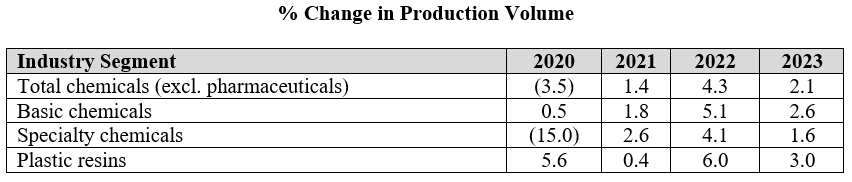

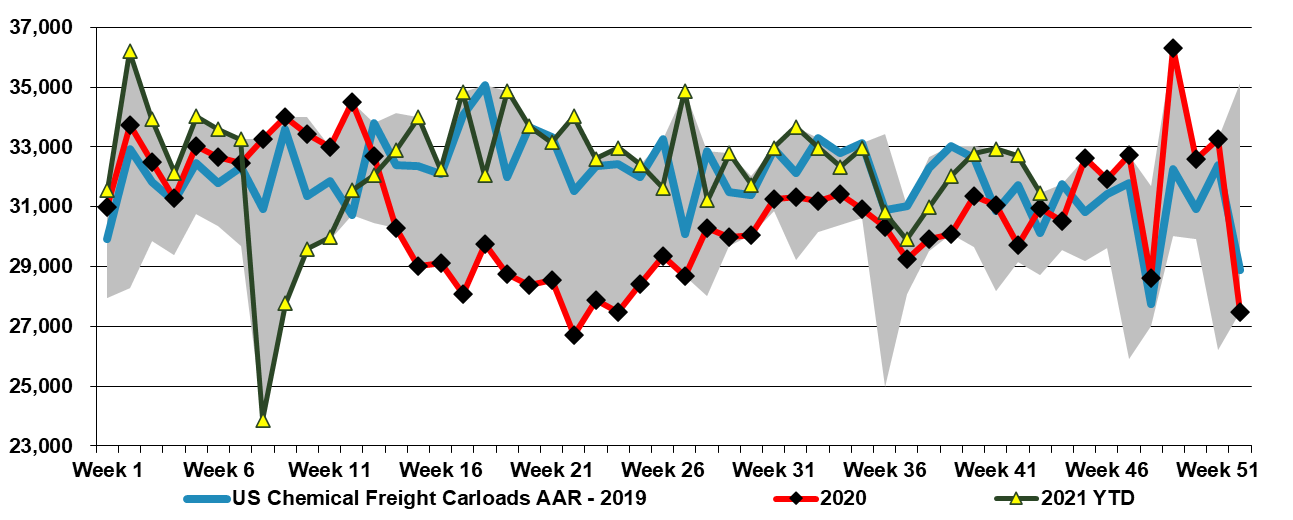

The ACC forecasts below leave us a little confused as the implication for specialty chemicals is that production declines in the US by an average of 2.0% per annum from 2019 to 2023. Given the demand that we are seeing for US manufacturing, as covered in our most recent Sunday Report, we would expect demand for all inputs to rise and it is unlikely that the gap would be filled by a swing in net imports. The lower demand from the Auto industry in 2020 and 2021 and broader manufacturing shutdowns in 2020 explains the 2020 and 2021 numbers to a degree, but it is not clear why there would not be a rebound as auto rates increase. We would also expect to see a stronger rebound in polymer production in 2022, assuming weather events are less impactful than in 2021, given substantial new capacity for polyethylene from ExxonMobil/SABIC, BayStar, and Shell.

