In an important, but inevitable, change in tone, it is worth noting that the Borouge ethylene expansion announcement includes the idea that the complex will explore the possibility of a major carbon capture facility that will take much of the CO2 from the existing complex as well as the new plant. We have stated previously that the mood has changed sufficiently such that large industrial investments without a carbon abatement plan will not get approval from stakeholders and this is a prime example of what we expect. Locations with low-cost CCS will see disproportionate investment in our view and Abu Dhabi already has CCS in place as Adnoc is selling blue ammonia already to Japan. As we noted in a recent Sunday Piece, we expect carbon abatement challenges to slow expansions in basic chemicals and, despite this announcement by Borealis, see a market shortage in 2024/25 as a consequence.

Borouge Complex Under Review; US Commodity Chemical Weakness Likely Near Term

Nov 16, 2021 2:51:19 PM / by Cooley May posted in Carbon Capture, Polymers, Propylene, Polypropylene, CO2, Ethylene, polymer grade propylene, PGP, carbon abatement, blue ammonia, Basic Chemicals, Borealis, monomers, chemicalindustry, Adnoc, Borouge

Is M&A The Path Of Least Resistance For The Chemical Industry?

Nov 15, 2021 11:10:57 AM / by Cooley May posted in ESG, Chemicals, Commodities, Emissions, ESG Investing, EBITDA, Capacity, climate, commodity chemicals, chemicalindustry, mergers, M&A, acquisition

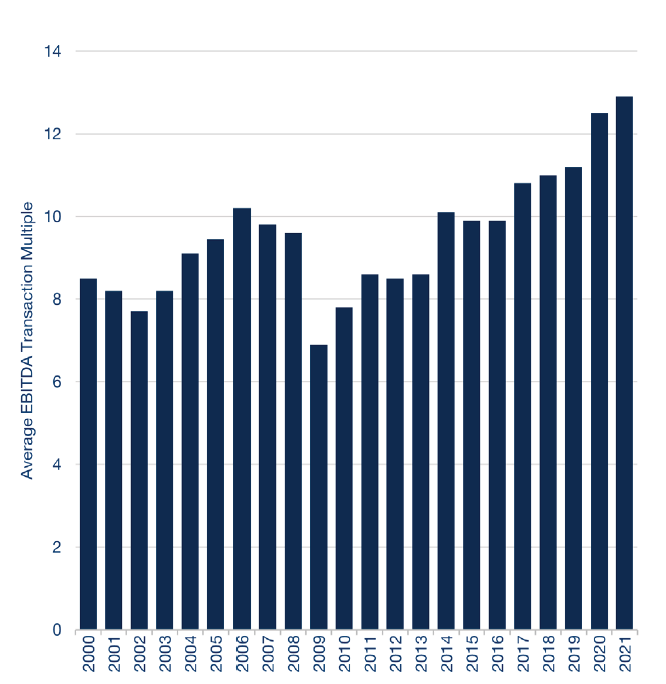

Our Sunday Thematic research a week ago (see linked report) discussed slowing growth investment in the traditional commodity chemical industry and suggested that ESG and climate pressures might slow investment even further. Yesterday, our Sunday Thematic made the argument that some of those dollars will target strategic M&A. We have recently seen an uptick in global chemicals sector M&A, and we find few items suggesting activity levels will slow in the near-to-medium term. In part, we think strategic M&A will be easier to get Board approval for than “new build” capacity additions, and it can be viewed as better use than holding cash or complementary to dividends and buybacks. Also, ESG and climate concerns could spur M&A activity, as companies look to separate bad emission assets from good ones – especially if the market values them very differently.

An Expected Year-End Surge in US Production - Will It Be Too Much?

Nov 12, 2021 3:09:43 PM / by Cooley May posted in Chemicals, Polymers, Propylene, Polyethylene, Ethylene, olefins, PDH, exports, chemicalindustry, plasticsindustry, railcar volumes

