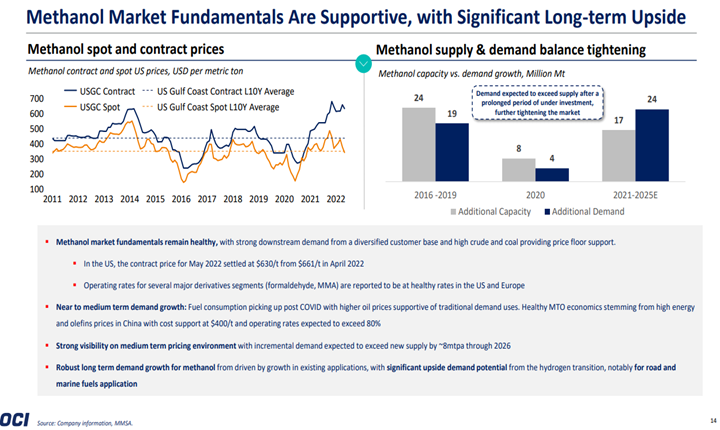

Today's apparent exceptions are in sectors very focused on energy security and transition, as we noted in our most recent Sunday Thematic, and agriculture, where crop shortages are driving up prices and demand for yield-enhancing inputs. In the OCI results below, we see a company doing well, despite having impacted assets in Europe. Still, we also see some potential upside in methanol as we head into the European winter, with the possibility that methanol is used as a fuel, essentially as a carrier for methane, and a workaround for constrained LNG infrastructure. As a fuel, it is not directly substituted for methane in any application, as it is a liquid, but some energy users might be able to adapt, and a $30 per MMBTU natural gas price in Europe can cause you to be quite creative. Of course, the methanol export opportunity for the US will depend on the US natural gas price remaining well below the price in Europe. For more see today's daily report.

Is Methanol An Energy Carrier?

May 12, 2022 2:19:59 PM / by Cooley May posted in LNG, Methane, Methanol, Energy, natural gas, energy transition, Agriculture, fuel, crop shortages

US Competitive Advantage To Offset Some Ex-US Polyethylene Producer Losses

Mar 10, 2022 2:50:46 PM / by Cooley May posted in Chemicals, Polymers, Crude, LNG, PVC, Polyethylene, LyondellBasell, HDPE, polyethylene producers, polymer producers, ethane, natural gas, Basic Chemicals, NGL, Westlake, oil prices

