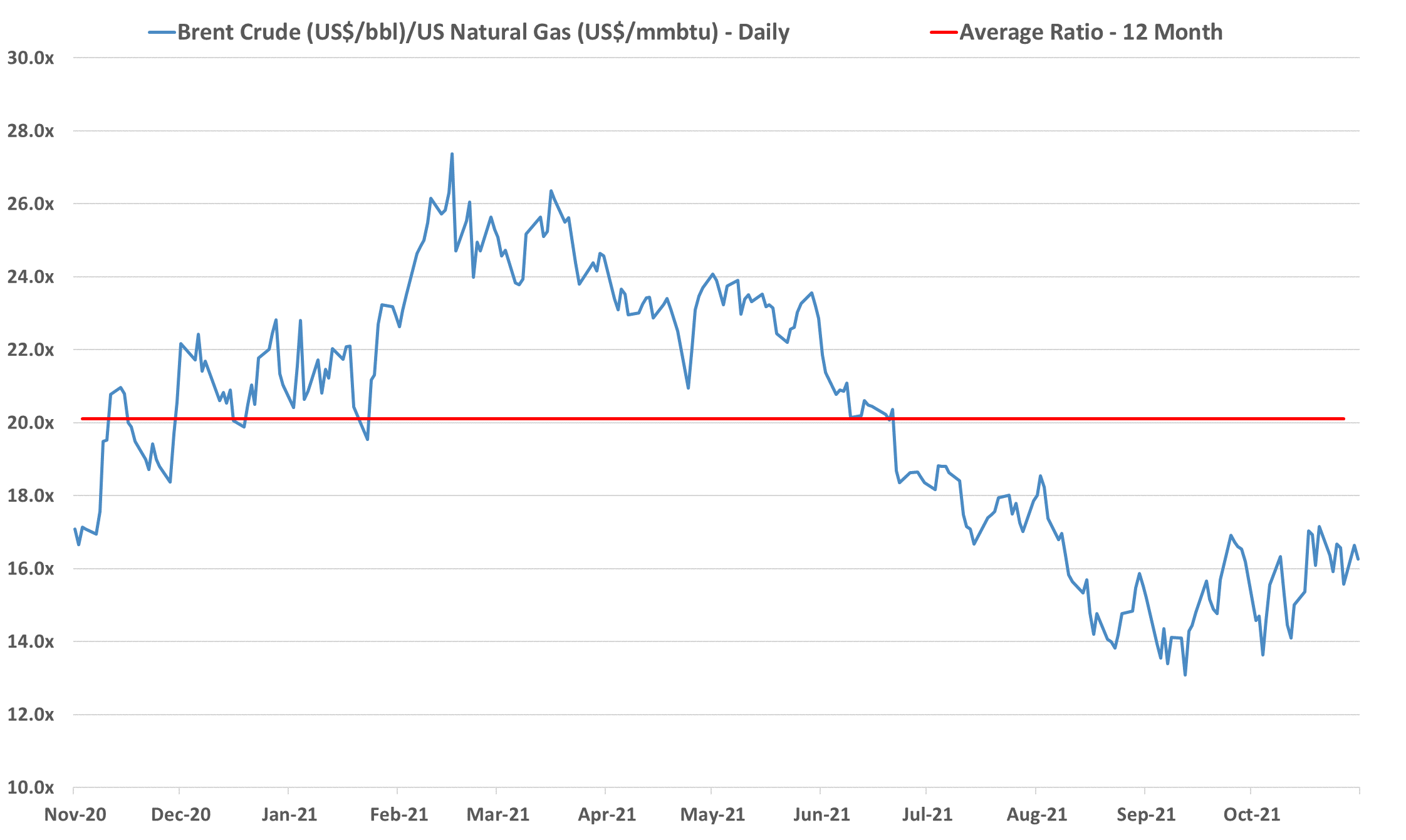

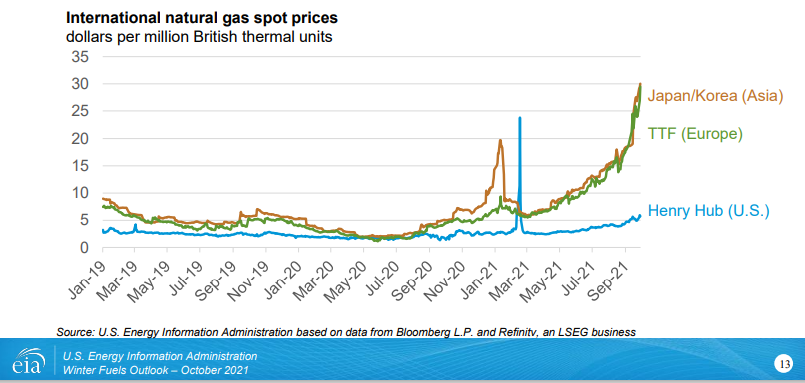

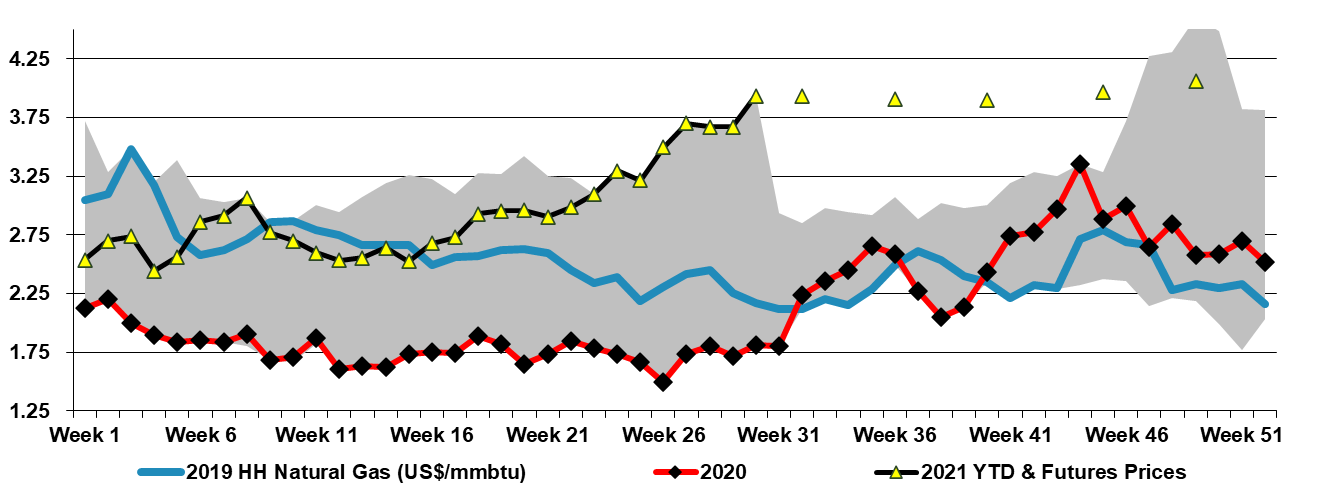

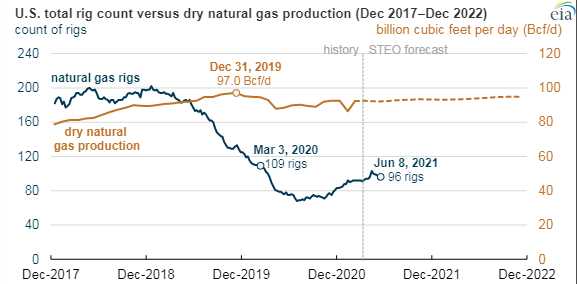

We remain concerned that natural gas E&P investment in the US remains too low to meet expected demand increases, especially for natural gas-fired power stations and LNG, but also possibly for NGLs, especially ethane, given new ethylene capacity and a fresh export market in Mexico. Near-term, natural gas prices are showing some easing relative to crude, albeit a very volatile trend – Exhibit below – but we see medium and longer-term shortages unless E&P spending increases. The new power facilities shown in the bottom Exhibit will all need incremental natural gas, and the international LNG market is so tight that as new capacity comes online in the US we would expect it to run as hard as is possible. This sets up for a market where the clearing price of natural gas in the US is at risk of being set by the marginal exporter. The price jump for domestic consumers would be dramatic and it would cause all sorts of headaches in Washington and probably intervention. We showed the incremental natural gas price in the Netherlands in our Daily Report on November 18th, and if the US price were to reflect the netback from this level, they would rise close to $30 per MMBTU. The natural gas industry needs some sort of global blessing to continue to operate as what will likely be the core transition fuel. It will be necessary to clean up the emissions footprint of natural gas, but the industry should be encouraged to invest on this basis. For those who doubt whether the US natural gas price can rise to $30/MMBTU – note that the Europeans did not think $30 was possible either.

