The US chemical rail volumes should be considered in the context of some of the slowing demand that has been indicated by companies downstream of chemicals, and we see this as further evidence for possible inventory build through the chain. Earlier in the year these builds would have been justified by supply chain issues that have plagued all segments of retail and manufacturing for close to two years, but today we should be at or above inventory comfort levels. We are calling for weakness in demand and some margin erosion in US chemicals and polymers in 2H 2022, before a strong rebound as early as 2024, but if buyers of polymers and chemicals and their customers look to reduce inventories more quickly, the landscape could change quickly. While this is possible, with the threat of higher energy prices very real, we would be surprised in anyone was interesting in dramatically lowering inventories today.

Runaway Trains Into Weaker Demand?

May 13, 2022 1:40:50 PM / by Cooley May posted in Chemicals, Polymers, Propylene, Ethylene, Styrene, Benzene, US Chemicals, natural gas, manufacturing, EDC, ethylene glycol, demand, US chemical rail, ethylbenzene

Is Methanol An Energy Carrier?

May 12, 2022 2:19:59 PM / by Cooley May posted in LNG, Methane, Methanol, Energy, natural gas, energy transition, Agriculture, fuel, crop shortages

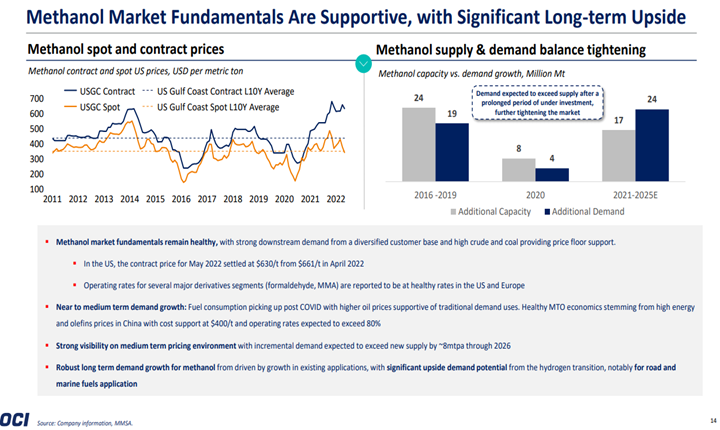

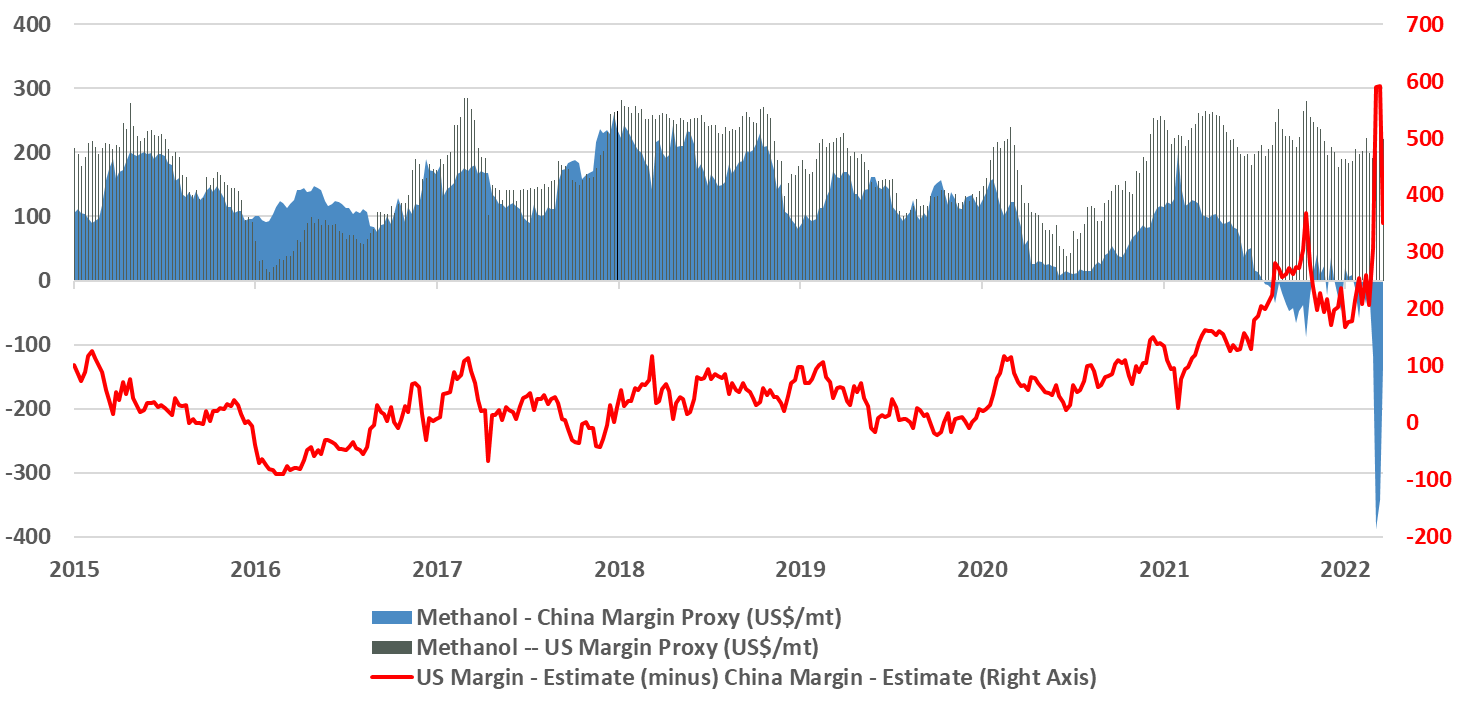

