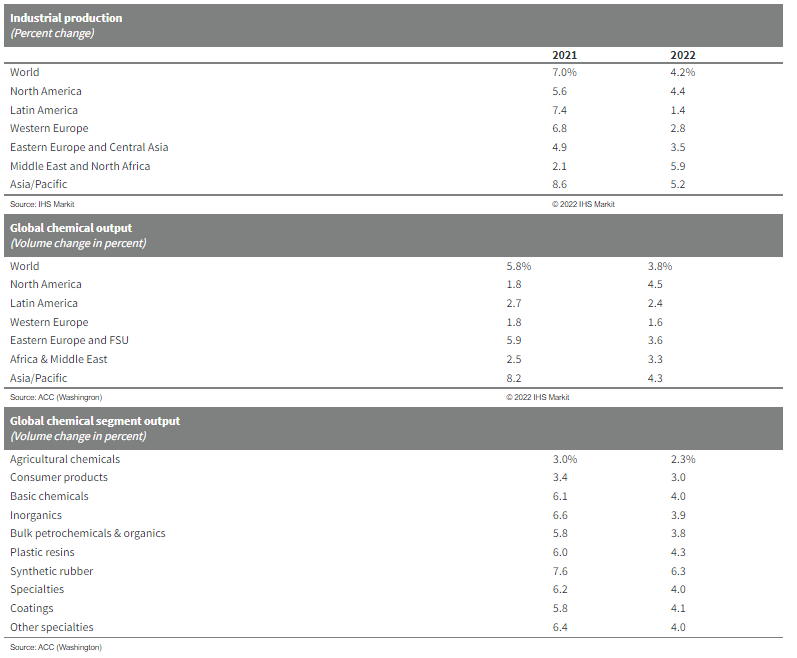

The jump in expected US chemical production in 2022 versus 2021 and the more anemic growth in 2021, is in part due to new capacity in the US but is likely more a function of lost production in the US in 2021 because of the February freeze and the hurricane that hit the New Orleans area. These two weather events, especially the freeze, cause significant production cutbacks, and not only would production have looked better in 2021 without them, but the inventory decline shown in Exhibit 1 in today's daily might have been less severe. IF we assume that climate change is causing more severe weather, then perhaps it would be prudent to build more unplanned downtime into forecasting models and on that basis perhaps the production growth forecast in the exhibit below is too hopeful. However, if you model more unplanned downtime you are inevitably going to end up with a more volatile market as available capacity will swing around the forecast average by a larger amplitude, which would make production and inventory planning more complicated.

Higher US Chemical Production In 2022 Could Be Weather Dependent Again

Jan 12, 2022 1:31:26 PM / by Cooley May posted in Chemicals, Polymers, Plastics, Raw Materials, Chemical Industry, US Chemicals, China, chemical production, COVID, forecasts, inventory planning, weather