Is A Feedstock Shock In The Cards For US Chemicals?

Nov 23, 2021 1:39:28 PM / by Cooley May posted in Chemicals, Polymers, Crude, LNG, Energy, Emissions, petrochemicals, propane, carbon footprint, feedstock, ethane, natural gas, ethylene capacity, E&P, NGLs, exports, shortages, chemicalindustry, Brent Crude, butane, Mexico, fuels

EU Ambitions Require More Natural Gas, Supply Readiness In Question

Nov 3, 2021 1:44:26 PM / by Cooley May posted in LNG, Energy, natural gas, oil producers, energy shortages, green energy, nuclear power

The EU revision to its green energy plans to include both nuclear and natural gas-based power is a direct response to the current energy shortage and price inflation that is evident in the exhibit below. While high natural gas pricing is part of the problem, Europe's renewed willingness to include natural gas in its forward energy planning may drive local investment to produce more gas and foreign investment to provide more LNG. The move indicates that the EU does not see the current natural gas shortage as a short-term issue. The nuclear inclusion is likely aimed at delaying any further planned nuclear closures and we have seen recent delays in closing older US facilities for the same reason - closures will put too much strain on an already challenged power grid and prices for power could be pushed higher by even higher natural gas prices.

Natural Gas: Good If You Have It, Very Bad If You Don't

Oct 27, 2021 3:11:03 PM / by Cooley May posted in LNG, Methane, Energy, Inflation, natural gas, power, chemical companies, energy inflation, energy costs, forecasts

There are lots of discussions around the durability of higher energy prices and energy inflation is a central topic on some earnings conference calls and in many of our discussions with clients, especially those at chemical companies with the unfortunate task of having to prepare a 2022 budget, which of course includes a forecast of costs. We see continuing strain on the US and global natural gas system and, behind what will inevitably be some seasonal weather-related price volatility, a stronger market that could endure for years. The rate of addition of renewable power does not seem to be able to keep up with demand growth and replacement needs caused by some fossil fuel-based power plant closures around the World. Natural gas (LNG) is the natural plug-in replacement, and we continue to see underinvestment, relative to natural gas prices, as a consequence of ESG related pressure around capital spending. We would advise all clients to look at a 2022 scenario with natural gas, and oil higher than current levels.

