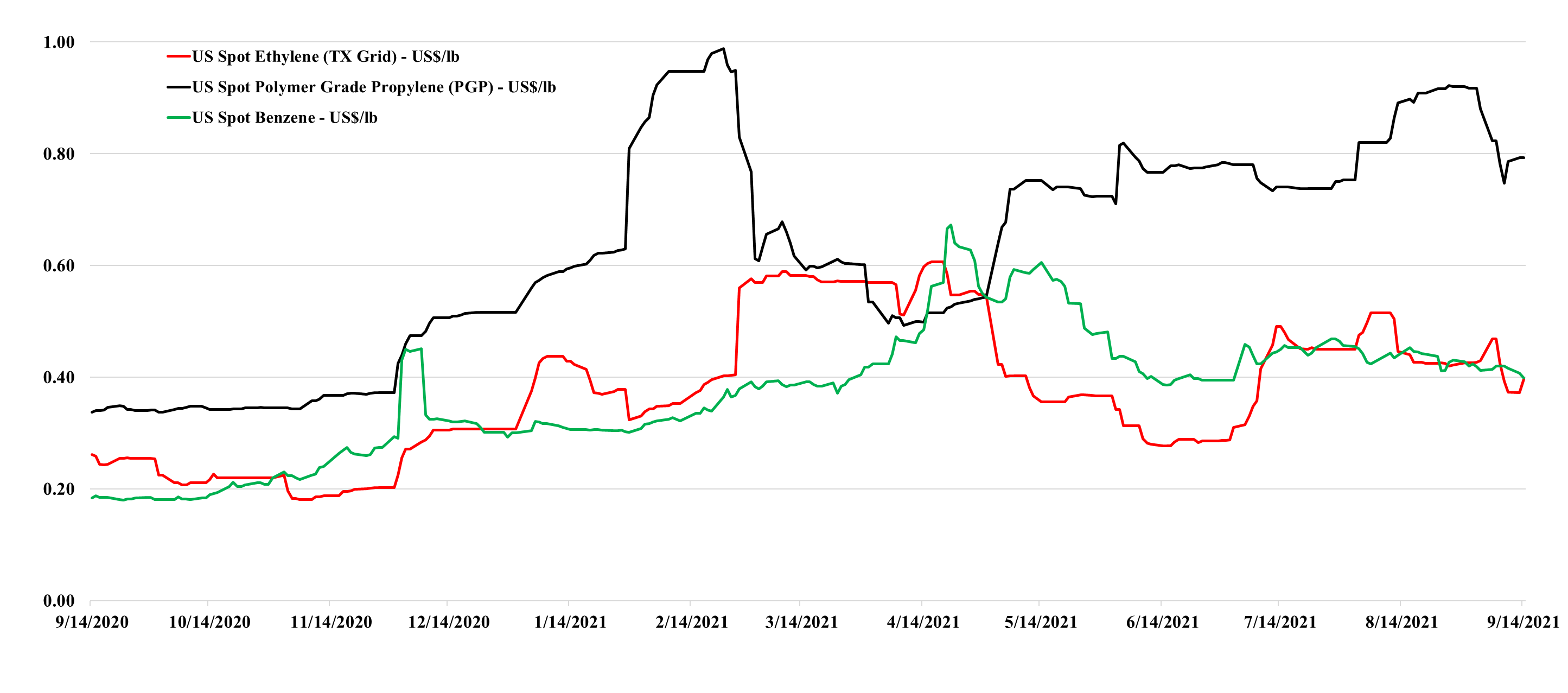

US ethylene prices have bounced off a low this week largely, in our view on the steep rise in natural gas and ethane. The drop in ethylene prices over the last couple of weeks signals an imbalance whereby production is more than enough to satisfy domestic demand and export demand. Export demand is limited by terminal capacity, and we have seen some domestic demand issues for polyethylene, not because of demand weakness, but because of export logistic bottlenecks, that are resulting in product (with homes to go to) backing up in the US ports. Given the timing of this build-up, we may see some higher end-quarter working capital from some of the chemical companies with sizeable export footprints for 1Q 2022. The sharp increase in US natural gas prices and the catch up that ethane has made to natural gas, should keep some upward pressure on spot ethylene prices if gas prices remain high. Propylene remains very supported by high propane prices.

US Propylene Is A Very Different Market Than Ethylene

Apr 8, 2022 1:04:37 PM / by Cooley May posted in Chemicals, Propylene, Polyethylene, Ethylene, Chemical Industry, Ammonia, Supply Chain, ethane, natural gas, natural gas prices, US ethylene, US propylene, fertilizer

Guidance Is Tough For Corporates To Provide; US Competitive Advantage Still Rising

Mar 11, 2022 2:56:20 PM / by Cooley May posted in Chemicals, Ethylene, hydrocarbons, US ethylene, DuPont, Navigator Gas, Russia, cost advantage, Ukraine, Lanxess, corporate guidance, competitive advantage

The Lanxess guidance below is likely the right way to go for now. The medium-term effects of the Russia/Ukraine crisis are unknowable today and all companies can monitor is the immediate impact on their businesses. Most had entered 2022 seeing very strong demand growth and the promise of a much better year as COVID restrictions were lifted and economic activity picked up generally. Now all bets are off, as it is not just the primary impacts that matter – such as a companies’ direct exposure to Russia or Ukraine – note McDonald's is suggesting that pulling out of Russia will cost the company $50 million a month, for example – but also the secondary impacts of what the conflict is doing for supply-chains and pricing. Higher hydrocarbon pricing in Europe, for example, will impact the economics of all production, not just the products sold to Russia or Ukraine. There will also be some demand adjustments directly related to the conflict – disaster relief for example – more PPE – more spending on defense and defense-related materials – DuPont’s kevlar business should be seeing a benefit for example.

