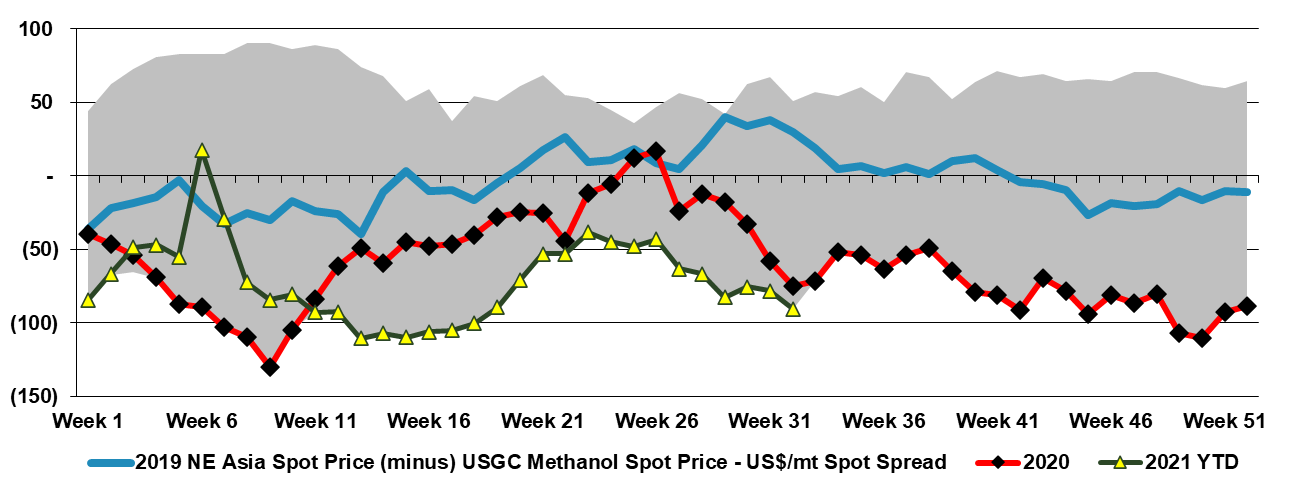

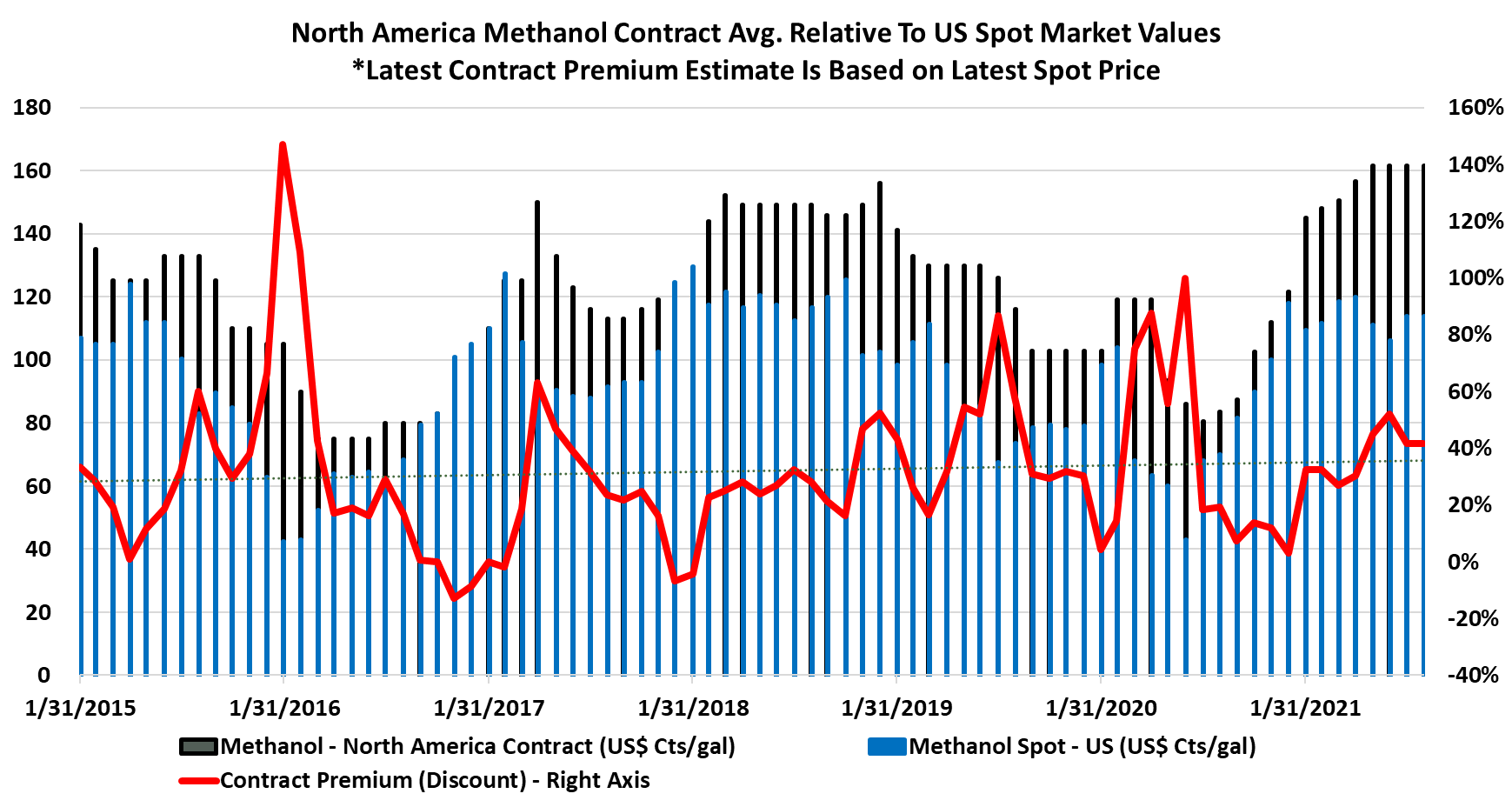

The methanol supply constraint in the US will add to the price momentum that we are seeing today, in part helped by the higher natural gas price. Despite the higher US natural gas price and the much weaker Asia price, there is still enough margin in US exports to Asia to justify the trade, although US producers would see meaningfully lower margins from these sales. However, to keep the US market balanced, pushing any surpluses offshore makes more sense than pushing into the domestic market and risking price declines. Much as in the polymer