The linked article looks at the chemical inflationary cycle of the 70s, which has some relevant indicators for what we are seeing today, but there were also some stark differences. Rising raw material prices is a common theme and while it is convenient to blame OPEC+ this time, the group is not nearly as much to blame today as it was in the 70s. Consumers were facing not just higher oil prices, but also genuine shortages because of the OPEC cutbacks and the multi-year lead times that it took non-OPEC producers to ramp up E&P and ultimately production. This time the oil is there and relatively easy to get to, especially in the US, but the capital spending decisions of the US oil producers – mostly because of ESG related pressure – are holding back the production.

Relative To The Chemical Inflationary Cycle Of The ’70s, Present Times Reflect Similarities But Some Major Differences

Nov 17, 2021 2:47:40 PM / by Cooley May posted in Chemicals, Polymers, LNG, Plastics, Ethylene, ExxonMobil, raw materials inflation, Inflation, feedstock, Borealis, ethylene capacity, crude oil, shortages, chemicalindustry, plasticsindustry, Adnoc, OPEC+, oil prices, Investments

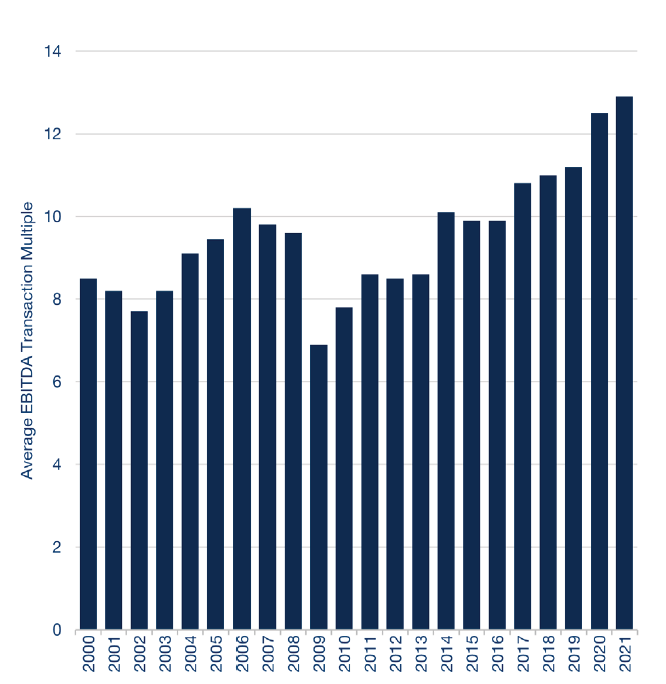

Is M&A The Path Of Least Resistance For The Chemical Industry?

Nov 15, 2021 11:10:57 AM / by Cooley May posted in ESG, Chemicals, Commodities, Emissions, ESG Investing, EBITDA, Capacity, climate, commodity chemicals, chemicalindustry, mergers, M&A, acquisition

Our Sunday Thematic research a week ago (see linked report) discussed slowing growth investment in the traditional commodity chemical industry and suggested that ESG and climate pressures might slow investment even further. Yesterday, our Sunday Thematic made the argument that some of those dollars will target strategic M&A. We have recently seen an uptick in global chemicals sector M&A, and we find few items suggesting activity levels will slow in the near-to-medium term. In part, we think strategic M&A will be easier to get Board approval for than “new build” capacity additions, and it can be viewed as better use than holding cash or complementary to dividends and buybacks. Also, ESG and climate concerns could spur M&A activity, as companies look to separate bad emission assets from good ones – especially if the market values them very differently.