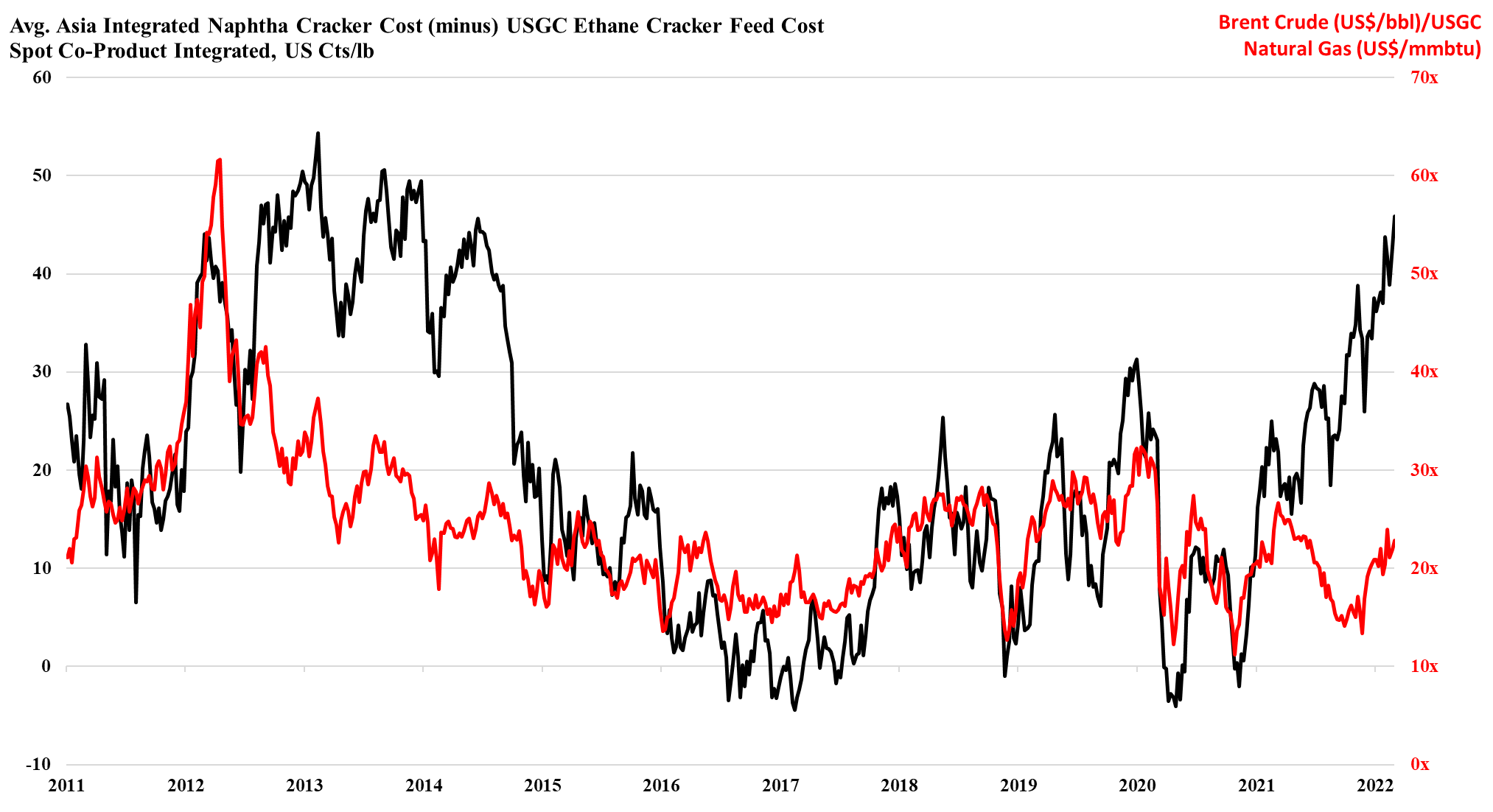

As noted in Exhibit 1 from today's daily report, the jump in oil prices has plunged the European polyethylene producers into the red and pushed Asian polyethylene producers further into the red. This will inevitably result in price increases as basic chemical and polymer producers will shut down at negative margins, and these price rises offer an opportunity for the US, Middle East, and select other producers.

The US Cost Advantage Is Increasing Daily

Mar 4, 2022 1:59:01 PM / by Cooley May posted in Chemicals, LNG, Polyethylene, Ethylene, Inflation, Supply Chain, natural gas, US ethylene, naphtha, US natural gas, crude oil, Brent Crude, cost advantage