markets, US domestic sellers have quite a bit of pricing protection because of the high costs of getting any competing material into the US. See more on Methanol in today's daily report.

Recent Posts

US Methanol - Evaluating Exports Amid Premium Domestic Product Prices

Aug 10, 2021 12:48:59 PM / by Cooley May posted in Methanol, natural gas, US Exports, methanol surplus

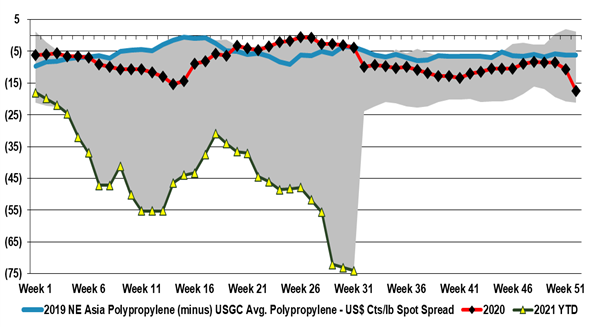

Polypropylene: Surpluses In Asia May Have To Stay In Asia

Aug 6, 2021 2:30:51 PM / by Cooley May posted in Polypropylene, Ethylene, propane, carbon emissions, polypropylene margins, PDH, Polypropylene Surplus, PP

