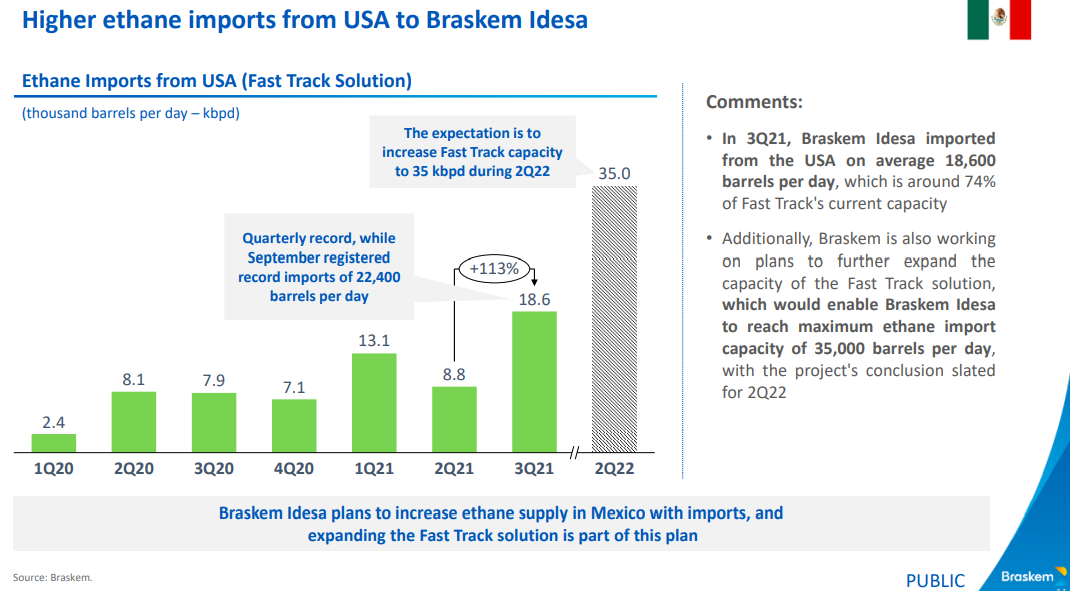

With ExxonMobil and Baystar’s ethylene plants in start-up and Shell expected to come online in Pennsylvania in 1H 2022, the news that Braskem wants to double its ethane imports from the US in 2022, adds to concern that the US may struggle to meet ethane needs at peak demand rates in 2022. We would be less concerned if we saw natural gas production rising, which is unclear for 2022, despite the expected new LNG capacity. Ethane is likely to follow any upward movement in natural gas pricing as there will be a need to bid the product away from heating alternatives. The increment suggested by Braskem in the Exhibit below is not larger in the overall scheme of US ethane demand, but every gallon may matter in 2022. See today's daily report for more.

US Ethane Markets To Tighten In 2022 Amid Greater Demand

Nov 11, 2021 1:47:28 PM / by Cooley May posted in Chemicals, LNG, Plastics, Ethylene, ExxonMobil, petrochemicals, hydrocarbons, ethane, natural gas, US Ethane, Baystar, ethylene plants, Braskem, chemicalindustry, ethane imports, oilandgasindustry, plasticsindustry, petrochemicalindustry

EU Ambitions Require More Natural Gas, Supply Readiness In Question

Nov 3, 2021 1:44:26 PM / by Cooley May posted in LNG, Energy, natural gas, oil producers, energy shortages, green energy, nuclear power