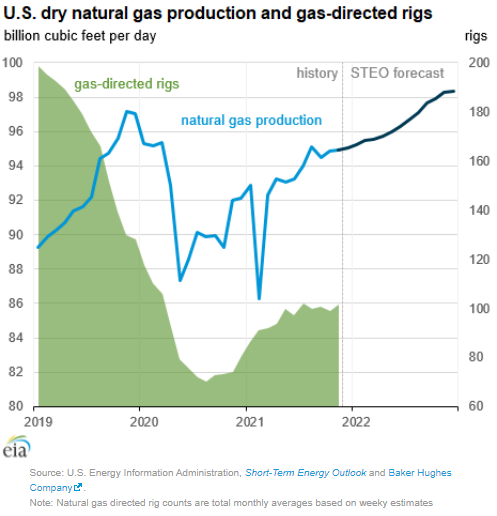

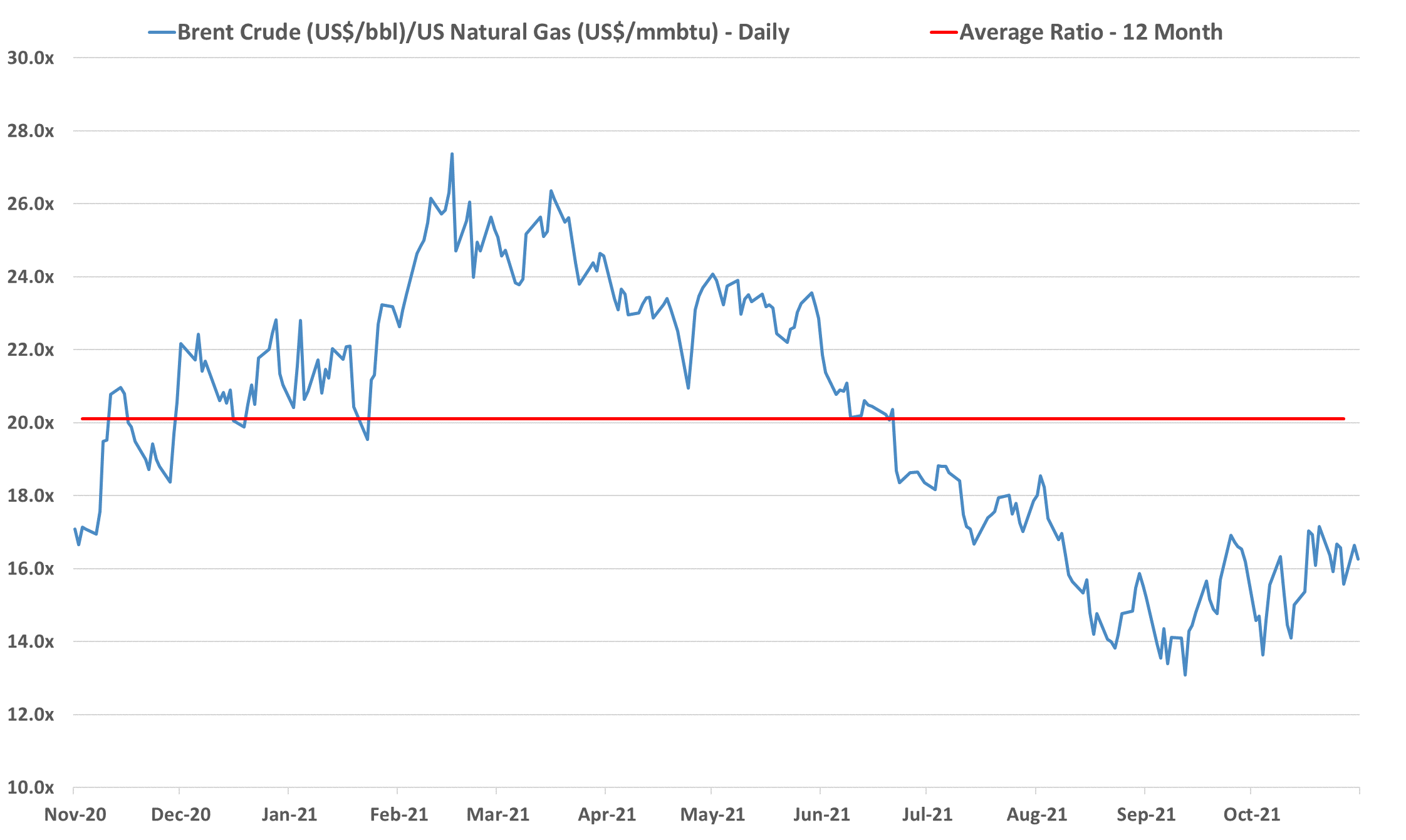

As the ratio of pricing between Brent crude and US natural gas rises, the US ethylene cost advantage is spiking, and as long as the US is producing enough natural gas to feed domestic demand and allow the LNG facilities to run at capacity, the advantage can remain. This gives the US a significant cost advantage and assuming that there is spare capacity the US industry can step up and support Europe if needed. However, it is not clear that there is much spare capacity, either in the production units or in the logistics to get the product to ports or across the Atlantic. There is a surplus of liquid and gas carriers today, but the container problems are global and the inflation and supply chain issues that we seem to be stuck with are likely to keep containers tied up in excess inventory that consumers will want to keep building as a cushion for a less certain supply outlook. The shipping issues are only part of the problem for Asia, as even with better opportunities to export, the region is seeing escalating production costs because of the movement in crude oil and naphtha pricing. We are in an unusual position where strong demand in the US is keeping domestic prices higher than in Asia, despite costs in the US that are low enough, especially for polyethylene to move material to Asia at costs well below the cost of manufacture in Asia. This dynamic can last for a lot longer in our view as long as oil prices remain elevated versus US natural gas. An abrupt turn will occur if US natural gas production falls below domestic demand and LNG demand – this would cause a spike in US natural gas prices. For more see today's daily report.

Is Demand Growth Driving Inflation? Or Vice Versa?

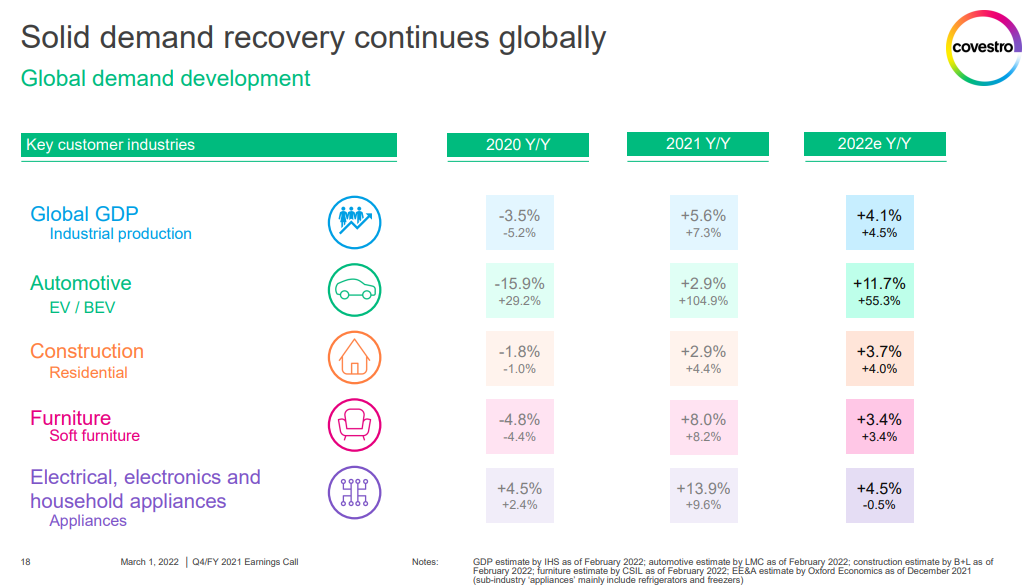

Mar 1, 2022 2:13:44 PM / by Cooley May posted in Chemicals, Polymers, LNG, Methanol, Energy, Raw Materials, Inflation, Chemical Industry, Supply Chain, polymer market, Covestro, energy shortages, Supply, demand strength, supply chain challenges, semiconductor, VW, Renault, semiconductor shortage