The ICIS polypropylene analysis in the linked headline is interesting in that it shows the vulnerability of the traditional exporters of polypropylene to China if China goes ahead with the longer-term capacity announcements that local producers have made to date. The analysis suggests that this development will move China moves from deficit to surplus in PP.. Where the analysis may be wrong in our view is that the current high price of propane, low ethylene margins, and low local polypropylene margins could put portions of the planned capacity on hold, and while it may come eventually, the phasing of additions may be different. Current economics make any ethylene (and associated propylene) investments hard to justify and the same with PDH. In the past, we have seen China pull back investments when economics have not worked – most notably in the early part of the last decade when oil prices were very high. At that time China moved to projects based on coal, and while that may re-emerge, local oversupply, in general, will slow things down in our view, and pushing back towards coal may not fit with whatever carbon emission targets China will set ahead of the COP26 meeting.

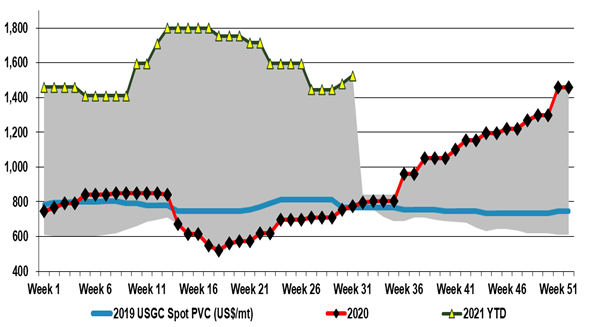

PVC: Still Our Preferred Polymer

Aug 5, 2021 1:19:46 PM / by Cooley May posted in Polymers, Polyolefins, PVC, housing demand, water infrastructure

We are seeing some of the same dynamics in PVC that have been prevalent in polyolefins this year with some weakness in Asia – although not as much as we are seeing for polyolefins - while markets in the US and Europe are finding enough support for prices to go back up again. As with other polymers, any possible arbitrage between Asia pricing and the West is quickly consumed by the higher container rates. PVC has seen less capacity added over the last few years compared to other polymers and while it has not seen much of a boost from the change in consumer spending patterns around packaged goods and durables (as it has more limited exposure to packaging and durables), it has benefited from strong housing demand and some initial infrastructure spending – with more to come around the globe. The blue sky scenario for PVC would be one in which some of the growing clean water issues that are emerging in many parts of the world move more to the front burner as PVC would be a major beneficiary on investments in desalination for example or simply from water infrastructure upgrades.

The Last Conventional Ethylene Plant Built In The US?

Aug 4, 2021 12:58:57 PM / by Cooley May posted in Polyethylene, CP Chemical, Ethylene Price, supply and demand, oversupply, chemical recycling, Chevron, ethylene plant, E&P

The ethylene price recovery in the US, discussed in today's daily report, is again a function of supply disruptions against a backdrop of robust demand. The net effect is to keep ethylene prices well above costs, at margins that justify investment and it is interesting to see the quick return of the CP Chemical project to the front burner. We could make a case that another ethylene facility in the US is likely a bridge too far at this point, despite the compelling current economics. The deep dependence on the export markets makes the US model very vulnerable to cyclical oversupply, and the current tight market is completely obscuring this risk and lulling producers into what we believe will be a misled sense of security. It is likely that the plants already built will prove to be good investments, not least because of the opportunity profits they are making in their early years of operations, but you would need to have a very bullish longer-term view of oil prices relative to natural gas to invest further, as even with an aggressive on-shoring manufacturing program in the US, the net export nature of the polyethylene businesses in the US is unlikely to change much. New capacity means more ethane demand, against a backdrop of lower E&P investment, and while Chevron has access to equity ethane from its US E&P operations, which may guarantee supply, it does not guarantee the price. Separately, while we believe that recycling targets in the US and the rest of the Wold will disappoint, they will still eat into virgin polymer demand. More chemical recycling will mean more “recycled” polyethylene available from heavy crackers – not ethane-based crackers.