The US Cost Advantage Is Increasing Daily

Mar 4, 2022 1:59:01 PM / by Cooley May posted in Chemicals, LNG, Polyethylene, Ethylene, Inflation, Supply Chain, natural gas, US ethylene, naphtha, US natural gas, crude oil, Brent Crude, cost advantage

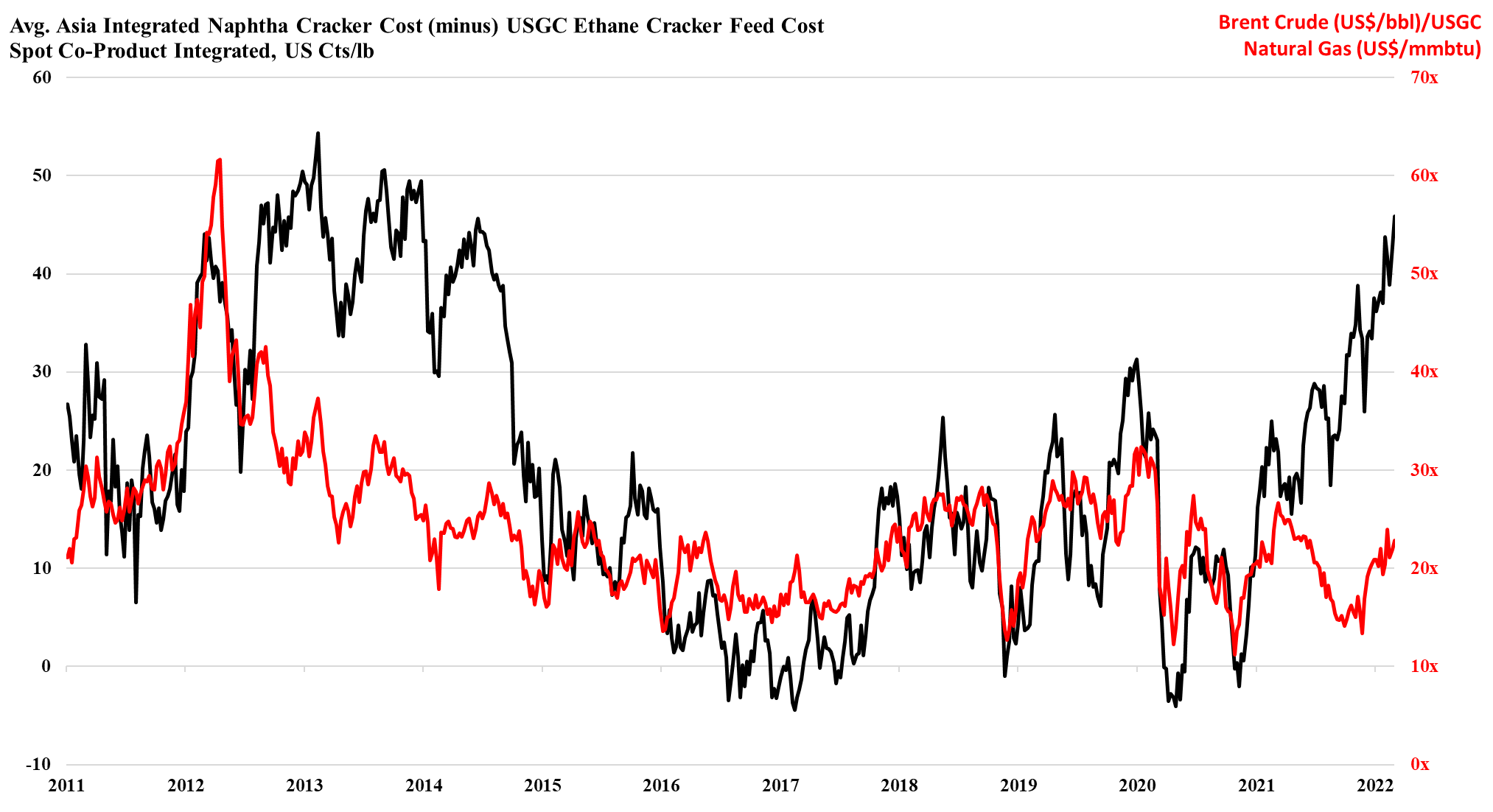

As the ratio of pricing between Brent crude and US natural gas rises, the US ethylene cost advantage is spiking, and as long as the US is producing enough natural gas to feed domestic demand and allow the LNG facilities to run at capacity, the advantage can remain. This gives the US a significant cost advantage and assuming that there is spare capacity the US industry can step up and support Europe if needed. However, it is not clear that there is much spare capacity, either in the production units or in the logistics to get the product to ports or across the Atlantic. There is a surplus of liquid and gas carriers today, but the container problems are global and the inflation and supply chain issues that we seem to be stuck with are likely to keep containers tied up in excess inventory that consumers will want to keep building as a cushion for a less certain supply outlook. The shipping issues are only part of the problem for Asia, as even with better opportunities to export, the region is seeing escalating production costs because of the movement in crude oil and naphtha pricing. We are in an unusual position where strong demand in the US is keeping domestic prices higher than in Asia, despite costs in the US that are low enough, especially for polyethylene to move material to Asia at costs well below the cost