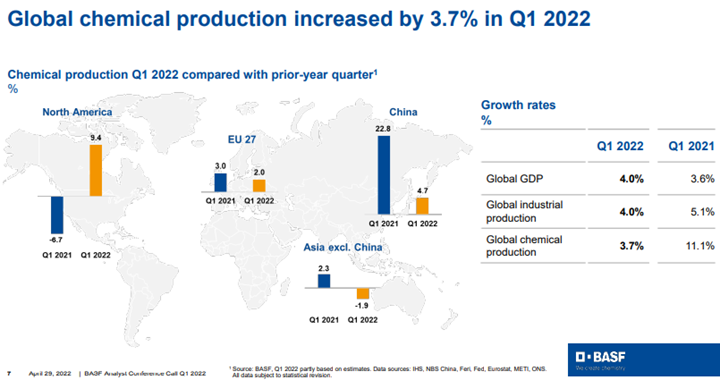

We see BASF taking a major risk by reaffirming its 2022 outlook today, as the uncertainty factors, especially in Europe, are rising. This week’s inflation and economic growth data in Europe, suggest an economy that is lowing quickly and the confidence levels in Europe are much lower, as we have discussed already this week. BASF and others will likely continue to push prices, but if consumer spending continues to slow, volumes will disappoint and at some point, there will be pushback on both volumes and pricing. Separately, as we mentioned above, we could see another leg up in energy prices as we approach next winter in Europe, especially if there is no resolution to the Ukraine conflict, which seems likely.

Recent Posts

Is BASF Too Bullish? Auto Delays Add To Other Macro Headwinds

Apr 29, 2022 3:38:21 PM / by Cooley May posted in Auto Industry, LyondellBasell, Inflation, Supply Chain, BASF, Eastman, Celanese

Overall Inventory Worries Hide Some Interesting Focused Upside

Apr 28, 2022 4:24:25 PM / by Cooley May posted in Chemicals, Polymers, Methanol, Energy, freight, US Methanol, US Polymers, Methanex

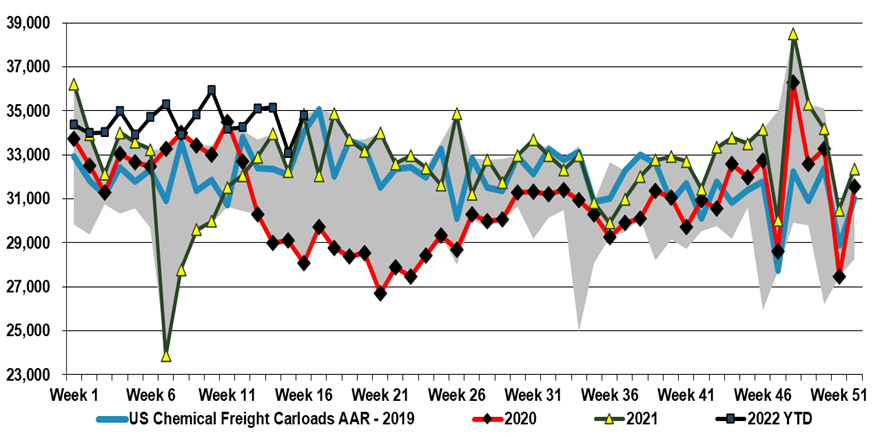

Chemical railcar volumes remain very strong in the US, despite some issues with exporting polymers, which has led to inventory builds on the coast, especially the Gulf Coast, and despite the implied consumer volume purchase decline in 1Q GDP estimates (sales grew but prices rose 500 basis points more than sales growth – suggesting an equivalent decline in volumes). As we noted yesterday, some companies closer to the consumer are indicating demand weakness and are more cautious about 2Q outlooks. If a higher than usual proportion of rail freight is moving into inventory, either at customers or stuck in rail cars – something Union Pacific has signaled – we could see a correction.

