The ExxonMobil board headline linked has come up a couple of times since the Engine No.1 victory at the board meeting. There is no doubt that capital spending plans will be reviewed with the changes at the top, and we expect more management changes, which could also drive spending priorities. Over the last couple of years, several more macro studies have been done talking about oil demand in a climate change-centric world and all have highlighted chemicals as one of the likely longer-term growth avenues for fossil fuels. We would expect ExxonMobil and other oil majors to look at investments in chemicals as a route to more captive consumption of hydrocarbons and believe that this could ultimately keep basic chemical and polymer markets oversupplied through the balance of this decade – we have been writing about this risk consistently since early 2020. ExxonMobil is already building ethylene capacity in the US in a JV with SABIC, but more oil company investments could come in the US. The caveat is that, as Dow covered in its MDI press release yesterday, any new investment is likely to need a carbon plan to get stakeholder and regulatory approval.

Could Big Oil Capital Reallocation Drive More Chemical Supply?

Jun 10, 2021 1:27:19 PM / by Cooley May posted in Chemicals, Polymers, Climate Change, Oil Industry, Ethylene, Carbon, ExxonMobil, fossil fuel, hydrocarbons, Dow, Base Chemicals, Sabic, JV, Engine No. 1

Will High Propane Prices Limit Propylene Demand Growth?

Jun 9, 2021 1:39:34 PM / by Cooley May posted in Chemicals, Recycling, Polymers, Polypropylene, Chemical Demand, Chemical Industry, propane, polystyrene, paint additives, ethane

