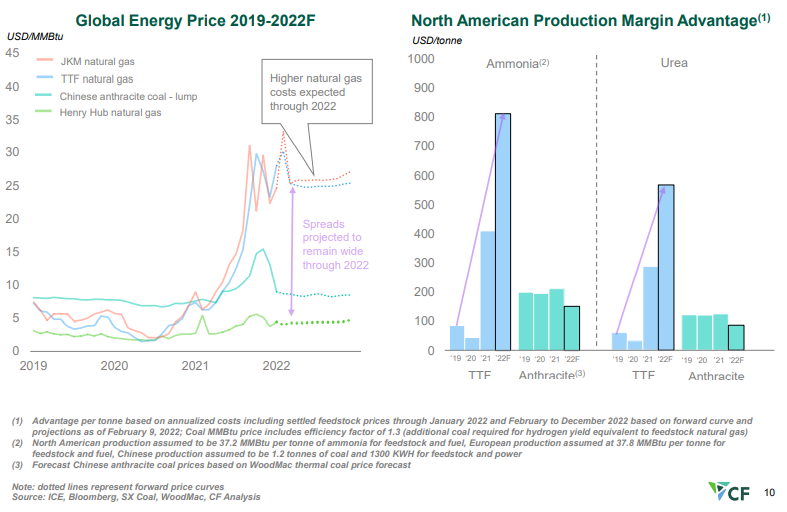

The CF slide below shows very clearly the US competitive edge when it comes to making anything that has a natural gas base, and while we tend to talk mostly about ethylene, ammonia, urea, other ammonia derivatives, and methanol are all seeing significant cost advantages. The Chinese coal-based costs are better than those in Europe and Asia based on natural gas but margins remain well below those in the US. The challenge with the coal-based chemistry in China is that it has substantial CO2 emissions, and the facilities were not designed for carbon capture. As China develops a carbon cap and trade market and as these facilities get included, costs will rise significantly.

Abundant Hydrocarbons Could Keep The US Advantaged, Even Considering Emission Goals

Feb 16, 2022 1:41:45 PM / by Cooley May posted in Chemicals, Carbon Capture, Coal, Methanol, CO2, Energy, Emission Goals, Ammonia, hydrocarbons, Oil, natural gas, urea, CF Industries, oil production, energy demand

Inflation Drivers Are Everywhere, But Especially In Energy

Dec 10, 2021 12:10:15 PM / by Cooley May posted in Chemicals, Crude, LNG, Coal, Energy, Inflation, Chemical Industry, petrochemicals, hydrocarbons, natural gas, power, natural gas prices, energy transition, EIA, Emission abatement, petrochemicalindustry, clean fuels, natural gas production, oil production, low emissions fuel

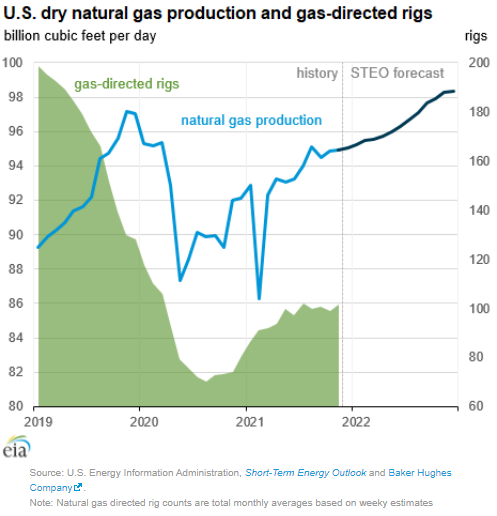

The theme of our Sunday report (to be found here) will be inflation this week and the signs that we are seeing across multiple industries which suggest it could be more problematic and worsen in 2022. One of the focuses is energy and how the pressures to be seen as good citizens is lowering investment in oil and natural gas production, while the world is not far enough advanced on energy transition to be able to substitute for the missing hydrocarbons. We would agree with many of the recent comments from some segments of congress, which is that the answer is not to curtail exports of LNG and crude, as by doing so we will starve the rest of the world of hydrocarbons and create worse shortages than Europe and China are seeing today. The better solution would be to support “clean” US production of the lowest emission fuels possible – especially for natural gas. As we have noted in prior research, with a global solutions hat on, the relatively low costs of natural gas F&D costs in the US, when combined with what we expect to be relatively low costs of emission abatement in the US, should drive more investment in the US, creating jobs and export income.