The BASF commentary about the impact of gas cuts in Europe should not be read as specific to BASF, but as we move out of the winter in Europe it is less likely that countries will directly restrict industry in favor of retail customers should gas supplies become limited. While many European countries will try to protect retail customers from hyperinflation in energy costs, their ability to do that for the industry might be more limited as they cannot find the additional gas, and subsidizing everything would be fiscally irresponsible. We expect to see more basic chemicals and derivatives moving from the US and the Middle East to Europe to displace uneconomic local production, but we understand that all shipping capacity is now constrained – liquids, gases, and containers – limiting the volumes that can move. The high end of the cost curve that Europe has occupied for decades in chemicals means that exports from Europe have been very limited and reducing exports is not a balancing act tool that Europe has to play with. We continue to see significant upward pressure on prices in Europe and the jump in inflation in the region, reported today, was dramatic but could accelerate as there are very few corrective levers that Europe can pull right now.

Europe: Short Of Chemicals But Logistics Limit Help

Apr 1, 2022 3:34:45 PM / by Cooley May posted in Chemicals, Polymers, Ethylene, BASF, Logistics, energy costs, Europe

Evidence Of Oversupply For Ethylene. Not The Case For Propylene

Mar 31, 2022 2:33:16 PM / by Cooley May posted in Chemicals, Propylene, Ethylene, propane, PGP, Propylene Derivatives, PDH, monomers, propylene prices, monomer prices