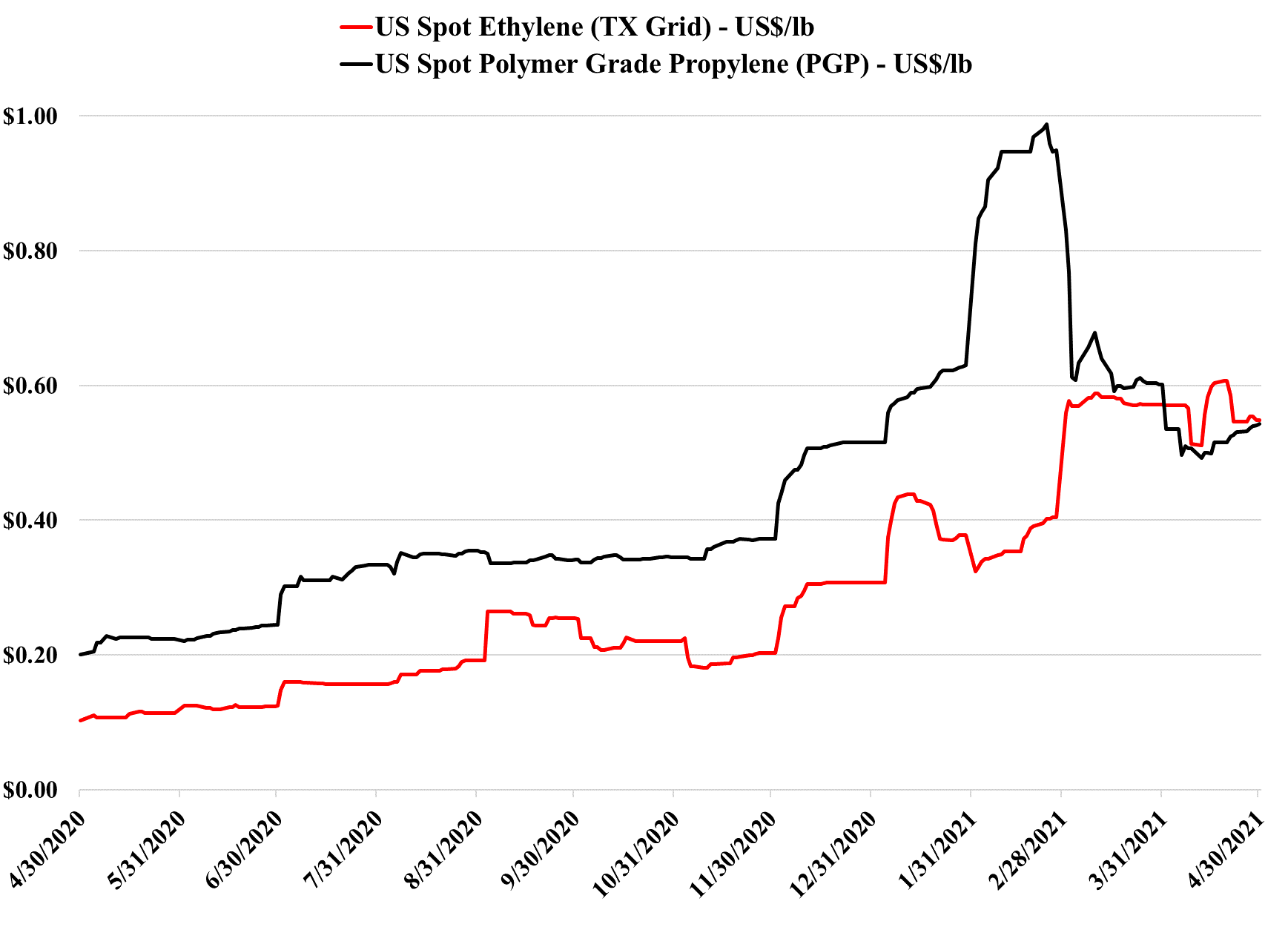

The relative strength in US propane versus ethane is something we have talked about before, with the strong export pull on propane, pushing prices higher, despite equally strong demand for ethane in US ethylene units and for export. The projects to consume propane coming online in the next 12 months overwhelm the projects to consume ethane in our estimate and consequently, we believe that the delta (in chart below) will remain high and may widen further. On a cost basis, this could put US propylene and a distinct disadvantage to US ethylene and at the margin might help ethylene derivative demand relative to propylene derivative demand – most likely in paint additives, but also in some polymers where polypropylene can be substituted with other materials – it may provide a bit of a lifeline for polystyrene if the polystyrene recycling initiatives gain traction. See our daily report for more.

Base Chemicals May Be Weaker, But Nothing Else Is

Jun 8, 2021 12:35:56 PM / by Cooley May posted in Chemicals, Polymers, Commodities, Ethylene, Base Chemicals, intermediates, downstream, Capacity shortages, derivatives