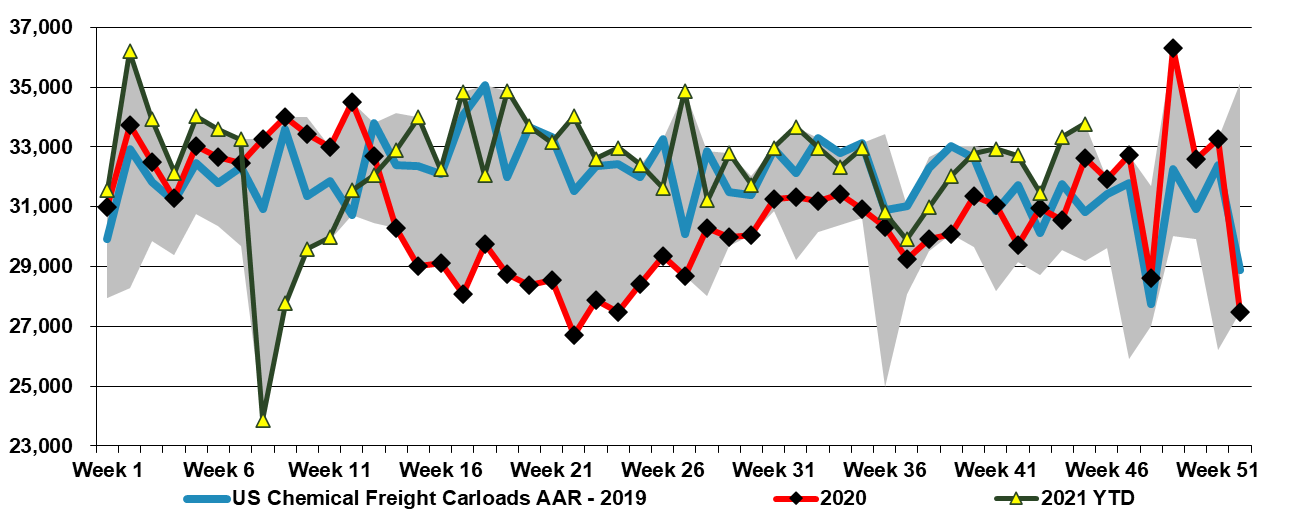

An Expected Year-End Surge in US Production - Will It Be Too Much?

Nov 12, 2021 3:09:43 PM / by Cooley May posted in Chemicals, Polymers, Propylene, Polyethylene, Ethylene, olefins, PDH, exports, chemicalindustry, plasticsindustry, railcar volumes