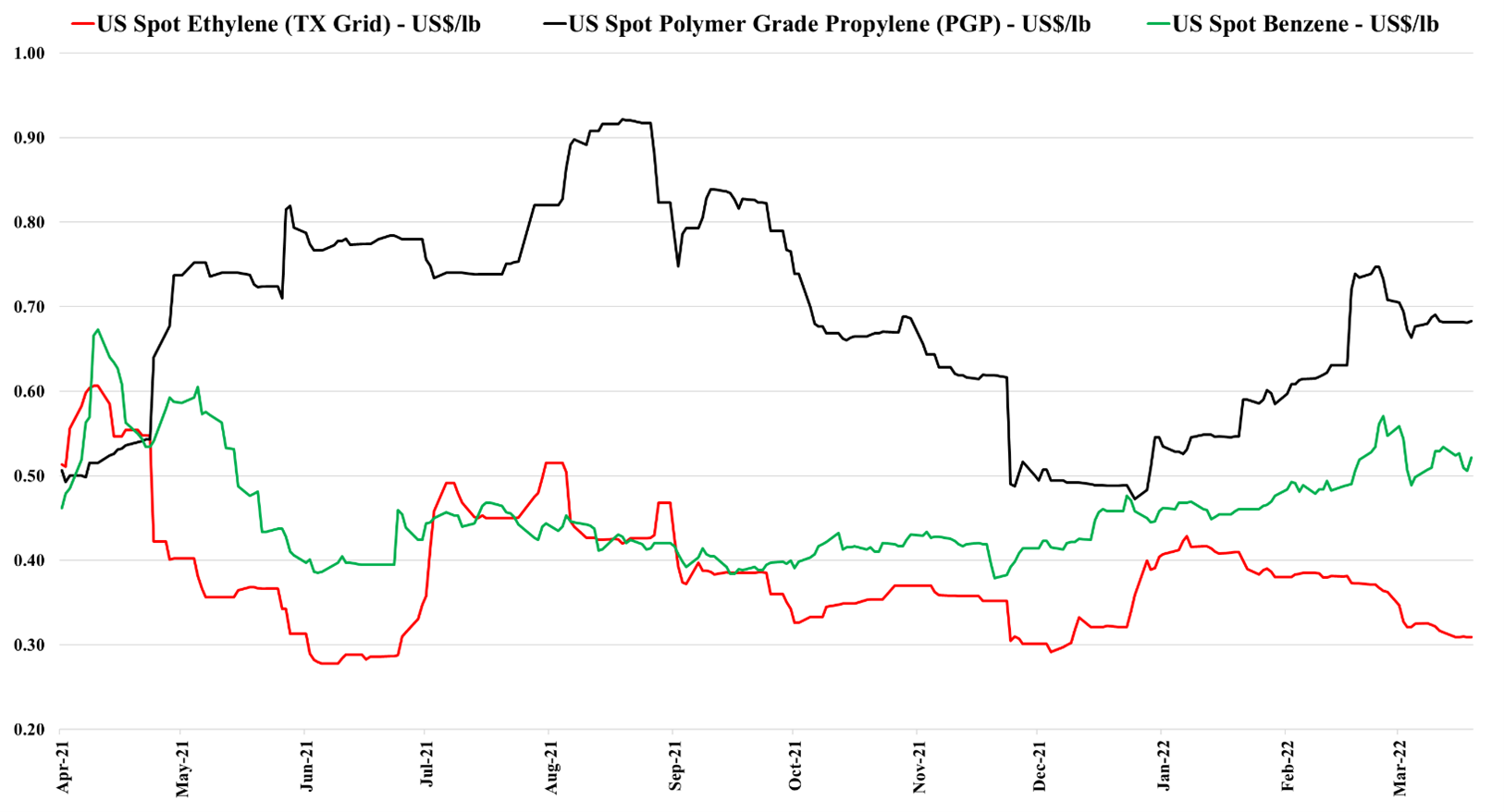

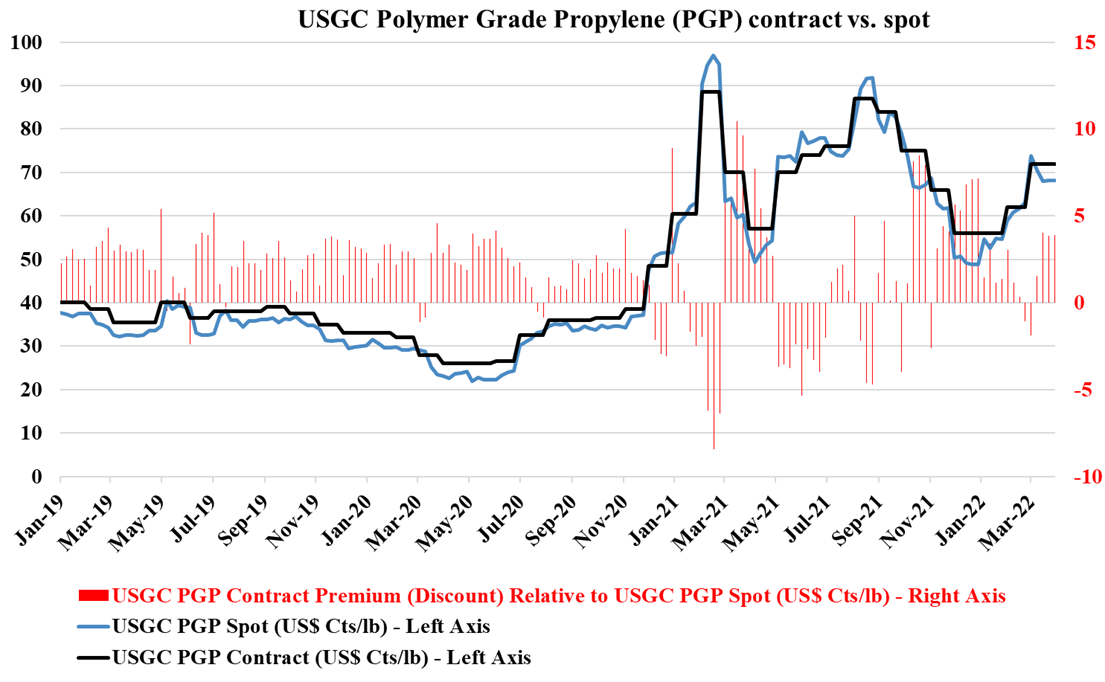

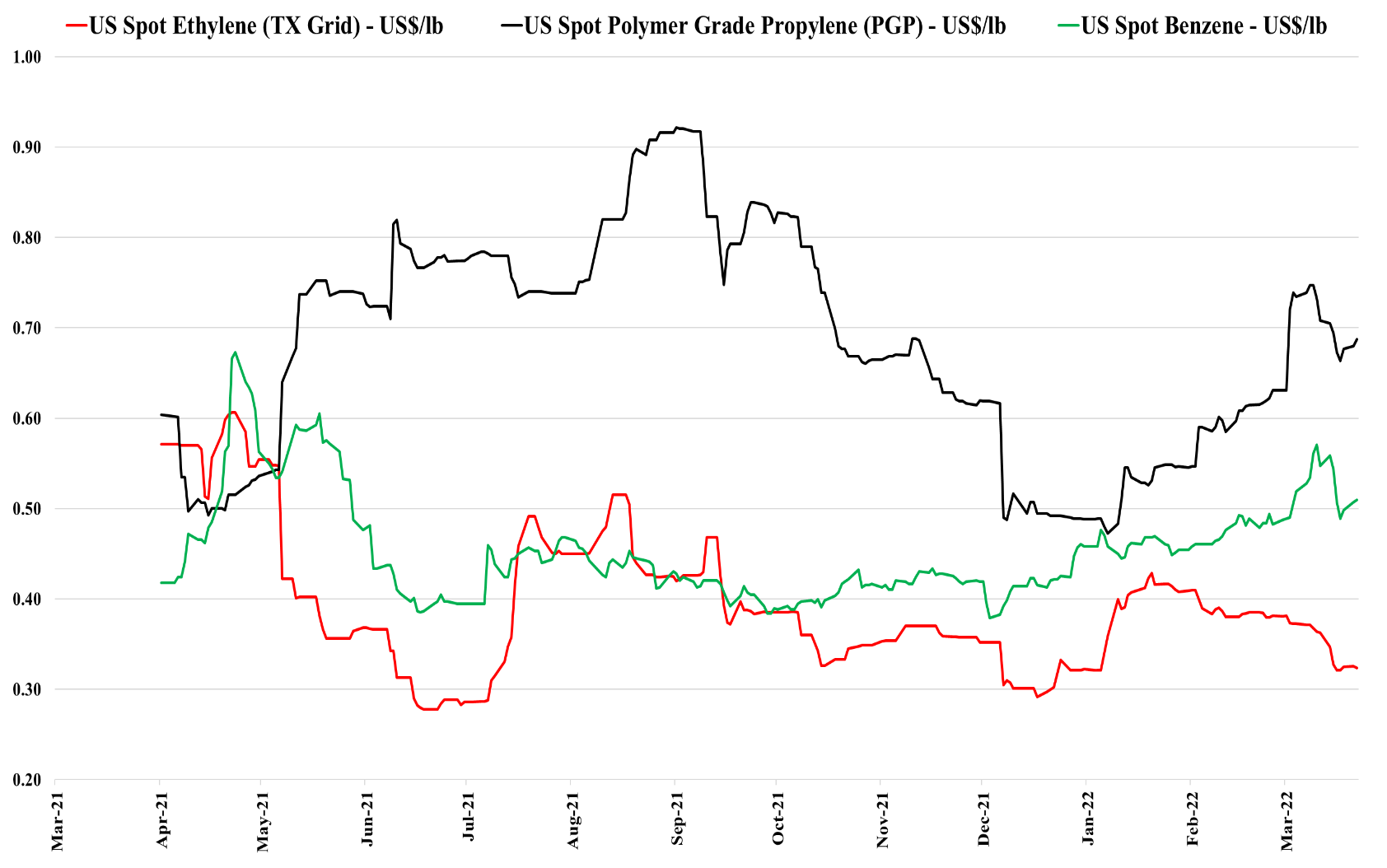

We are seeing some monomer price weakness in the US, despite the rising costs. For ethylene, this is likely because of increased supplies (new capacity and turnarounds ending) and all capacity to consume running at full rates, including the export terminals. There is plenty of margin in exporting ethylene today and US prices are not falling because they need to find another buyer internationally. We could see some opportunistic buying for inventory at these prices, especially if you believe that the conflict in Ukraine is not ending soon and also if you are concerned about more extreme weather as we move through the summer in the south of the US.

Some Chemical Plants May Not Survive This Feedstock Squeeze

Mar 29, 2022 2:25:44 PM / by Cooley May posted in Chemicals, Polyethylene, Emissions, Carbon Price, decarbonization, Base Chemicals, polymer, chemical companies, feedstock costs, feeedstock

We noted in today's daily report the number of shutdowns that are taking place in Asia and in Europe as feedstock costs become unmanageable, and the assumption is that these units will restart when economics recover. This may not be the case as companies factor in the costs of operating smaller units in an emission-constrained world, and the decision to shut down for economic reasons today may be the final nail in the coffin for some older and generally less economic base chemical units. Many smaller facilities in China were built in the 80s and 90s and these might not come back online if there is no easy way to lower emissions, but the harder decisions will likely be in Europe.

Higher Costs And Inventory Increases Will Drive High Prices

Mar 25, 2022 2:51:04 PM / by Cooley May posted in Chemicals, Methanol, Ammonia, Supply Chain, natural gas, US Methanol, urea, Methanex, HB Fuller