Incremental Price Strength for US Ethylene and Propylene

Aug 3, 2021 3:17:24 PM / by Cooley May posted in Chemicals, Commodities, Ethylene, supply and demand, LyondellBasell, freight, natural gas, monomers

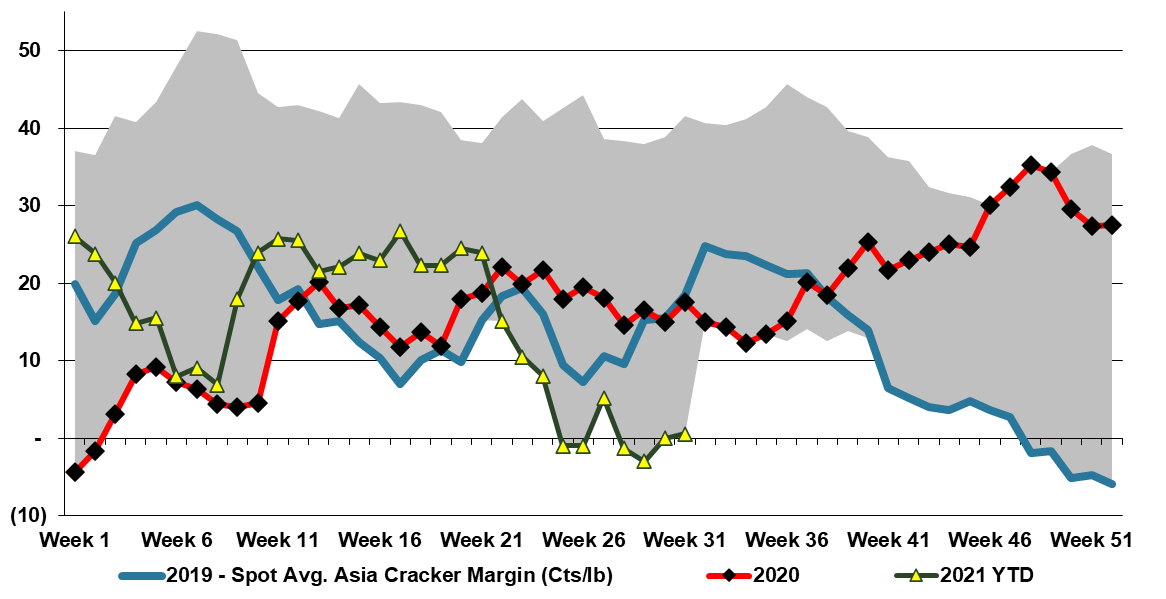

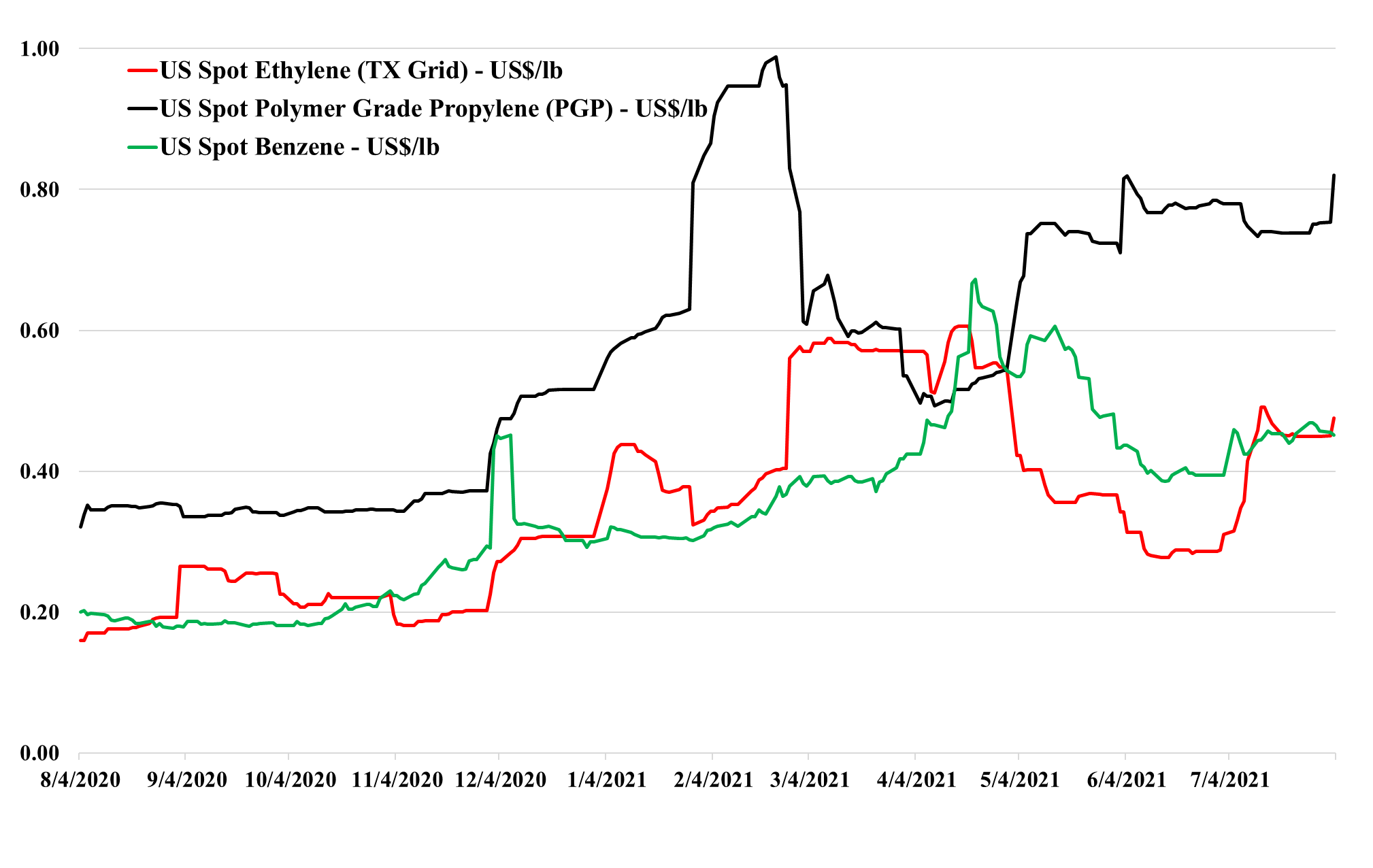

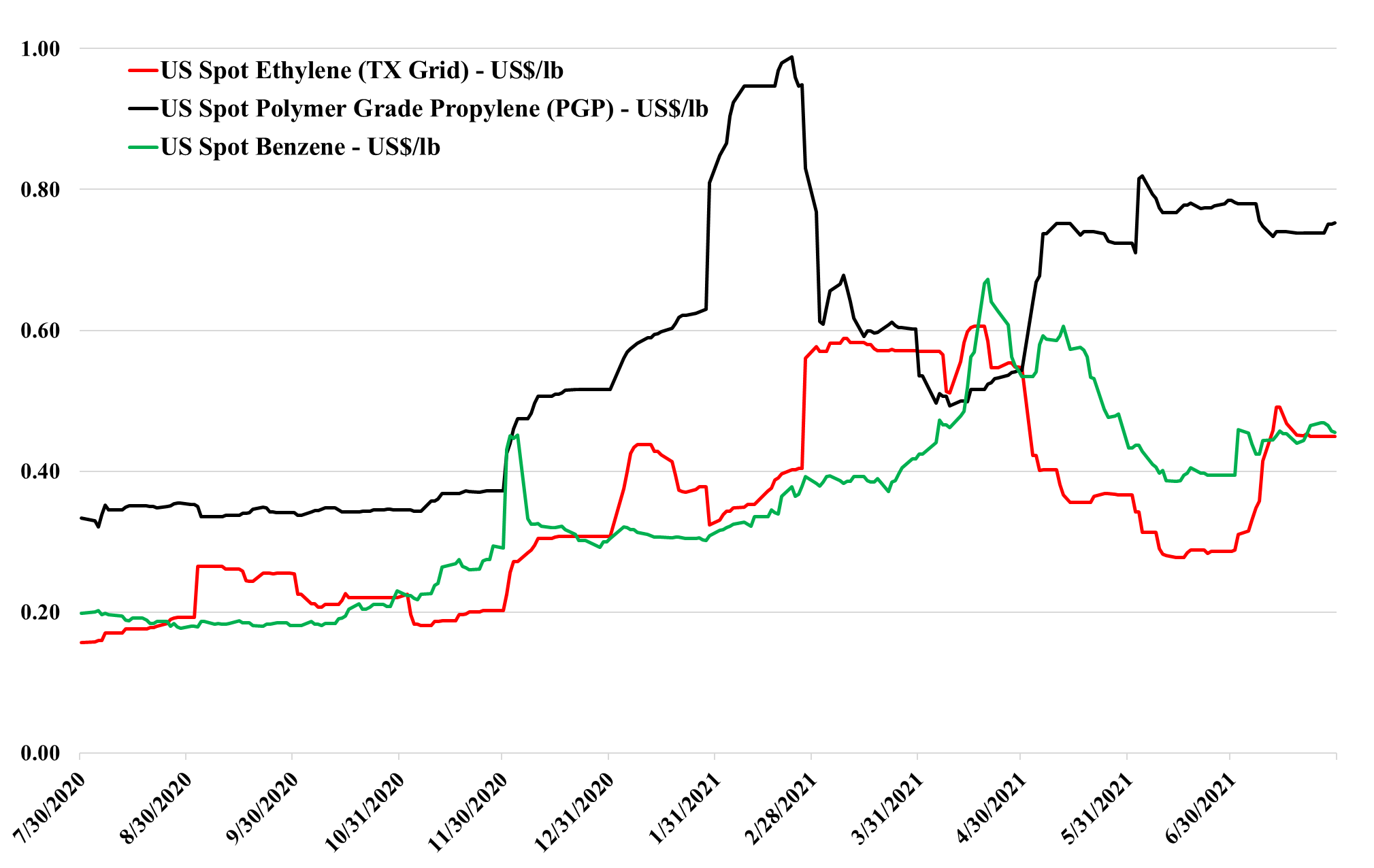

If this commodity cycle has the same drivers as prior cycles, producers like LyondellBasell and others will make comments like “stronger of longer” until prices turn, and if history is any guide, that turn will catch everyone by surprise, and even if it does not, there is no upside for any producer in predicting its end. As with all commodities, markets are tight until they are not, and markets are long until they are not. If you look at the ethylene and propylene price movements in the exhibit below you can see the speed of change that is possible and while the slope may be less severe for polymers in both directions, it can still be abrupt. The worst-case for the US industry would be a step down in demand coincident with the rising natural gas trend. There is no evidence of demand weakness today, but there will not be until it is happening. The extraordinary incremental freight rates shown in Exhibit 1 of today's daily report, make it increasingly unlikely that anyone sitting on surplus polyethylene or polypropylene in Asia can exploit the regional price difference. When demand and sentiment around supply chains turn, we would expect this spot shipping rate to collapse also – but there is no sign of that today.

