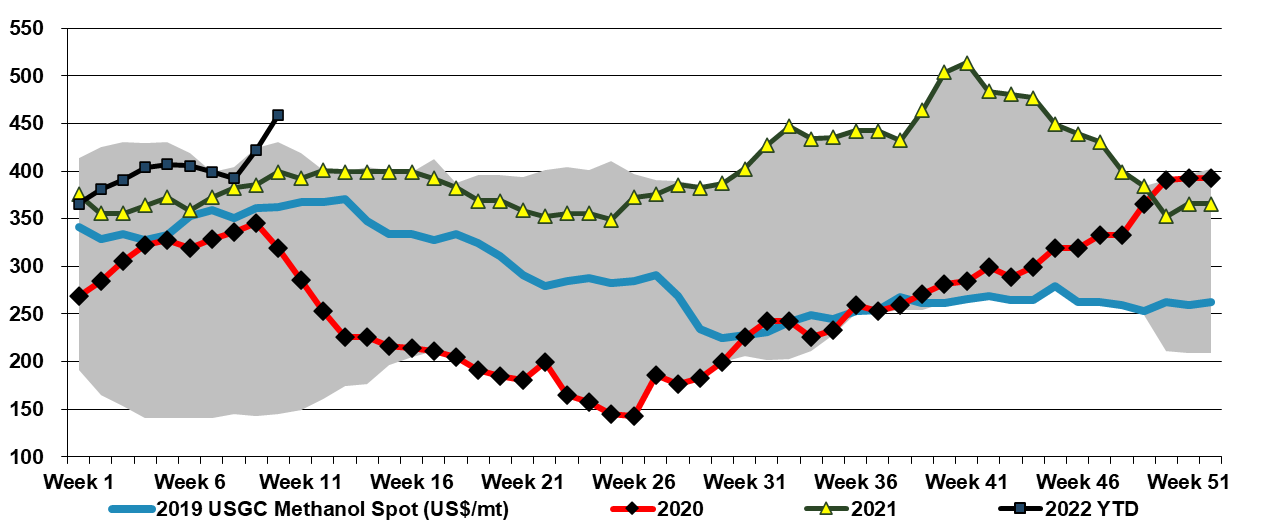

A couple of weeks ago we raised the idea that US methanol could be a significant beneficiary of the conflict in Central Europe, not just because it is very economically unattractive to make methanol in Europe, but because it might be possible for Europe to import methanol for its energy value - $40 per MMBTU natural gas can make all sort of alternates look attractive. The impetus behind the methanol spot price increase in the US may be in part rising local natural gas – or the fear of further increases – but export demand is likely the larger driving factor and this could continue or even increase further if potential European importers work out how to convert to use methanol as a fuel.

March And April Are Likely All About Price Increases

Mar 17, 2022 12:29:56 PM / by Cooley May posted in Chemicals, Polymers, Plastics, Methanol, Energy, natural gas, energy transition, US Methanol, materials, fuel, raw material

US Competitive Advantage To Offset Some Ex-US Polyethylene Producer Losses

Mar 10, 2022 2:50:46 PM / by Cooley May posted in Chemicals, Polymers, Crude, LNG, PVC, Polyethylene, LyondellBasell, HDPE, polyethylene producers, polymer producers, ethane, natural gas, Basic Chemicals, NGL, Westlake, oil prices