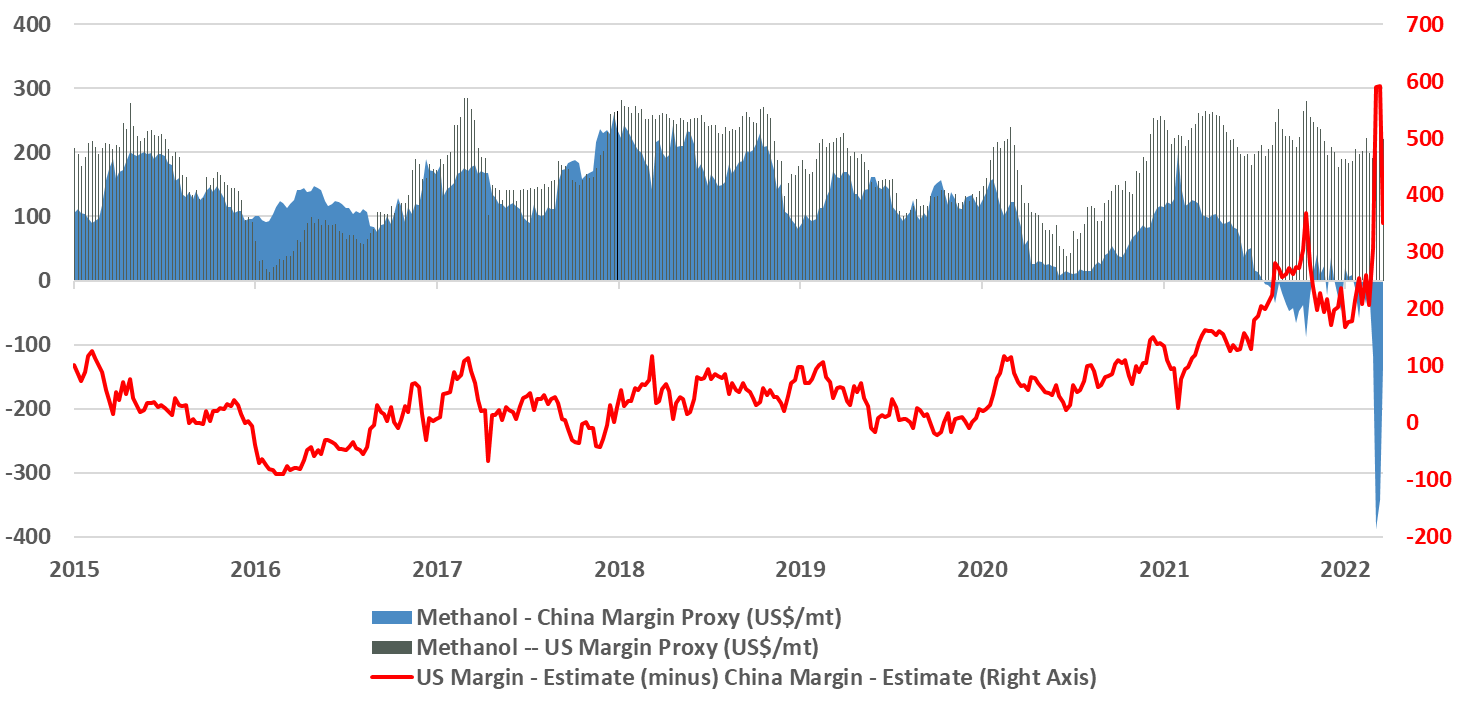

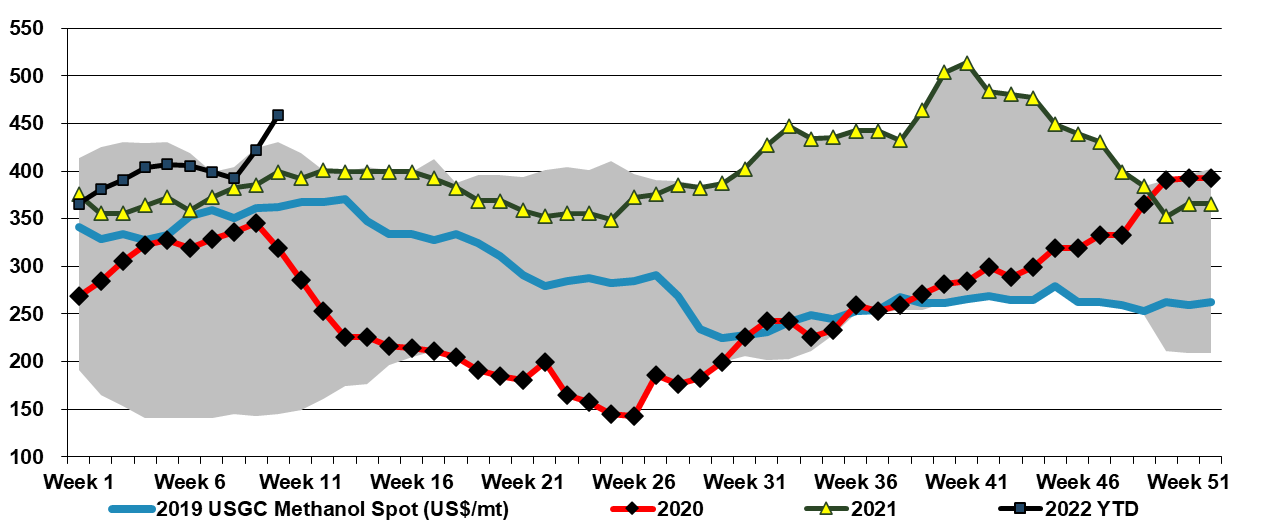

Methanol is one of a few chemicals that is directly impacted by the price of natural gas, and as the chart below shows, the pain in China (and in Europe) is extreme and it is unlikely that any facilities that require imported natural gas – or local gas with prices based on imports – are operating today. The volume and margin opportunities for those companies connected to low priced natural gas – the US, the Middle East, and other niche locations such as Trinidad, are as good as they have ever been and we are a little surprised that Methanex did not push a little harder with US pricing, given that export netbacks are likely surging. Urea and ammonia are in the same boat and prices are much higher, but the US is a net importer and international prices are directly impacting the US price.

US Refiners Profits Rise On Margin And Roubles

Mar 24, 2022 3:02:20 PM / by Cooley May posted in Chemicals, Oil, natural gas, gasoline, refinery, Russia, oil and gas, refining margins, refiners

The closure of the Russian oil pipeline and export terminal as well as the move to want payment in Roubles, are all likely tactics from Putin to cause more market chaos in an attempt to hit back over sanctions. While Russia likely needs the oil and gas revenues, sending oil higher is likely intended to see whether the West cracks, which seems unlikely. The Rouble payment is also meant to inconvenience the West but at the same time maybe support the Rouble as West Europe needs the gas and will need to buy Roubles to may payments.

Commodity Shortage - It's Not Just Oil

Mar 23, 2022 2:27:41 PM / by Cooley May posted in Chemicals, Commodities, Metals, Oil, natural gas, Lithium, Shortage, commodity chemicals, fertilizer, nickel, World Petrochemical Conference, WPC, crops, crop protection

