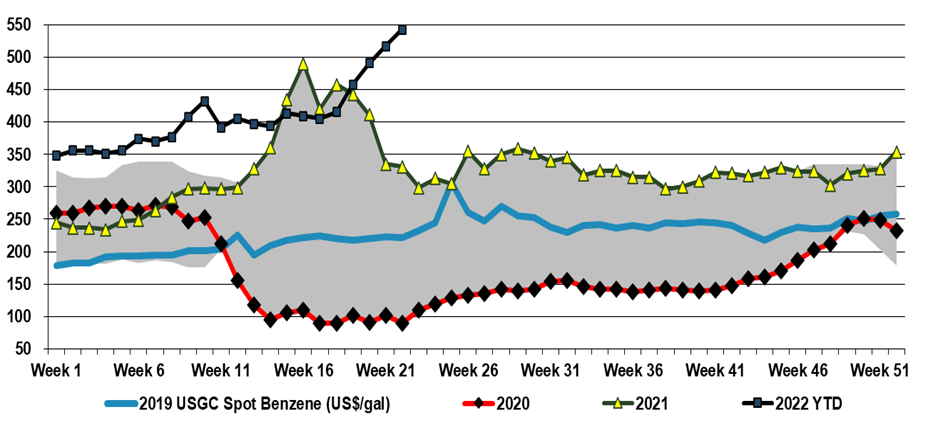

US benzene prices reflect both the net short market in the US but also the alternative value of reformate as a gasoline feed. While benzene is very limited in terms of how much can be left in fuel streams, its refinery-based feedstock, reformate, is a key component in gasoline – albeit low octane – prior to reforming and even during reforming the benzene conversion can be limited if the gasoline value is higher and volumes are constrained. In the US, as well as in many other parts of the world, we are facing gasoline shortages and today more than 13 US states have gasoline prices above $5 per gallon. While that may be shocking to Americans, the car ride from Heathrow yesterday was in a very popular make in the US that currently costs more than $200 to fill up in the UK! So benzene is getting squeezed – its feedstocks are more expensive and some of the alternatives to making benzene currently offer better netbacks. While we see all polymer costs rising in the US and elsewhere, this US benzene surge is not good for US polystyrene producers at a time when the industry is trying to justify polystyrene’s existence in a “circular” world, and it is also inflationary for the epoxy businesses, and other consumers of both styrene and phenol.

Benzene: Tightness Persists, Derivatives Mixed

Jun 7, 2022 2:47:09 PM / by Cooley May posted in Styrene, Benzene, Inflation, feedstock, polystyrene, polyurethanes, gasoline, US benzene, MDI, gasoline shortage, epoxy, phenol

US Chemicals: Some Signs Of Continued Strength, But Mostly Lagging Indicators

Apr 20, 2022 2:33:11 PM / by Cooley May posted in Chemicals, Polyethylene, Ethylene, Polyurethane, Inflation, US Chemicals, ethane, natural gas, naphtha, polymer, US polyethylene, MDI