The ACC Forecasts Look Too Conservative To Us

Dec 9, 2021 2:15:01 PM / by Cooley May posted in Chemicals, Polymers, PVC, Polyethylene, Plastics, Polypropylene, Ethylene, Auto Industry, Shell, ExxonMobil, petrochemicals, Sabic, natural gas, natural gas prices, Baystar, Basic Chemicals, manufacturing, polymer production, specialty chemicals, ACC, Polyethylene Capacity, US manufacturing, plastics resin

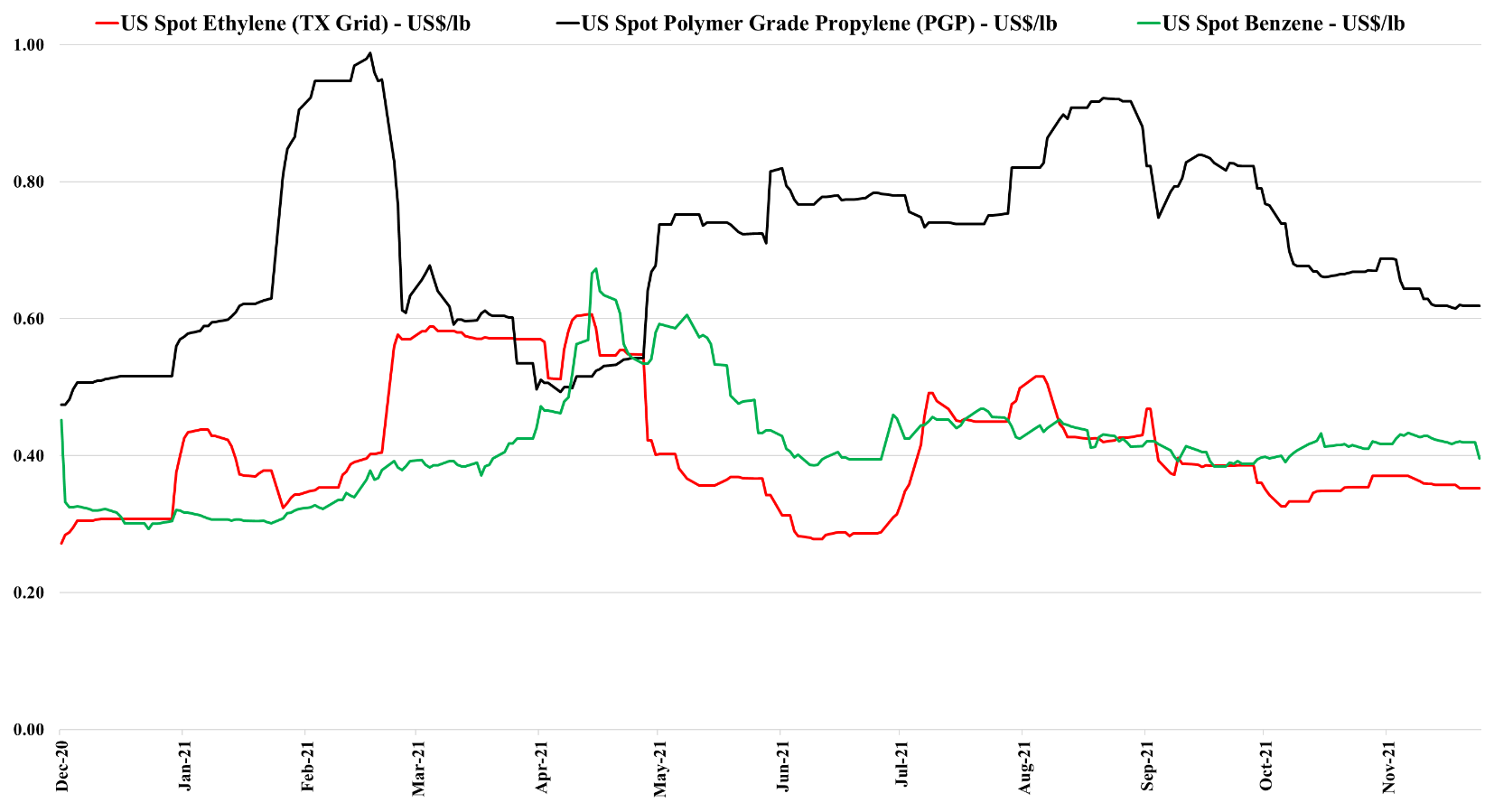

Energy Moves Could Drive US Chemical Price Volatility

Nov 30, 2021 1:46:26 PM / by Cooley May posted in Chemicals, Polymers, Propylene, Ethylene, Energy, Benzene, PGP, Oil, US Chemicals, ethane, natural gas, US ethylene, Basic Chemicals, naphtha, polymer, polymer production, NGLs, ethylene feedstocks, crude oil, chemicalindustry, US benzene