US Polypropylene & PVC: Both Benefiting From Logistic Challenges

Apr 27, 2022 12:32:52 PM / by Cooley May posted in Chemicals, Propylene, PVC, Polypropylene, freight, Logistics, US polypropylene, Alpek

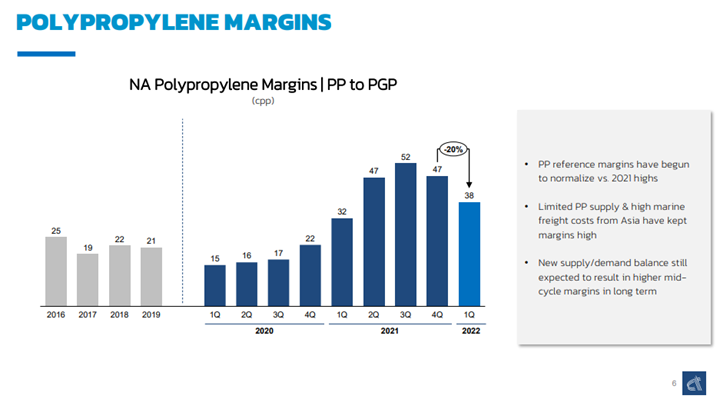

While Alpek shows a decline in the polypropylene to propylene spread in the exhibit below, it is important to note how high margins remain in the US. It is also important to note that the company points to high freight costs from Asia as one of the key drivers. China has significant polypropylene surpluses, and the price delta with the US is very high and, on paper, looks high enough to encourage imports into the US. But it is not that simple. The freight rates for containers from Asia are just one of many roadblocks, including wait time – on the water and the docks – and product quality. A US converter will likely not risk buying a few spot containers from China if focused on a product spec for a US customer. One way to get more material into the US would be for the end-user to buy the product – durable manufacturer or packager – and then ask its supplier to effectively toll-process. That way the product quality and logistic risk sit with the end consumer rather than the converter in the middle. The longer US domestic polypropylene prices remain inflated versus Asia, the more end-users may look at this option.

Some Prices Are Keeping Up With Costs But Shipping Remains Challenging

Apr 26, 2022 1:42:08 PM / by Cooley May posted in Chemicals, Polymers, Axalta, Inflation, Prices, shipping, specialty chemicals, basic polymers, container freight rates, logistic constraints, Costs, Mobility

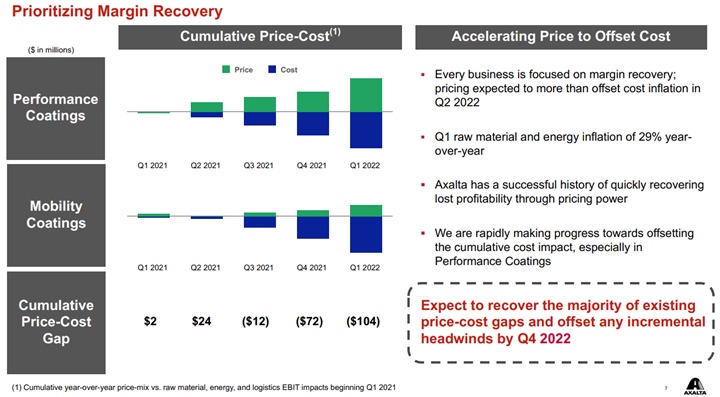

Axalta shows a helpful picture below of how pricing and costs are moving. All coatings producers are seeing the same cost inflation, some of it energy/hydrocarbon input related and some of it supply chain-related – either for inputs such as pigments or higher costs of getting products to markets. How pricing looks relative to costs is very customer dependent, as shown in the chart below. Auto OEM customers have long lead times on price adjustments and this is why Axalta is signaling the end of the year before prices will be aligned with costs. This of course assumes that costs do not rise again in 2H 2022 as they will also drive a lag in price increases and create a further gap as shown in the “Mobility” bar below. In the more consumer-facing coatings, it is easier to raise prices more quickly and Axalta and others have managed to keep pace with costs. We see the pricing versus costs issue as a much greater headwind for the specialty chemical companies than for the commodity companies and the industrial gas companies – the commodity chemical companies can raise prices more quickly and most industrial gas pricing is on a cost pass-through basis.