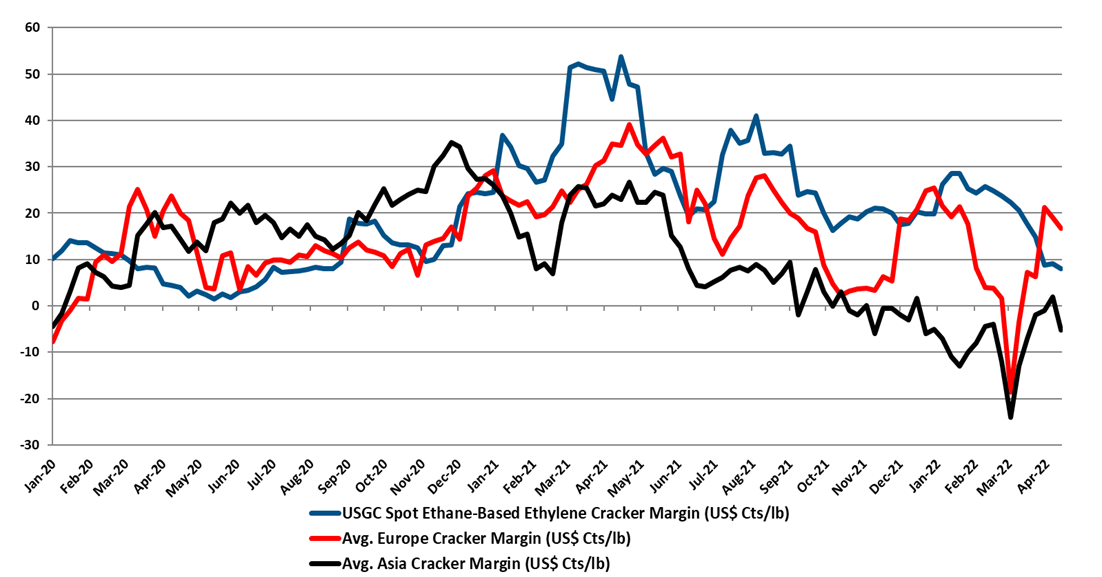

We note the polyethylene price nominations in the US, timed by some to coincide with earnings releases this week and next, and would remind clients that there is always price momentum in commodities, one way or another. In our view, the price increase moves aim to maintain directional momentum (upwards) while giving the polymer producers some cover should natural gas prices spike further. US ethane prices are now tracking natural gas more closely and have moved up meaningfully over the last few weeks, and US ethane-based ethylene margins have fallen around 80% since the start of the year, with at least half of that coming from cost increases. All polyethylene producers are integrated back to ethylene, and the price nominations will be attempts to recoup some of the cost increases. This is against a backdrop of still very strong polyethylene margins in the US, which although way off their 2021 highs remain much higher than in 2019 and 2020 and the longer-term average. This is covered in our Weekly Catalyst report each Monday. Ethylene margins are summarized in exhibit below and the chart shows the impact of higher costs in the US and falling spot ethylene prices as the US now has more surplus ethylene capacity and is looking for export homes for ethylene and easy to ship derivatives. As we have noted before, the jump in margins in Europe and Asia is because of extreme volatility in naphtha markets over the last couple of weeks. We would expect margins to be lower next week based on naphtha moves this week.

Is Current Enthusiasm Justified Or Preceding A Collapse?

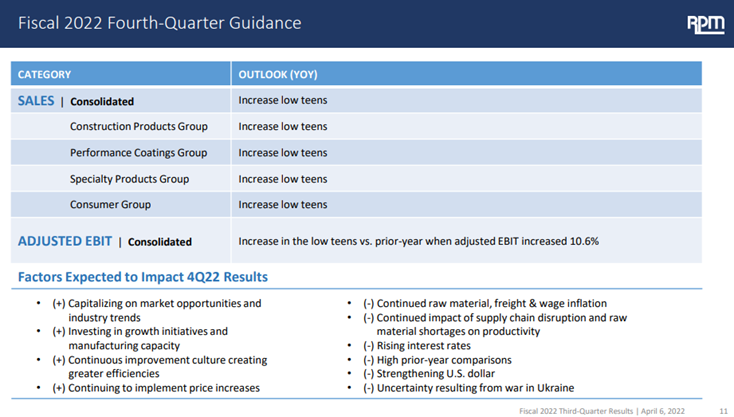

Apr 6, 2022 12:46:26 PM / by Cooley May posted in Chemicals, PVC, Ethylene, Energy, Metals, Auto Industry, Chemical Demand, Chemical Industry, clean energy, materials, Building Products, RPM, MDI

While we remain advocates of “stronger for longer” with respect to chemical demand and pricing in the US, the auto data does suggest that the US consumer may be cooling off a bit in reaction to higher prices and higher borrowing rates. Historically, the chemical industry has a habit of running headlong into a downturn while waving an “everything is great” flag, and the RPM results and outlook have a vague “deja vu” feel to them. We also note some surprise at the robustness of the MDI market in the chart below, and it would be wrong not to admit that our cautionary antennas are rising. The auto exposed products should still see some upside from higher auto production in the second half of the year, but otherwise, a possible consumer pullback to take the wind out of the sector sales, especially if the US is constrained moving out products because of container and shipping issues. The significant cost advantage remains in the US but the ethylene market over the last week is a reminder of what can happen when you struggle to find someone who can take the last pound. Given infrastructure, energy, and clean energy investment, as well as reshoring, many materials could see significant offsets to consumer spending pullbacks and our focus would remain on PVC and building products, as most of the hit would be in consumer durables. Metals demand should remain strong regardless. For more see today's daily report.