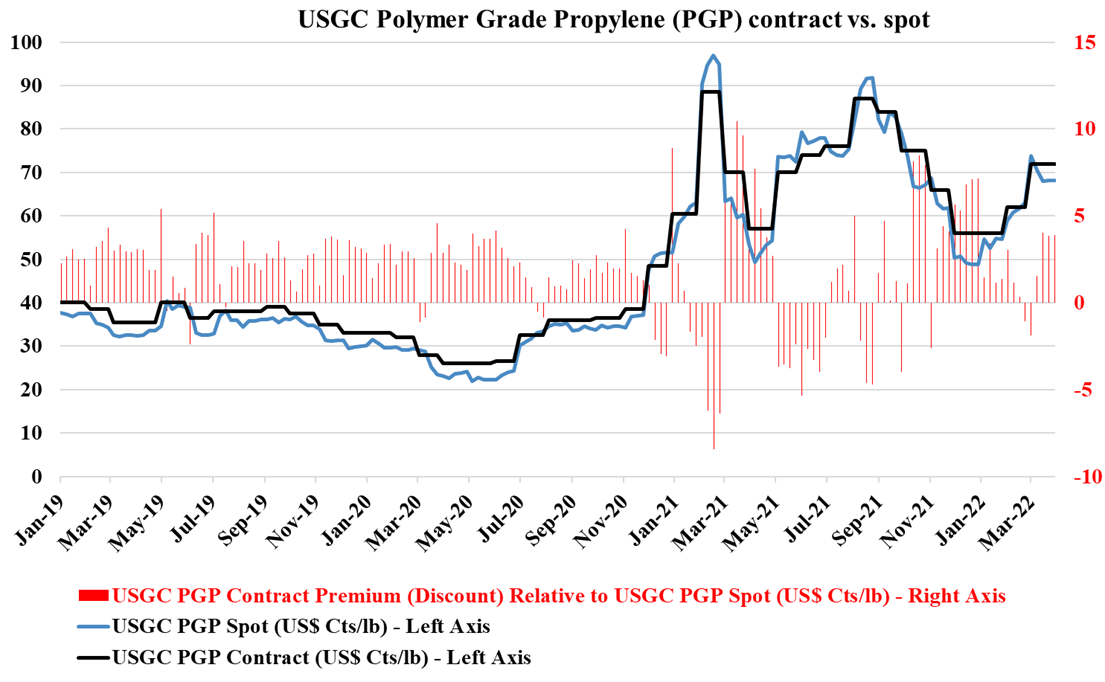

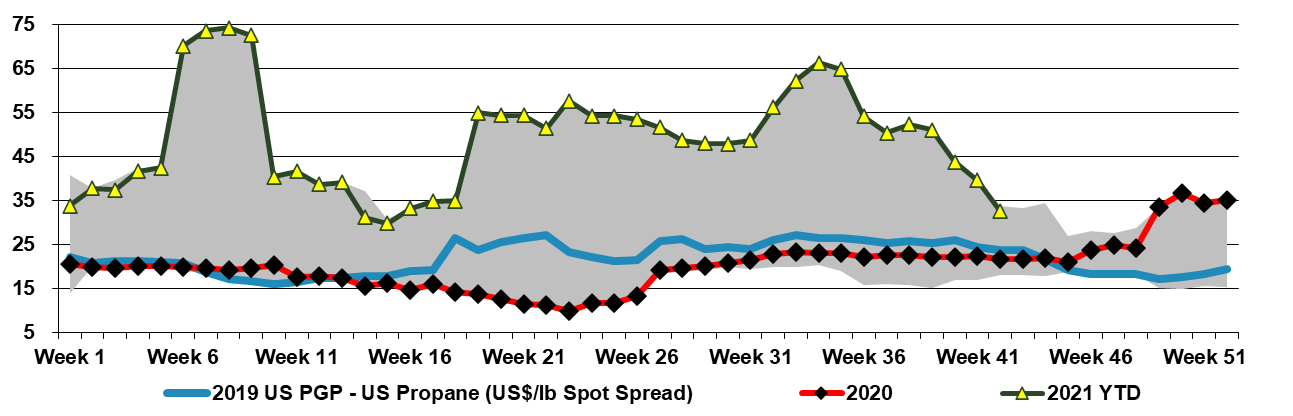

The US propylene to propane spread finished this week within the 5-year range, as opposed to setting the high end of the 5-year range, for the first time since December 2020. It still has a long way to go to reach seasonal 5-year averages and even further to reach seasonal lows, and there is plenty of margin left in PDH production in the US, even if the returns are now much lower than they were only a couple of months ago. Propylene pricing in the US is now low enough to encourage all derivative units to operate at high rates and we expect derivative price declines to follow – perhaps as steeply as propylene in the spot markets but more slowly in the contract markets.