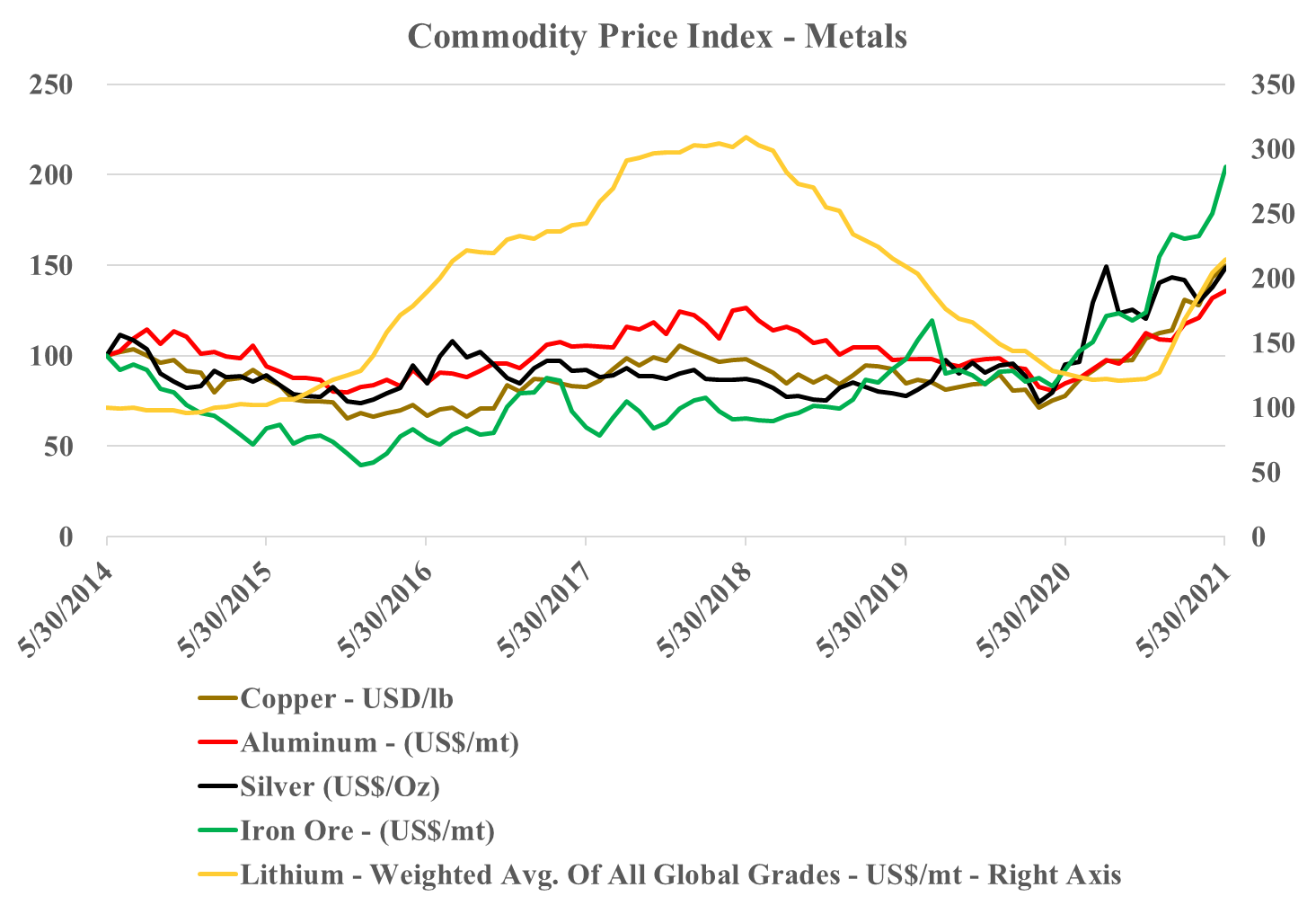

There is an interesting difference between the base chemicals markets and some of the other broad commodities and intermediates, and we have economic growth that is testing the capacity limits for many commodities and downstream products, but the overbuild in basic chemicals, most recently in China, is putting significant downward pressure on pricing, as we highlighted in yesterday’s Weekly Report. Capacity shortages in intermediates and some specialties, which are driving the investments we highlighted in today's daily report and which are a steady flow of news this year, are leading to some expanding margins over base chemicals in select areas where capacity has not kept pace with demand.

Polyethylene: A Really Compelling Disconnect

May 27, 2021 2:56:45 PM / by Cooley May posted in Chemicals, Polymers, Polyethylene, US Polymer, arbitrage, freight, HDPE, polyethylene industrial sheet, imported polymer