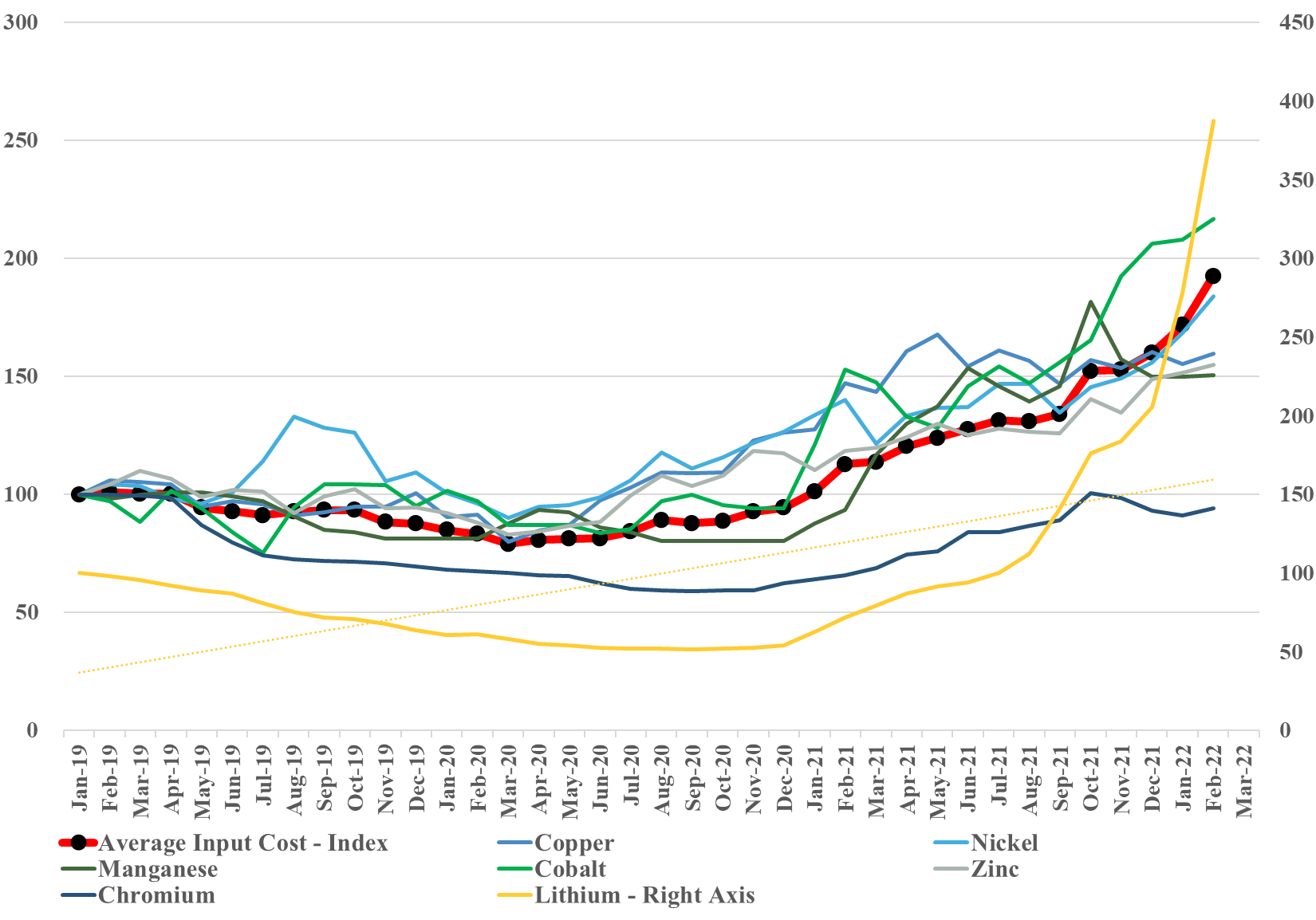

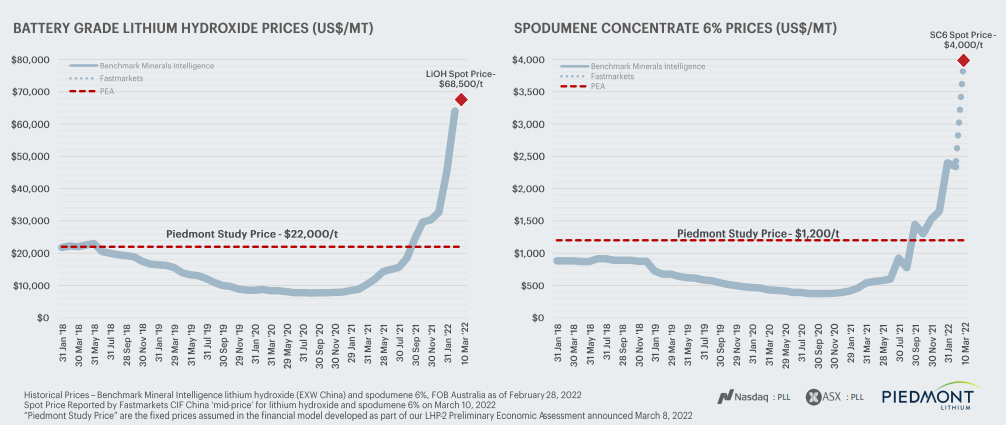

One of the key messages from the World Petrochemical Conference is that it is not an oil shortage, it is a commodity shortage, and we show our key metals index (updated through February) again in the chart below. We will update this again at the end of March (when consistent data is available) and given what has happened to both lithium and nickel prices we would expect a jump in the March index.

A Chemical Mega-Cycle Is Coming

Mar 22, 2022 12:55:58 PM / by Cooley May posted in Hydrogen, Chemicals, Polymers, Ethylene, polymer pricing, downstream, renewables, EV, Aramco, monomers, crude oil, fuels, mega-cycle

We have talked at length in today's daily and recent Sunday recaps about our expectation for a mega-cycle in chemicals because of an unwillingness to deploy capital as uncertainty rises. The exception is likely to be large oil producers looking at long-term downstream integration plans, with the primary objective of consuming captive crude oil. The Aramco ambitions in China bear some similarities to the ExxonMobil investment announced for China last year. While the crude oil market may be tight and prices may be high today, few oil producers believe that demand will not ultimately be hurt by renewable penetration and EV and hydrogen growth as transport fuels. Looking for captive crude oil demand is a logical step for the major and it is likely that the Aramco ambitions include refining as well as chemicals in China.