US Petrochemical Cost Advantage Erodes As Natural Gas Prices Surge

Oct 5, 2021 2:38:18 PM / by Cooley May posted in Chemicals, Ethylene, petrochemicals, propane, feedstock, ethane, natural gas, NGL, naphtha, US natural gas, crude oil

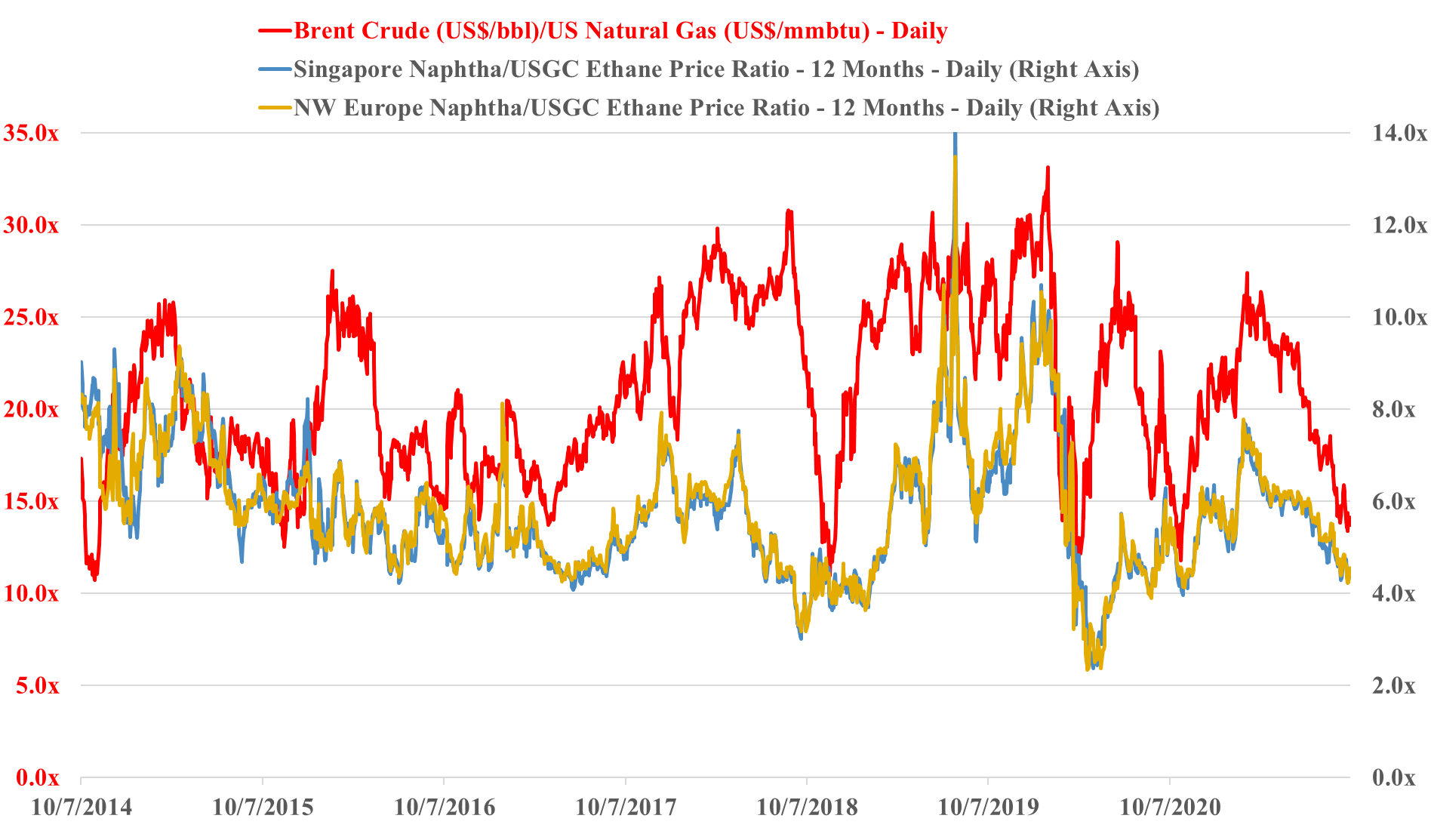

The US petrochemical production cost competitive advantage reflects a sharp decline at the feedstock level. Natural gas and natural gas liquids prices have risen faster than crude oil and Ex-US naphtha values since mid-1H21. In yesterday's report we identified the disconnect between propane and ethane pricing in the US. While both are high, propane is so high that it is now unprofitable to make ethylene from propane instead of just less profitable. The direction of the lines in the exhibit below shows the changing landscape clearly, and the only reason why the US chemical industry is so much more profitable than the markets in Asia is that chemical product prices are so robust, in part because of the high cost of freight between the regions.