Today's apparent exceptions are in sectors very focused on energy security and transition, as we noted in our most recent Sunday Thematic, and agriculture, where crop shortages are driving up prices and demand for yield-enhancing inputs. In the OCI results below, we see a company doing well, despite having impacted assets in Europe. Still, we also see some potential upside in methanol as we head into the European winter, with the possibility that methanol is used as a fuel, essentially as a carrier for methane, and a workaround for constrained LNG infrastructure. As a fuel, it is not directly substituted for methane in any application, as it is a liquid, but some energy users might be able to adapt, and a $30 per MMBTU natural gas price in Europe can cause you to be quite creative. Of course, the methanol export opportunity for the US will depend on the US natural gas price remaining well below the price in Europe. For more see today's daily report.

In The Race Against Inflation Some Are Winning And Some Are Losing Badly

May 10, 2022 4:58:42 PM / by Cooley May posted in Chemicals, Energy, Ammonia, natural gas, EBITDA, blue ammonia, Agriculture, clean fuels, IFF, Armstrong, financial markets

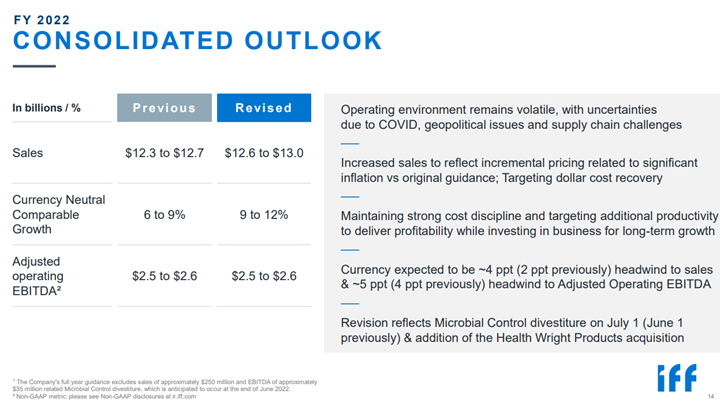

The pricing effect is very evident in the IFF results and projections, highlighted below. The company projected higher revenue expectations for the year but no increase in EBITDA with that higher revenue. We expect this trend to continue through at least the next couple of quarters, even if energy prices do not rise any further, as we believe that there is still some energy-related pass-through to come in many sectors. As the ammonia chart below shows, inputs in the agriculture/food industry keep rising.