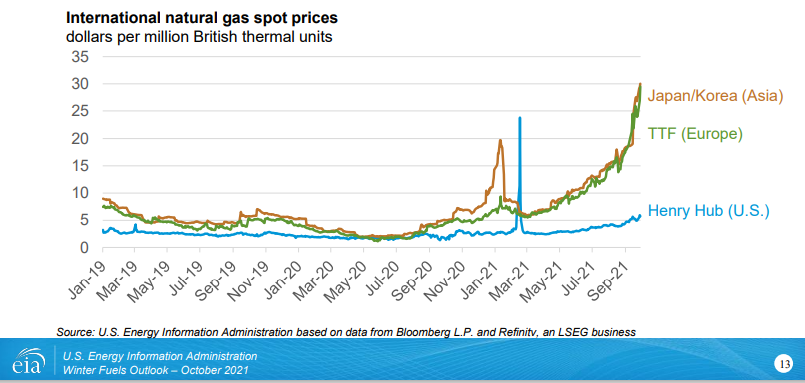

The EU revision to its green energy plans to include both nuclear and natural gas-based power is a direct response to the current energy shortage and price inflation that is evident in the exhibit below. While high natural gas pricing is part of the problem, Europe's renewed willingness to include natural gas in its forward energy planning may drive local investment to produce more gas and foreign investment to provide more LNG. The move indicates that the EU does not see the current natural gas shortage as a short-term issue. The nuclear inclusion is likely aimed at delaying any further planned nuclear closures and we have seen recent delays in closing older US facilities for the same reason - closures will put too much strain on an already challenged power grid and prices for power could be pushed higher by even higher natural gas prices.

Relative Economics Keep US Chemicals On The Tracks

Oct 28, 2021 2:39:10 PM / by Cooley May posted in Chemicals, LNG, Methanol, carbon abatement, natural gas, CO2 footprint, Methanex, low carbon ammonia, chemical shipments, commodity chemicals, methanol capacity, low carbon polymers

Global commodity chemicals are often a relative rather than an absolute game, especially where there is significant international trade. The global price of natural gas has risen dramatically, especially in countries or regions where the marginal BTU is coming from imported LNG – see yesterday’s daily report for a comparative chart. The US may be seeing much higher natural gas prices but other parts of the world have it much worse, and with most of its methanol capacity in regions/areas with very competitive natural gas, it is not surprising that Methanex is upbeat. The higher natural gas price in the US is giving Methanex and other US producers the ammunition to raise prices and the higher costs outside the US mean that international volumes are going to find more attractive markets in many locations versus the US. While we have seen some moves to create low carbon polymers and low carbon ammonia, this has not come to methanol yet and methanol does have one of the largest CO2 footprints, per ton of product. While Methanex is currently talking about returning surplus cash to shareholders, there may come a time – sooner rather than later – when some of that cash gets redirected to carbon abatement.

Natural Gas: Good If You Have It, Very Bad If You Don't

Oct 27, 2021 3:11:03 PM / by Cooley May posted in LNG, Methane, Energy, Inflation, natural gas, power, chemical companies, energy inflation, energy costs, forecasts

There are lots of discussions around the durability of higher energy prices and energy inflation is a central topic on some earnings conference calls and in many of our discussions with clients, especially those at chemical companies with the unfortunate task of having to prepare a 2022 budget, which of course includes a forecast of costs. We see continuing strain on the US and global natural gas system and, behind what will inevitably be some seasonal weather-related price volatility, a stronger market that could endure for years. The rate of addition of renewable power does not seem to be able to keep up with demand growth and replacement needs caused by some fossil fuel-based power plant closures around the World. Natural gas (LNG) is the natural plug-in replacement, and we continue to see underinvestment, relative to natural gas prices, as a consequence of ESG related pressure around capital spending. We would advise all clients to look at a 2022 scenario with natural gas, and oil higher than current levels.

More LNG For The US, But Less Gasoline!