More confirmation from Covestro that global demand growth is strong, supporting reports that we have seen from most companies over the last few weeks. Some have struggled with raw material cost squeezes and either late attempts to raise prices or pricing lags in contract agreements, but almost all have pointed to very strong demand outside of auto OEM. We have questioned how much of this strong demand is inflation-driven, but it is very hard to tell as the last time we had significant inflation we did not have such an interwoven global supply chain as we have today, and consequently, it is harder to assess how much pre-buying may be going on, not because of fear of higher prices but because of fear of supply. Note that we have at least two European automakers (VW and Renault) shutting down facilities this week because they cannot key parts from Ukraine. This adds to the already problematic path for parts from China as well as the semiconductor shortage. If everyone is looking for a little bit more it would explain the very high 1Q 2022 demand that all are talking about and it likely means that inflationary pressures will continue as chemical and polymer makers try to make more, against a backdrop of higher raw materials and find it easier to increase their prices because their customers are as concerned about availability as they are prices.

Troubling Times Ahead For European Chemicals

Feb 24, 2022 1:50:41 PM / by Cooley May posted in Chemicals, LNG, PVC, Energy, Inflation, Chemical Industry, natural gas, materials, feedstocks, energy prices, fuel, Europe, Russia, fuel prices, European Chemicals, industrials, Orbia

It is likely a difficult day for the European chemical industry as all of the fuel prices that they depend on are rising quickly, which will force many difficult decisions over the coming days. There are a couple of factors to consider – what happens to costs and margins if energy prices remain inflated, and what happens if energy availability becomes an issue and plant closures are necessary. In a world that is already reeling from inflationary pressure that we have not seen in four decades, there is at least an acceptance that prices can move higher, but the energy-dependent European industrial and materials companies will need to move prices quickly and meaningfully to absorb their higher costs. If natural gas supplies from Russia are halted, Europe is likely going to need to allocate supplies, as there is no easy fix given an LNG system that is already at capacity. Industry will likely take the hit to ensure power for heating and cooling. This will drive product shortages in Europe, especially for chemicals, which will likely make it easier to get the pricing necessary to cover costs.

Expectations From Dow Supportive Of Our Mega-Cycle Thesis

Jan 27, 2022 11:50:52 AM / by Cooley May posted in Chemicals, LNG, CCS, CO2, Ethylene, Chemical Industry, decarbonization, Dow, naphtha, CO2 footprint, ethylene production, oil prices, mega-cycle, Alberta