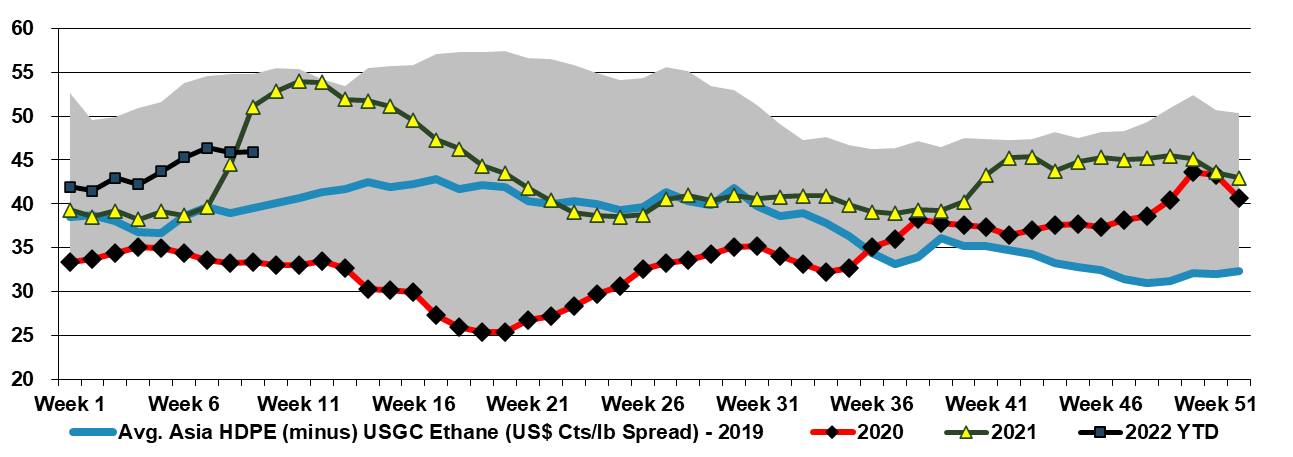

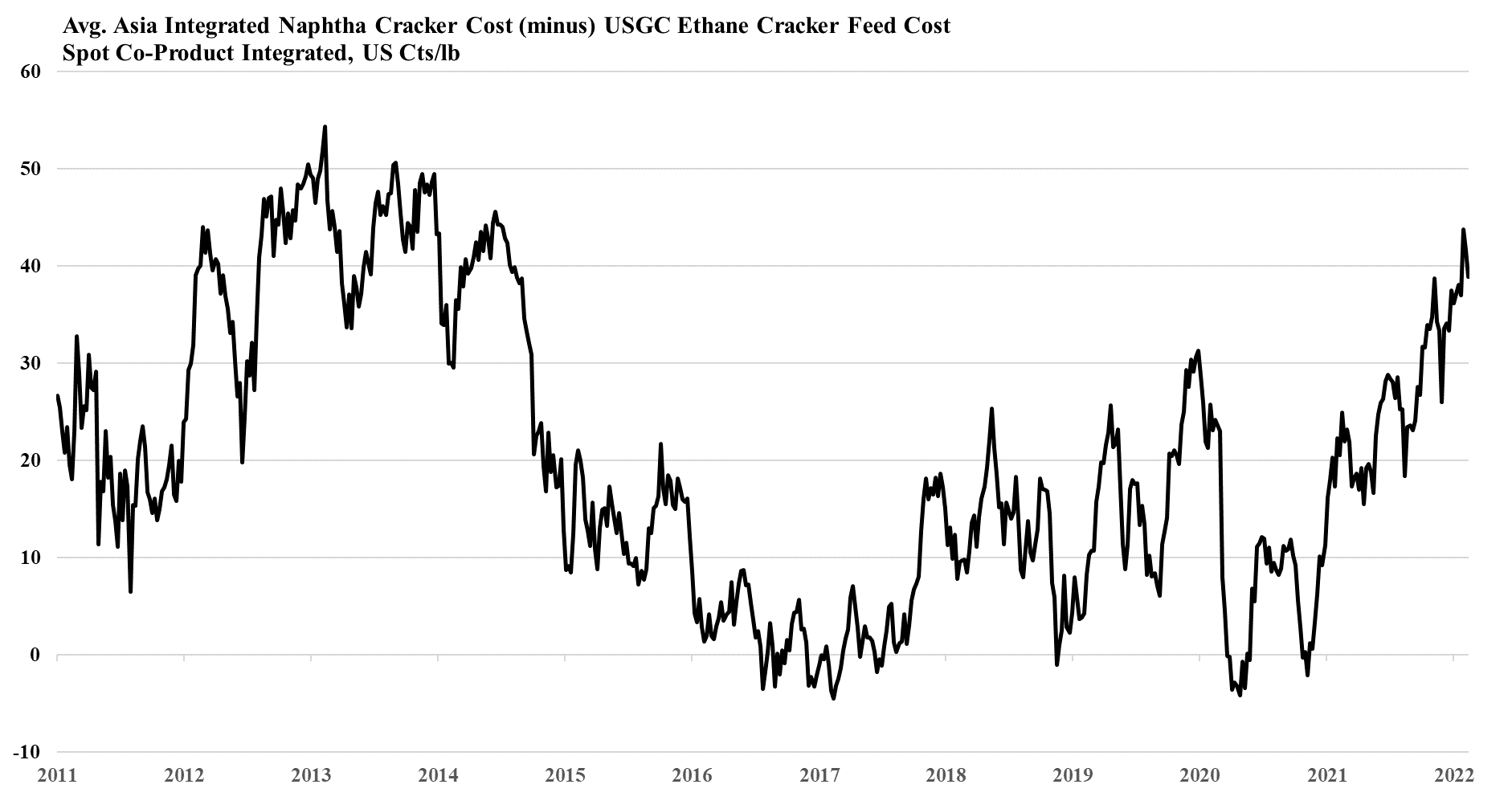

As noted in Exhibit 1 from today's daily report, the jump in oil prices has plunged the European polyethylene producers into the red and pushed Asian polyethylene producers further into the red. This will inevitably result in price increases as basic chemical and polymer producers will shut down at negative margins, and these price rises offer an opportunity for the US, Middle East, and select other producers.