Ag Related Chemicals Look Robust, Everything Else Looks More Risky Today

May 6, 2022 4:00:42 PM / by Cooley May posted in Chemicals, Propylene, Ethylene, feedstock, natural gas, Agriculture, refining margins, natural gas shortages, nylon, AdvanSix

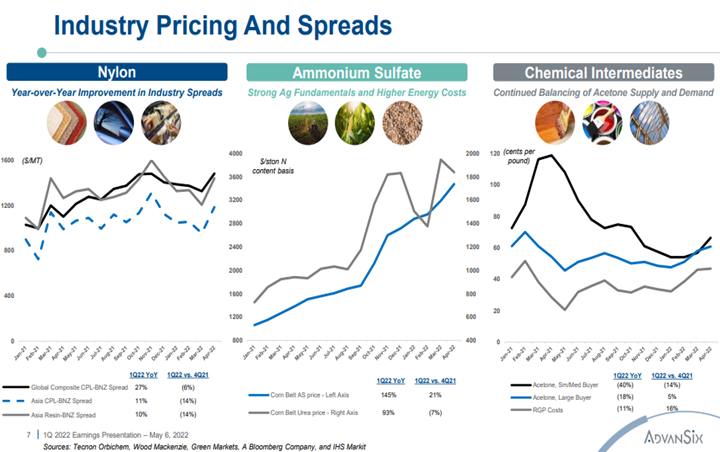

In our Sunday Thematic to be published this weekend we are focused on business lines that will still look good in an economic turndown versus those that are more vulnerable, and ASIX may find itself spread across both buckets. The momentum in agriculture is very strong and even with a quick resolution in Ukraine, we could see high prices for crops and farm inputs for years as it will take a long time to correct recent imbalances and the Ag markets were already tightening before Russia invaded Ukraine. This and natural gas shortages (see today's daily report) should keep upward pressure on ammonia and ammonia derivatives pricing. On the other hand, any slowdown in consumer durable/discretionary spending will likely negatively impact nylon. A faster resolution in Ukraine would likely be negative for the Ag names as even if it takes a while to correct crop and fuel imbalances, the stock market will likely look through that and start focusing on eventual more normalized markets.

US Chemicals: Some Signs Of Continued Strength, But Mostly Lagging Indicators

Apr 20, 2022 2:33:11 PM / by Cooley May posted in Chemicals, Polyethylene, Ethylene, Polyurethane, Inflation, US Chemicals, ethane, natural gas, naphtha, polymer, US polyethylene, MDI