The drop in US benzene pricing is likely a function of lower crude oil pricing and the overall impact this is having on oil product values. As the US has moved to much lighter ethylene feedstocks, the proportion of benzene that is coming from refining is overwhelming and alternative values for benzene or reformate in the gasoline pool are a strong driver of US and international pricing. Lower naphtha pricing for ethylene units outside the US will also hurt benzene values. By contrast, the stronger natural gas market – through the end of last week - supported ethane pricing in the US and we saw a step up in propane pricing – which have provided support for ethylene and propylene – also note that the analysis we published yesterday in the weekly catalyst suggests that the US can export ethylene to Asia at current prices – delivering ethylene into the region below current local costs. This should keep a floor under US ethylene pricing although any further decline in crude oil prices relative to US natural gas and NGLs will close this arbitrage.

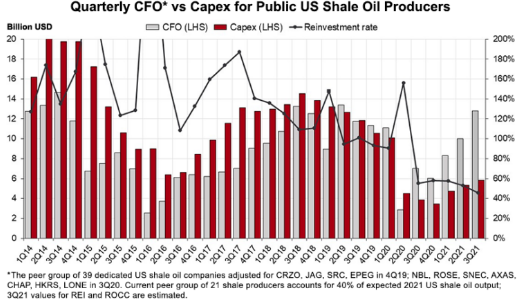

More Evidence That Higher Energy Prices Could Linger

Nov 24, 2021 2:08:46 PM / by Cooley May posted in Chemicals, Energy, petrochemicals, Oil, natural gas, NGL, climate, US Gasoline, EVs, crude oil, energy prices, chemicalindustry, petrochemicalindustry, hydrocarbon demand

We should probably link the message in the exhibit below with the write-ups in both today's daily report and today's ESG and Climate report. The drop in E&P spending relative to cash flows and the shortage signals that are evident from the current oil and natural gas prices is likely to bump into rising hydrocarbon demand for the next several years, while the rate of renewable investment tires to catch up with energy growth before it can focus on energy substitution as meaningfully as the climate agenda would like. We also cannot look at the chart below and say that it does not matter because oil is less important in energy transition than natural gas. The oil-based investments in the Permian and Eagleford plays, in particular, have significant volumes of associated gas, and much of the natural gas supply growth in the US has come from these oil-centric investments. As they slow down, natural gas supply and NGL supply will be impacted, and while we are seeing increased rig counts in the natural gas biased regions, such as the Marcellus, the potential declines from the other fields will be hard to make up for.