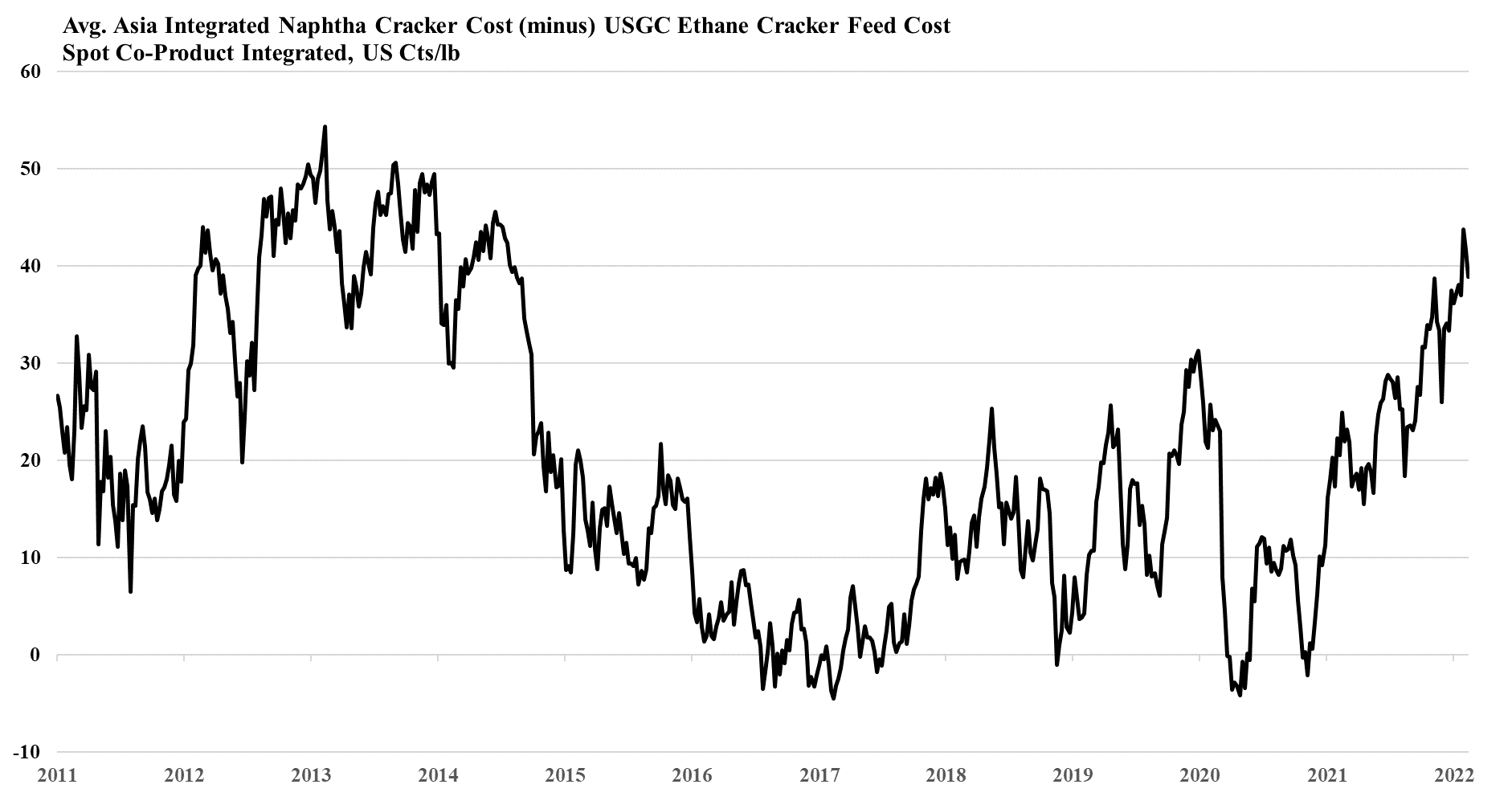

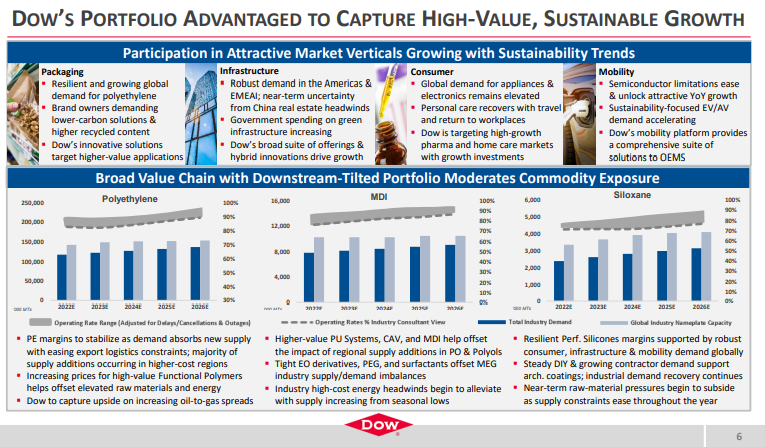

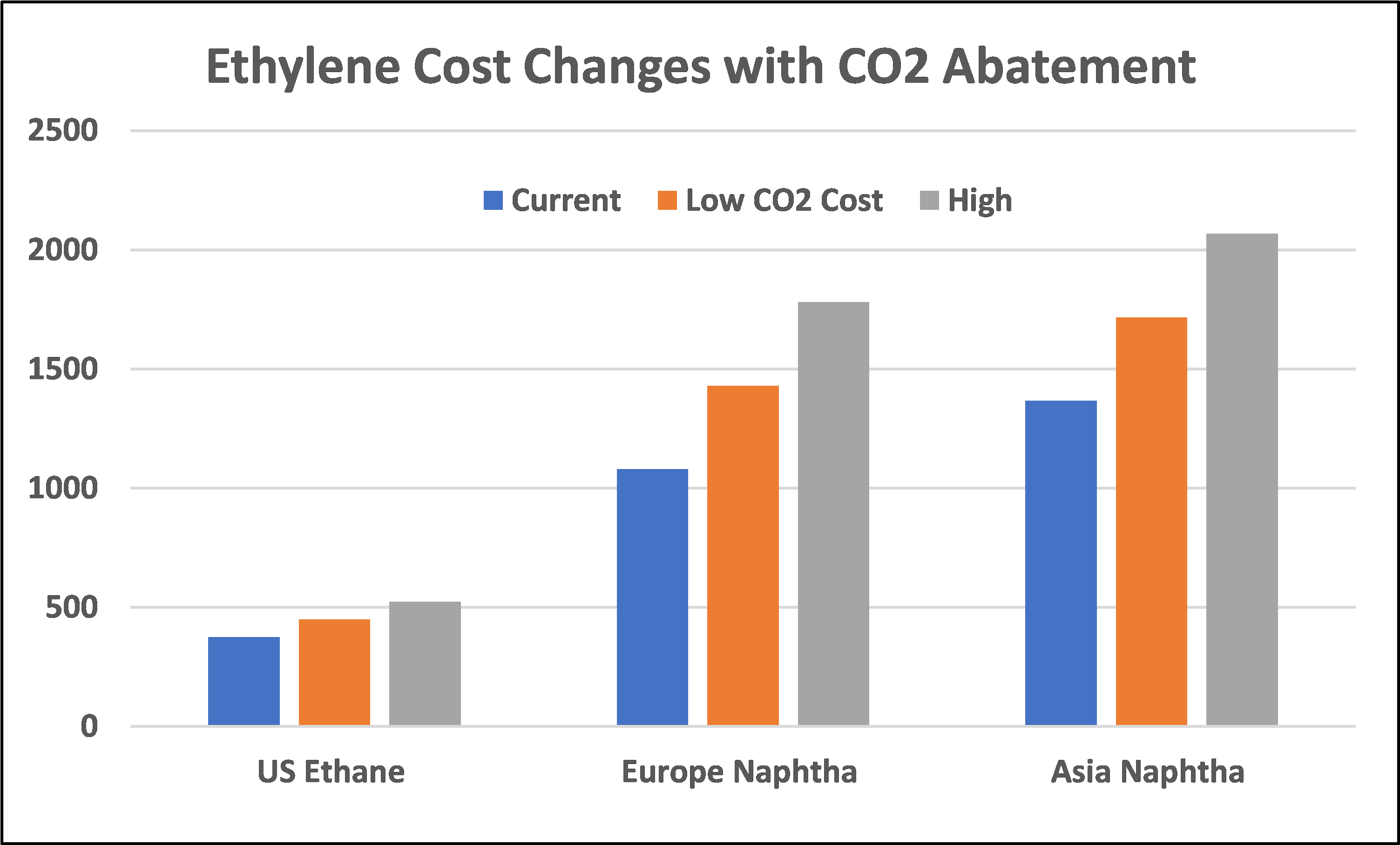

While it might be tempting (and perhaps easier) to focus on the negatives in the Dow earnings release – such as price declines in polyethylene and higher costs in Asia, we think it is much more interesting to focus on the positives. For a while now we have been suggesting that the industry is gearing up for a mega-cycle of profitability, perhaps as early as 2024 – see report – and we see nothing in the current macro environment or in Dow’s release to suggest we might be wrong. Demand growth is very robust across the industry, with consumer spending driving some quite impressive GDP growth numbers in the US in 4Q 2021, as an example. We often see companies suggest improving global operating rates in earnings calls, and while it is mostly hopeful and self-serving, the chart below, from Dow’s report may be conservative. The very high ratio of Asia costs versus US costs in the 2012 to 2014 period (second image below), because of high oil prices, effectively shutdown new naphtha based ethylene investment in Asia for several years and it is what prompted China’s move into coal-based and methanol chemicals (China has almost no ethylene capacity from methanol or coal in 2011, but close to 6 million tons by 2016). As the price of oil rises and the cost curve works against China and the rest of Asia again, the move to more coal is less attractive because of the environmental footprint – coal gasification creates a lot of CO2 emissions and elaborates CCS investment would be needed to justify further expansions, which increases the cost of ethylene production.