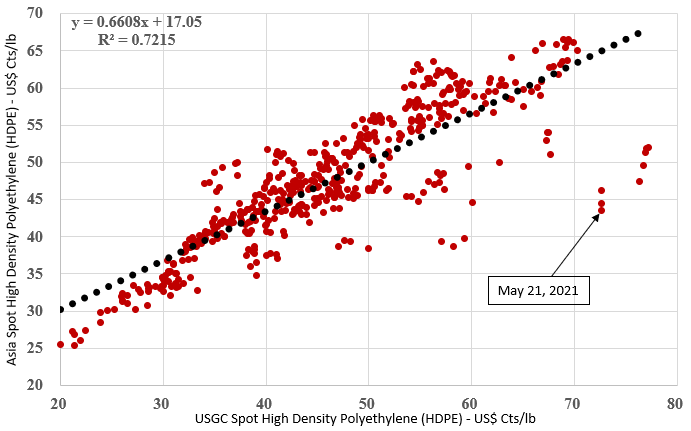

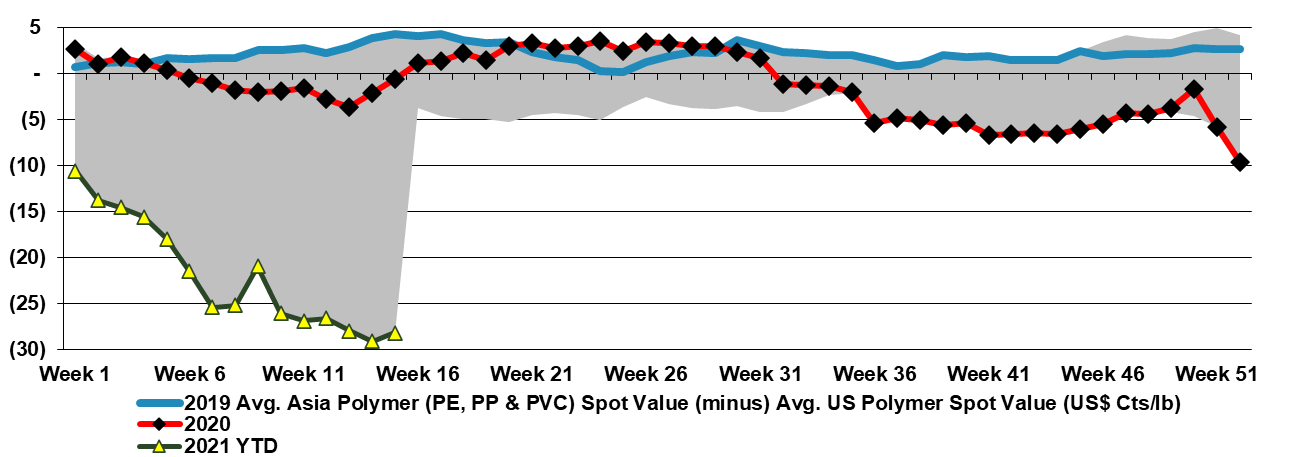

Scatter charts with significant outlying points are always eye-catching and the exhibit below is no exception. The extremes of the chart are interesting as they show that when US polymer prices are low, Asia generally trades at a premium, and when US prices are high Asia trades at a discount. But today’s discount is several standard deviations from the norm, and it is too compelling a trade to ignore. If the US was short polyethylene we would be less focused on this arbitrage but that is not the case. Unilateral decisions from US producers to keep production in line with contract demand could maintain pricing support, but the competitive disadvantage that this places on US consumers – especially in durable applications (where the polymer is a larger part of the finished product cost) is significant. It is also a major cost headwind for the packaging companies in the US, and tough to pass through in most cases on staples and household products, because of the buying power of the major food and drug retailers.

US Chemicals and Polymers Holding On, But Under Pressure...

May 26, 2021 1:45:58 PM / by Cooley May posted in Chemicals, Polymers, Ethylene, polymer pricing, polymer grade propylene, PGP, feedstock, arbitrage, ethylene producers

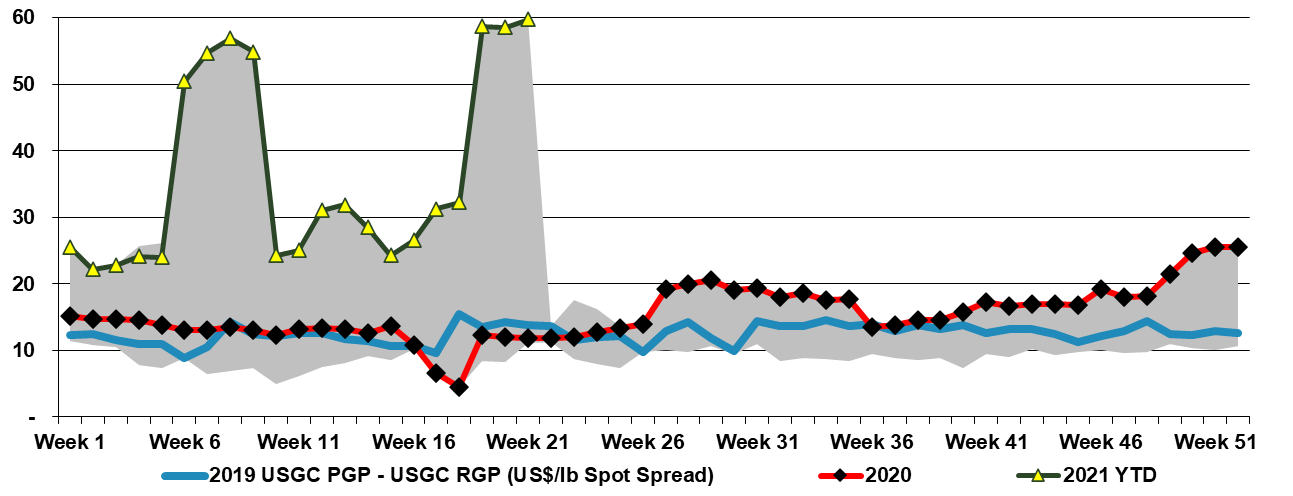

The chart below and the others in our daily report linked add more weight to our argument that polymer grade propylene prices in the US have some downside and that it could happen relatively quickly, especially if ethylene producers play the current propane feedstock arbitrage to their full extent. Given weaker propylene derivative markets outside the US, propylene derivative pricing would likely come under some negative pressure if propylene prices fell.