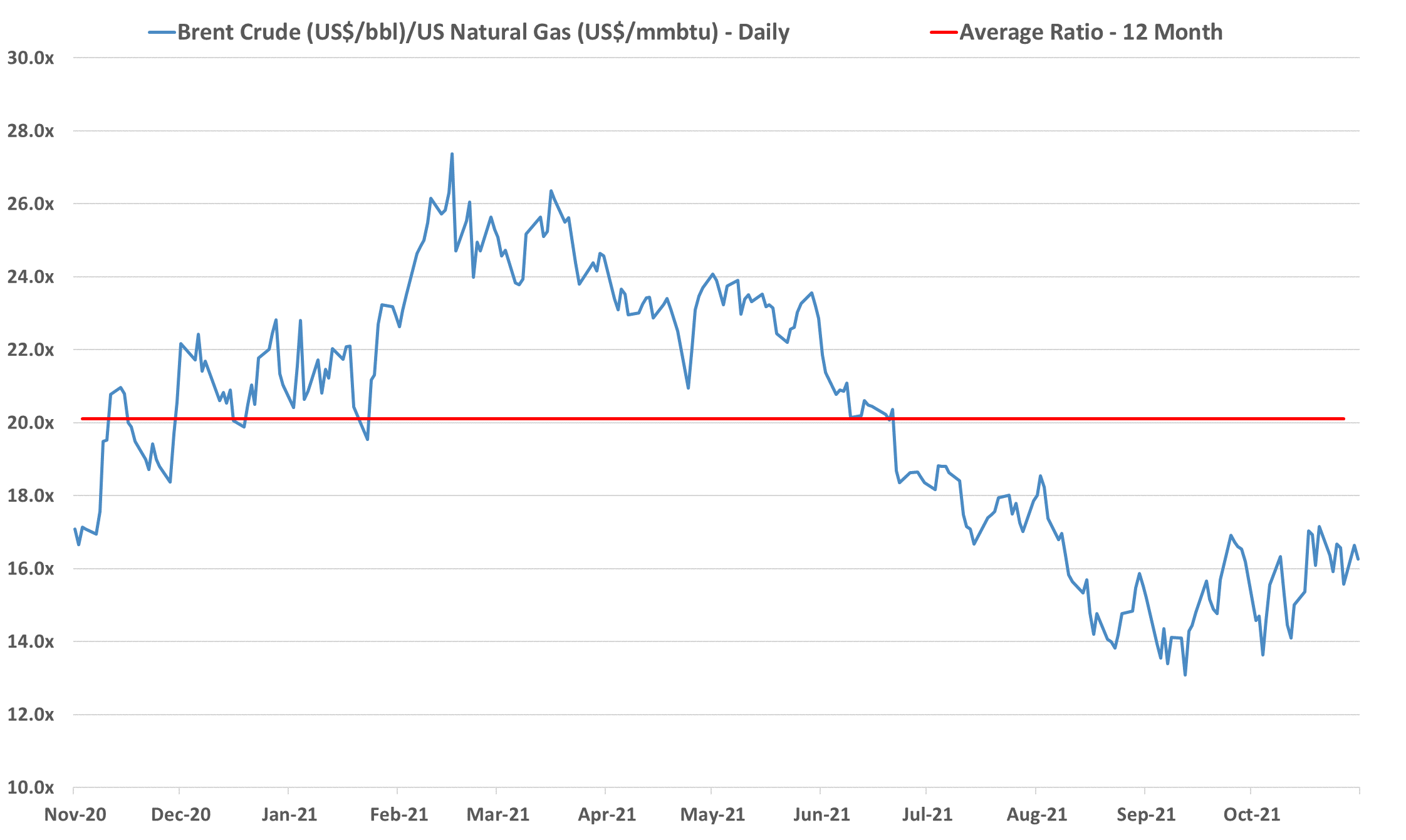

Is A Feedstock Shock In The Cards For US Chemicals?

Nov 23, 2021 1:39:28 PM / by Cooley May posted in Chemicals, Polymers, Crude, LNG, Energy, Emissions, petrochemicals, propane, carbon footprint, feedstock, ethane, natural gas, ethylene capacity, E&P, NGLs, exports, shortages, chemicalindustry, Brent Crude, butane, Mexico, fuels