All Eyes On Costs - Prices Going Higher

Mar 9, 2022 12:38:11 PM / by Cooley May posted in Chemicals, Inflation, Prices, feedstock, HDPE, Oil, polymer producers, ethane, natural gas, Basic Chemicals, manufacturing, polymer, exports, Global Costs, polymer prices

With the rapid jump in international natural gas and oil prices, we would see very concerted efforts to raise basic chemicals and polymer prices in Europe and Asia and will have a positive knock-on effect for the US. In our weekly catalyst report on Monday, we showed that ethylene producers outside the US were all losing money, especially in Europe and Asia. Some European demand will already be lower, because of curtailed product exports to Russia and Ukraine, but producers will want to cover costs at a very minimum and consequently, will be trying to match price increases with cost increases and if possible do a bit better than that. All of this will create a greater margin umbrella for the US, and US exporters selling directly into international markets will see export margins step up and may see incremental opportunities to export more, assuming that the freight rates are not too onerous for incremental containers.

US Ethylene Decoupled From Global Costs

Mar 8, 2022 2:05:18 PM / by Cooley May posted in Chemicals, Propylene, Ethylene, Benzene, propane, natural gas, Ethylene Surplus, ethylene exports, US propylene, crude oil, crude prices, Global Costs

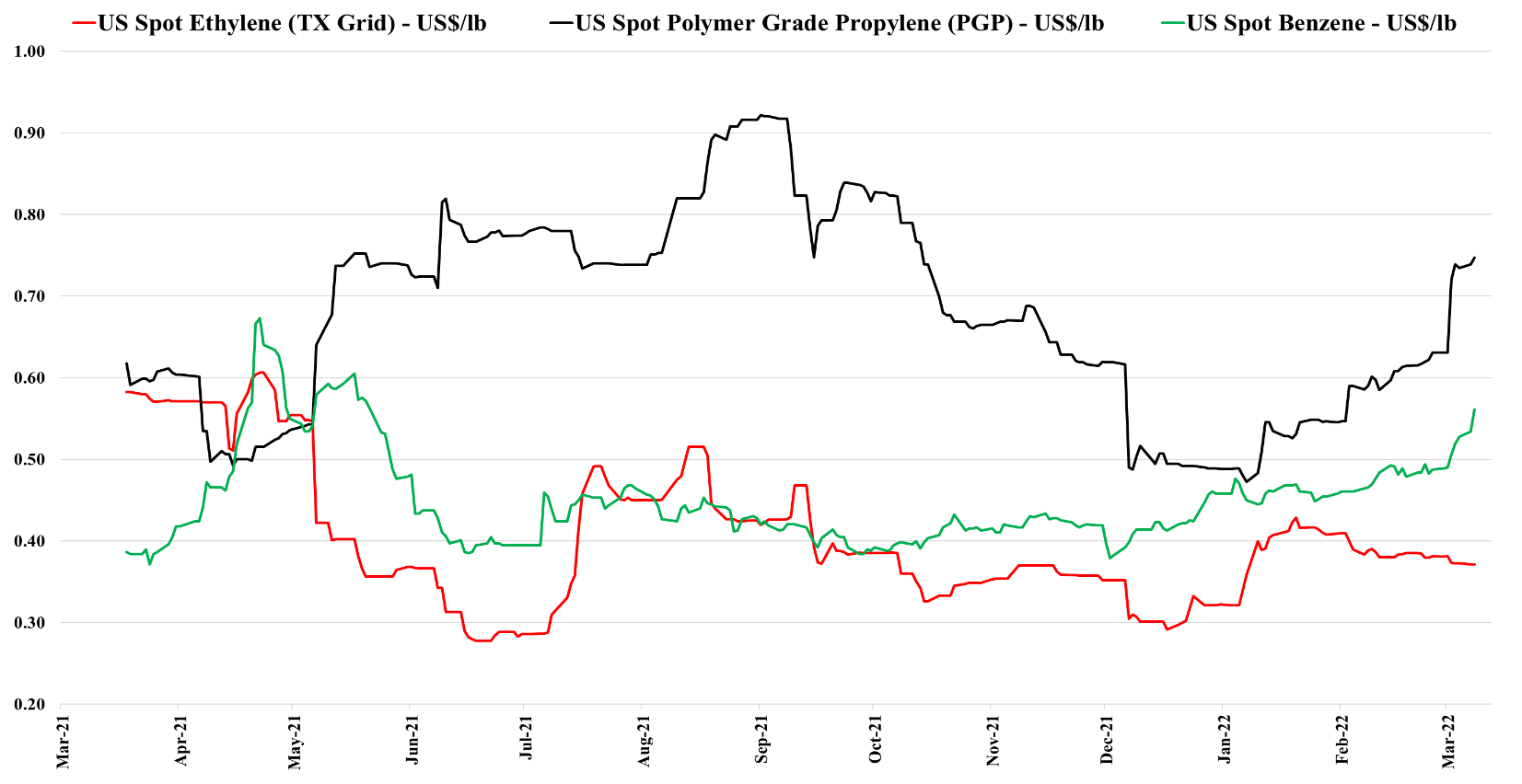

It is interesting to note the rapid rise in US propylene (and benzene) values as they follow propane and crude prices (propane is following crude because of its heating value and export opportunities). Ethylene is not moving as US natural gas is in surplus and is not following international natural gas prices. The US is surplus ethylene and derivatives, but we would expect to see ethylene and ethylene derivative prices jump up in the US if Europe is physically unable to make ethylene and derivatives or if the costs in Europe become so high that supplying incremental volumes from the US becomes even more compelling. For more see today's report titled "Into The Mystic – Ex-US Energy Price Surge Favors US Producers; Low Visibility Keeps Capex In Check".

The US Cost Advantage Is Increasing Daily

Mar 4, 2022 1:59:01 PM / by Cooley May posted in Chemicals, LNG, Polyethylene, Ethylene, Inflation, Supply Chain, natural gas, US ethylene, naphtha, US natural gas, crude oil, Brent Crude, cost advantage