Higher Global Energy Costs - A Real Problem For Most

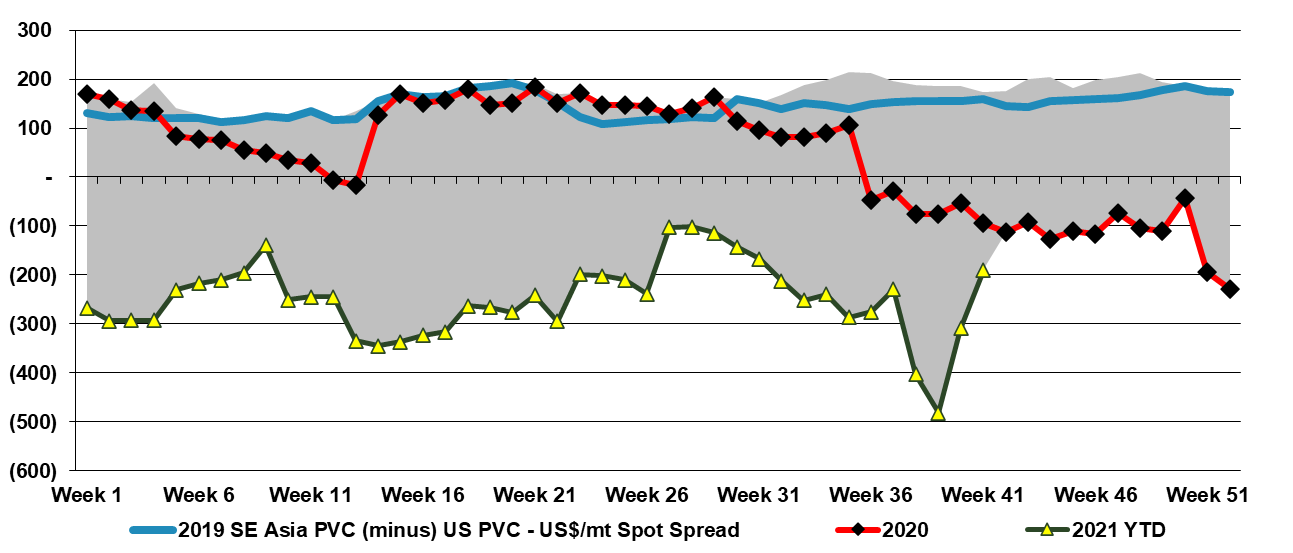

Oct 12, 2021 3:07:57 PM / by Cooley May posted in Chemicals, Polymers, PVC, Ethylene, Energy, natural gas, Westlake, PVC producer, energy inflation, Occidental, Formosa, Shintech, Olin

With the rapid rise in energy prices, we are seeing price increase announcements for many intermediate chemicals, especially in regions of the world where margins were already very slim. The energy inflation issue is hard to call, with more and more commentators suggesting that it could be prolonged (which generally means it will be short), but lots of dislocations support duration. We would certainly be pushing prices today on the back of energy costs that could move higher again, and given that many chemical and polymer buyers have price protection in their contracts (for at least a month), producers could face a margin squeeze and an uphill climb to get adequate price coverage. Seasonally, demand for chemicals and polymers is at its weakest for the next couple of months, so the price hikes may be difficult. However, because of supply chain constraints, buyers may feel less confident and concede more easily. We could see a significant swing in sentiment from the chemical companies on 3Q earnings calls over the coming weeks as they talk about how good results were in 3Q but throw up all sorts of cautionary statements concerning 4Q.

High Natural Gas Prices May Be Here To Stay Without More E&P Investment

Oct 1, 2021 1:54:55 PM / by Cooley May posted in LNG, Coal, Energy, ExxonMobil, natural gas, power, renewables, Gas prices, Venture Global

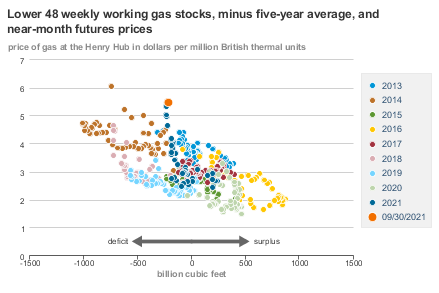

It is a gas, gas, gas! Every other story this week is about natural gas shortages and pricing – whether it is natural gas in the US or LNG everywhere else. The scatter diagram below from the EIA below is very interesting as it speaks of anticipation more than anything else. Gas prices are high given the level of US inventory relative to “normal”. There is speculation that demand is going to outstrip supply over the next few months. Whether much of this will be LNG-related remains to be seen as we may not be able to run the current capacity any faster – that said, through the end of July it looked like there was spare capacity at several of the US LNG facilities and maybe the constraint is shipping. Regardless, the current US price implies shortage, whether because domestic demand overwhelms supply this winter or because LNG steps up. The original timeline of the Venture Global facility at Calcasieu Pass in Louisiana has slipped and this facility will not impact demand for the next 12 months at least, with ExxonMobil’s Golden Pass project a year later and targeting a 2024 start.

Lithium Is Not The Only Material We Need More Of...