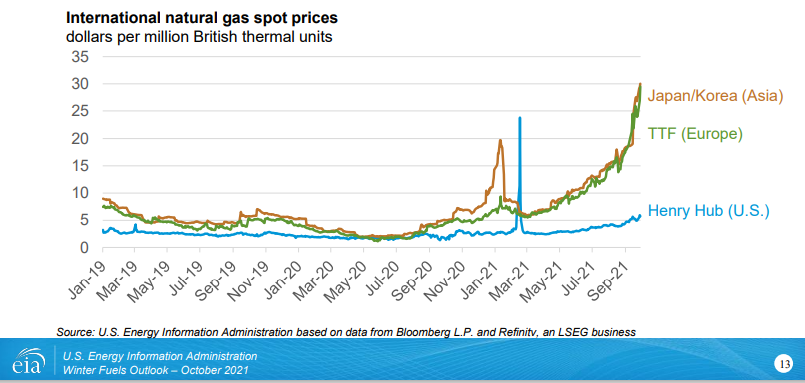

We remain concerned that natural gas E&P investment in the US remains too low to meet expected demand increases, especially for natural gas-fired power stations and LNG, but also possibly for NGLs, especially ethane, given new ethylene capacity and a fresh export market in Mexico. Near-term, natural gas prices are showing some easing relative to crude, albeit a very volatile trend – Exhibit below – but we see medium and longer-term shortages unless E&P spending increases. The new power facilities shown in the bottom Exhibit will all need incremental natural gas, and the international LNG market is so tight that as new capacity comes online in the US we would expect it to run as hard as is possible. This sets up for a market where the clearing price of natural gas in the US is at risk of being set by the marginal exporter. The price jump for domestic consumers would be dramatic and it would cause all sorts of headaches in Washington and probably intervention. We showed the incremental natural gas price in the Netherlands in our Daily Report on November 18th, and if the US price were to reflect the netback from this level, they would rise close to $30 per MMBTU. The natural gas industry needs some sort of global blessing to continue to operate as what will likely be the core transition fuel. It will be necessary to clean up the emissions footprint of natural gas, but the industry should be encouraged to invest on this basis. For those who doubt whether the US natural gas price can rise to $30/MMBTU – note that the Europeans did not think $30 was possible either.

European Polymer Buyers Are Complaining, But They Will Pay Up

Nov 18, 2021 2:02:51 PM / by Cooley May posted in Chemicals, Polymers, polymer buyers, Inflation, natural gas, chemicalindustry, petrochemicalindustry, power shortages, packaging industry

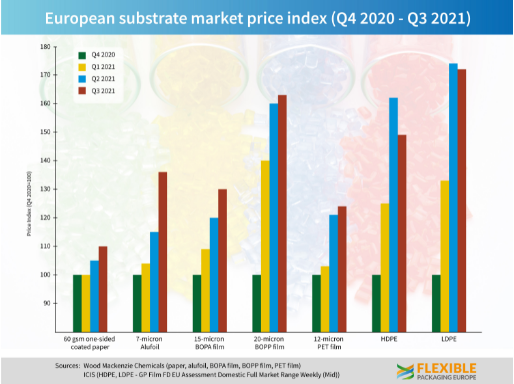

Focusing on a theme from our daily report today and our ESG report yesterday, the cost pressures in Europe are very real, and the more the power or natural gas component to your costs the more the pain and the more important it will be to raise prices. The industry and consumers, in general, have not had to deal with significant inflation for decades and it is very easy for customers to push back with a “this is transitory” argument, especially when many governments are telling that story. The supply chain is to blame to a degree, but it is largely a symptom of the underlying cause, which is that demand has outstripped supply. It is easy and more palatable to try and brush it off as temporary, but if the energy price issues persist in Europe and China and companies are not successful in passing on prices they will, at some point, choose not to operate. Alternatively, if power shortages are enough to cause interruptions, industrial users may have no choice but to close down. All this will impact product availability and buyers pushing back on price increases could find themselves without supply which is generally worse than paying more. The European packaging industry is right to raise the flag around higher prices, but their customers will pay the increases needed to ensure that they can keep operating, even if the discussions are more challenging than they have needed to be for the last 30 years.

US Ethane Markets To Tighten In 2022 Amid Greater Demand

Nov 11, 2021 1:47:28 PM / by Cooley May posted in Chemicals, LNG, Plastics, Ethylene, ExxonMobil, petrochemicals, hydrocarbons, ethane, natural gas, US Ethane, Baystar, ethylene plants, Braskem, chemicalindustry, ethane imports, oilandgasindustry, plasticsindustry, petrochemicalindustry