Ethylene To Stay Volatile: Sizable Price Swings Likely

Jul 30, 2021 3:15:12 PM / by Cooley May posted in Chemicals, Ethylene, feedstock, ethane demand, ethylene capacity

We focus on ethylene price trends today, as we discuss it’s movement and related ethane tightness in today's daily report – more operating ethylene capacity means more ethylene (depressing prices) but it also means more ethane demand, inflating its price. Margins remain robust, even with the feedstock increase and the price decline and it is important to remember that any decline in US ethylene prices would be stopped at a level that allowed increased exports, which would still be well above US costs. With the full ethylene fleet operating in the US, there is a surplus (i.e. more ethylene than there is consuming capacity) so we expect export economics to drive spot pricing under “normal” circumstances. Abnormal production outages over the last year have seen that export surplus come and go a couple of times and the price volatility the Exhibit below shows that.

Strong Demand And Higher Costs Keep Methanol Supported

Jul 29, 2021 2:45:35 PM / by Cooley May posted in Chemicals, Polymers, Methanol, LyondellBasell, natural gas, US Methanol, MMA, Methanol demand

Methanol prices in the US remain very robust and quite profitable for producers, despite weakness in China. The higher natural gas price in the US (see today's daily report) provides some support for methanol pricing, but ultimately coal-based methanol in China will win out if US costs keep rising and this may curtail demand for US methanol at the margin. As with all other chemical and polymer markets today, freight costs are making it difficult to play off some of these apparent regional arbitrages and the US methanol producers would have to be somewhat reckless to upset the balance domestically and give up the margins that they have today. Domestic demand for methanol derivatives is high and the LyondellBasell accident may provide more pricing strength through the acetic acid chain. While the incident will decrease the demand for methanol, LyondellBasell should be able to manage this, and higher pricing in the acetic chain would mean that consumers would have no issue paying current prices. Higher MMA production in the US – implied in the headline below - should keep methanol demand high.

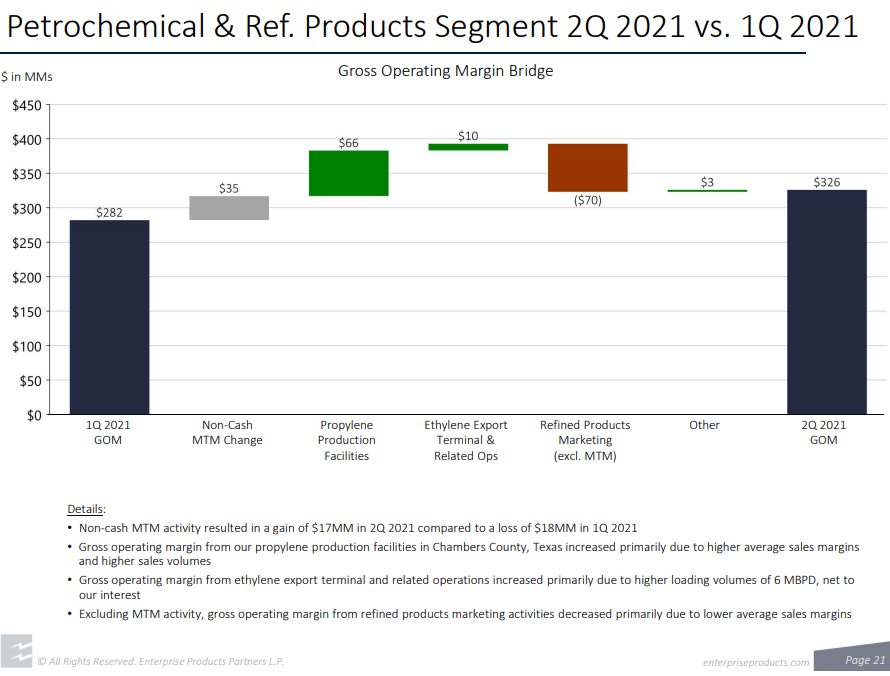

Propylene: Market Tightness and Derivatives Momentum

Jul 28, 2021 12:57:41 PM / by Cooley May posted in Chemicals, Propylene, petrochemicals, Propylene Derivatives, Enterprise Products, PDH

The Enterprise Products propylene numbers are impressive when you considering that its PDH facility was closed for a significant portion of the quarter, and while this likely contributed to tightness in the market, the company could have made even more money in 2Q. The results show the clear tightness in the propylene market in the US and reflect the very strong momentum in propylene derivatives, which is broad-based although we have tended to focus on polypropylene in recent work. See more in today's daily report.