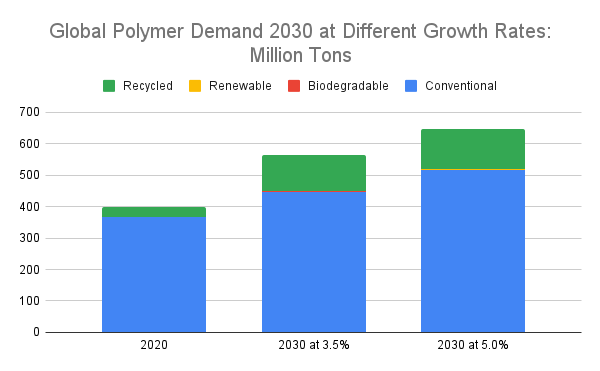

Sep 30, 2021 2:45:02 PM / by Cooley May posted in Chemicals, Polymers, Energy, natural gas, solar, renewables, wind, Lithium, conventional polymers

We have discussed a theme around shortages that has been going on for months and is prevalent in many of the headlines today. It has also been a central theme of much of our energy transition work, as we think about the raw materials needed to meet the demand for solar and wind power as well as the infrastructure for hydrogen generation. The exception is lithium, where we see regular announcements around expansion projects, such as the one linked from Albemarle. The EV makers and battery storage manufacturers are doing an excellent job of encouraging investment in lithium, taking stakes in battery projects, and in some cases taking stakes in the lithium projects themselves. Offtake agreements also help projects get funding. We suspect that the offtake agreements are tactical – not aimed at buying out a source of lithium or a source of batteries but aimed at ensuring that a surplus of capacity gets built, to ensure no bottlenecks in the future.