If You Are In The Right Place With The Right Products, Times Are Good

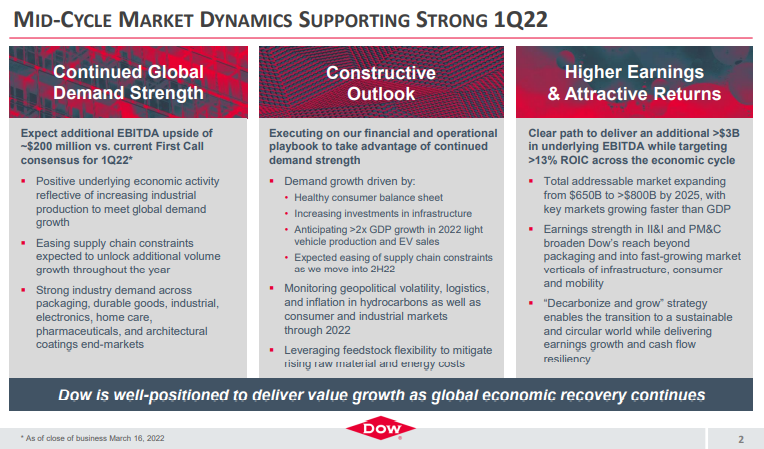

Mar 18, 2022 12:19:25 PM / by Cooley May posted in Chemicals, Polymers, Polyethylene, Polypropylene, LyondellBasell, Inflation, Dow, US Chemicals, natural gas, Basic Chemicals, Westlake, Braskem, US Polymers, commodity chemicals, demand strength, raw material, silicone