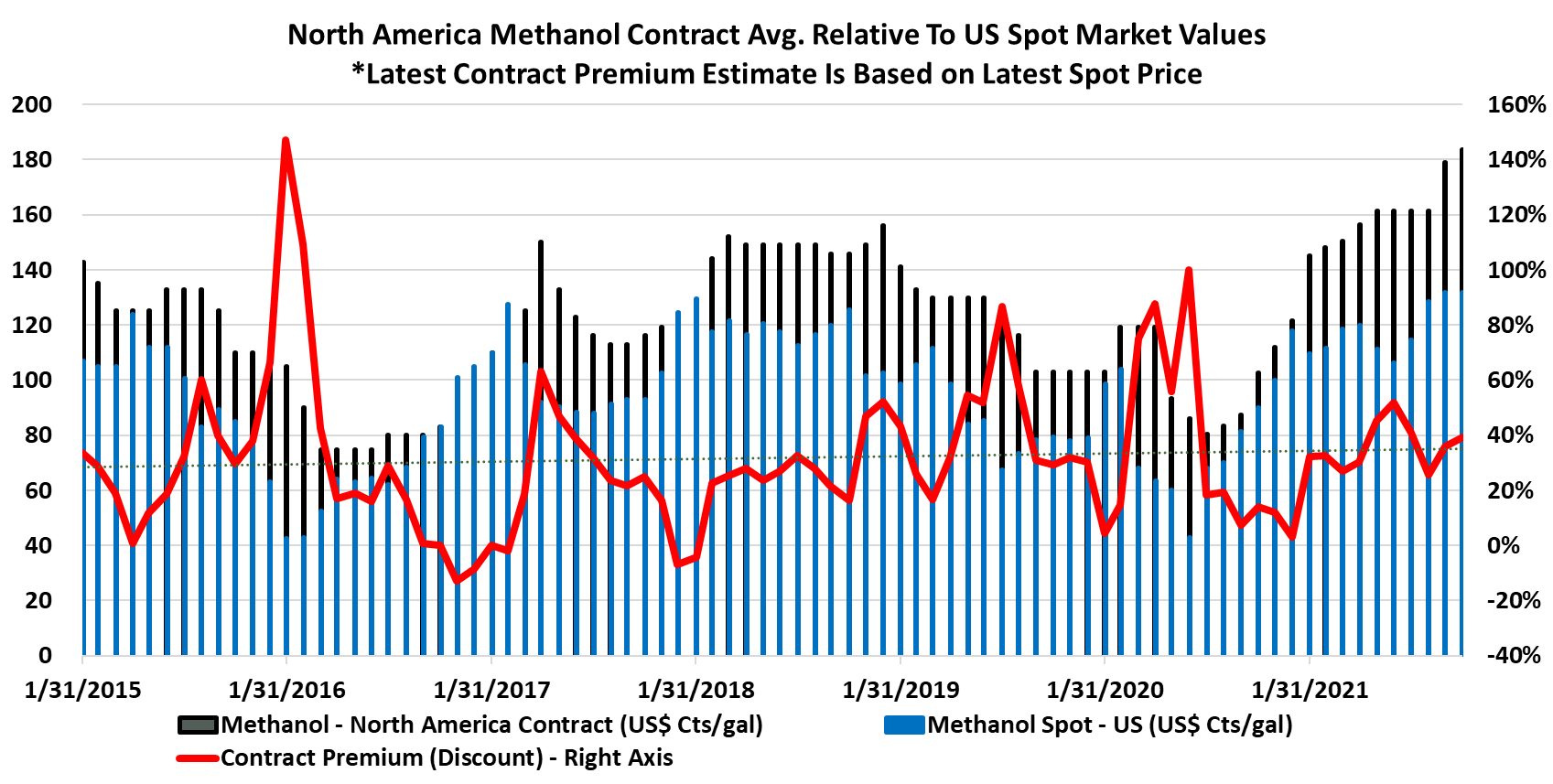

US Methanol Sees Support From Higher US Natural Gas and Overseas Markets

Sep 29, 2021 2:14:00 PM / by Cooley May posted in Chemicals, Polyolefins, LNG, Methanol, propane, olefins, natural gas, naphtha, chemical production