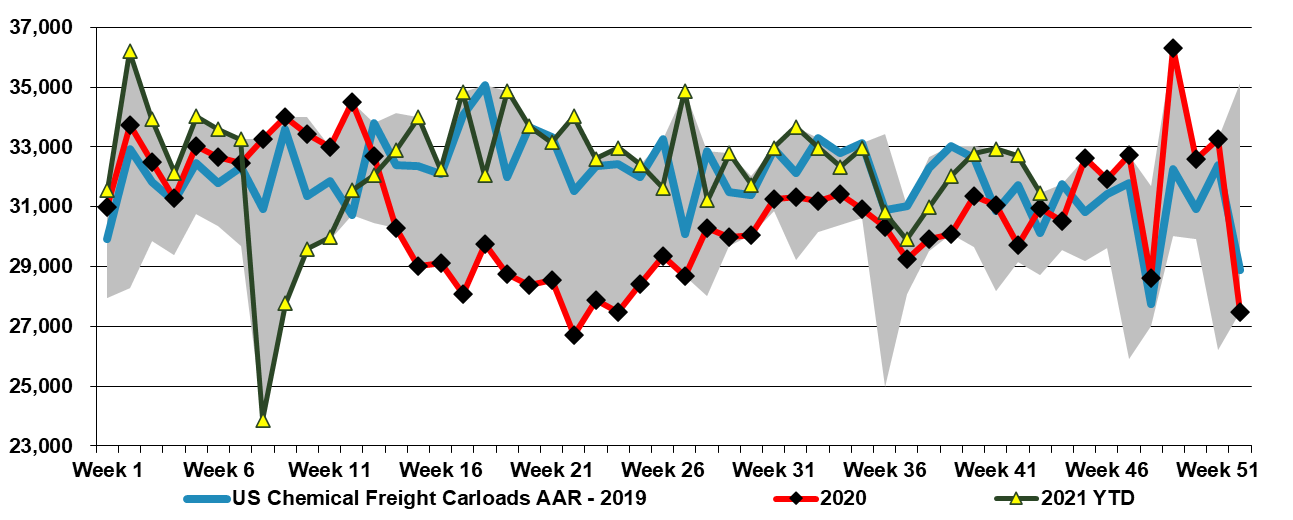

In the first Exhibit below we show a 5-year high in chemical rail-car movements. We have noted in research since early October that 4Q production in the US could be very high because of a combination of available capacity – following a year of weather-related delays – and very attractive margins and demand. We have been at the high end of rail car volumes for most of the quarter, and this may be part of the reason why we are seeing some price weakness for polymers in the US. Most of the polyethylene exported from the US moves from the manufacturing site to the export port via rail, so increased exports would also drive higher rail car numbers. As long as pricing and margins remain high and customer demand robust, we would expect these higher volumes to continue. This does not make us any less concerned that somewhere in the chain there is now an inventory build going on and that fortunes could reverse in 2022.

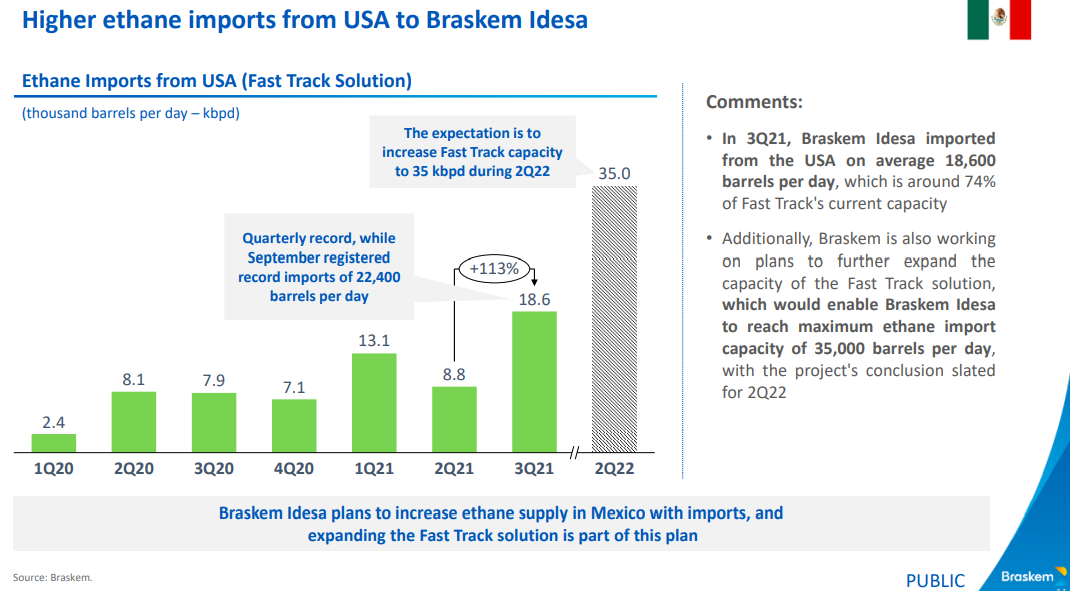

US Ethane Markets To Tighten In 2022 Amid Greater Demand

Nov 11, 2021 1:47:28 PM / by Cooley May posted in Chemicals, LNG, Plastics, Ethylene, ExxonMobil, petrochemicals, hydrocarbons, ethane, natural gas, US Ethane, Baystar, ethylene plants, Braskem, chemicalindustry, ethane imports, oilandgasindustry, plasticsindustry, petrochemicalindustry