European Energy Prices Likely Rise With Any Russia Conflict

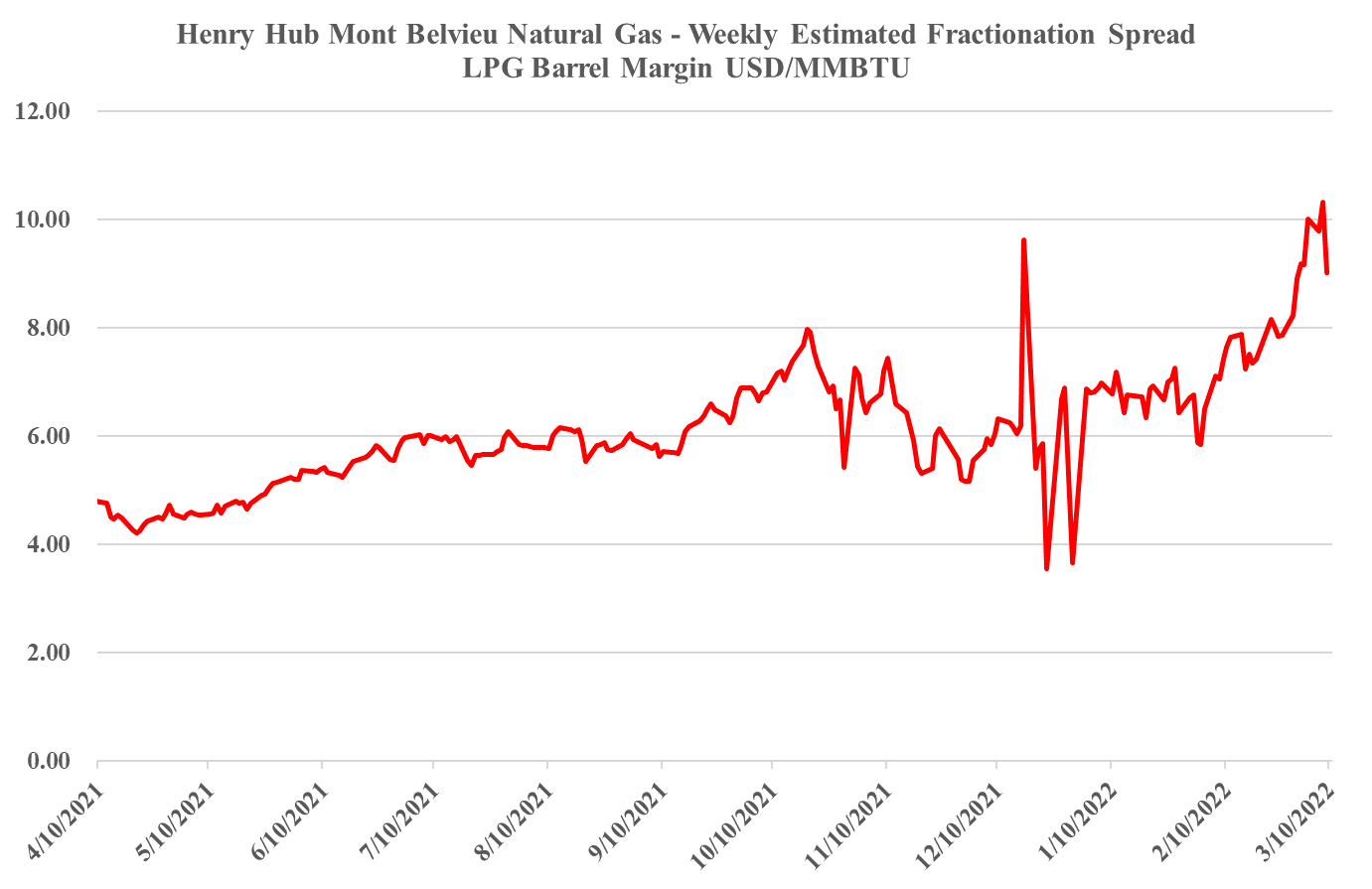

Jan 25, 2022 1:48:37 PM / by Cooley May posted in Chemicals, LNG, Energy, natural gas, natural gas prices, energy inflation, energy prices, energy shortages, fuels, Russia, European energy prices, energy supply, power generators, price inflation, LPG, Industry cutbacks