The charts below show that North American methanol pricing is seeing support from higher natural gas prices as you would expect, but we are also seeing some significant price improvement in China, See more in today's daily report. If China is coal constrained, as suggested in many of the power-related stories, it may be impacting chemical production from coal at the margin. Alternatively, with LNG prices so high and imported naphtha and propane prices rising in China, the country may be using more coal at the margin to make chemicals.

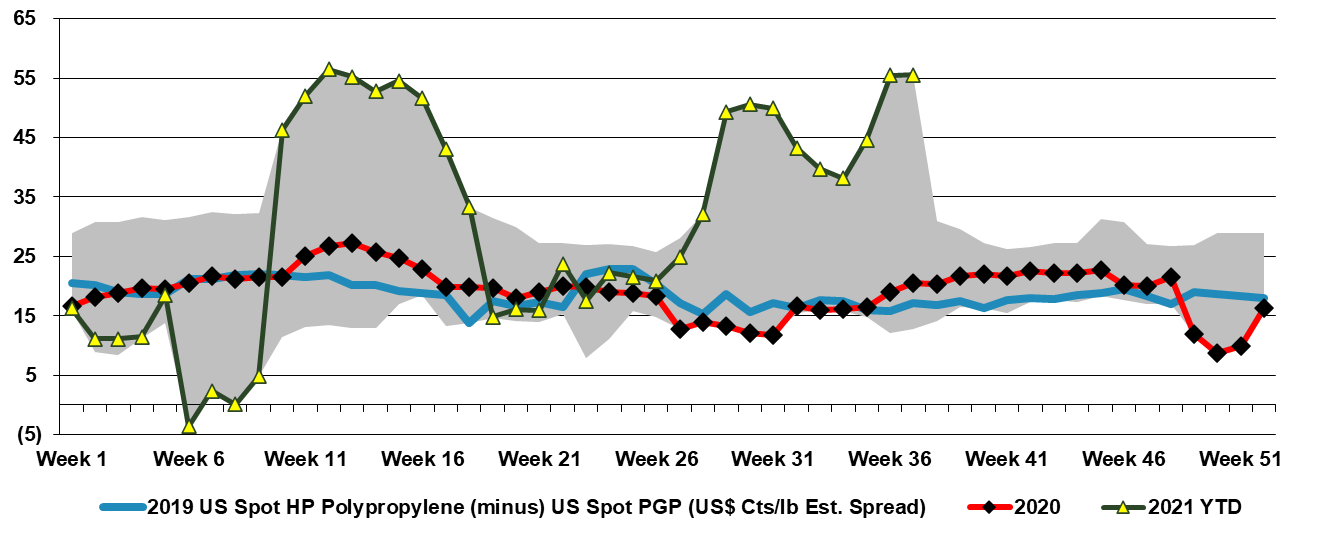

How Durable Is Polypropylene?

Sep 15, 2021 12:22:50 PM / by Cooley May posted in Chemicals, Propylene, Polypropylene, Surplus, propane, polymer, propane prices, polymer market, ethylene feedstocks, US polypropylene

The crack in US polypropylene prices is probably worth some comments as the polymer has shown extraordinary strength since the middle of last year, in the face of new capacity that was expected to push the US market into surplus. In the chart below we show that the spread over propylene has not fallen, but this is because propylene is falling lock-step with polypropylene for the most part. Those companies integrated back to PDH economics will see a significant margins squeeze as polymer prices fall while propane prices increase. We have written recently about a concern that lower auto production rates in the US will back up into parts and that this will impact materials. In the early days of the auto cutbacks, we assumed that the automakers and their suppliers would simply build inventory, with the expectation of a bounce-back in demand once the chip shortage was over. As the chip shortage has dragged on and become more significant, we have likely hit any limit of inventory build, and we are concerned that polypropylene pricing could collapse if auto-related demand does not recover quickly. While autos are not a dominant demand category for polypropylene the sector is certainly large enough to swing the polymer market from shortage to surplus. With the rise in propane prices and other ethylene feedstocks, polypropylene profits could fall meaningfully. See today's daily for more comments on the propane markets.