With ExxonMobil and Baystar’s ethylene plants in start-up and Shell expected to come online in Pennsylvania in 1H 2022, the news that Braskem wants to double its ethane imports from the US in 2022, adds to concern that the US may struggle to meet ethane needs at peak demand rates in 2022. We would be less concerned if we saw natural gas production rising, which is unclear for 2022, despite the expected new LNG capacity. Ethane is likely to follow any upward movement in natural gas pricing as there will be a need to bid the product away from heating alternatives. The increment suggested by Braskem in the Exhibit below is not larger in the overall scheme of US ethane demand, but every gallon may matter in 2022. See today's daily report for more.

Chemical Portfolio Moves Already Active But Could Accelerate

Nov 10, 2021 2:42:04 PM / by Cooley May posted in ESG, Chemicals, Westlake, chemical companies, DuPont, GE, Trinseo, Huntsman, Arkema

ExxonMobil Pushing Ahead With Chemical Capacity, Despite The Risks

Nov 9, 2021 3:04:16 PM / by Cooley May posted in Chemicals, Polymers, ExxonMobil, hydrocarbons, Capacity, plastic surplus, chemical surplus, chemical capacity

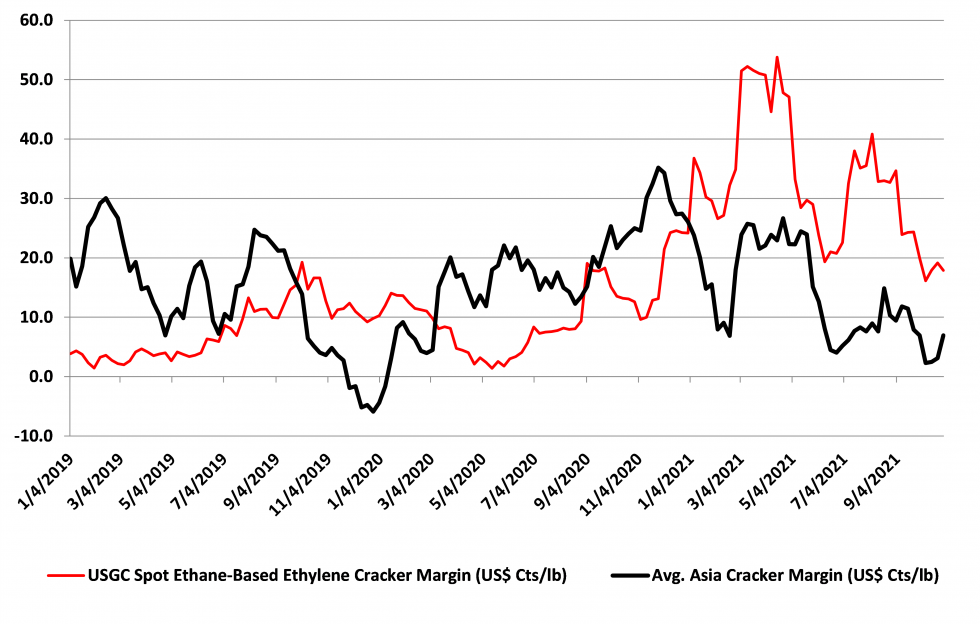

Clearly, as a direct consequence of our shortage theme this week, ExxonMobil announces a large new complex in China is through FID. This may be the company rushing something ahead before tighter restrictions are imposed or it may be an indication that with a 2060 net-zero pledge China is going to let things slide for a while. We would not be surprised to see ExxonMobil face some bad PR around this project if there is not some emission abatement plan with it. The facility will give ExxonMobil some further integration – effectively consuming equity hydrocarbons – but, if the company is setting itself up for criticism for investing in jurisdictions with lower emissions standards, this could backfire. It is also a very counter-cyclical investment given the poor profitability seen in the region right now (chart below) and as we discussed in our Sunday Piece - Waiting For The Big One – Is A Chemical Mega-Cycle Ahead?.