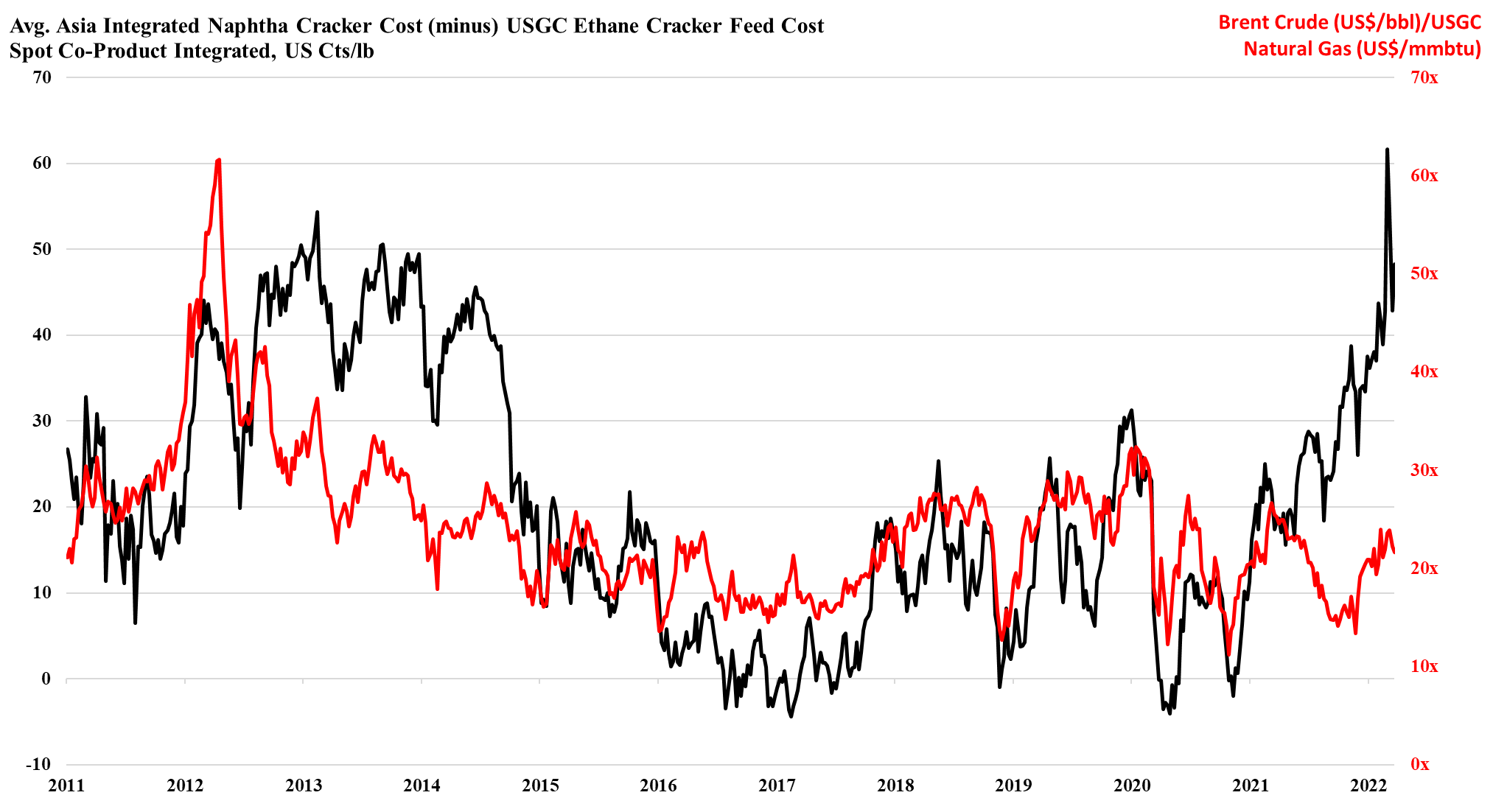

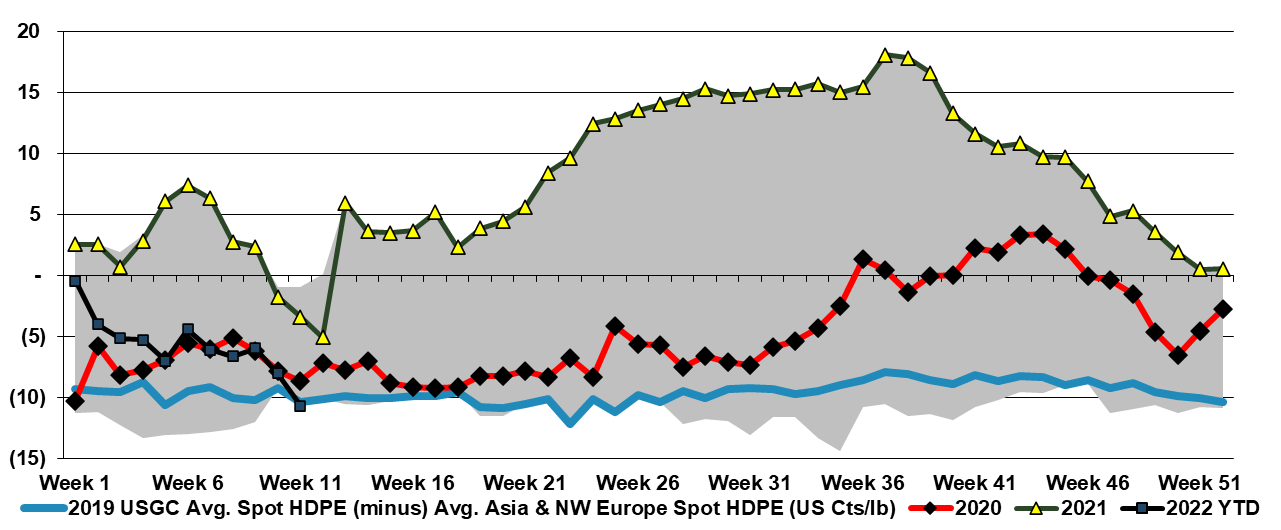

As we have been suggesting for some time, there are pockets of real strength in chemicals; identifying them is the hard part. It is not enough to have pricing strength in a market where raw material prices are volatile daily and we have seen plenty of examples of companies with very strong end demand dynamics missing earnings because of a cost squeeze. We continue to highlight the competitive strength in the US in basic chemicals because of the decoupled and relatively low natural gas price and this is likely a large piece of the Dow earnings strength – strong polyethylene demand against a backdrop of relatively stable and lower costs. While polypropylene (Braskem) remains extremely profitable in the US, it has seen more sequential weakness than polyethylene – as we show in Exhibit 1 of today's daily report. That said, both polyethylene and polypropylene margins in the US are significantly higher than was likely expected this year and certainly what has been reflected in stock valuations, even with the commodity chemicals rally. Dow is also seeing the benefit of a very strong silicones market – something that was covered in detail in Wacker’s release earlier this month.

March And April Are Likely All About Price Increases

Mar 17, 2022 12:29:56 PM / by Cooley May posted in Chemicals, Polymers, Plastics, Methanol, Energy, natural gas, energy transition, US Methanol, materials, fuel, raw material

A couple of weeks ago we raised the idea that US methanol could be a significant beneficiary of the conflict in Central Europe, not just because it is very economically unattractive to make methanol in Europe, but because it might be possible for Europe to import methanol for its energy value - $40 per MMBTU natural gas can make all sort of alternates look attractive. The impetus behind the methanol spot price increase in the US may be in part rising local natural gas – or the fear of further increases – but export demand is likely the larger driving factor and this could continue or even increase further if potential European importers work out how to convert to use methanol as a fuel.

Runaway Prices Unlikely in Plastics, Like in Metals, Without Energy Related Plant Closures

Mar 16, 2022 11:55:17 AM / by Cooley May posted in Chemicals, Polymers, Polyethylene, Plastics, Energy, Metals, Raw Materials, renewables, Basic Chemicals, Lithium, crude oil, nickel, metals pricing

Could what we are seeing in metals happen in chemicals and polymers? Over the last few weeks, we have seen already high metals pricing spike even further, both because of production shortfalls and because of expectation of higher demand, especially in the renewables space, as conventional energy prices have spiked. We show a lithium example below, but note that after chaotic nickel trading last week and a halt to trading, the market has made some attempts to reopen this morning with renewed problems.