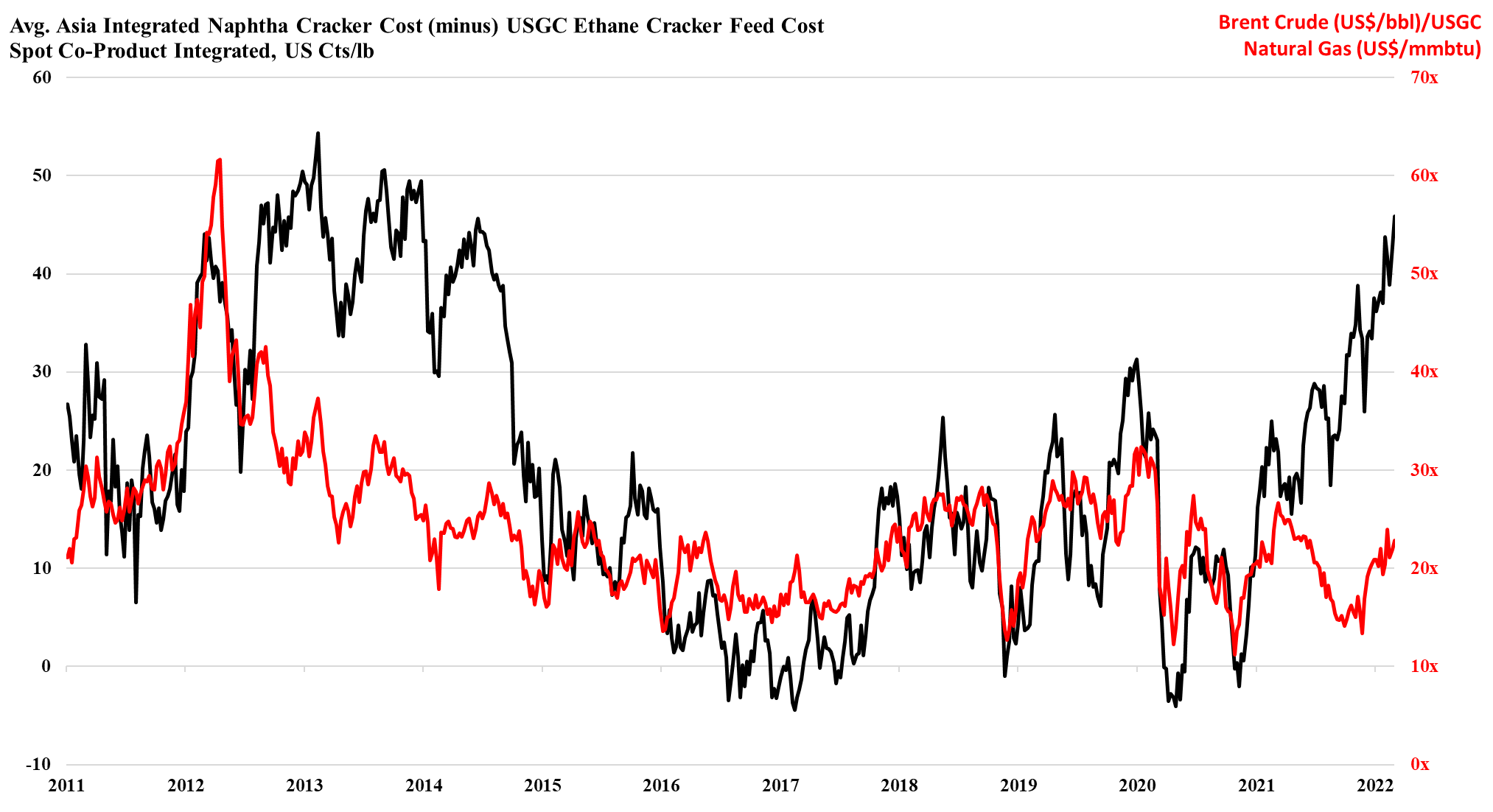

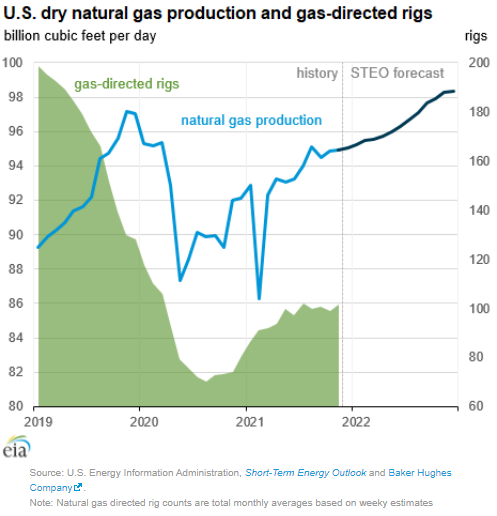

As the ratio of pricing between Brent crude and US natural gas rises, the US ethylene cost advantage is spiking, and as long as the US is producing enough natural gas to feed domestic demand and allow the LNG facilities to run at capacity, the advantage can remain. This gives the US a significant cost advantage and assuming that there is spare capacity the US industry can step up and support Europe if needed. However, it is not clear that there is much spare capacity, either in the production units or in the logistics to get the product to ports or across the Atlantic. There is a surplus of liquid and gas carriers today, but the container problems are global and the inflation and supply chain issues that we seem to be stuck with are likely to keep containers tied up in excess inventory that consumers will want to keep building as a cushion for a less certain supply outlook. The shipping issues are only part of the problem for Asia, as even with better opportunities to export, the region is seeing escalating production costs because of the movement in crude oil and naphtha pricing. We are in an unusual position where strong demand in the US is keeping domestic prices higher than in Asia, despite costs in the US that are low enough, especially for polyethylene to move material to Asia at costs well below the cost of manufacture in Asia. This dynamic can last for a lot longer in our view as long as oil prices remain elevated versus US natural gas. An abrupt turn will occur if US natural gas production falls below domestic demand and LNG demand – this would cause a spike in US natural gas prices. For more see today's daily report.