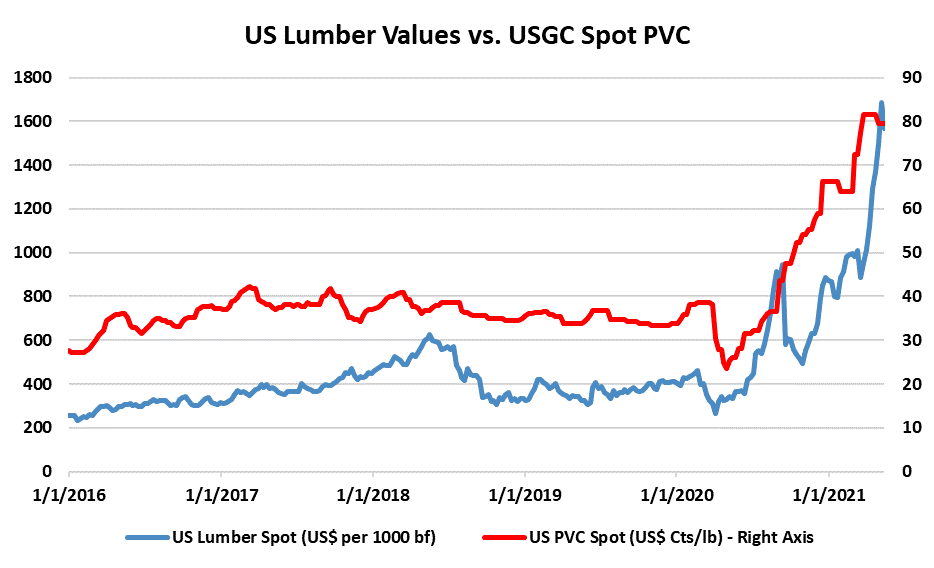

We Think Housing Stalled In April, But Still Has Momentum; Good For PVC

May 19, 2021 1:55:21 PM / by Cooley May posted in Polymers, PVC, Housing Products, Lumber

Prices for housing products such as lumber and PVC appear to have hit a pause on their upward march, in part because of lower housing starts, which may be linked to the higher costs – recent estimates suggested that the lumber price moves alone had added $15,000 to the cost of building an average home this year. The overall momentum in the housing market remains strong and the recent lower housing start number could be a one-off. We maintain our preference for the PVC players and still believe that the underlying fundamentals are less precarious than they are for other polymers. See more in Today's Daily.