US Polymers Continue To Test Relative Limits

Nov 5, 2021 3:23:23 PM / by Cooley May posted in Chemicals, Polymers, Polyolefins, Polyethylene, Polypropylene, HDPE, US Polymers, demand

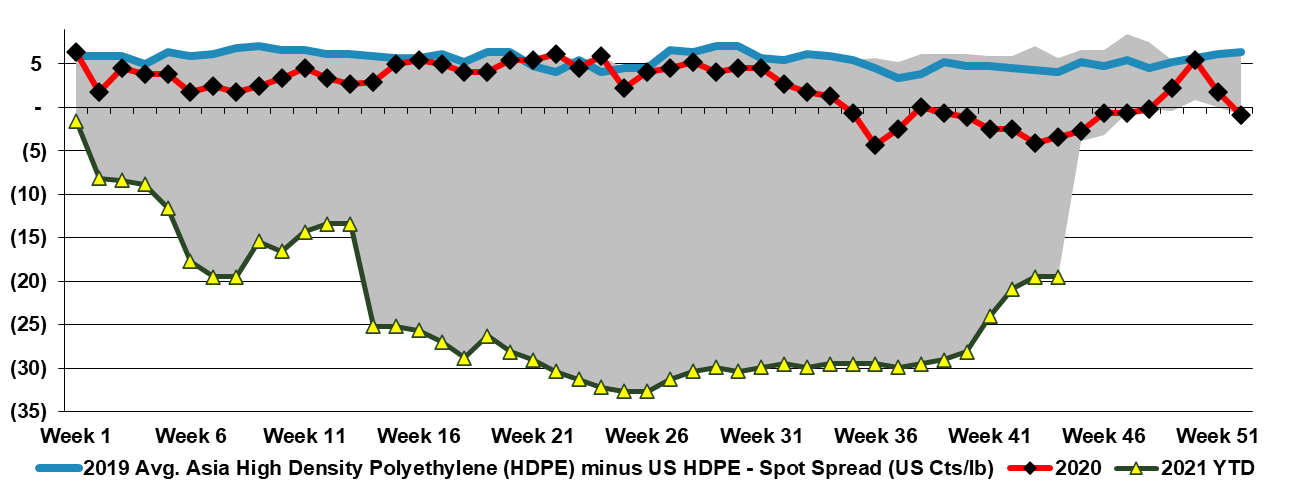

While we are beginning to see some easing in US polyolefin prices we note in today's daily that prices are not falling in step with monomers and so spreads are widening. Because of the very integrated nature of the polyethylene market, we see swings in where the margin is being captured based on relative tightness and today it is squarely biased towards polyethylene in the US. Despite the polymer price declines in the US we maintain a level of pricing that is well above Asia – Exhibit below, but not high enough to attract imports, given the high container rates and the long lead times on shipping. The same is not true for polypropylene, which maintains a spread versus Asia that can cover the very high current costs of transport (bottom exhibit).

DuPont: More Value From More Actions

Nov 2, 2021 3:44:19 PM / by Cooley May posted in ESG, Chemicals, Polymers, Chemical Industry, COVID, DuPont, acquisitions, electronics, industrial technologies, automotive, divestments, water, resins

We are not surprised by some of the DuPont stories this morning. We had predicted a long time ago that Mr. Breen was far from done on the restructuring of the company and that COVID might have caused a delay in some of the plans but not changed them. Mr. Breen did a very value-enhancing job of taking Tyco from a slightly out of control, then GE wannabe, to a group of focused companies, separated from the whole. What he has panned for DuPont comes from the same playbook in our view. The divestments and acquisitions announced today will create a core at DuPont – focused on electronics, water, protection, industrial technologies, and “next generation” automotive. Given some of the recent industry moves, we would expect significant interest in the engineering polymers and other resins platforms. After these moves are complete, while not yet obvious from a valuation perspective, we could see a further split, carving out an ESG friendly piece focused around water and protection, although the moves announced today may be enough to get the company an earnings multiple boost.