of manufacture in Asia. This dynamic can last for a lot longer in our view as long as oil prices remain elevated versus US natural gas. An abrupt turn will occur if US natural gas production falls below domestic demand and LNG demand – this would cause a spike in US natural gas prices. For more see today's daily report.

Some Holiday Stability For Ethylene And Propylene

Dec 22, 2021 1:55:27 PM / by Cooley May posted in Chemicals, Ethylene, Chemical Industry, US ethylene, ethylene exports, PDH, US propylene, feedstocks, US propylene demand

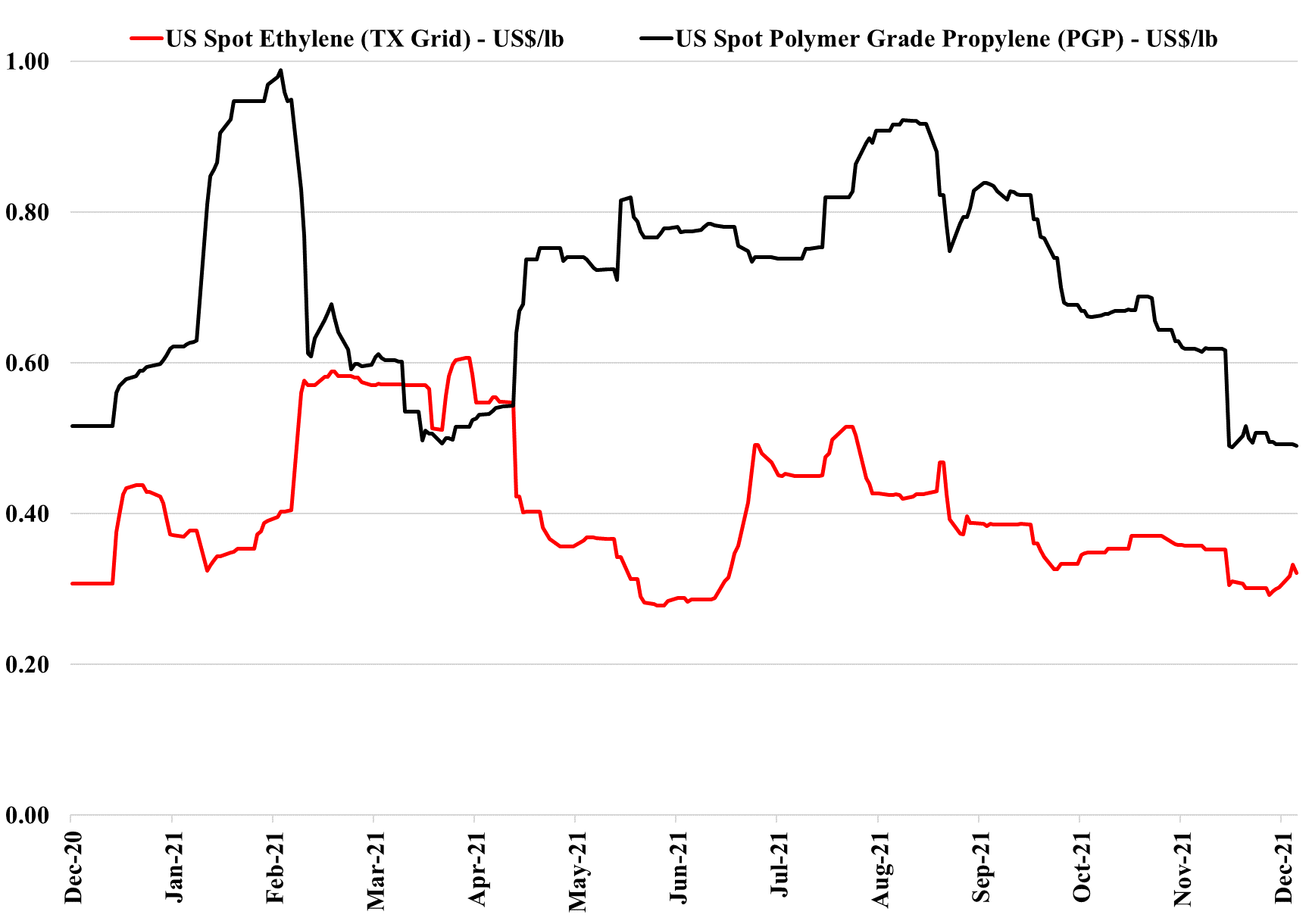

We have seen relative stability in US spot ethylene and propylene prices for several weeks now, despite some volatility in feedstock markets. Ethylene likely has significant export support in that there are complexes in Asia that are net short of ethylene and where derivative production can be increased if ethylene is available at the right price. There are also displacement opportunities if US ethylene can be delivered to importers in Asia at lower prices than local production costs. This is broadly the case today and there may even be select opportunities in Europe. In Asia it is likely easier, as the buyer would be replacing an alternate supplier. In Europe, most potential buyers would be looking at cutting back their own local production and that is a more marginal decision given the impact on unit economics of lower operating rates. US propylene demand remains high, but prices are now settling closer to PDH costs, although not close enough to encourage anyone to slow production. See more in today's daily report!