Logistic Problems Are Far From Over: 2Q May Still Throw Some Curveballs

Apr 22, 2022 2:57:06 PM / by Cooley May posted in Chemicals, Supply Chain, Dow, Logistics, specialty chemicals, labor shortages, PPG, supply chain challenges

The linked China polyethylene headline highlights a possible risk for US producers, as we link much of what is happening in China to logistic challenges. China has high production costs in a high oil environment, which is driving some of the cutbacks, but a portion is likely driven by an inability to move product and a huge disincentive to build inventory at break-even or negative margins. If the current shipping challenges in China roll over more aggressively into the rest of the world and container and vessel availability fall again, the US may face more challenges exporting polymers. As warehouse space fills, especially on the Gulf Coast, we may see some need to cut back rates, even if all of the material in storage currently has an agreed home and an agreed price. The US can afford to build inventory, as production costs still remain attractive relative to international prices, but if the supply chain is full there could be nowhere to put more material. One of Union Pacific's issues highlighted last week was too much inventory in rail cars, snarling up the system.

Chasing Costs With Prices And Watching Your Peers

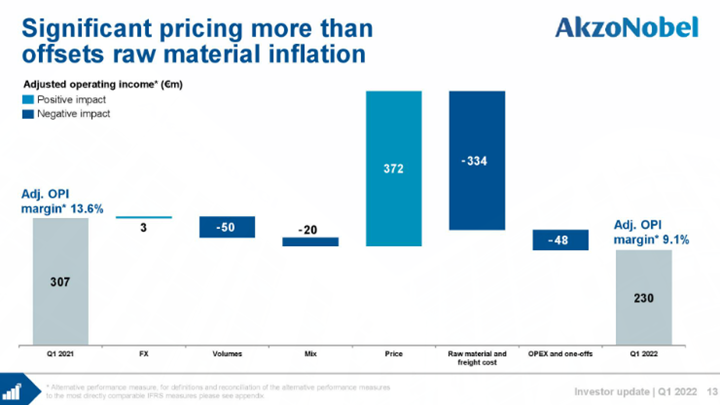

Apr 21, 2022 2:57:41 PM / by Cooley May posted in Chemicals, Polyethylene, raw materials inflation, Chemical Industry, Dow, specialty chemicals, intermediate chemicals, commodity chemicals, price inflation, AkzoNobel

We have discussed in several recent reports the very mixed fortunes in the intermediate and specialty chemical sector related to whether companies have been able to move prices fast enough to cover costs. The two large blue bars in the AkzoNobel chart below show that Akzo was close, but did not make it. We expect other examples like this over the coming weeks but we also expect some companies to have done better – some of this depends on mix and contract terms, but a lot has to do with how early you acted on the rising cost trend and how aggressive you were willing to be with customers. Dow is another example of a company struggling to get pricing high enough to cover cost increases, although Dow and others have aggressive price increase announcements in the market for polyethylene for April and May that would make a significant difference to US margins if successful.

US Chemicals: Some Signs Of Continued Strength, But Mostly Lagging Indicators

Apr 20, 2022 2:33:11 PM / by Cooley May posted in Chemicals, Polyethylene, Ethylene, Polyurethane, Inflation, US Chemicals, ethane, natural gas, naphtha, polymer, US polyethylene, MDI