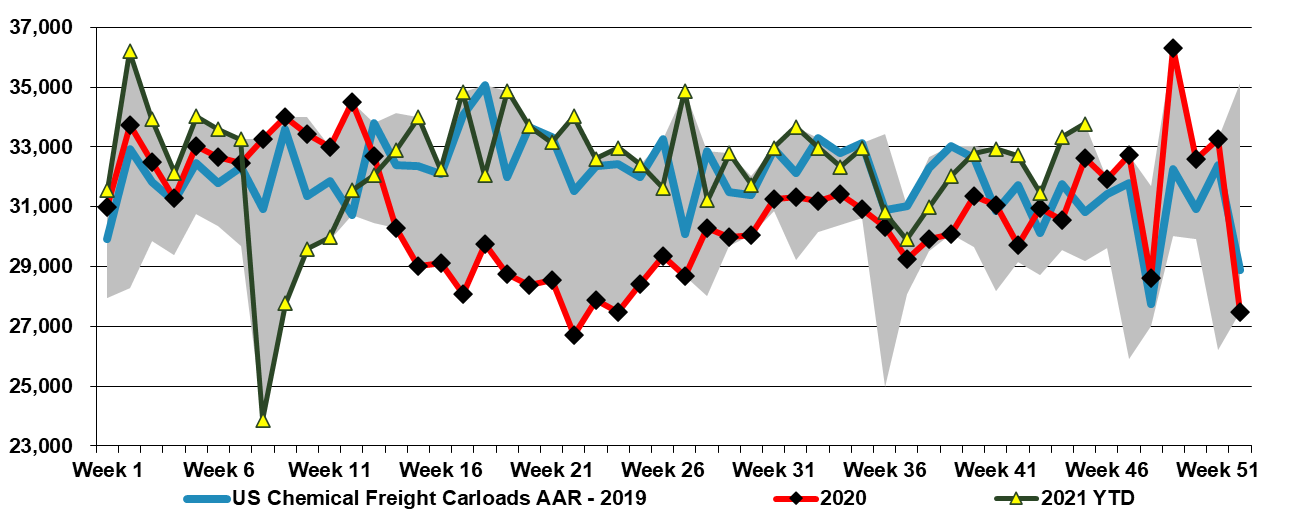

In the first Exhibit below we show a 5-year high in chemical rail-car movements. We have noted in research since early October that 4Q production in the US could be very high because of a combination of available capacity – following a year of weather-related delays – and very attractive margins and demand. We have been at the high end of rail car volumes for most of the quarter, and this may be part of the reason why we are seeing some price weakness for polymers in the US. Most of the polyethylene exported from the US moves from the manufacturing site to the export port via rail, so increased exports would also drive higher rail car numbers. As long as pricing and margins remain high and customer demand robust, we would expect these higher volumes to continue. This does not make us any less concerned that somewhere in the chain there is now an inventory build going on and that fortunes could reverse in 2022.

US Ethane Markets To Tighten In 2022 Amid Greater Demand

Nov 11, 2021 1:47:28 PM / by Cooley May posted in Chemicals, LNG, Plastics, Ethylene, ExxonMobil, petrochemicals, hydrocarbons, ethane, natural gas, US Ethane, Baystar, ethylene plants, Braskem, chemicalindustry, ethane imports, oilandgasindustry, plasticsindustry, petrochemicalindustry

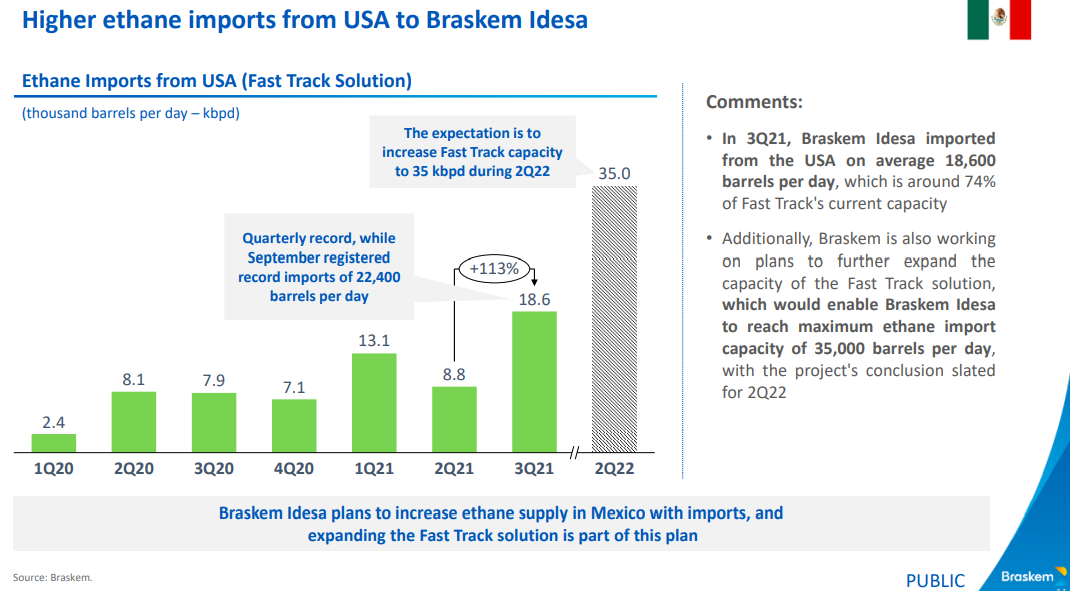

With ExxonMobil and Baystar’s ethylene plants in start-up and Shell expected to come online in Pennsylvania in 1H 2022, the news that Braskem wants to double its ethane imports from the US in 2022, adds to concern that the US may struggle to meet ethane needs at peak demand rates in 2022. We would be less concerned if we saw natural gas production rising, which is unclear for 2022, despite the expected new LNG capacity. Ethane is likely to follow any upward movement in natural gas pricing as there will be a need to bid the product away from heating alternatives. The increment suggested by Braskem in the Exhibit below is not larger in the overall scheme of US ethane demand, but every gallon may matter in 2022. See today's daily report for more.