Could Enterprise Beam Up Ethylene?

Dec 17, 2021 2:54:43 PM / by Cooley May posted in Chemicals, Polymers, Ethylene, Air Products, LyondellBasell, Chemical Industry, Dow, US ethylene, Basic Chemicals, ethylene exports, Enterprise Products, COP26, acquisitions

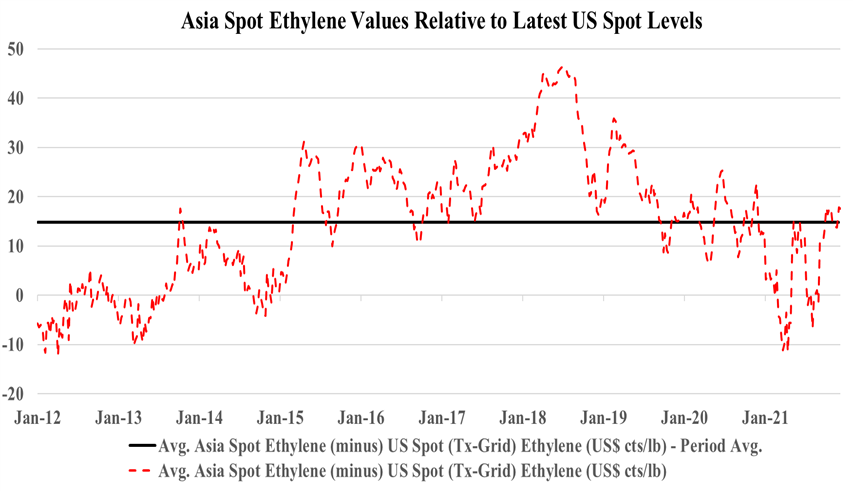

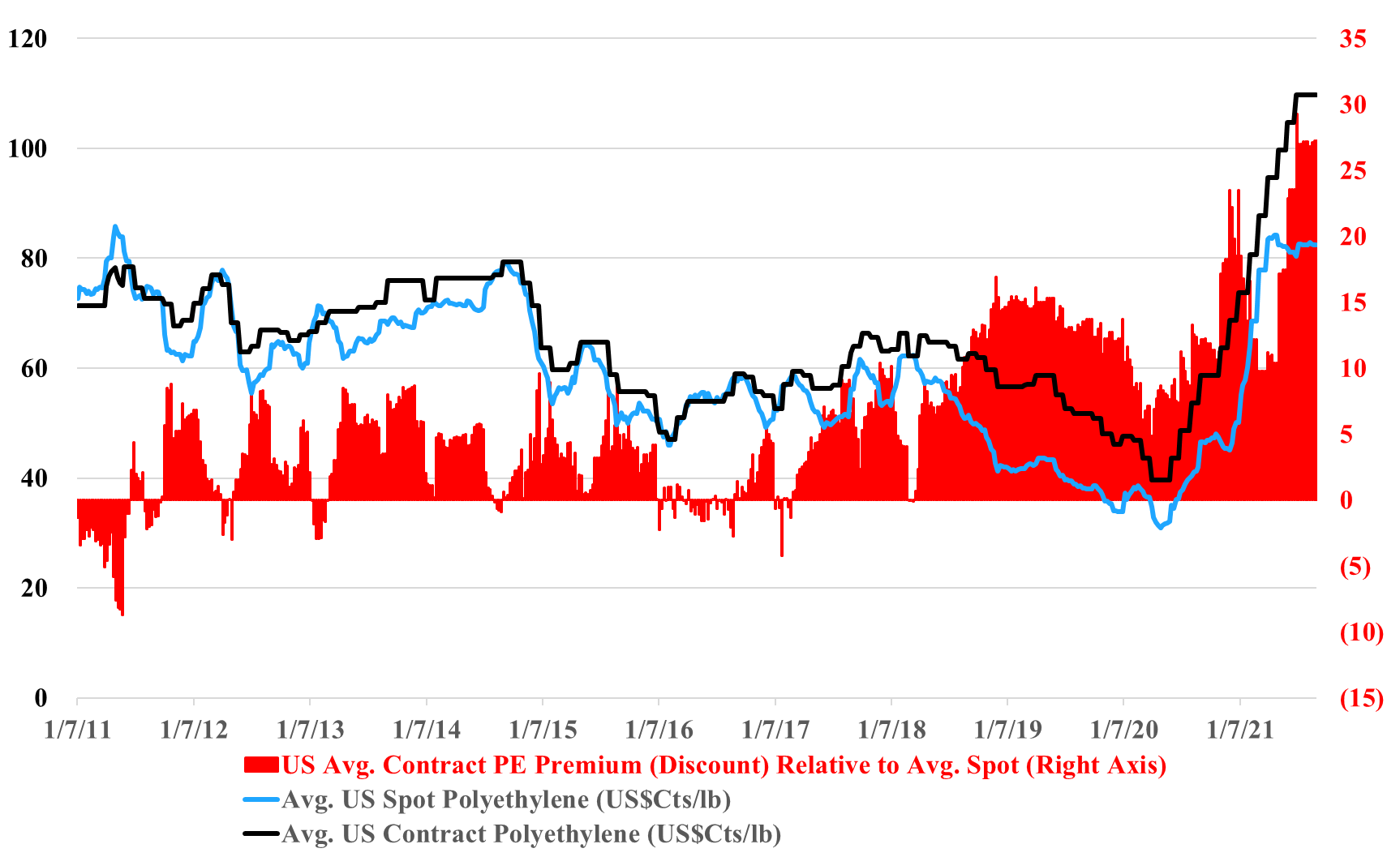

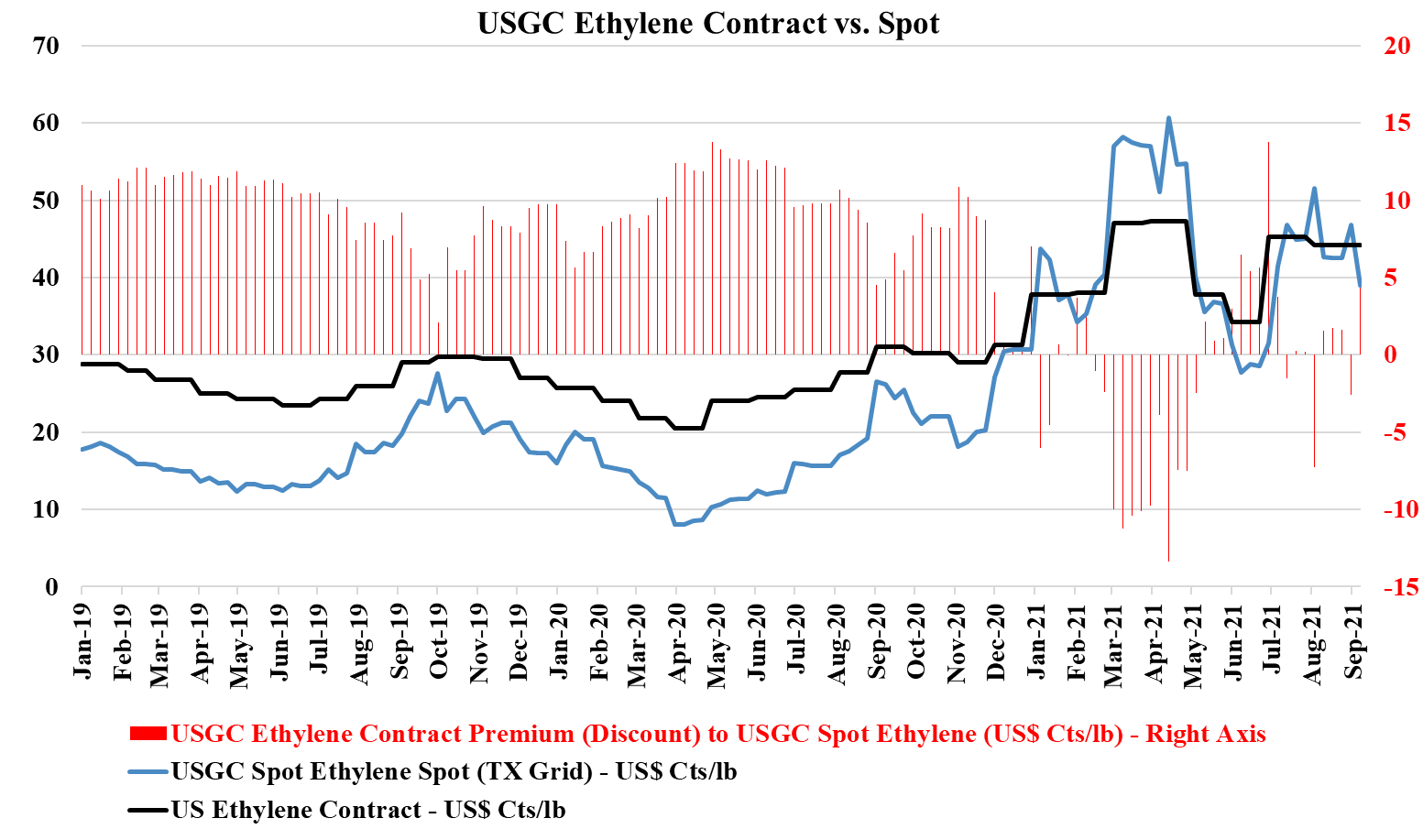

Following on from the Enterprise comments covered in our daily report, the company is more likely to acquire something in chemicals than build it in our view, especially if a move into ethylene or polymers is on the table. Today, building capacity will come with all sorts of emission-related restrictions most likely, and many of the new build announcements we have seen since COP26 have come with a carbon plan (Dow, Air Product, and Borouge). While it is not obvious today that any Gulf Coast ethylene capacity is up for sale, we would imagine that most companies are reviewing strategy and evaluating whether they have assets of entire businesses that may have a better owner. This would be especially true if a basic chemical business is holding back the valuation of a more interesting core. In the recent past, we have talked about the relative value arbitrage open to LyondellBasell from separating its compounding, licensing, and recycling business from the core. Maybe the core would fit well with Enterprise? As the chart below shows, there is money in buying ethylene for export, but there is more money in the US in making ethylene, as discussed in our daily report.