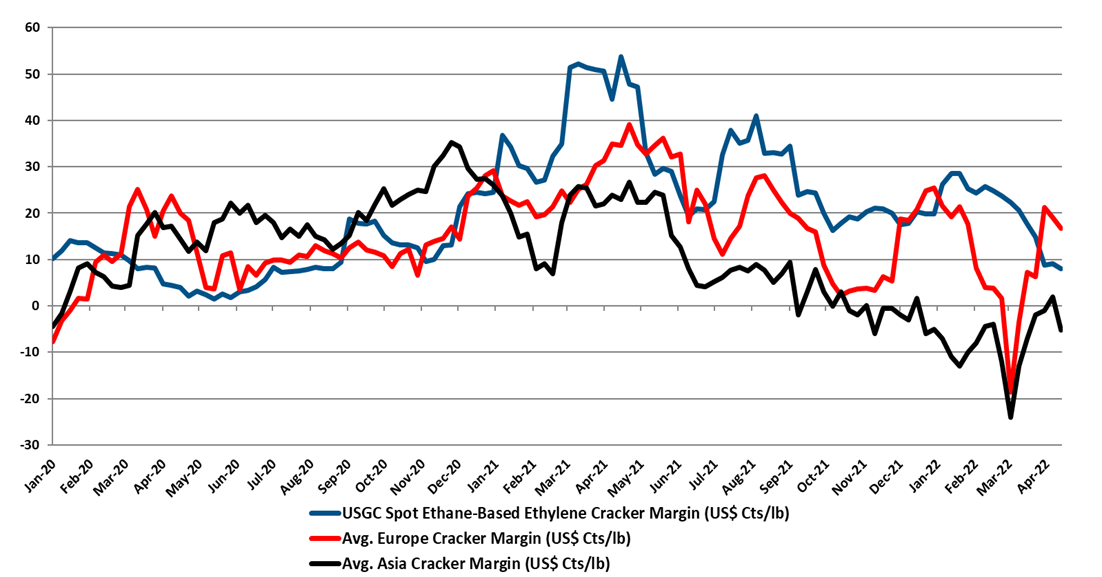

We note the polyethylene price nominations in the US, timed by some to coincide with earnings releases this week and next, and would remind clients that there is always price momentum in commodities, one way or another. In our view, the price increase moves aim to maintain directional momentum (upwards) while giving the polymer producers some cover should natural gas prices spike further. US ethane prices are now tracking natural gas more closely and have moved up meaningfully over the last few weeks, and US ethane-based ethylene margins have fallen around 80% since the start of the year, with at least half of that coming from cost increases. All polyethylene producers are integrated back to ethylene, and the price nominations will be attempts to recoup some of the cost increases. This is against a backdrop of still very strong polyethylene margins in the US, which although way off their 2021 highs remain much higher than in 2019 and 2020 and the longer-term average. This is covered in our Weekly Catalyst report each Monday. Ethylene margins are summarized in exhibit below and the chart shows the impact of higher costs in the US and falling spot ethylene prices as the US now has more surplus ethylene capacity and is looking for export homes for ethylene and easy to ship derivatives. As we have noted before, the jump in margins in Europe and Asia is because of extreme volatility in naphtha markets over the last couple of weeks. We would expect margins to be lower next week based on naphtha moves this week.

If We Make Chemicals Out Of Crops, What Happens To The Prices Below?