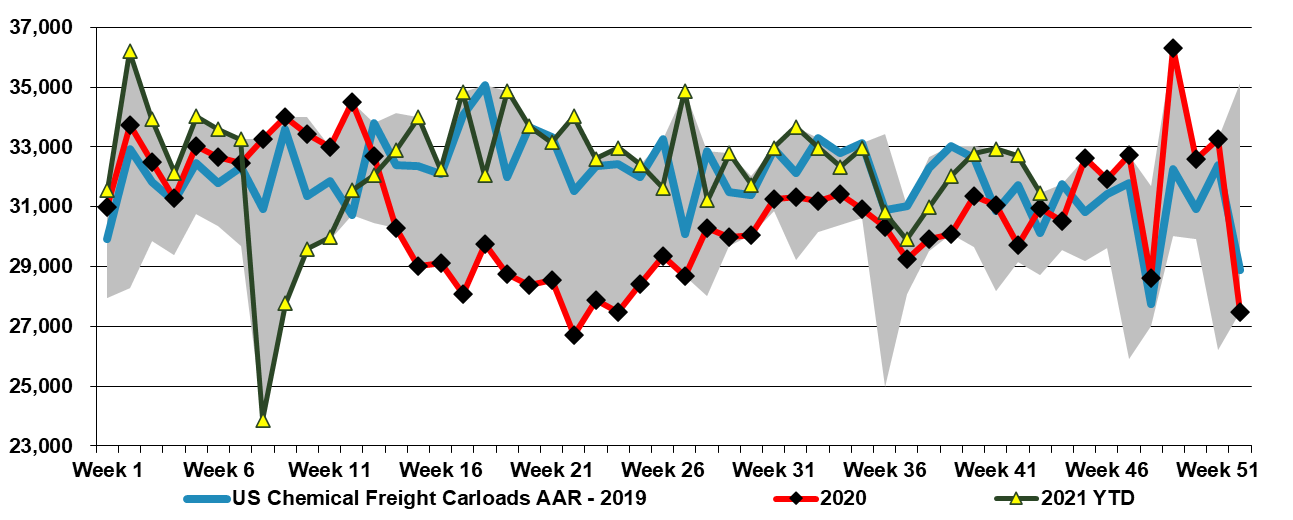

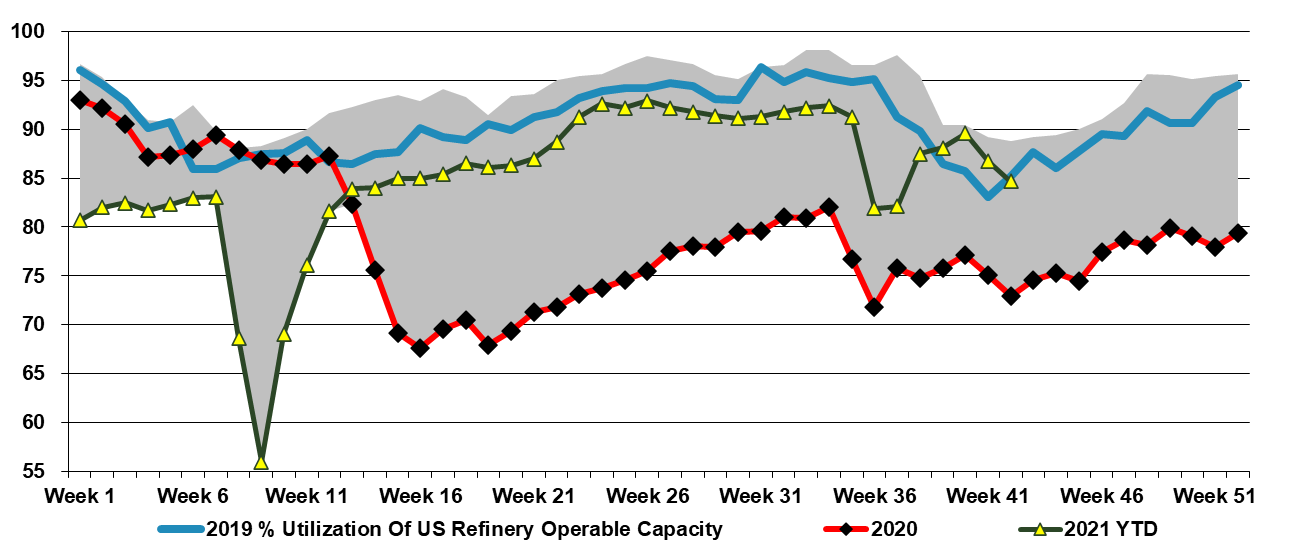

Oct 21, 2021 2:20:32 PM / by Cooley May posted in Chemicals, LNG, natural gas, Sinopec, energy shortages, US refining rates, gasoline, refinery capacity