US Competitive Advantage Pushing Ethylene Exports

Dec 1, 2021 12:43:50 PM / by Cooley May posted in Chemicals, Ethylene, petrochemicals, propane, arbitrage, ethylene producers, Ethylene Surplus, US ethylene, manufacturing, naphtha, ethylene exports, exports, chemicalindustry, ethane imports, petrochemicalindustry, Navigator Gas

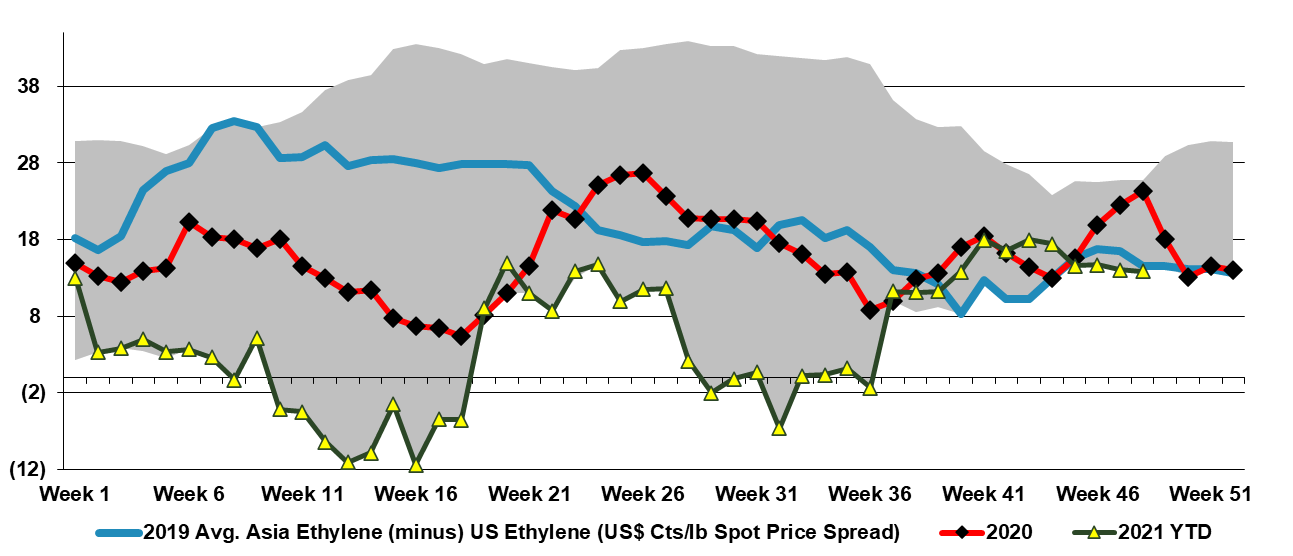

The Navigator Gas announcement should not be a surprise as the ethylene export arbitrage reopened in the US in September (Exhibit below) and since the terminal opened there has been a demand for ethylene exports each time the numbers have made sense. There are ethylene consumers in Asia that are net short and will buy incremental volumes from the US when the price is right relative to local suppliers and there is incremental demand in countries and regions that appear to be in surplus, including Europe, where a buyer can leverage an import to try to push local prices lower. In China, some of the facilities that require either propane or ethane imports might be better off buying ethylene versus making it today, and this is certainly the case for naphtha importers, as we highlighted in our Weekly Catalyst report on Monday. Today a US exporter can buy spot ethylene in the US and deliver it to China for less than the cost of manufacture in China, before the cost of getting the local ethylene to any consumer that is not on site.

Energy Moves Could Drive US Chemical Price Volatility

Nov 30, 2021 1:46:26 PM / by Cooley May posted in Chemicals, Polymers, Propylene, Ethylene, Energy, Benzene, PGP, Oil, US Chemicals, ethane, natural gas, US ethylene, Basic Chemicals, naphtha, polymer, polymer production, NGLs, ethylene feedstocks, crude oil, chemicalindustry, US benzene