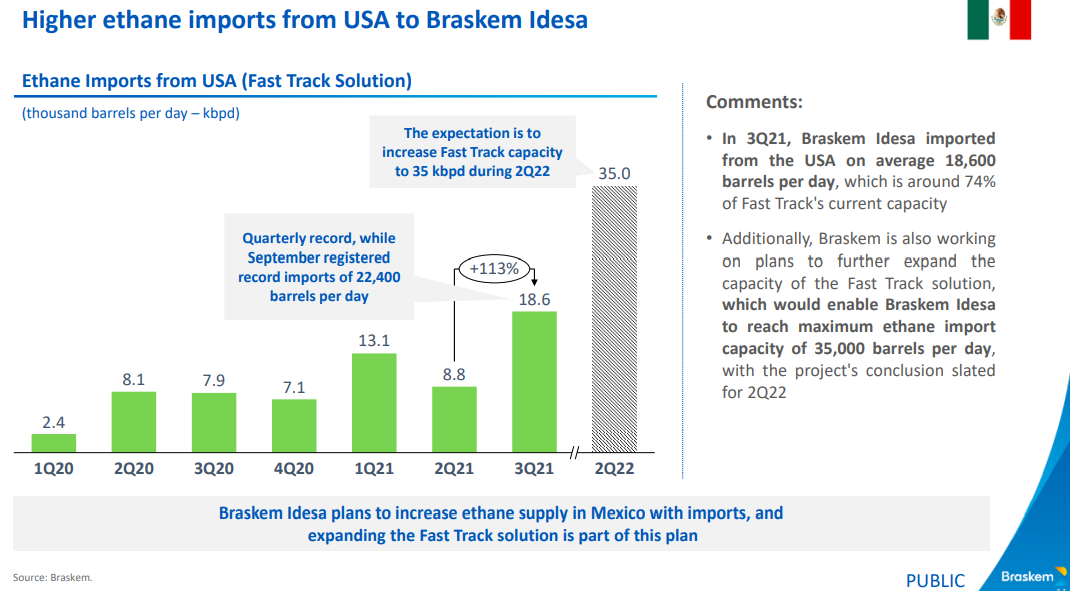

With ExxonMobil and Baystar’s ethylene plants in start-up and Shell expected to come online in Pennsylvania in 1H 2022, the news that Braskem wants to double its ethane imports from the US in 2022, adds to concern that the US may struggle to meet ethane needs at peak demand rates in 2022. We would be less concerned if we saw natural gas production rising, which is unclear for 2022, despite the expected new LNG capacity. Ethane is likely to follow any upward movement in natural gas pricing as there will be a need to bid the product away from heating alternatives. The increment suggested by Braskem in the Exhibit below is not larger in the overall scheme of US ethane demand, but every gallon may matter in 2022. See today's daily report for more.

EU Ambitions Require More Natural Gas, Supply Readiness In Question

Nov 3, 2021 1:44:26 PM / by Cooley May posted in LNG, Energy, natural gas, oil producers, energy shortages, green energy, nuclear power

The EU revision to its green energy plans to include both nuclear and natural gas-based power is a direct response to the current energy shortage and price inflation that is evident in the exhibit below. While high natural gas pricing is part of the problem, Europe's renewed willingness to include natural gas in its forward energy planning may drive local investment to produce more gas and foreign investment to provide more LNG. The move indicates that the EU does not see the current natural gas shortage as a short-term issue. The nuclear inclusion is likely aimed at delaying any further planned nuclear closures and we have seen recent delays in closing older US facilities for the same reason - closures will put too much strain on an already challenged power grid and prices for power could be pushed higher by even higher natural gas prices.

Relative Economics Keep US Chemicals On The Tracks

Oct 28, 2021 2:39:10 PM / by Cooley May posted in Chemicals, LNG, Methanol, carbon abatement, natural gas, CO2 footprint, Methanex, low carbon ammonia, chemical shipments, commodity chemicals, methanol capacity, low carbon polymers

Global commodity chemicals are often a relative rather than an absolute game, especially where there is significant international trade. The global price of natural gas has risen dramatically, especially in countries or regions where the marginal BTU is coming from imported LNG – see yesterday’s daily report for a comparative chart. The US may be seeing much higher natural gas prices but other parts of the world have it much worse, and with most of its methanol capacity in regions/areas with very competitive natural gas, it is not surprising that Methanex is upbeat. The higher natural gas price in the US is giving Methanex and other US producers the ammunition to raise prices and the higher costs outside the US mean that international volumes are going to find more attractive markets in many locations versus the US. While we have seen some moves to create low carbon polymers and low carbon ammonia, this has not come to methanol yet and methanol does have one of the largest CO2 footprints, per ton of product. While Methanex is currently talking about returning surplus cash to shareholders, there may come a time – sooner rather than later – when some of that cash gets redirected to carbon abatement.

