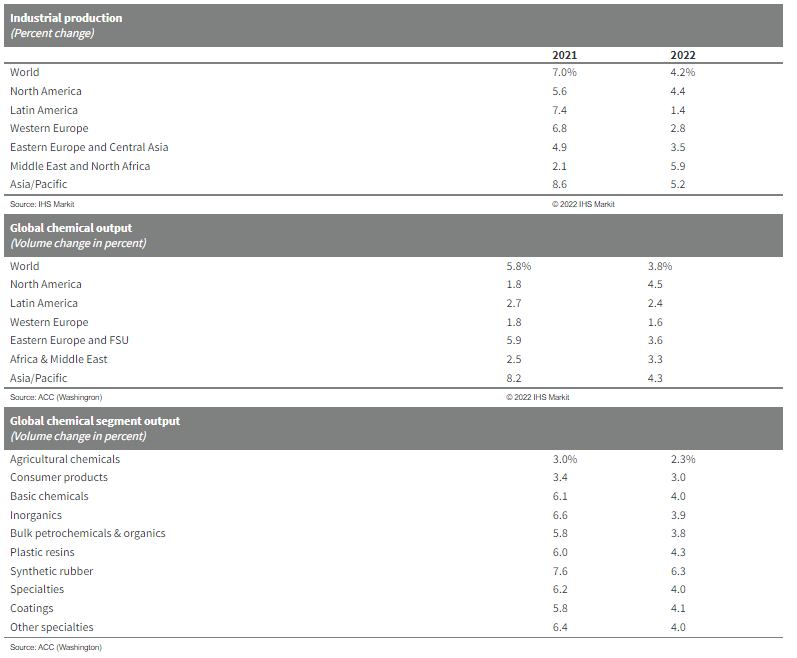

The jump in expected US chemical production in 2022 versus 2021 and the more anemic growth in 2021, is in part due to new capacity in the US but is likely more a function of lost production in the US in 2021 because of the February freeze and the hurricane that hit the New Orleans area. These two weather events, especially the freeze, cause significant production cutbacks, and not only would production have looked better in 2021 without them, but the inventory decline shown in Exhibit 1 in today's daily might have been less severe. IF we assume that climate change is causing more severe weather, then perhaps it would be prudent to build more unplanned downtime into forecasting models and on that basis perhaps the production growth forecast in the exhibit below is too hopeful. However, if you model more unplanned downtime you are inevitably going to end up with a more volatile market as available capacity will swing around the forecast average by a larger amplitude, which would make production and inventory planning more complicated.

Higher US Chemical Production In 2022 Could Be Weather Dependent Again

Jan 12, 2022 1:31:26 PM / by Cooley May posted in Chemicals, Polymers, Plastics, Raw Materials, Chemical Industry, US Chemicals, China, chemical production, COVID, forecasts, inventory planning, weather

Natural Gas: Good If You Have It, Very Bad If You Don't

Oct 27, 2021 3:11:03 PM / by Cooley May posted in LNG, Methane, Energy, Inflation, natural gas, power, chemical companies, energy inflation, energy costs, forecasts

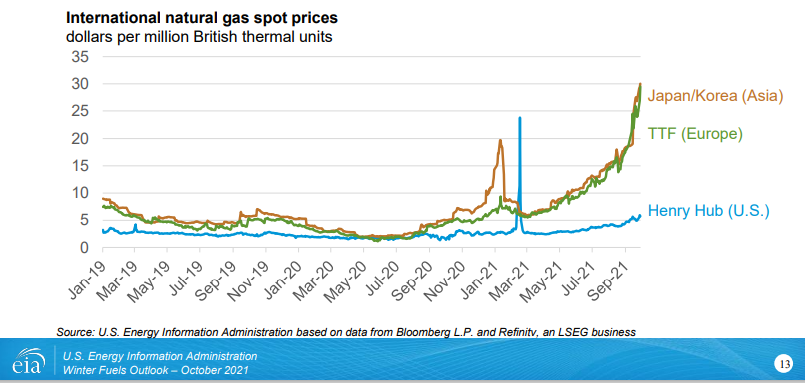

There are lots of discussions around the durability of higher energy prices and energy inflation is a central topic on some earnings conference calls and in many of our discussions with clients, especially those at chemical companies with the unfortunate task of having to prepare a 2022 budget, which of course includes a forecast of costs. We see continuing strain on the US and global natural gas system and, behind what will inevitably be some seasonal weather-related price volatility, a stronger market that could endure for years. The rate of addition of renewable power does not seem to be able to keep up with demand growth and replacement needs caused by some fossil fuel-based power plant closures around the World. Natural gas (LNG) is the natural plug-in replacement, and we continue to see underinvestment, relative to natural gas prices, as a consequence of ESG related pressure around capital spending. We would advise all clients to look at a 2022 scenario with natural gas, and oil higher than current levels.