The Venture Global LNG contracts with Sinopec are likely the big energy news of the day, as is the expectation that the West Louisiana terminal is close to completion and could begin shipping as soon as late 2021, according to a report in the Financial Times today. This would be earlier than prior guidance and will add demand pressure to a US natural gas balance that is already tight (distracted in the immediate term in our view by a wave of mild weather). With Venture Global now likely to go ahead with its second LNG facility, as well as other capacities under construction, we will likely see greater inflation in US natural gas prices without increased E&P spending.

Lack Of Consumer Goods Make Higher Energy Prices More Affordable…

Oct 14, 2021 3:42:08 PM / by Cooley May posted in Hydrogen, LNG, Air Products, natural gas, EIA, shortages, Consumer Goods, energy prices

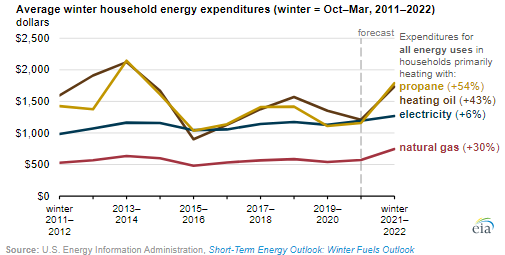

At this point, it has stopped being a story about how transient higher energy prices might be and instead become a story of how high could they go as well as how long the higher prices could last. With sentiment easing in the US because of an expected milder October, we also have the headline of the restart of Cove Point LNG, which should add to natural gas demand. The EIA, in the chart below, shows US prices peaking through the end of the year before falling again in early 2022. There remains an expectation that the rest of the world will be short of LNG and so we will either see the US natural gas competitive advantage remain strong, or the US LNG facilities will stretch their underutilized nameplate capacity and this could be supportive of higher US natural gas prices. New LNG capacity does not hit until late 2022 and how much is exported until them will be a function of the throughput of the existing terminals – which today look like they were very prudent investments.

What's Contributing To Truck Driver Shortages & Why It Matters

Oct 5, 2021 8:31:12 AM / by Graham Copley posted in Chemicals, LNG, freight, Logistics, transportation, Shortage, truck drivers shortage, trucking