Natural Gas: Good If You Have It, Very Bad If You Don't

Oct 27, 2021 3:11:03 PM / by Cooley May posted in LNG, Methane, Energy, Inflation, natural gas, power, chemical companies, energy inflation, energy costs, forecasts

There are lots of discussions around the durability of higher energy prices and energy inflation is a central topic on some earnings conference calls and in many of our discussions with clients, especially those at chemical companies with the unfortunate task of having to prepare a 2022 budget, which of course includes a forecast of costs. We see continuing strain on the US and global natural gas system and, behind what will inevitably be some seasonal weather-related price volatility, a stronger market that could endure for years. The rate of addition of renewable power does not seem to be able to keep up with demand growth and replacement needs caused by some fossil fuel-based power plant closures around the World. Natural gas (LNG) is the natural plug-in replacement, and we continue to see underinvestment, relative to natural gas prices, as a consequence of ESG related pressure around capital spending. We would advise all clients to look at a 2022 scenario with natural gas, and oil higher than current levels.

More LNG For The US, But Less Gasoline!

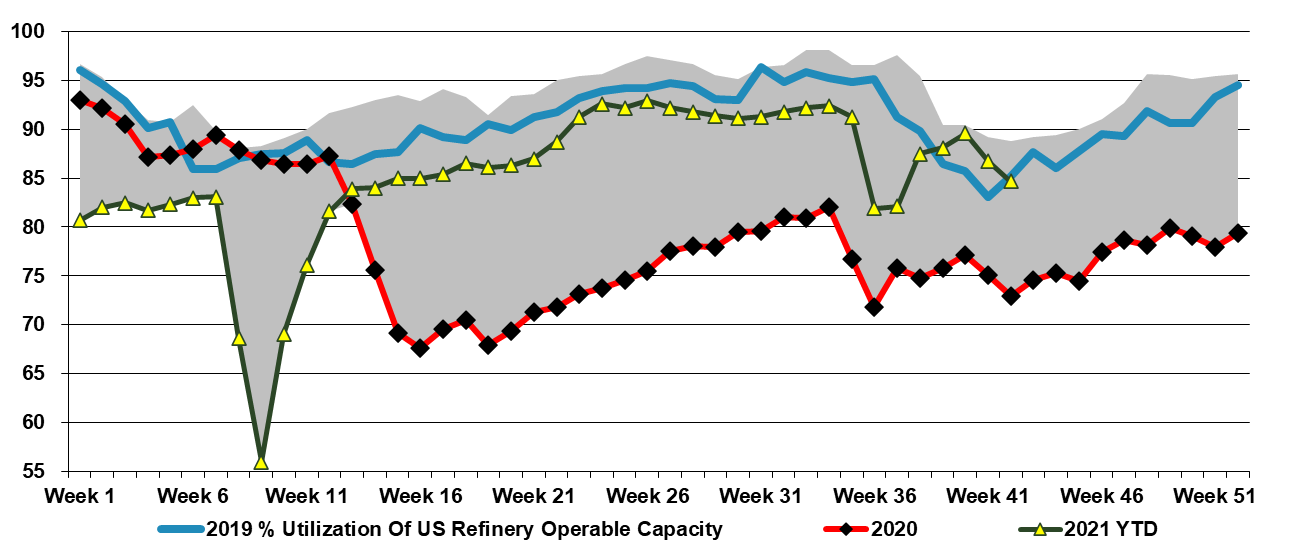

Oct 21, 2021 2:20:32 PM / by Cooley May posted in Chemicals, LNG, natural gas, Sinopec, energy shortages, US refining rates, gasoline, refinery capacity

The Venture Global LNG contracts with Sinopec are likely the big energy news of the day, as is the expectation that the West Louisiana terminal is close to completion and could begin shipping as soon as late 2021, according to a report in the Financial Times today. This would be earlier than prior guidance and will add demand pressure to a US natural gas balance that is already tight (distracted in the immediate term in our view by a wave of mild weather). With Venture Global now likely to go ahead with its second LNG facility, as well as other capacities under construction, we will likely see greater inflation in US natural gas prices without increased E&P spending.