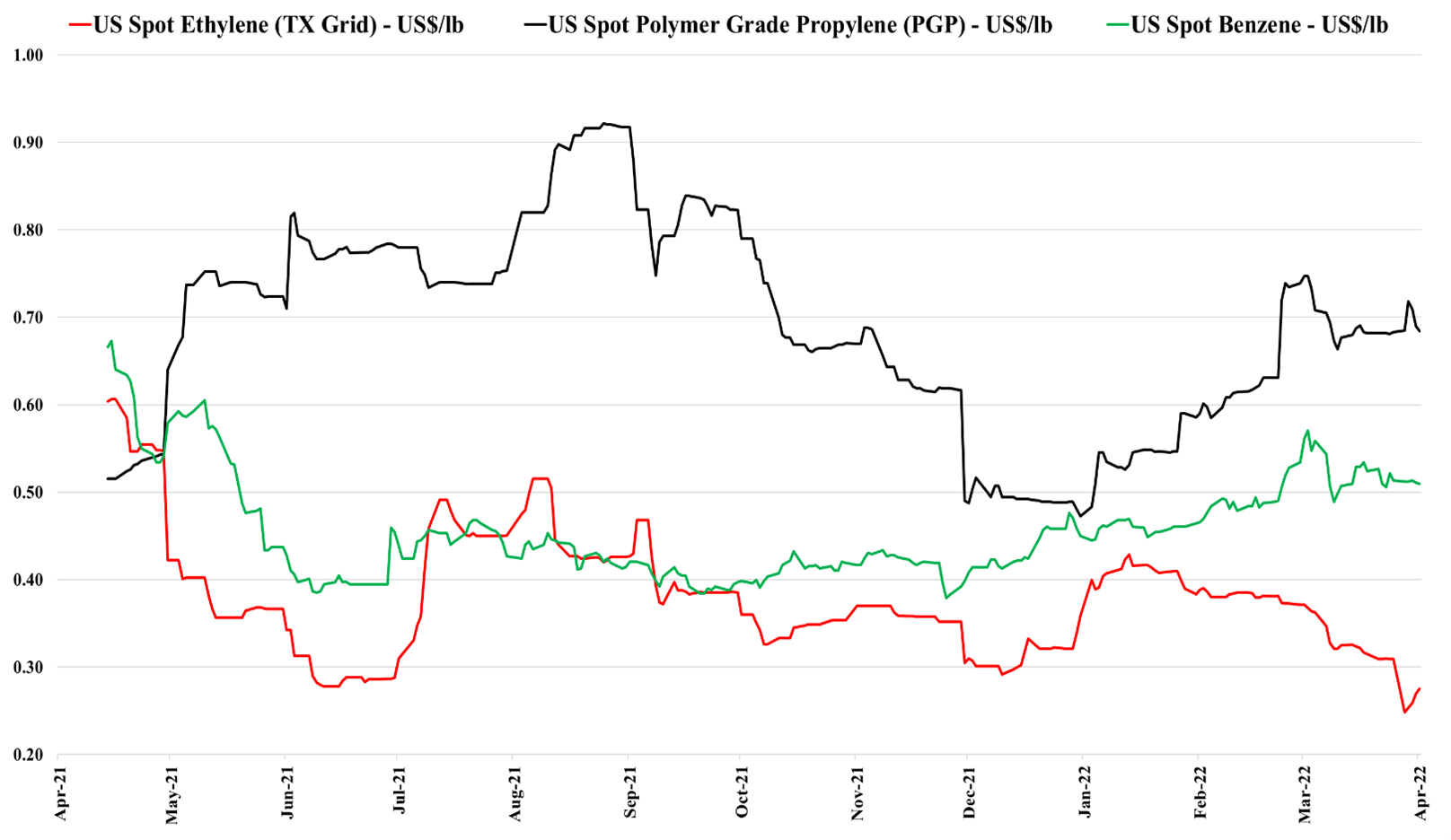

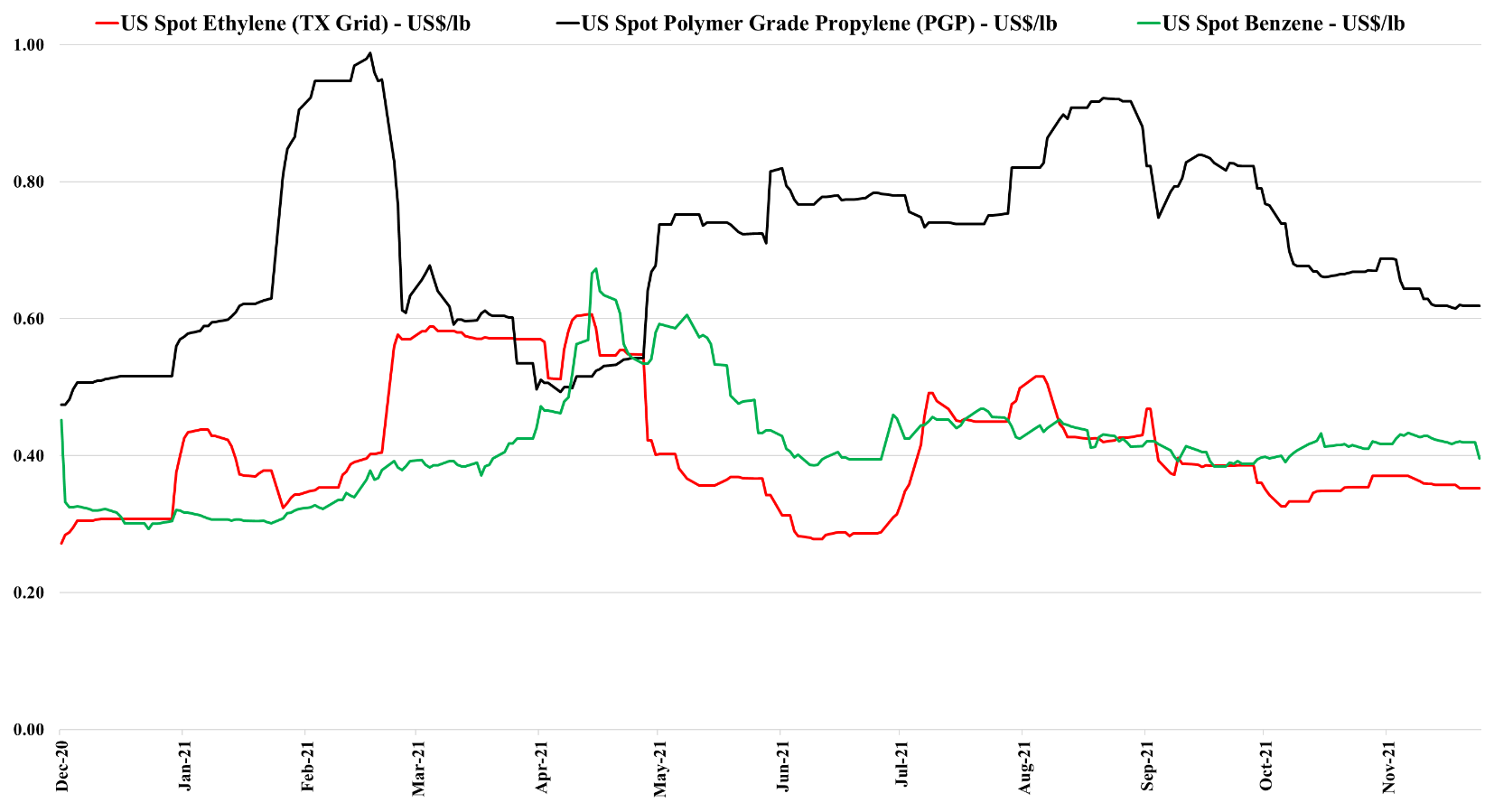

The drop in US benzene pricing is likely a function of lower crude oil pricing and the overall impact this is having on oil product values. As the US has moved to much lighter ethylene feedstocks, the proportion of benzene that is coming from refining is overwhelming and alternative values for benzene or reformate in the gasoline pool are a strong driver of US and international pricing. Lower naphtha pricing for ethylene units outside the US will also hurt benzene values. By contrast, the stronger natural gas market – through the end of last week - supported ethane pricing in the US and we saw a step up in propane pricing – which have provided support for ethylene and propylene – also note that the analysis we published yesterday in the weekly catalyst suggests that the US can export ethylene to Asia at current prices – delivering ethylene into the region below current local costs. This should keep a floor under US ethylene pricing although any further decline in crude oil prices relative to US natural gas and NGLs will close this arbitrage.

More Storm Related Volatility For Ethylene

Sep 14, 2021 1:24:12 PM / by Cooley May posted in Chemicals, Ethylene, supply and demand, US ethylene, Nicholas, ethylene production

What a difference a day makes – over the weekend we discussed how US ethylene pricing was approaching levels relative to Asia that could restart trade and today prices are jumping again in anticipation of possible lost production from the Tropical Storm. The risk from Nicholas is flooding, but it has already passed much of the South Texas capacity and the larger risk is to the capacity east of Houston and into Western Louisiana at this time. As with Ida, it will take several days to get a read on how much of the chemical and related capacity has been impacted and the likely impacts on supply/demand. See today's daily for more.

US Ethylene and Polyethylene: Instability From Many Directions