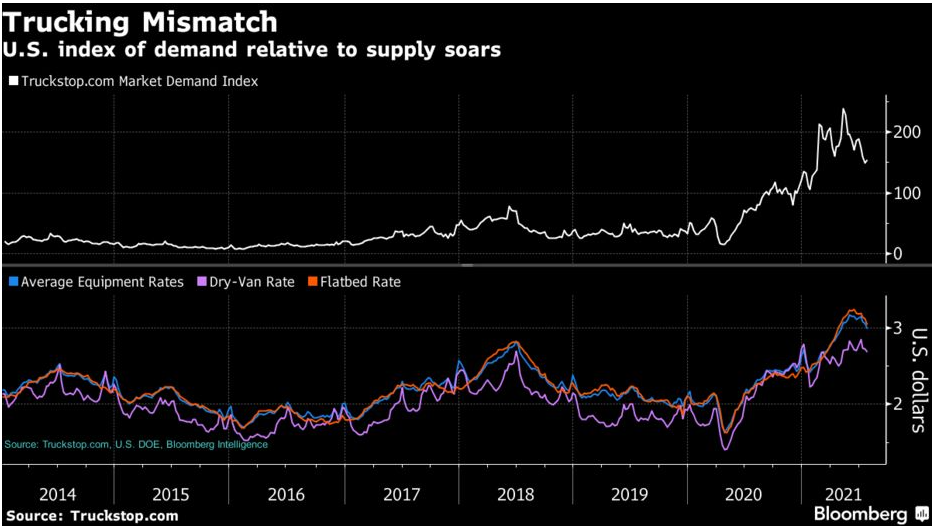

Our Sunday thematic and weekly recap report covers how the US is short of truck drivers (60,000) during a period when freight is struggling to move from congested ports – holiday buying will add more stress. This matters because we have record shipments of containers on the docks at US ports and record shipping backlogs waiting to unload as well as well documented shortages of durables in warehouses and at retailers.

The image below shows the mismatch in driver availability and trucking rates:

High Natural Gas Prices May Be Here To Stay Without More E&P Investment

Oct 1, 2021 1:54:55 PM / by Cooley May posted in LNG, Coal, Energy, ExxonMobil, natural gas, power, renewables, Gas prices, Venture Global

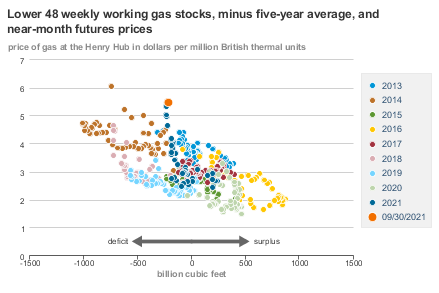

It is a gas, gas, gas! Every other story this week is about natural gas shortages and pricing – whether it is natural gas in the US or LNG everywhere else. The scatter diagram below from the EIA below is very interesting as it speaks of anticipation more than anything else. Gas prices are high given the level of US inventory relative to “normal”. There is speculation that demand is going to outstrip supply over the next few months. Whether much of this will be LNG-related remains to be seen as we may not be able to run the current capacity any faster – that said, through the end of July it looked like there was spare capacity at several of the US LNG facilities and maybe the constraint is shipping. Regardless, the current US price implies shortage, whether because domestic demand overwhelms supply this winter or because LNG steps up. The original timeline of the Venture Global facility at Calcasieu Pass in Louisiana has slipped and this facility will not impact demand for the next 12 months at least, with ExxonMobil’s Golden Pass project a year later and targeting a 2024 start.

US Methanol Sees Support From Higher US Natural Gas and Overseas Markets

Sep 29, 2021 2:14:00 PM / by Cooley May posted in Chemicals, Polyolefins, LNG, Methanol, propane, olefins, natural gas, naphtha, chemical production