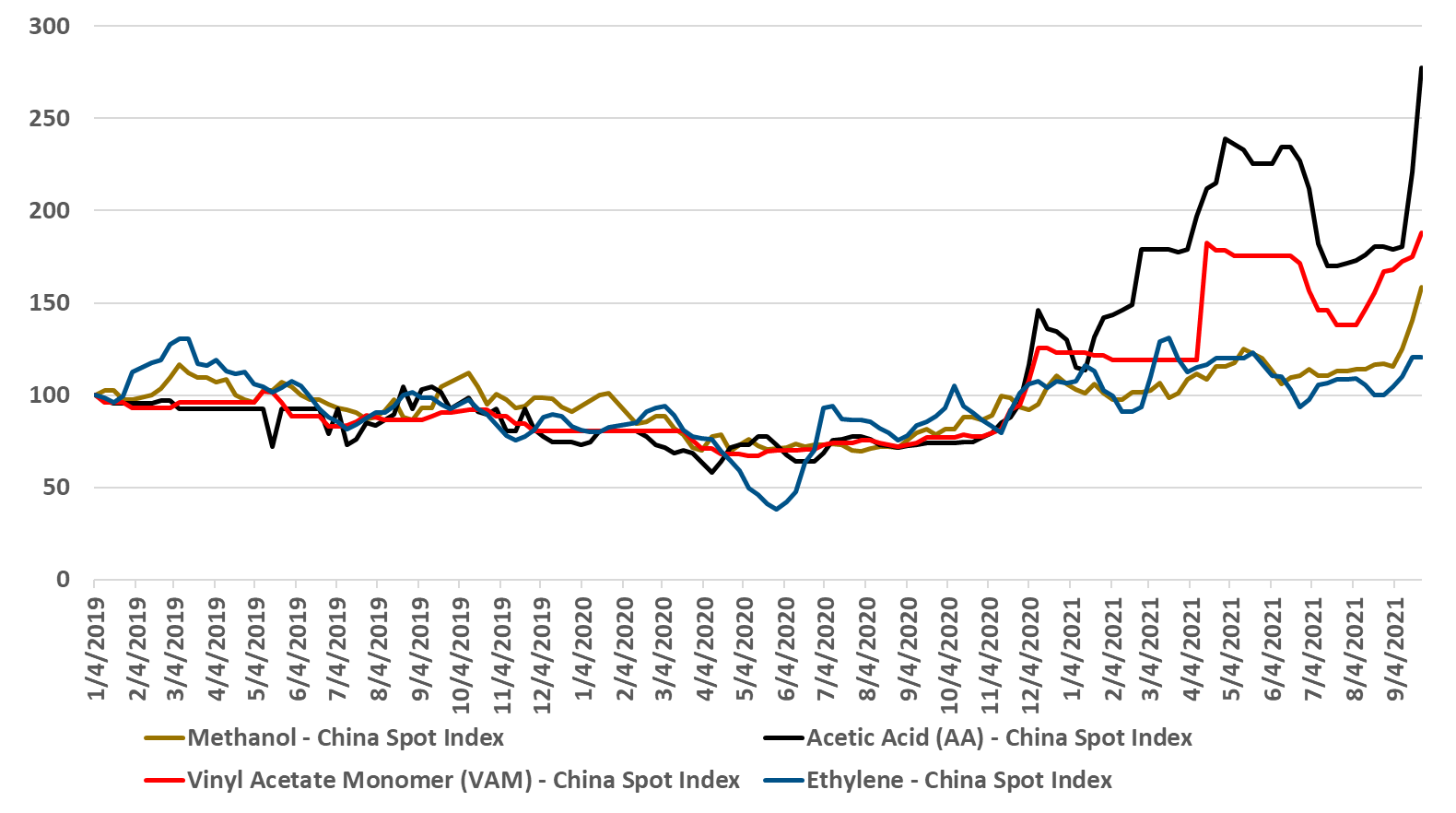

Energy Issues In China Hurting Some Chemical Production

Sep 24, 2021 2:42:46 PM / by Cooley May posted in Chemicals, Polyolefins, Energy, Emissions, PET, PTA, Acetic Acid, Monomer, China, vinyl acetate, ethylene chain

The move by China to reduce overall energy consumption is an effort to make progress on emissions but also to curtail energy demand where there is either a shortage or an over-dependence on coal-based power generation. The immediate impact in the acetic acid chain is clear from exhibit 1 in today's daily report.If these moves in China become more widespread they could reduce the significant near-term surpluses that the country has in polyolefins, PTA and PET. Why consume either expensive or high carbon power to make products that you currently cannot sell and that are either being sold at a loss or flowing into inventory? China has the structure to make decisions like this. Should this happen we could perhaps see a recovery in polyolefins pricing and PET pricing in China – as seen for the acetic chain in the exhibit below. Keeping production in line with the demand in China is important in the very near term as the fall out from the Evergrande collapse suggests that demand into the property market has been inflated and will likely correct negatively – increasing surpluses. China can force material into the export market, if it can find containers and if it is willing to operate at break-even margins. Better to curtail production.

Investment in China Continues Despite A Desire For Supply Diversity

Jun 29, 2021 3:01:45 PM / by Cooley May posted in Auto Industry, Air Liquide, China, EV, semiconductor markets, batteries, semiconductor supply, manufacturing

The Air Liquide announcement linked is consistent with the widely held view that semiconductor markets desperately need new capacity and shows that existing China-based manufacturers are stepping up. Air Liquide will supply new capacity in Wuhan, where it has been an active producer of high purity gases for the semiconductor industry for decades. While this is likely a sound investment for Air Liquide, backed by strong “take or pay” agreements from customers, the risk to the expansion is that while the world is in dire need of new semiconductor capacity, it is unclear how much of that need is for more China-based production. There is significant semiconductor demand in China and that demand will continue to grow, but consumers in the West are not only looking for more semiconductor supply but also more semiconductor supply security, and with the concentration of production in China and Taiwan, supply from outside the region is more desirable. We see new semiconductor capacity announced for the US and the auto industry, in particular, is calling for more diversity of supply, not just for semi’s but also for other EV components, especially batteries. There is already anecdotal evidence of a preference for non-China-based materials – all the way back to lithium - but how much more US and European producers are willing to pay for this “preference” will dictate the ultimate level of spending. Despite these concerns and absent broader geopolitical risk, this is likely a relatively safe project for Air Liquide and the capital commitment is not going to break the bank.