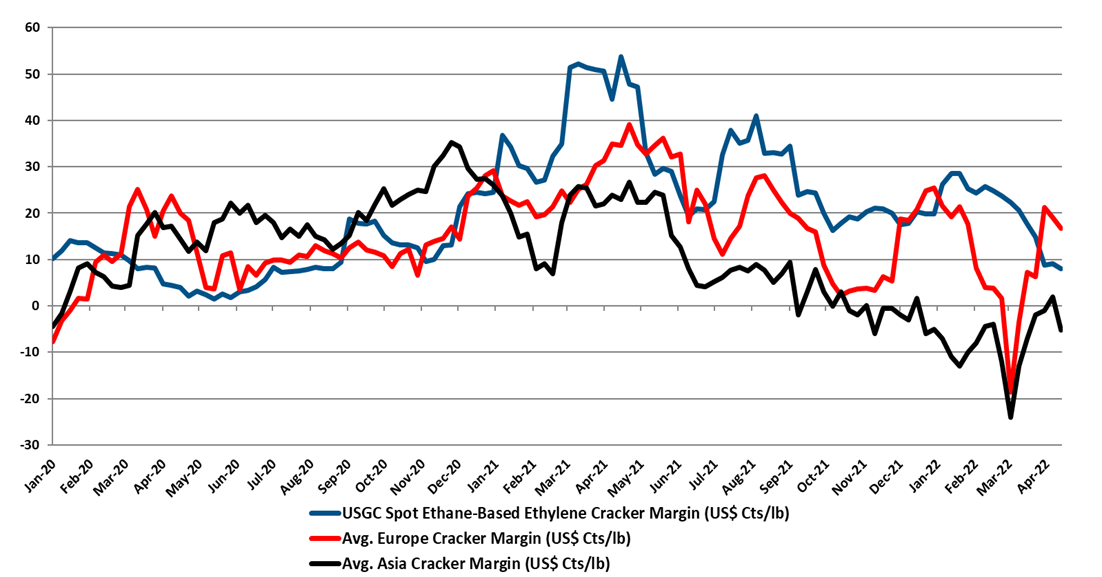

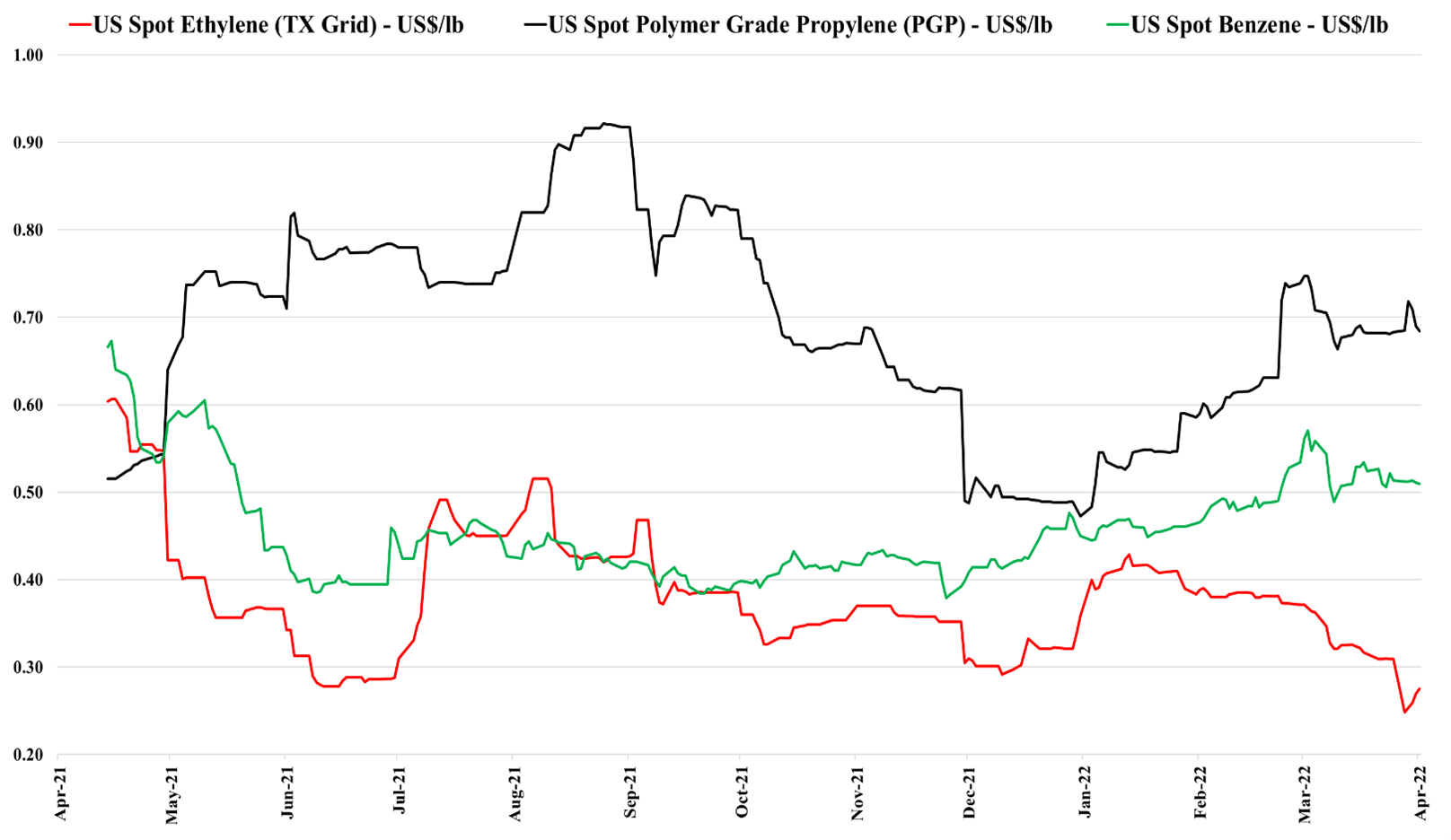

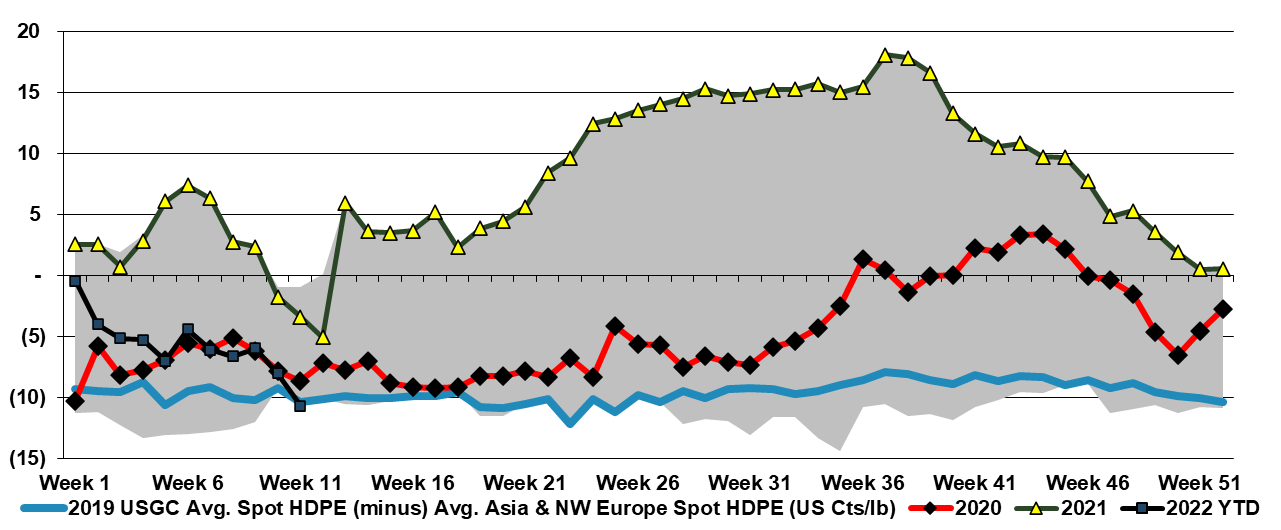

We note the polyethylene price nominations in the US, timed by some to coincide with earnings releases this week and next, and would remind clients that there is always price momentum in commodities, one way or another. In our view, the price increase moves aim to maintain directional momentum (upwards) while giving the polymer producers some cover should natural gas prices spike further. US ethane prices are now tracking natural gas more closely and have moved up meaningfully over the last few weeks, and US ethane-based ethylene margins have fallen around 80% since the start of the year, with at least half of that coming from cost increases. All polyethylene producers are integrated back to ethylene, and the price nominations will be attempts to recoup some of the cost increases. This is against a backdrop of still very strong polyethylene margins in the US, which although way off their 2021 highs remain much higher than in 2019 and 2020 and the longer-term average. This is covered in our Weekly Catalyst report each Monday. Ethylene margins are summarized in exhibit below and the chart shows the impact of higher costs in the US and falling spot ethylene prices as the US now has more surplus ethylene capacity and is looking for export homes for ethylene and easy to ship derivatives. As we have noted before, the jump in margins in Europe and Asia is because of extreme volatility in naphtha markets over the last couple of weeks. We would expect margins to be lower next week based on naphtha moves this week.

US Propylene Is A Very Different Market Than Ethylene

Apr 8, 2022 1:04:37 PM / by Cooley May posted in Chemicals, Propylene, Polyethylene, Ethylene, Chemical Industry, Ammonia, Supply Chain, ethane, natural gas, natural gas prices, US ethylene, US propylene, fertilizer

US ethylene prices have bounced off a low this week largely, in our view on the steep rise in natural gas and ethane. The drop in ethylene prices over the last couple of weeks signals an imbalance whereby production is more than enough to satisfy domestic demand and export demand. Export demand is limited by terminal capacity, and we have seen some domestic demand issues for polyethylene, not because of demand weakness, but because of export logistic bottlenecks, that are resulting in product (with homes to go to) backing up in the US ports. Given the timing of this build-up, we may see some higher end-quarter working capital from some of the chemical companies with sizeable export footprints for 1Q 2022. The sharp increase in US natural gas prices and the catch up that ethane has made to natural gas, should keep some upward pressure on spot ethylene prices if gas prices remain high. Propylene remains very supported by high propane prices.