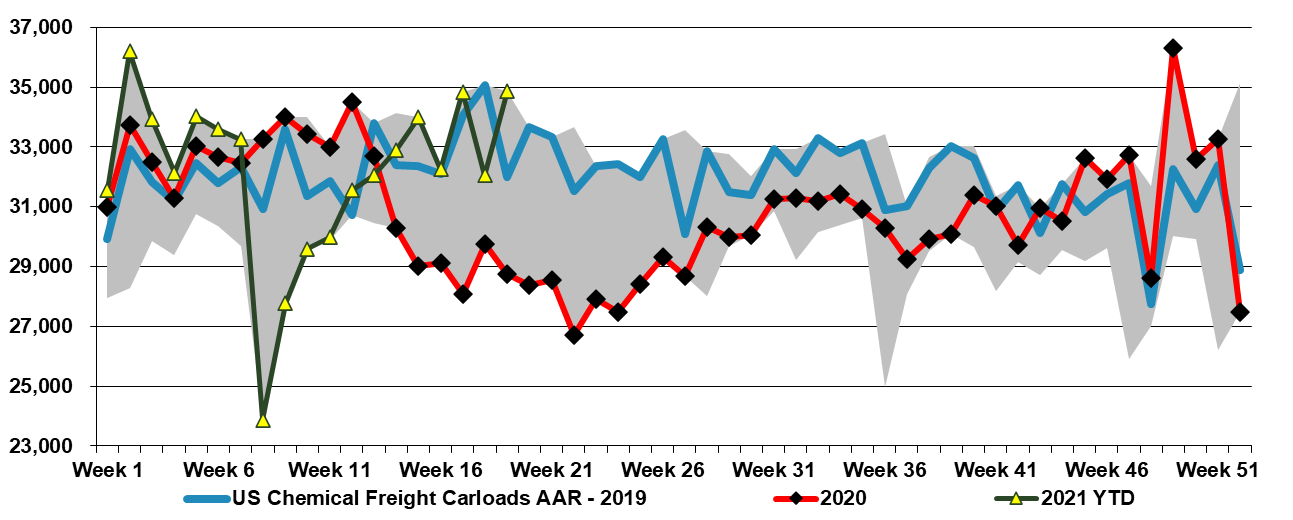

Despite Concerns, Inflation May Not Slow Chemical Demand Materially

May 13, 2021 1:50:33 PM / by Cooley May posted in Polymers, Raw Materials, raw materials inflation, Inflation, Chemical Demand, containerboard, packaging, durables, railcar shipments

The concerns about supply chain inflation hurting chemical demand are likely very end-use specific. While the packagers and consumer goods sellers are seeing significant inflation in all raw materials, not just polymers, the packaging is a minor component of the cost and value of what they are selling and while it may hurt their earnings, it is unlikely to stifle demand – none of us is likely to stop buying milk, orange juice or cookies if the prices rise a couple of cents because the manufacturers are trying to cover some of their higher costs.

2Q-2021 Likely To Be The Polymer Profits Peak, Weather Permitting

Apr 30, 2021 1:54:54 PM / by Cooley May posted in Chemicals, Polymers, Propylene, PVC, Polyethylene, Polypropylene, Ethylene, Styrene, PET, PTA, Acetic Acid, Polyurethane, Glycol

We still believe that there is a good chance that 2Q 2021 is the peak for polymer profits in the US and Europe, but it very unclear how severe the downside could be, given the growth potential. Seasonal turnaround will keep markets more balanced in 2Q, and the major uncertainty beyond that will be weather in the US. A series of storms like last year could hold the market up through 3Q and into 4Q, but an absence of any weather events could expose US surpluses quite quickly, especially for ethylene and derivatives. The new builds in China have focused on ethylene and polyethylene (and some glycol), propylene and polypropylene, and PTA and PET, and this is where the potential weakness will emerge. There has been some new styrene capacity and that is also a vulnerable segment in our view. PVC, acetic acid, and large parts of the polyurethane chains look much more balanced to us and we have more faith in the projections being made by companies like Celanese, Olin, and Orbia than we do the major polyethylene producers. See today's daily report for more details.