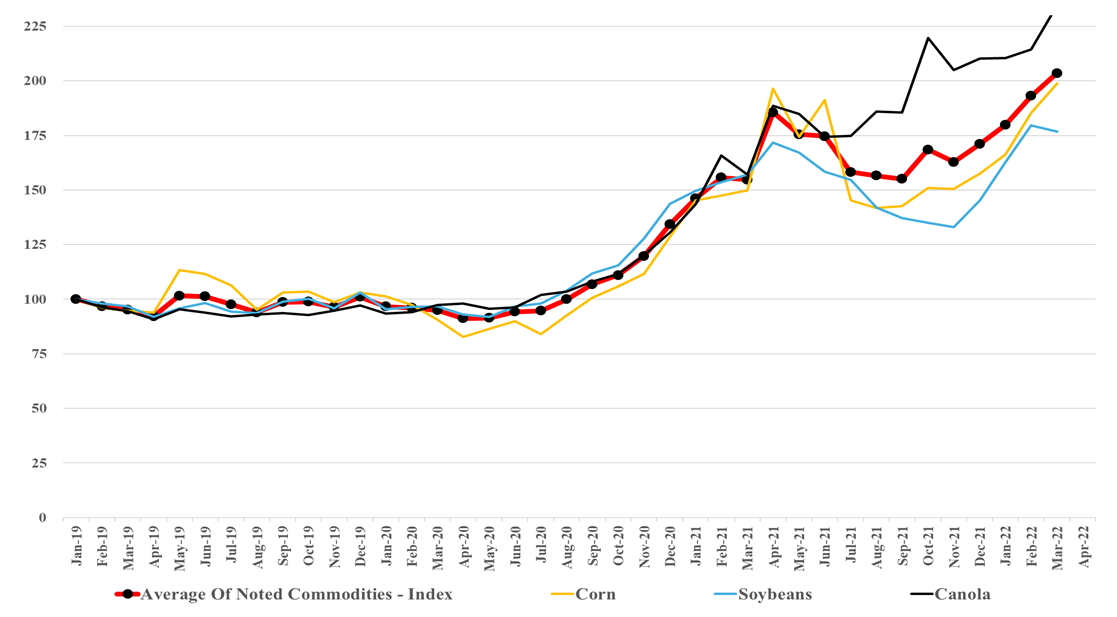

Apr 19, 2022 1:45:16 PM / by Cooley May posted in Chemicals, Commodities, Polyethylene, Supply Chain, renewables, naphtha, materials, crude oil, gasoline, renewable fuels, Corn, crops, food chain

In our ESG and Climate report tomorrow, we are focusing on renewable materials and fuels, emphasizing counting carbon and the importance of verification and auditing. However, one of the side issues concerning renewables is their impact on food prices if they bid crops away from the food chain. The chart of the day from our daily chemical reactions report shows that corn prices are above their historical correlation with crude oil, but it also indicates a correlation and fuel markets can pay more for corn and other crop-based fuels when oil prices are high. The issue with exhibit below is that we already have inflated crop prices with minimal incremental demand for the fuel markets today. Prices are rising on strong global demand growth for food – supply chain issues that existed before the Ukraine crisis and – the supply challenges that are a direct consequence of the Ukraine crisis. This is before any significant investment in renewable fuels or materials. As governments implement policies to encourage renewable fuels – especially SAF – they need to consider what policies and incentives might be required in addition to price, encourage meaningful changes to the acres planted around the world, and help productivity where it is low.

Industrial Products: Plastic Prices Reflect Support, Recycled Resin Prices Advance

Apr 13, 2022 2:44:51 PM / by Cooley May posted in Chemicals, Polymers, Polyethylene, Polypropylene, Industrial Sector, HDPE, plastic resin, materials, resins, polypropylene recycling