Higher Costs And Inventory Increases Will Drive High Prices

Mar 25, 2022 2:51:04 PM / by Cooley May posted in Chemicals, Methanol, Ammonia, Supply Chain, natural gas, US Methanol, urea, Methanex, HB Fuller

Methanol is one of a few chemicals that is directly impacted by the price of natural gas, and as the chart below shows, the pain in China (and in Europe) is extreme and it is unlikely that any facilities that require imported natural gas – or local gas with prices based on imports – are operating today. The volume and margin opportunities for those companies connected to low priced natural gas – the US, the Middle East, and other niche locations such as Trinidad, are as good as they have ever been and we are a little surprised that Methanex did not push a little harder with US pricing, given that export netbacks are likely surging. Urea and ammonia are in the same boat and prices are much higher, but the US is a net importer and international prices are directly impacting the US price.

US Refiners Profits Rise On Margin And Roubles

Mar 24, 2022 3:02:20 PM / by Cooley May posted in Chemicals, Oil, natural gas, gasoline, refinery, Russia, oil and gas, refining margins, refiners

The closure of the Russian oil pipeline and export terminal as well as the move to want payment in Roubles, are all likely tactics from Putin to cause more market chaos in an attempt to hit back over sanctions. While Russia likely needs the oil and gas revenues, sending oil higher is likely intended to see whether the West cracks, which seems unlikely. The Rouble payment is also meant to inconvenience the West but at the same time maybe support the Rouble as West Europe needs the gas and will need to buy Roubles to may payments.

Commodity Shortage - It's Not Just Oil

Mar 23, 2022 2:27:41 PM / by Cooley May posted in Chemicals, Commodities, Metals, Oil, natural gas, Lithium, Shortage, commodity chemicals, fertilizer, nickel, World Petrochemical Conference, WPC, crops, crop protection