Some Supply Signals Easing, But Some Proposed Fixes Are Inflationary

Oct 29, 2021 2:28:30 PM / by Cooley May posted in Chemicals, Polymers, Inflation, shipping, shipping costs, container freight rates, containers

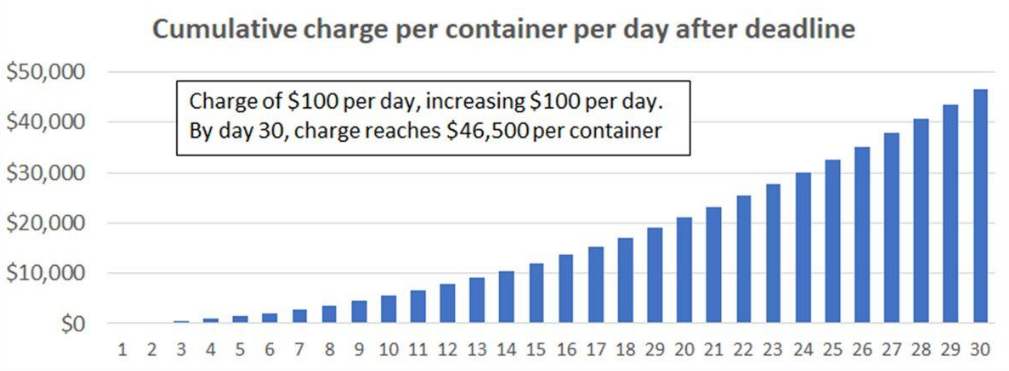

Shipping rates are falling steeply but we are not out of the logistic woods yet with the Ports of Los Angeles and Long Beach proposing very punitive charges for containers that are not collected quickly enough. The initiative is intended to decrease bottlenecks at the ports by clearing the docksides more quickly, but the reason why there are delays is often out of the shippers' and buyers’ hands as it is a lack of truck drivers and rail capacity that is at issue. The penalty rates proposed are steep and might discourage some shipments – especially of polymers and other low-value products. If it takes you an extra 20 days to offload a container from the port the cost of shipping polymers from Asia would double – very few importers would take that risk given the small margin opportunity that exists in the trade already. The penalties might encourage trucking companies to increase driver compensation to attract more drivers, but only if they can pass the potential penalty through to their customers. While this move proposed for containers may help drive down some of the port congestion times it is not a good sign for inflation as someone will have to pay – either pay the fines or pay up to improve resources to clear the containers more quickly.