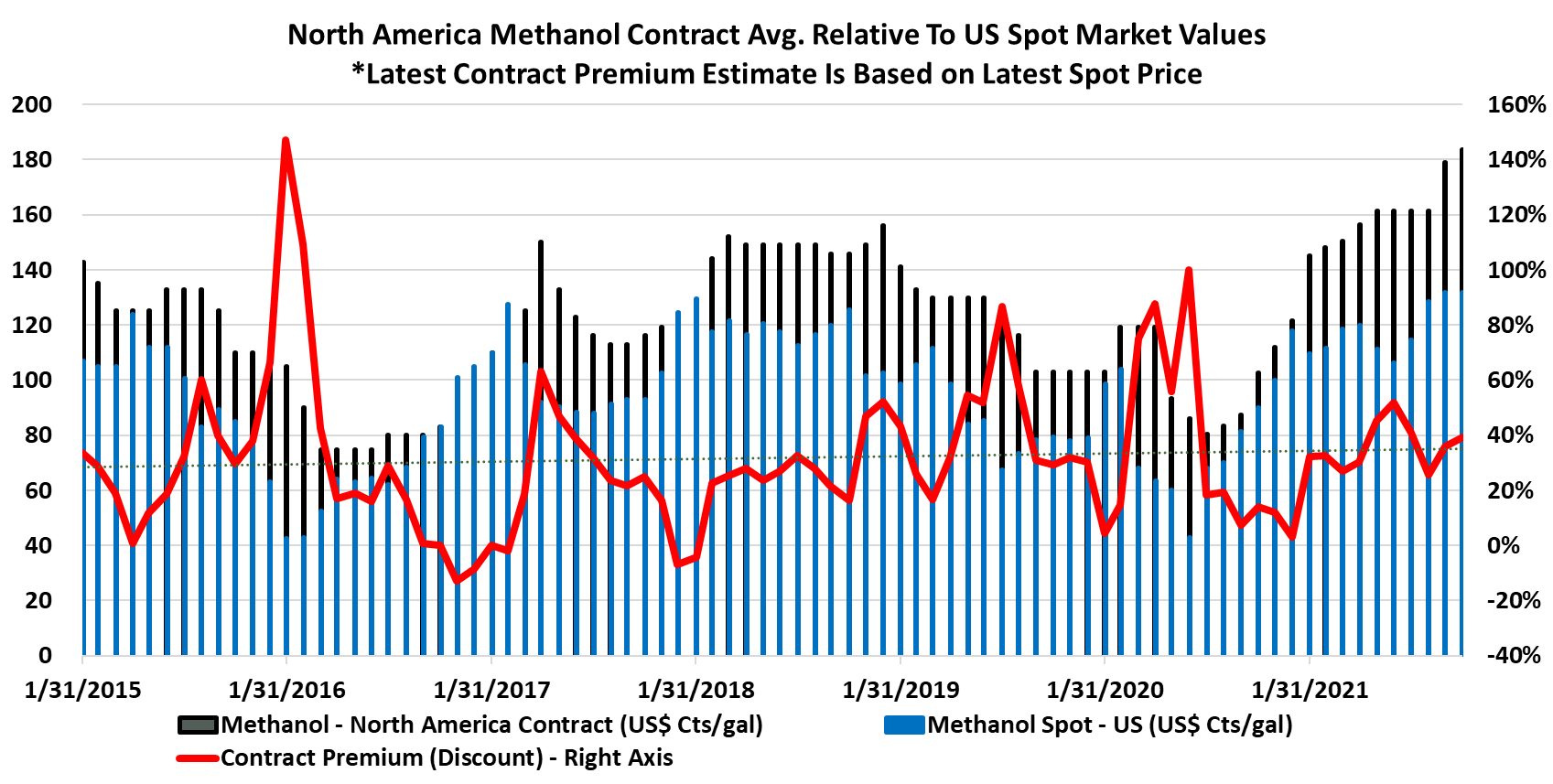

The charts below show that North American methanol pricing is seeing support from higher natural gas prices as you would expect, but we are also seeing some significant price improvement in China, See more in today's daily report. If China is coal constrained, as suggested in many of the power-related stories, it may be impacting chemical production from coal at the margin. Alternatively, with LNG prices so high and imported naphtha and propane prices rising in China, the country may be using more coal at the margin to make chemicals.