ExxonMobil, SABIC JV Petrochemical Project Runs Ahead of Schedule

Jul 27, 2021 3:41:21 PM / by Cooley May posted in Chemicals, Polyethylene, Ethylene, Styrene, ExxonMobil, petrochemicals, petrochemical capacity, Dow, Sabic, Gulf Coast Growth Ventures, Aramco, Motiva, NPV, chemical plant, ethylene plant

ExxonMobil Chemicals has announced that its Corpus Christi JV project with SABIC is ahead of its original schedule – ExxonMobil is now targeting a start-up in 2H21, ahead of its previously targeted 1H22 expectation. It is unusual for projects in the US to be ready ahead of schedule these days, and start-up delays tend to be the norm. We also take a positive view of this development upon comparison to the Shell Pennsylvania project, which still has a vague 2022 start-up expectation though its construction began before ExxonMobil. One could argue that the remoteness of the location – well away from petrochemical infrastructure has been a constraint for Shell, but the Corpus Christi location is also a greenfield project for ExxonMobil/SABIC. This will be the largest ethylene plant built in the US, though it is likely that the recent 1.5 million ton units (Dow, ExxonMobil, CP Chem) are expandable to 2.0 million tons. Dow is already discussing such a move with a new polyethylene facility at Freeport. It will be interesting to see what impact this ExxonMobil/SABIC facility has on both the USGC ethane market and the polyethylene market – 1.3 million tons of polyethylene is a large increment and SABIC will have half of the capacity and will be a new market entrant with on-shore production. Aramco has ethylene, through Motiva’s purchase of Flint Hills, and SABIC owns half of the Cosmar styrene plant in Louisiana.

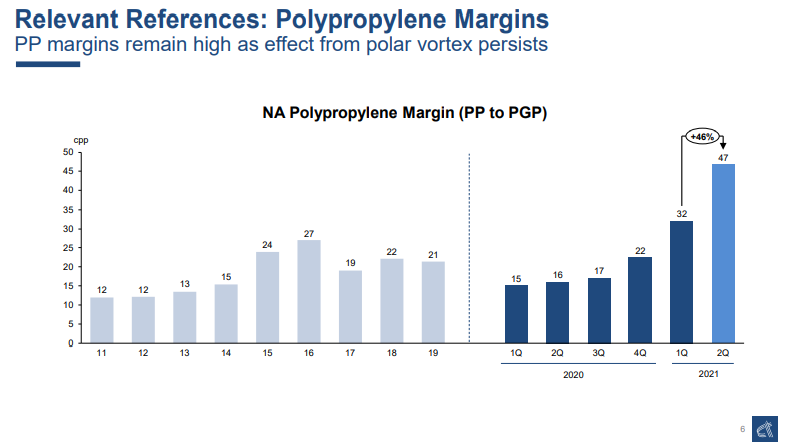

Great North American Polypropylene Margins Despite New Capacity

Jul 22, 2021 12:07:14 PM / by Cooley May posted in Chemicals, Propylene, Polypropylene, Supply Chain, Capacity, cyclical demand, polypropylene margins, Braskem

The much higher polypropylene margins in the US come despite very high propylene pricing, and the whole chain did well in the first half of the year. Demand for polypropylene has been significantly stronger than most expected year to date, although production outages have helped the market, and what we had expected to be a surplus in the US in 2021, precipitated by the Braskem start-up has turned out to be production coming online just in time and prices might have been higher still had the Braskem plant not been there. We see some of the demand as cyclical - in response to consumer durables, though there has been lower use in the auto industry because of the production cutbacks. See more in today's daily report.