Relative Economics Keep US Chemicals On The Tracks

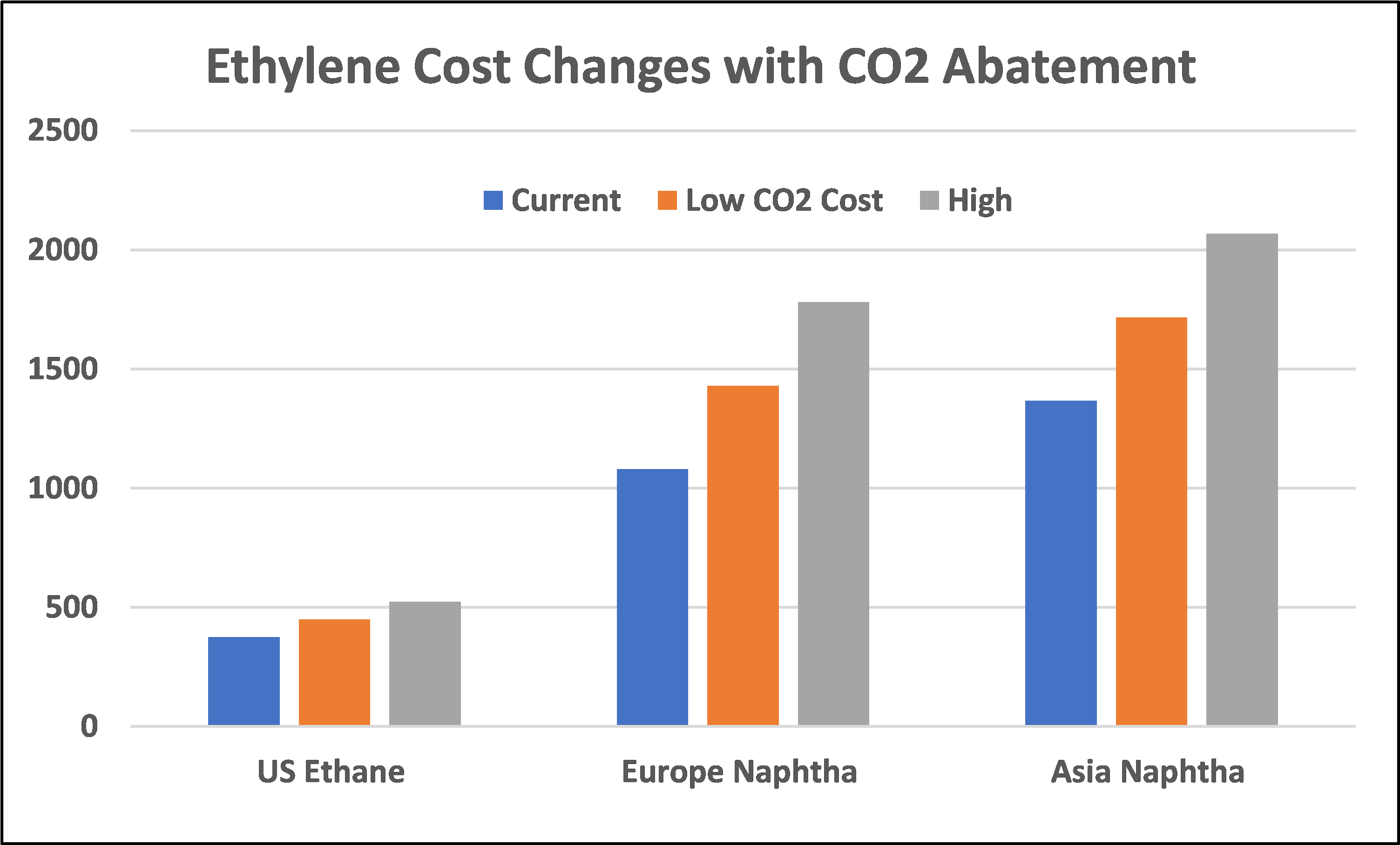

Oct 28, 2021 2:39:10 PM / by Cooley May posted in Chemicals, LNG, Methanol, carbon abatement, natural gas, CO2 footprint, Methanex, low carbon ammonia, chemical shipments, commodity chemicals, methanol capacity, low carbon polymers

Global commodity chemicals are often a relative rather than an absolute game, especially where there is significant international trade. The global price of natural gas has risen dramatically, especially in countries or regions where the marginal BTU is coming from imported LNG – see yesterday’s daily report for a comparative chart. The US may be seeing much higher natural gas prices but other parts of the world have it much worse, and with most of its methanol capacity in regions/areas with very competitive natural gas, it is not surprising that Methanex is upbeat. The higher natural gas price in the US is giving Methanex and other US producers the ammunition to raise prices and the higher costs outside the US mean that international volumes are going to find more attractive markets in many locations versus the US. While we have seen some moves to create low carbon polymers and low carbon ammonia, this has not come to methanol yet and methanol does have one of the largest CO2 footprints, per ton of product. While Methanex is currently talking about returning surplus cash to shareholders, there may come a time – sooner rather than later – when some of that cash gets redirected to carbon abatement.