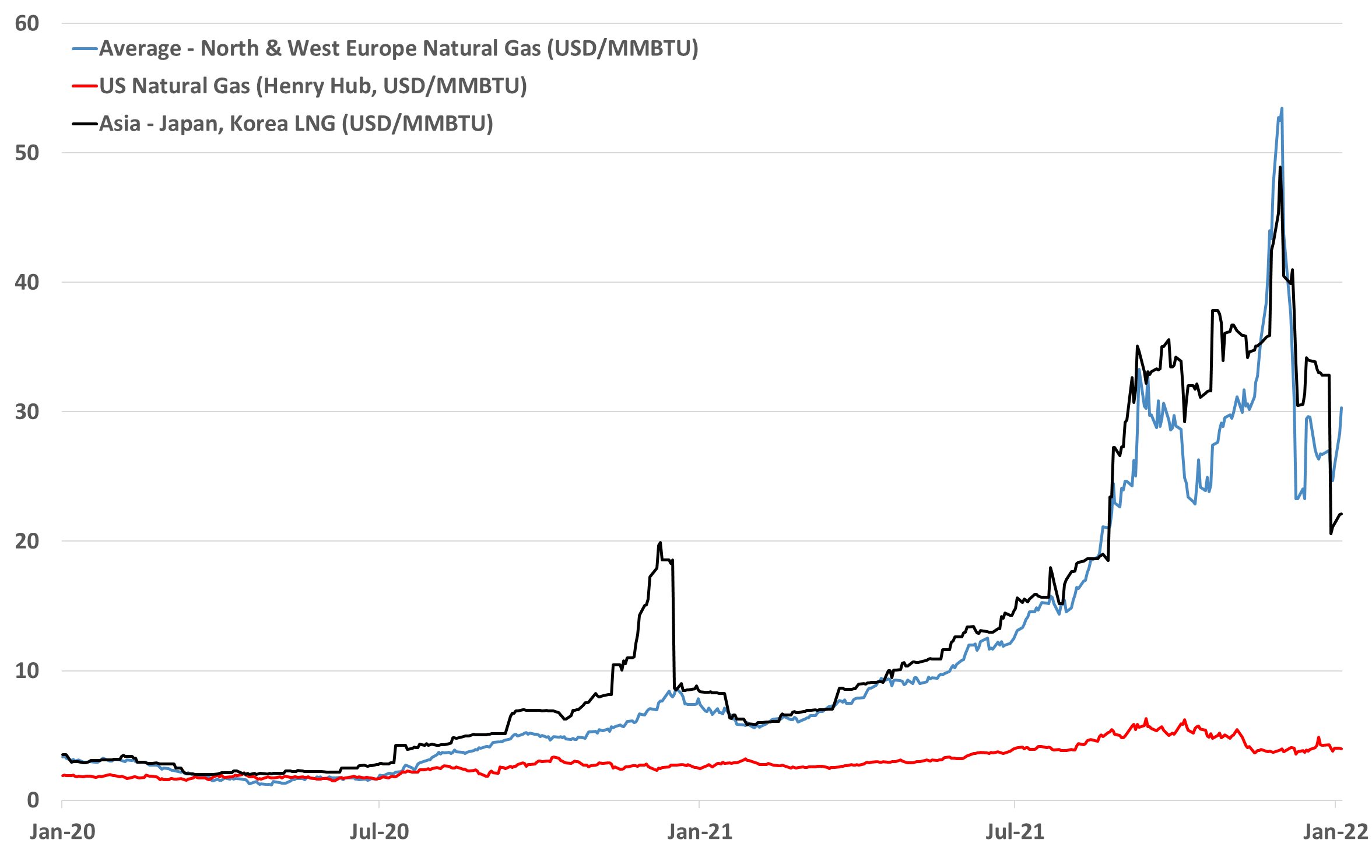

There are a couple of related topics in the charts below from today's daily report, as any conflict with Russia would almost inevitably impact European energy supply, raising prices for natural gas and pulling on as much LNG as possible. That said, we suspect that part of the recent run-up in prices has likely been to build a cushion of inventory, as much as that is possible with limited storage relative to demand.

Inflation Drivers Are Everywhere, But Especially In Energy

Dec 10, 2021 12:10:15 PM / by Cooley May posted in Chemicals, Crude, LNG, Coal, Energy, Inflation, Chemical Industry, petrochemicals, hydrocarbons, natural gas, power, natural gas prices, energy transition, EIA, Emission abatement, petrochemicalindustry, clean fuels, natural gas production, oil production, low emissions fuel

The theme of our Sunday report (to be found here) will be inflation this week and the signs that we are seeing across multiple industries which suggest it could be more problematic and worsen in 2022. One of the focuses is energy and how the pressures to be seen as good citizens is lowering investment in oil and natural gas production, while the world is not far enough advanced on energy transition to be able to substitute for the missing hydrocarbons. We would agree with many of the recent comments from some segments of congress, which is that the answer is not to curtail exports of LNG and crude, as by doing so we will starve the rest of the world of hydrocarbons and create worse shortages than Europe and China are seeing today. The better solution would be to support “clean” US production of the lowest emission fuels possible – especially for natural gas. As we have noted in prior research, with a global solutions hat on, the relatively low costs of natural gas F&D costs in the US, when combined with what we expect to be relatively low costs of emission abatement in the US, should drive more investment in the US, creating jobs and export income.

Is A Feedstock Shock In The Cards For US Chemicals?

Nov 23, 2021 1:39:28 PM / by Cooley May posted in Chemicals, Polymers, Crude, LNG, Energy, Emissions, petrochemicals, propane, carbon footprint, feedstock, ethane, natural gas, ethylene capacity, E&P, NGLs, exports, shortages, chemicalindustry, Brent Crude, butane, Mexico, fuels

We remain concerned that natural gas E&P investment in the US remains too low to meet expected demand increases, especially for natural gas-fired power stations and LNG, but also possibly for NGLs, especially ethane, given new ethylene capacity and a fresh export market in Mexico. Near-term, natural gas prices are showing some easing relative to crude, albeit a very volatile trend – Exhibit below – but we see medium and longer-term shortages unless E&P spending increases. The new power facilities shown in the bottom Exhibit will all need incremental natural gas, and the international LNG market is so tight that as new capacity comes online in the US we would expect it to run as hard as is possible. This sets up for a market where the clearing price of natural gas in the US is at risk of being set by the marginal exporter. The price jump for domestic consumers would be dramatic and it would cause all sorts of headaches in Washington and probably intervention. We showed the incremental natural gas price in the Netherlands in our Daily Report on November 18th, and if the US price were to reflect the netback from this level, they would rise close to $30 per MMBTU. The natural gas industry needs some sort of global blessing to continue to operate as what will likely be the core transition fuel. It will be necessary to clean up the emissions footprint of natural gas, but the industry should be encouraged to invest on this basis. For those who doubt whether the US natural gas price can rise to $30/MMBTU – note that the Europeans did not think $30 was possible either.

Relative To The Chemical Inflationary Cycle Of The ’70s, Present Times Reflect Similarities But Some Major Differences

Nov 17, 2021 2:47:40 PM / by Cooley May posted in Chemicals, Polymers, LNG, Plastics, Ethylene, ExxonMobil, raw materials inflation, Inflation, feedstock, Borealis, ethylene capacity, crude oil, shortages, chemicalindustry, plasticsindustry, Adnoc, OPEC+, oil prices, Investments

The linked article looks at the chemical inflationary cycle of the 70s, which has some relevant indicators for what we are seeing today, but there were also some stark differences. Rising raw material prices is a common theme and while it is convenient to blame OPEC+ this time, the group is not nearly as much to blame today as it was in the 70s. Consumers were facing not just higher oil prices, but also genuine shortages because of the OPEC cutbacks and the multi-year lead times that it took non-OPEC producers to ramp up E&P and ultimately production. This time the oil is there and relatively easy to get to, especially in the US, but the capital spending decisions of the US oil producers – mostly because of ESG related pressure – are holding back the production.