Troubling Times Ahead For European Chemicals

Feb 24, 2022 1:50:41 PM / by Cooley May posted in Chemicals, LNG, PVC, Energy, Inflation, Chemical Industry, natural gas, materials, feedstocks, energy prices, fuel, Europe, Russia, fuel prices, European Chemicals, industrials, Orbia

It is likely a difficult day for the European chemical industry as all of the fuel prices that they depend on are rising quickly, which will force many difficult decisions over the coming days. There are a couple of factors to consider – what happens to costs and margins if energy prices remain inflated, and what happens if energy availability becomes an issue and plant closures are necessary. In a world that is already reeling from inflationary pressure that we have not seen in four decades, there is at least an acceptance that prices can move higher, but the energy-dependent European industrial and materials companies will need to move prices quickly and meaningfully to absorb their higher costs. If natural gas supplies from Russia are halted, Europe is likely going to need to allocate supplies, as there is no easy fix given an LNG system that is already at capacity. Industry will likely take the hit to ensure power for heating and cooling. This will drive product shortages in Europe, especially for chemicals, which will likely make it easier to get the pricing necessary to cover costs.

Abundant Hydrocarbons Could Keep The US Advantaged, Even Considering Emission Goals

Feb 16, 2022 1:41:45 PM / by Cooley May posted in Chemicals, Carbon Capture, Coal, Methanol, CO2, Energy, Emission Goals, Ammonia, hydrocarbons, Oil, natural gas, urea, CF Industries, oil production, energy demand