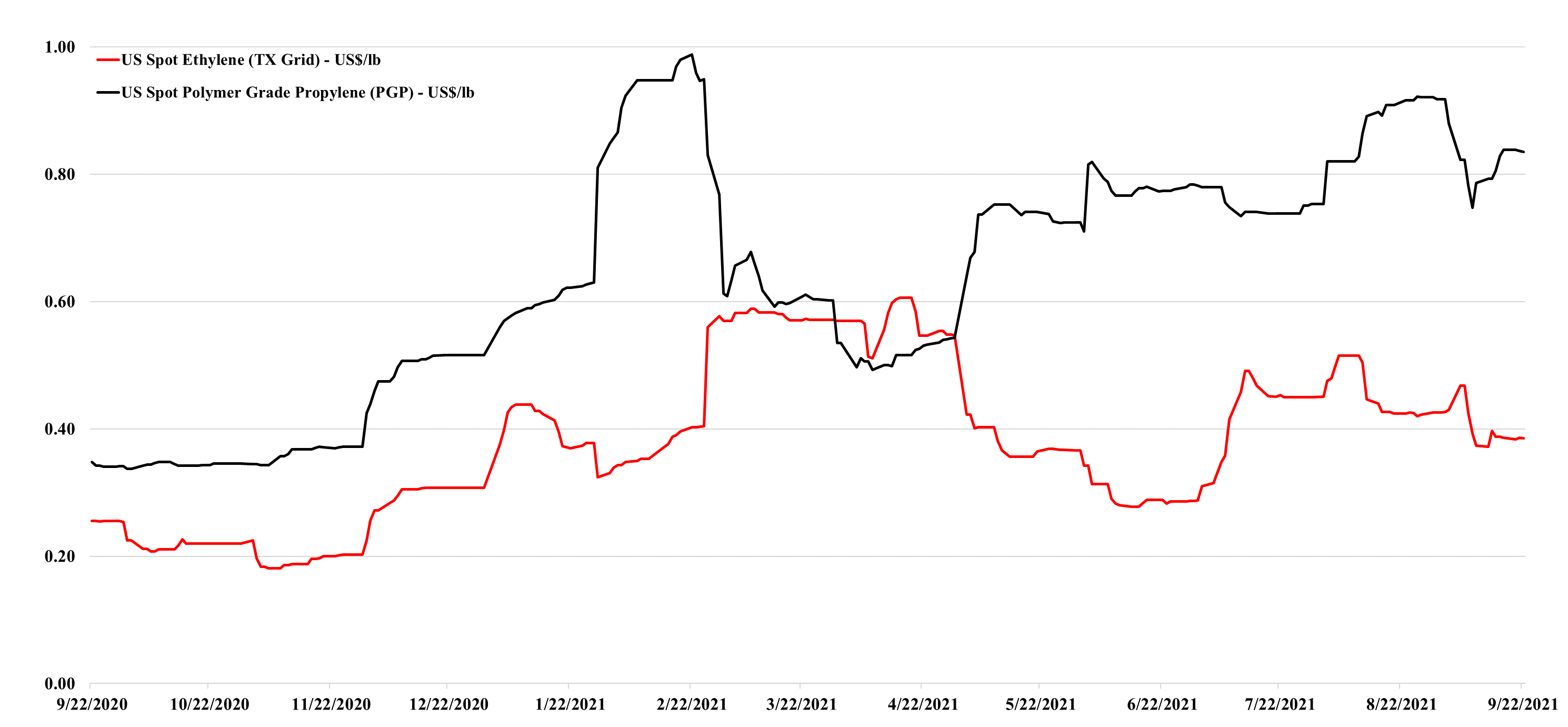

Natural Gas Short, Ethylene & Propylene Not So Much...

Sep 22, 2021 3:15:00 PM / by Cooley May posted in Chemicals, Propylene, LNG, Methanol, CO2, Ethylene, Ammonia, natural gas

The major issue with the higher natural gas prices in Europe (and rising prices globally) is the knock-on inflationary impact it will have on products that have natural gas as a feed, rather than those buying it as a fuel. The fuel buyers will take some of the hit, but will also try to pass on some of the hit, as it is generally a small part of overall product or service costs. The focus has been on ammonia/urea production because of the knock-on effect on food-grade CO2. But other products, such as methanol, would also be impacted, although there is not much methanol capacity in Europe. Higher LNG prices in Asia could encourage more coal-based methanol production, which is precisely what the increased use of LNG was supposed to prevent – replacing a high carbon footprint route with a much lower one. In our view, it is imperative that the attendees of COP26 recognize the need for (cleaner) natural gas and LNG, and enact policies to support it. This inflationary lesson is well-timed.