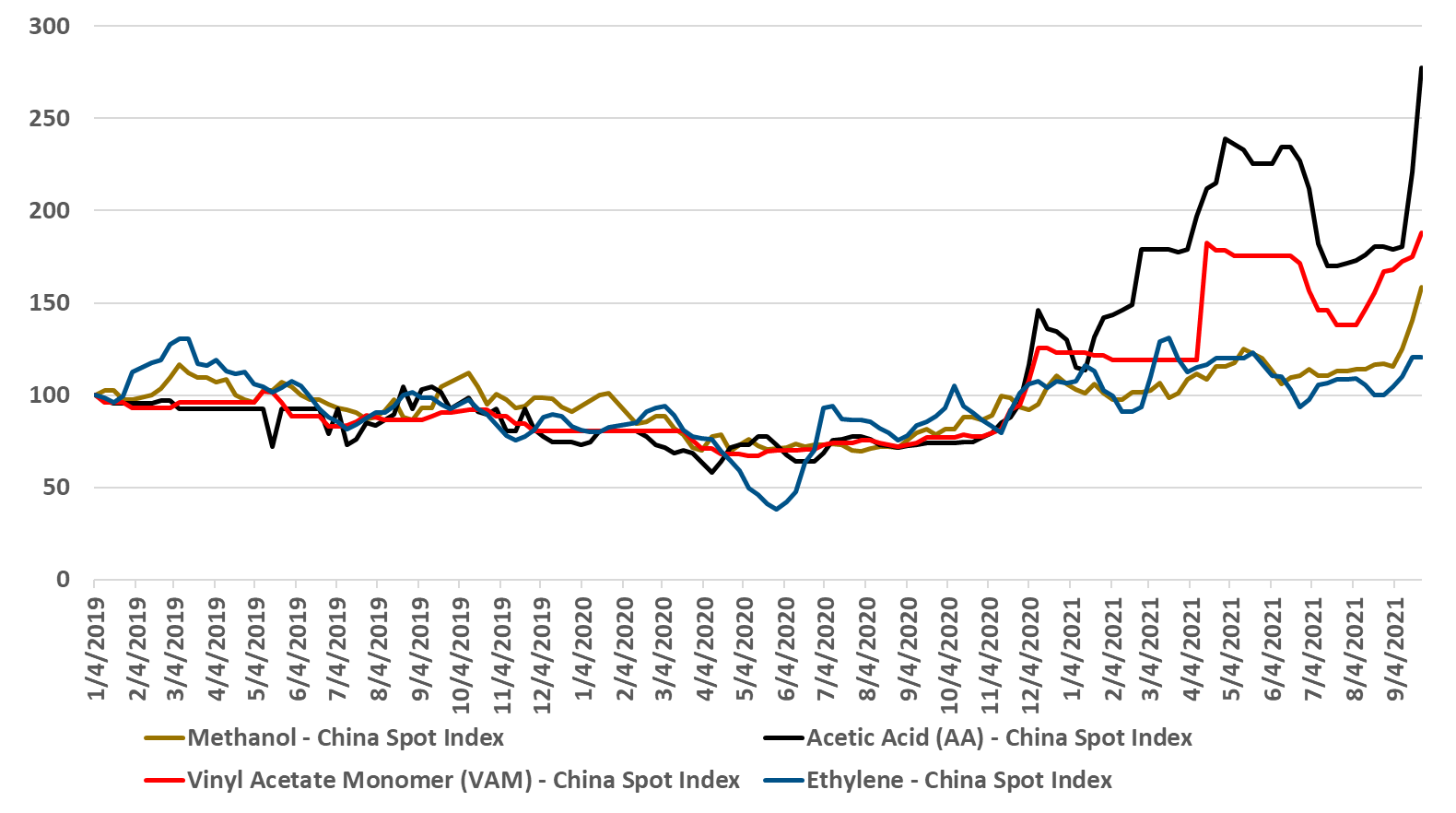

Energy Issues In China Hurting Some Chemical Production

Sep 24, 2021 2:42:46 PM / by Cooley May posted in Chemicals, Polyolefins, Energy, Emissions, PET, PTA, Acetic Acid, Monomer, China, vinyl acetate, ethylene chain

The move by China to reduce overall energy consumption is an effort to make progress on emissions but also to curtail energy demand where there is either a shortage or an over-dependence on coal-based power generation. The immediate impact in the acetic acid chain is clear from exhibit 1 in today's daily report.If these moves in China become more widespread they could reduce the significant near-term surpluses that the country has in polyolefins, PTA and PET. Why consume either expensive or high carbon power to make products that you currently cannot sell and that are either being sold at a loss or flowing into inventory? China has the structure to make decisions like this. Should this happen we could perhaps see a recovery in polyolefins pricing and PET pricing in China – as seen for the acetic chain in the exhibit below. Keeping production in line with the demand in China is important in the very near term as the fall out from the Evergrande collapse suggests that demand into the property market has been inflated and will likely correct negatively – increasing surpluses. China can force material into the export market, if it can find containers and if it is willing to operate at break-even margins. Better to curtail production.