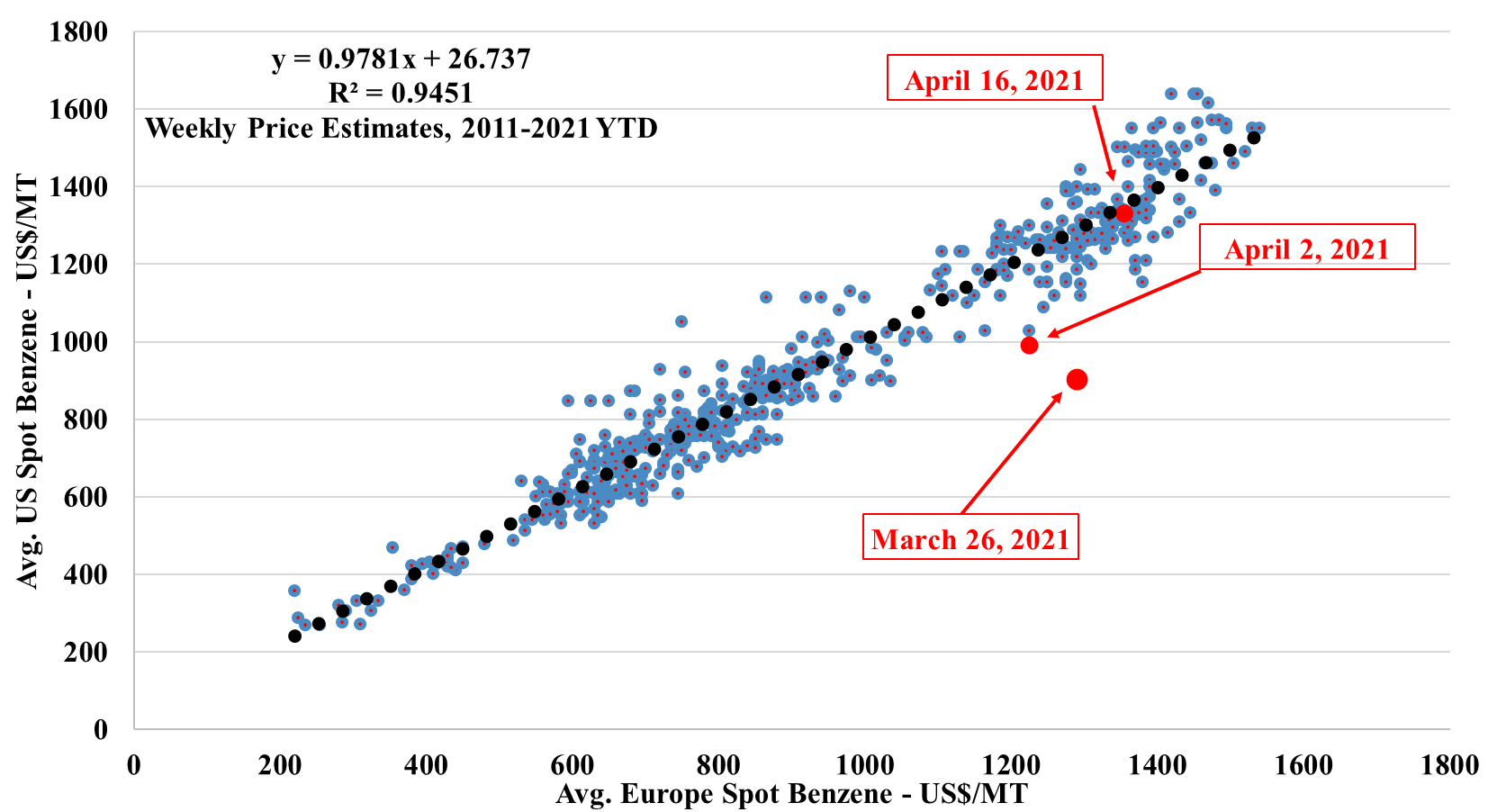

US and European Benzene Prices Normalize as Expected

Apr 16, 2021 4:54:05 PM / by Cooley May posted in Chemicals, Polymers, Ethylene, Benzene

So, if you had been able to play the obvious arbitrage in the exhibit below when we published it first in March, you would have done quite well. You would have done better if you had just bought benzene on both continents, but you would have taken more risk. We like these scatter charts and we will use them more often when there are obvious regional arbitrages or just product arbitrages within a region. The overall benzene tightness has been caused by production outages in the US, shipping issues to Europe, and very strong demand for benzene derivatives. The start-up of the Shell POSM unit in the Netherlands has likely added to the imbalance as the facility is a major ethylbenzene consumer.

The Case for Trouble Ahead in Plastics

Apr 13, 2021 1:01:01 PM / by Cooley May posted in Chemicals, Polymers, Plastics

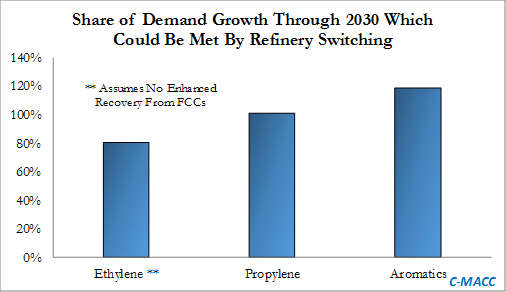

About a year ago we wrote a piece highlighting the longer-term risks to plastics supply and demand because of oil company interest in chasing a market that they perceived to be growing faster than other oil products markets, and potentially running headlong into a plastic market that was either seeing slower growth because of concerns around plastic waste and sustainability or was declining.

A year of COVID-related uncertainty put some of the projects on hold, but as we move through 2021 we have a couple of factors driving the plastic bet again. First, demand for plastics is very high and pricing is “off the charts”, suggesting that converting oil to plastics could be profitable as well as a home for some of the oil. Second, with the climate agenda now front and center in every economy and more discussions around electric vehicles, hydrogen, and biofuels, the future for oil demand is looking incrementally bleaker. The economics of NOW thesis would support large-scale investment in oil to chemicals – either directly – or through refining to more common feedstocks. But…