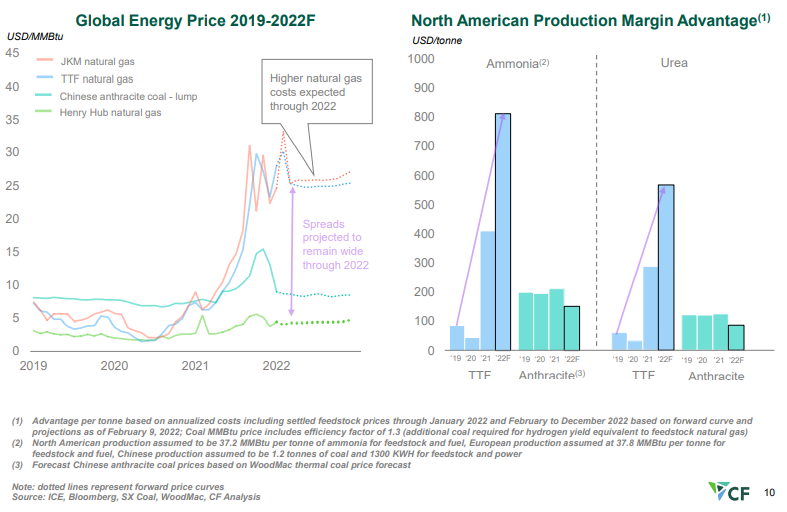

The CF slide below shows very clearly the US competitive edge when it comes to making anything that has a natural gas base, and while we tend to talk mostly about ethylene, ammonia, urea, other ammonia derivatives, and methanol are all seeing significant cost advantages. The Chinese coal-based costs are better than those in Europe and Asia based on natural gas but margins remain well below those in the US. The challenge with the coal-based chemistry in China is that it has substantial CO2 emissions, and the facilities were not designed for carbon capture. As China develops a carbon cap and trade market and as these facilities get included, costs will rise significantly.

Another Example Of Materials Inflation For Renewable Power - Good For Chemicals

Jan 26, 2022 3:56:25 PM / by Cooley May posted in Chemicals, Renewable Power, Materials Inflation, Inflation, natural gas, polysilicon, Wacker, silicon, solar module, materials, solar installations, US natural gas prices, solar panel, equipment supply

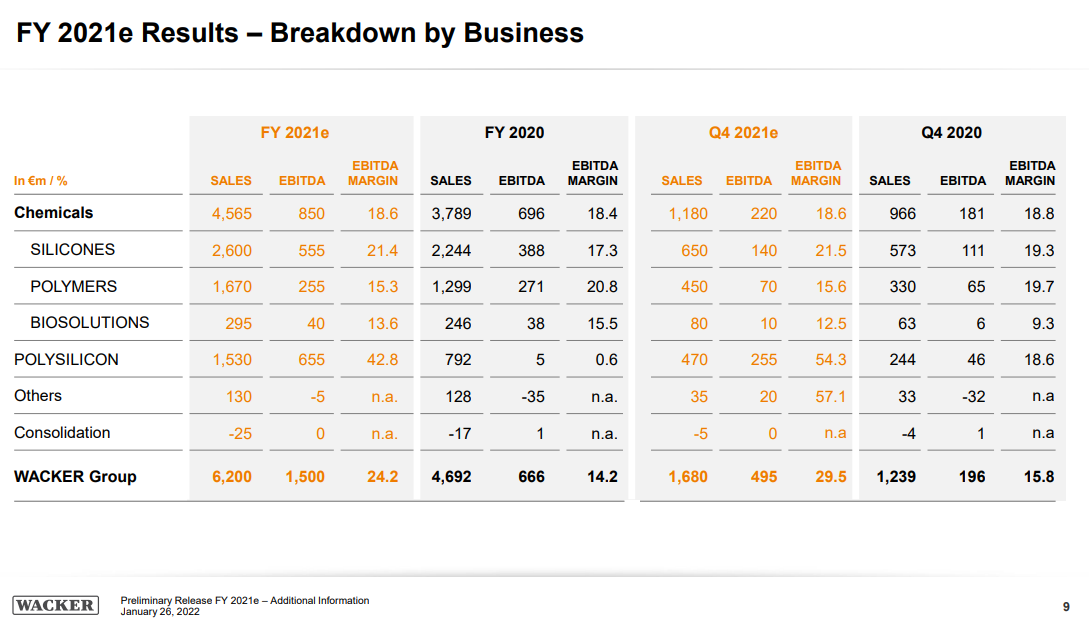

While this is covered in more detail in our ESG report today as well as our daily report, we highlight the Wacker results below. This confirms a key inflation fear for renewable power, as we see the rapid increase in silicon and polysilicon sales at Wacker – Exhibit below. Wacker has certainly seen significant volume growth between the periods highlighted, but the step-up in demand will have allowed the company to move prices up., something we have been noting for months, but it is good to have confirmation. This is additional cost pressure for the solar panel manufacturers and is driving solar module prices higher. Given the expected demand growth for solar installations, we see no reason why this demand-pull should ease any time soon. While this is a problem for the solar industry, their materials suppliers could do very well for many years.