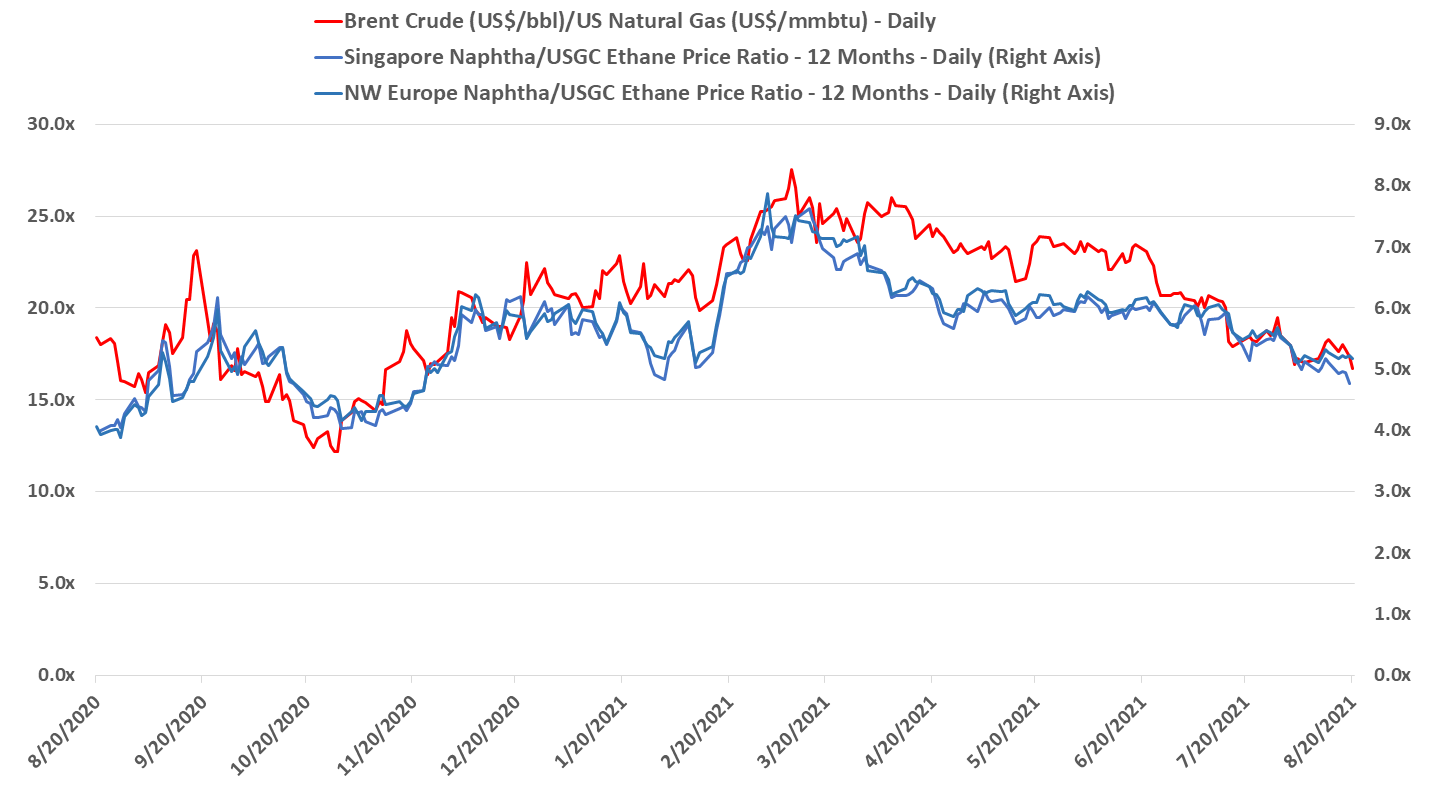

Oil To Gas Ratios Declining But US Competitive Edge Still Intact

Aug 20, 2021 11:51:38 AM / by Cooley May posted in Chemicals, LNG, Energy, Oil, natural gas, US natural gas, Upstream

The slow decline in the oil/natural gas ratio that has persisted through the year continues – this time oil is falling faster than natural gas as both are reacting to slower demand or expectations of slower demand. We are unconvinced that the price declines will continue, but it is much less clear which direction the ratio will move. OPEC+ has far more chance of keeping cash flows high by trimming volume to balance the oil market and the overwhelming strategic logic of such a move means that it is a likely path – there is no 10-20% boost to demand to be found by lowering prices. US natural gas is still on a medium-term demand march higher in our view and more limited E&P spending should keep the market balance quite tight. There are no near-term large increments of new LNG capacity on the horizon and consequently, inventory and pricing will likely bounce around on weather changes for a while. See more in today's daily report.

More Oil and Gas Activity Does Not Mean Lower Prices

Jul 21, 2021 1:38:26 PM / by Cooley May posted in ESG, Chemicals, Oil Industry, Energy, Oil, natural gas, natural gas prices, Halliburton

The Halliburton forecast of an upcycle for oil services likely needs to be put into context, as while activity should rise in the sector with higher oil and gas prices, it is unlikely that we will see a major boom. The uncertainty in the energy market, coupled with ESG pressure and borrowing constraints means that the oil industry will likely focus on its lowest hanging fruit first and may hold off on secondary opportunities completely. The oil service guys will benefit because the more productive shale wells can require longer laterals, deeper wells, and more fracking pressure, but it will likely be quality over volume when it comes to drilling activity, in keeping with what we have seen year to date.

Energy Inflation Coming But Unlikely To Change The Pace Of Renewable Investment

Jun 17, 2021 1:48:57 PM / by Cooley May posted in Chemicals, LNG, Oil Industry, Energy, Inflation, Net-Zero, natural gas, renewable energy, renewable investment, natural gas prices

The commentary on oil reflects the opposing views that OPEC+ capacity is looming and that every piece of incremental negative demand news is frightening, versus that OPEC+ is disciplined and wants higher prices, resulting in every incremental positive being welcomed. We are firmly on the side of higher oil prices as we cannot see any stakeholder in oil wanting anything except opportunity profits for as long as it may last from here.