Sep 10, 2021 1:54:53 PM / by Cooley May posted in Chemicals, Polymers, Polyethylene, Polypropylene, Ethylene, Styrene, Dow, arbitrage, US ethylene, US polyethylene, ethylene glycol

The gap between the US contract and spot price for polyethylene in the exhibit below looks wrong, and it could be wrong in absolute terms but the trend alone makes a statement. In the past, we have seen a couple of instances where reported contract settlements have drifted further from net transaction prices, either because of larger agreed discounts or because of contract formulae that reflect spot pricing to a greater degree. This tends to work for a while, but ultimately smaller buyers with more limited purchasing power become more disadvantaged and there is a breaking point at which the “contract” price is adjusted downwards by the price reporting services to better reflect what is really going on. The current market feels like the times in the past when an adjustment has been needed.

US Monomer Prices Falling, But Weather Remains A Risk

Sep 9, 2021 4:03:52 PM / by Cooley May posted in Chemicals, Polymers, Propylene, Ethylene, PGP, ethylene producers, US ethylene, Propylene Derivatives, US propylene, Hurricane Ida

We saw the stable to downward trends in both US ethylene and propylene spot prices reverse at the end of 2020, in part because of recovering demand post the initial wave of COVID, but also because of storm-related production constraints in October and early November. The weaker spot markets for both ethylene and propylene today reflect much stronger production for propylene (all PDH capacity running) and Hurricane Ida-related upsets that have left the monomer markets less badly impacted than derivatives. Something similar happened in 2020, especially for ethylene, but the backlog of derivative demand cause a step up in ethylene consumption when everything restarted. This could happen again, and we are earlier in the Hurricane season. See today's daily report for more.