European Energy Prices Likely Rise With Any Russia Conflict

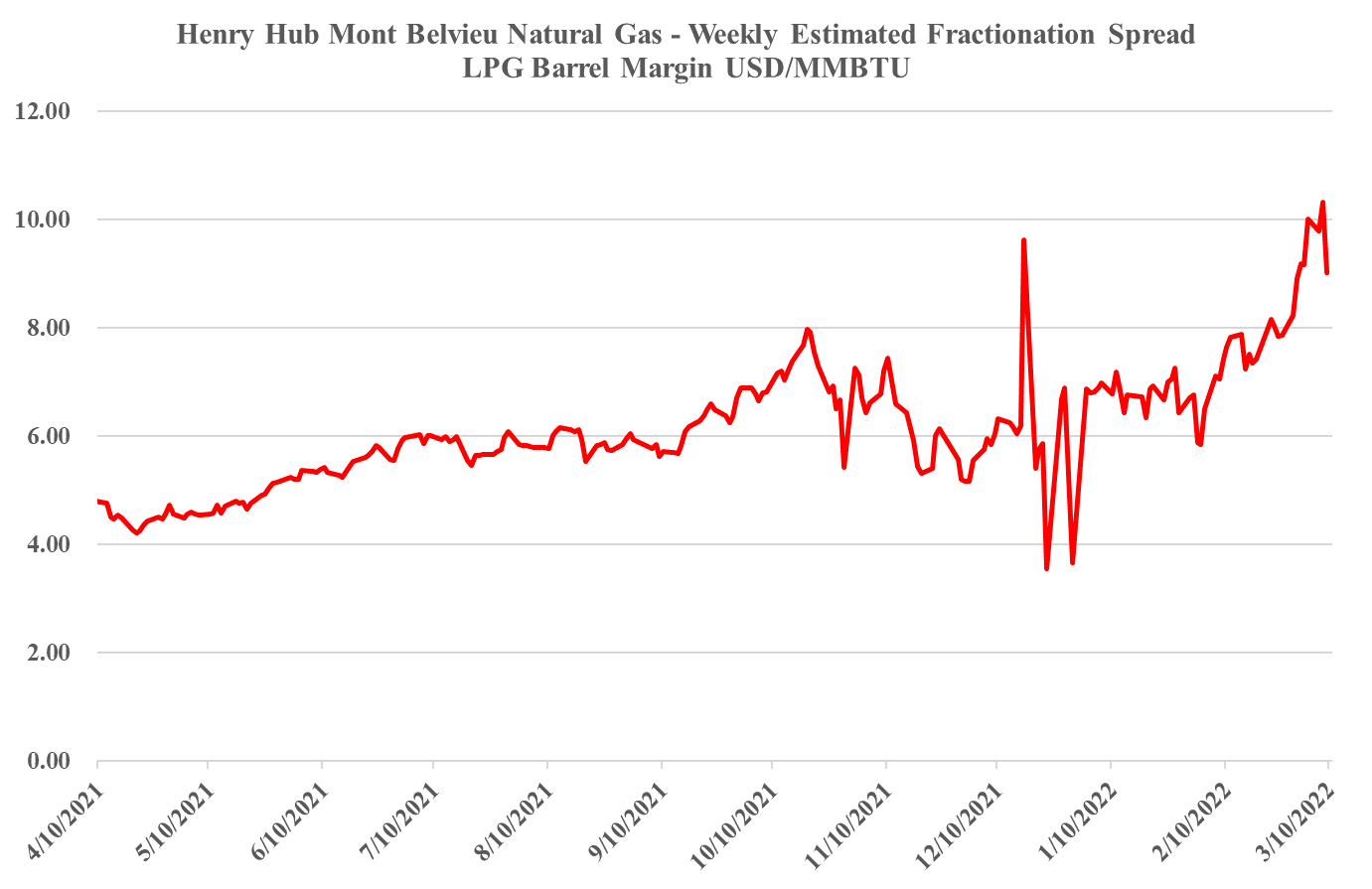

Jan 25, 2022 1:48:37 PM / by Cooley May posted in Chemicals, LNG, Energy, natural gas, natural gas prices, energy inflation, energy prices, energy shortages, fuels, Russia, European energy prices, energy supply, power generators, price inflation, LPG, Industry cutbacks