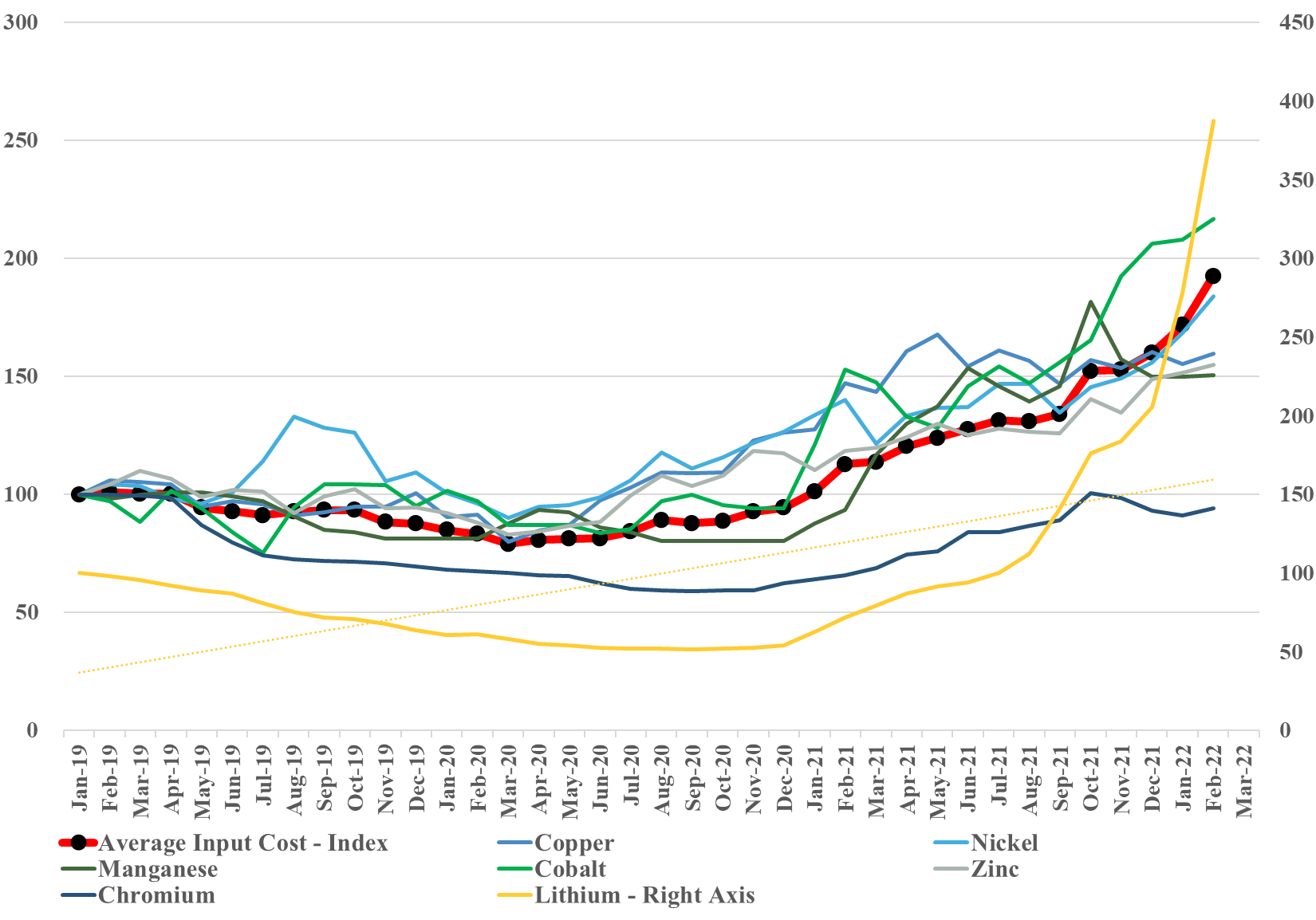

One of the key messages from the World Petrochemical Conference is that it is not an oil shortage, it is a commodity shortage, and we show our key metals index (updated through February) again in the chart below. We will update this again at the end of March (when consistent data is available) and given what has happened to both lithium and nickel prices we would expect a jump in the March index.

If You Are In The Right Place With The Right Products, Times Are Good

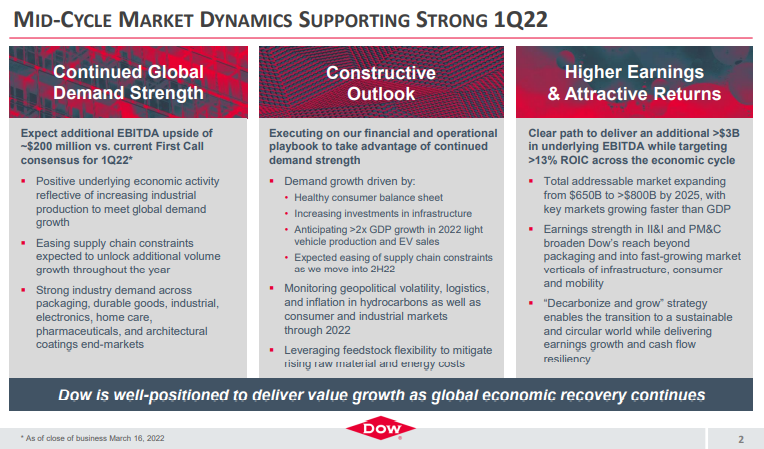

Mar 18, 2022 12:19:25 PM / by Cooley May posted in Chemicals, Polymers, Polyethylene, Polypropylene, LyondellBasell, Inflation, Dow, US Chemicals, natural gas, Basic Chemicals, Westlake, Braskem, US Polymers, commodity chemicals, demand strength, raw material, silicone

As we have been suggesting for some time, there are pockets of real strength in chemicals; identifying them is the hard part. It is not enough to have pricing strength in a market where raw material prices are volatile daily and we have seen plenty of examples of companies with very strong end demand dynamics missing earnings because of a cost squeeze. We continue to highlight the competitive strength in the US in basic chemicals because of the decoupled and relatively low natural gas price and this is likely a large piece of the Dow earnings strength – strong polyethylene demand against a backdrop of relatively stable and lower costs. While polypropylene (Braskem) remains extremely profitable in the US, it has seen more sequential weakness than polyethylene – as we show in Exhibit 1 of today's daily report. That said, both polyethylene and polypropylene margins in the US are significantly higher than was likely expected this year and certainly what has been reflected in stock valuations, even with the commodity chemicals rally. Dow is also seeing the benefit of a very strong silicones market – something that was covered in detail in Wacker’s release earlier this month.