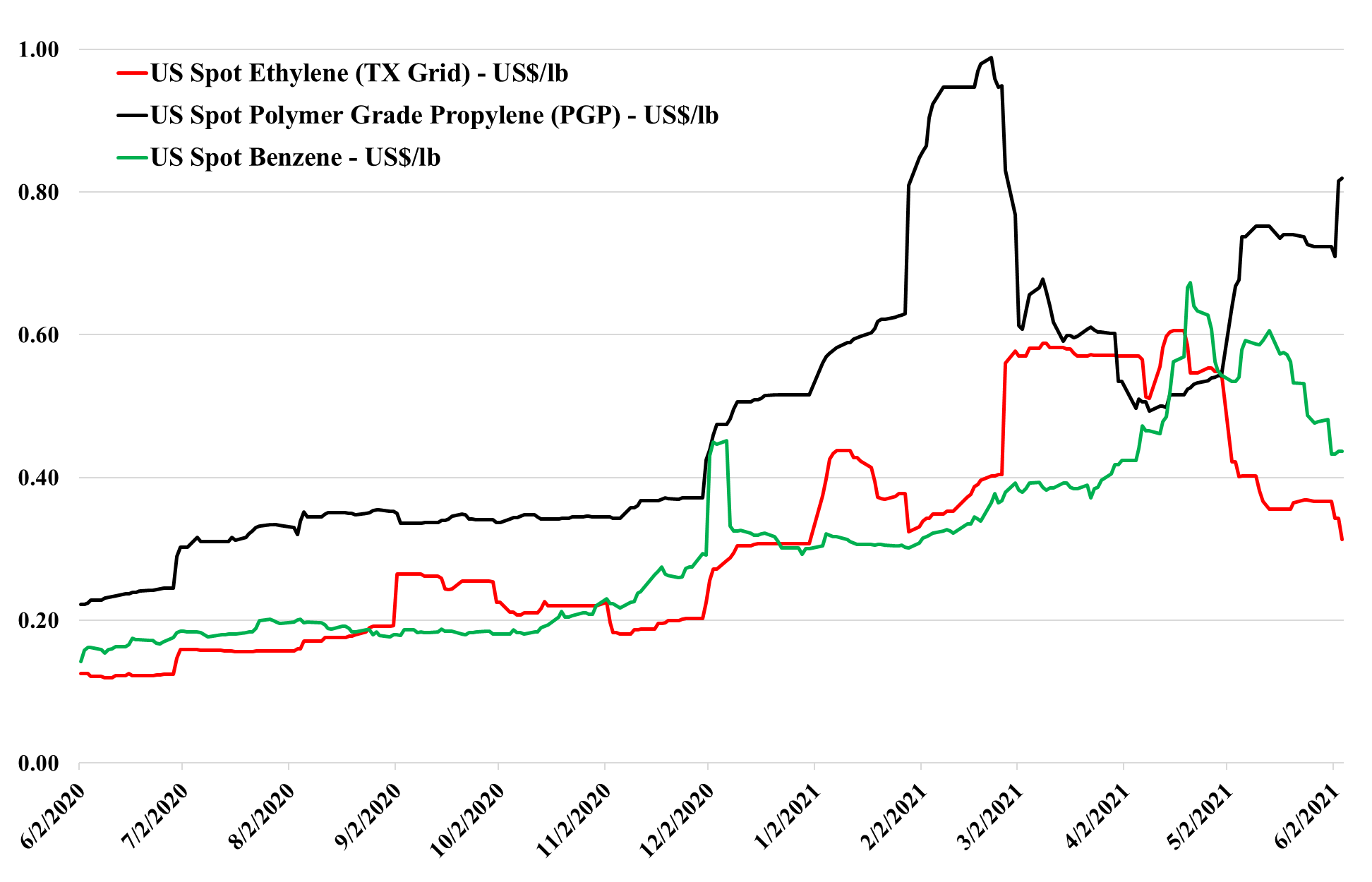

A Very Disorderly Olefins Market: More To Come?

Jun 4, 2021 12:57:49 PM / by Cooley May posted in Propylene, Commodities, Ethylene, olefins, China, oversupply, derivative capacity

The oversupply in China for many commodities is becoming more evident daily. Our research depicts this as supply-driven, based on the surge of ethylene and propylene and derivative capacity since 3Q 2020. Notwithstanding the Dow commentary (in our daily report today), the weakness in Asia in polyethylene will ultimately impact the US, as the US relies on international demand for at least 25% of its polyethylene production – much less for polypropylene. The gyrations in the ethylene and propylene markets, as shown in the chart below, indicate the US dealing with the differences between the two monomer chains. Far more ethylene and ethylene derivatives move offshore than propylene and propylene derivatives. Despite the ongoing strength in derivatives, the ethylene market is loosening. At the same time, propylene shows extreme volatility because demand remains strong and has seen greater production issues on a relative basis, per our estimate. Supply is barely keeping up, even as refinery rates increase, because of problems with PDH units, pipelines, and splitters, which would not be meaningful in a more normalized market, but make a difference when refinery supply is constrained. High propane prices, which could move even higher, keep upward pressure because of PDH economics and because they keep propane out of ethylene units.