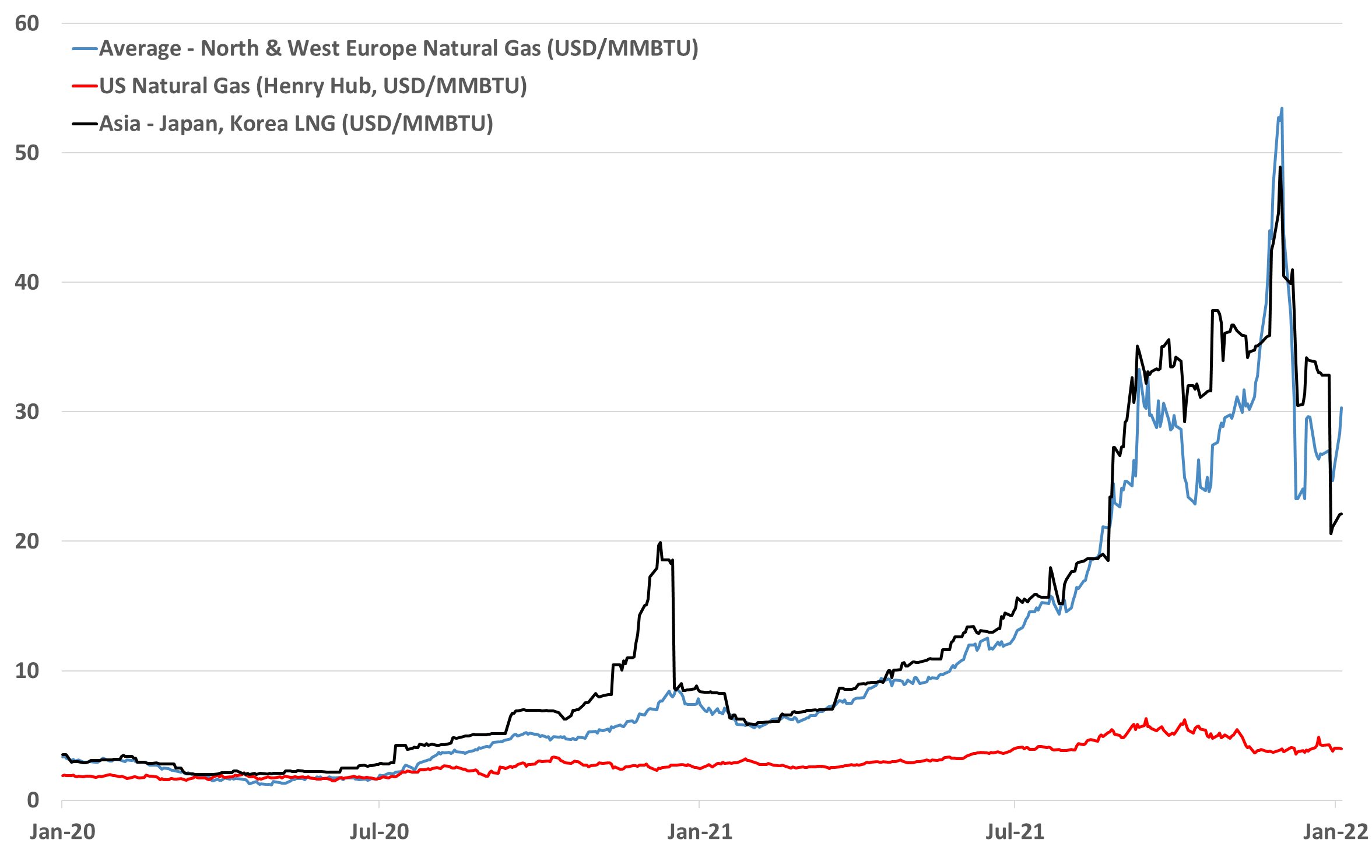

There are a couple of related topics in the charts below from today's daily report, as any conflict with Russia would almost inevitably impact European energy supply, raising prices for natural gas and pulling on as much LNG as possible. That said, we suspect that part of the recent run-up in prices has likely been to build a cushion of inventory, as much as that is possible with limited storage relative to demand.

Inflation Drivers Are Everywhere, But Especially In Energy

Dec 10, 2021 12:10:15 PM / by Cooley May posted in Chemicals, Crude, LNG, Coal, Energy, Inflation, Chemical Industry, petrochemicals, hydrocarbons, natural gas, power, natural gas prices, energy transition, EIA, Emission abatement, petrochemicalindustry, clean fuels, natural gas production, oil production, low emissions fuel

The theme of our Sunday report (to be found here) will be inflation this week and the signs that we are seeing across multiple industries which suggest it could be more problematic and worsen in 2022. One of the focuses is energy and how the pressures to be seen as good citizens is lowering investment in oil and natural gas production, while the world is not far enough advanced on energy transition to be able to substitute for the missing hydrocarbons. We would agree with many of the recent comments from some segments of congress, which is that the answer is not to curtail exports of LNG and crude, as by doing so we will starve the rest of the world of hydrocarbons and create worse shortages than Europe and China are seeing today. The better solution would be to support “clean” US production of the lowest emission fuels possible – especially for natural gas. As we have noted in prior research, with a global solutions hat on, the relatively low costs of natural gas F&D costs in the US, when combined with what we expect to be relatively low costs of emission abatement in the US, should drive more investment in the US, creating jobs and export income.