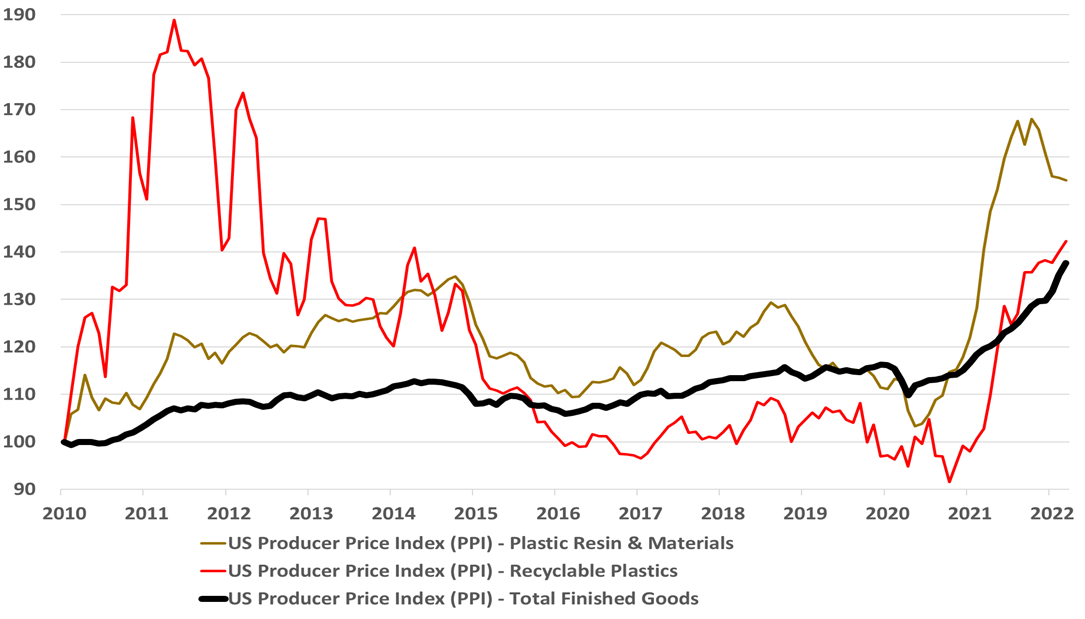

It is important to note from the chart below that the US plastic resin price index is out of phase with the overall industrial products markets as we saw a shortage driven peak in 2021 – largely weather and supply chain-related. The US on average continues to command resin price premiums relative to Asia. The China polymer surpluses are largely land-locked for now because of very high shipping costs and very high oil-based production costs, and the US surplus is also challenged because of logistic issues with exports. In the US, exporters are building inventory in anticipation of better logistics and on the basis that the surpluses for the most part have customers. If we do see a global slowdown in demand, triggered by inflation – see our most recent Sunday Recap – the inventories in the US and China could become a problem.

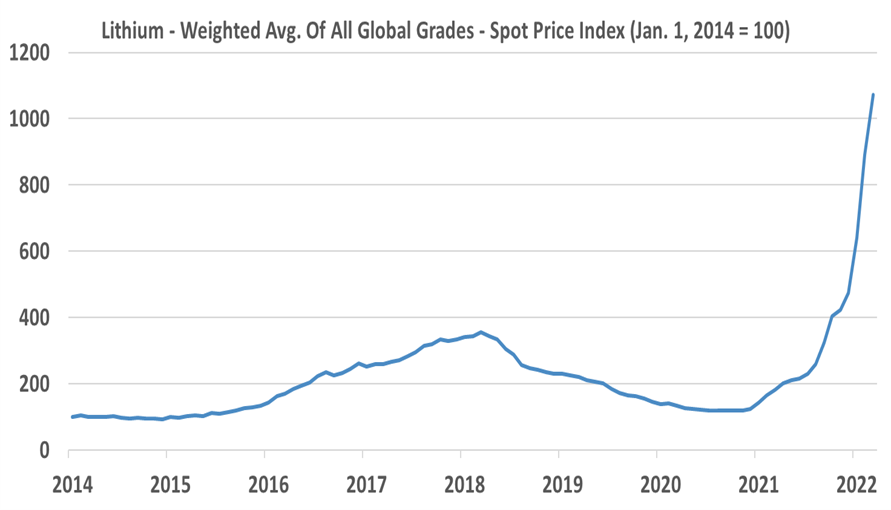

Lithium Supply Fails To Keep Pace With Demand - A Familiar Commodity Story

Apr 12, 2022 12:20:28 PM / by Cooley May posted in Chemicals, Commodities, Supply Chain, Lithium, EVs, Supply, capital spending, Lithium supply

Lithium prices keep rising. We refer back to some work we did on the subject several months ago, where we predicted that lithium was likely to be a cyclical commodity - eventually. Right now we see demand for new EVs, demand to fill the supply chain for new EVs, and demand to fill the supply chain for new battery factories – and consequently, demand is likely overstated relative to the number of EVs leaving production lines. In lithium’s favor, EVs are surprising on the upside in production and sales, but this will add to the need to fill supply chains. We do not see the lithium bubble bursting soon, but we do not see enough barriers to entry for lithium to protect the product from overbuilding. There are many dilute lithium sources, and high prices could allow for some high-cost options to move up the learning curve and become future low-cost options.