It is likely a difficult day for the European chemical industry as all of the fuel prices that they depend on are rising quickly, which will force many difficult decisions over the coming days. There are a couple of factors to consider – what happens to costs and margins if energy prices remain inflated, and what happens if energy availability becomes an issue and plant closures are necessary. In a world that is already reeling from inflationary pressure that we have not seen in four decades, there is at least an acceptance that prices can move higher, but the energy-dependent European industrial and materials companies will need to move prices quickly and meaningfully to absorb their higher costs. If natural gas supplies from Russia are halted, Europe is likely going to need to allocate supplies, as there is no easy fix given an LNG system that is already at capacity. Industry will likely take the hit to ensure power for heating and cooling. This will drive product shortages in Europe, especially for chemicals, which will likely make it easier to get the pricing necessary to cover costs.

Troubling Times Ahead For European Chemicals

Feb 24, 2022 1:50:41 PM / by Cooley May posted in Chemicals, LNG, PVC, Energy, Inflation, Chemical Industry, natural gas, materials, feedstocks, energy prices, fuel, Europe, Russia, fuel prices, European Chemicals, industrials, Orbia

Demand Growth Continues To Favor Strong Corporate Results

Feb 23, 2022 3:56:50 PM / by Cooley May posted in Chemicals, Polyolefins, PVC, Energy, Supply Chain, manufacturing, Westlake, Building Products, construction, housing, diversification, construction market, Element Solutions

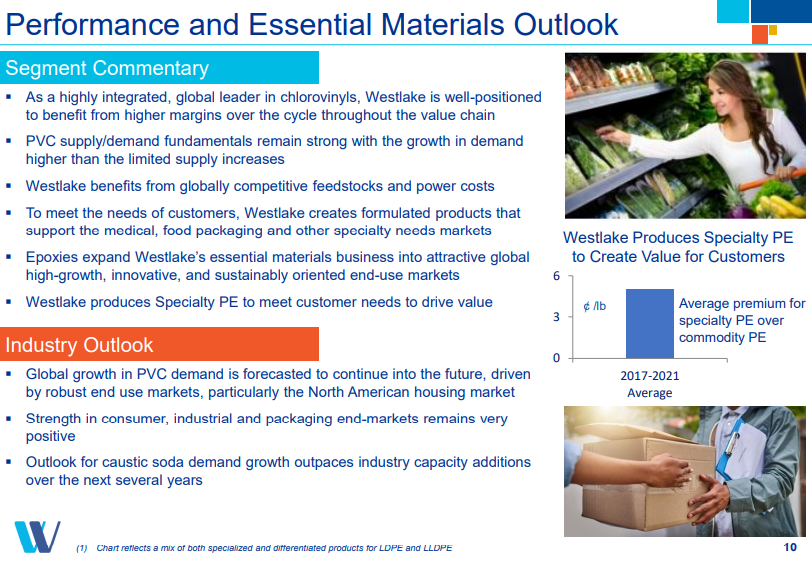

Westlake Chemical began today at a 52 week high on the back of very strong earnings but has retreated with the market. Westlake has been one of our favorite ideas since founding C-MACC in part because we believe in the diversification strategy into building products and in part because the PVC market has not seen the same level of overinvestment as polyolefins globally over the last 3 years. Westlake’s view of the housing and construction market aligns with ours and by breaking out this segment of the business Westlake should see some valuation benefit from the more stable earnings that this segment should provide. Note that the focused building products companies trade at significantly higher multiples than chemicals. We expect Westlake to get earnings and multiple boosts from here.

Abundant Hydrocarbons Could Keep The US Advantaged, Even Considering Emission Goals

Feb 16, 2022 1:41:45 PM / by Cooley May posted in Chemicals, Carbon Capture, Coal, Methanol, CO2, Energy, Emission Goals, Ammonia, hydrocarbons, Oil, natural gas, urea, CF Industries, oil production, energy demand

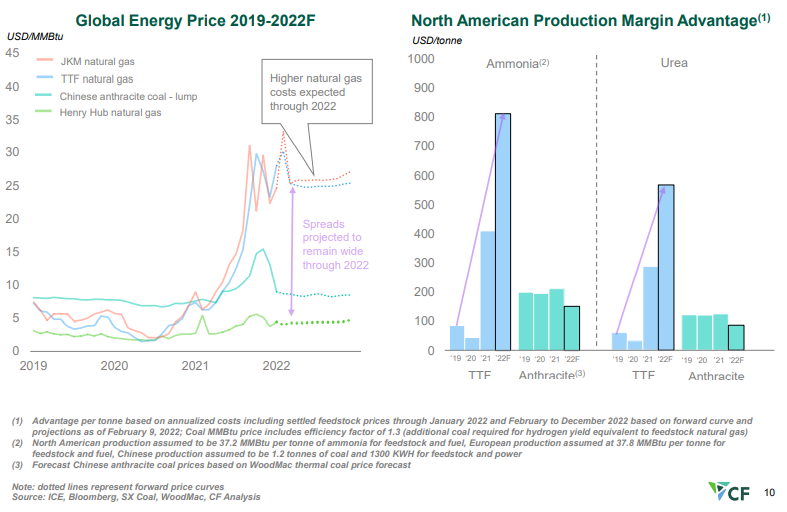

The CF slide below shows very clearly the US competitive edge when it comes to making anything that has a natural gas base, and while we tend to talk mostly about ethylene, ammonia, urea, other ammonia derivatives, and methanol are all seeing significant cost advantages. The Chinese coal-based costs are better than those in Europe and Asia based on natural gas but margins remain well below those in the US. The challenge with the coal-based chemistry in China is that it has substantial CO2 emissions, and the facilities were not designed for carbon capture. As China develops a carbon cap and trade market and as these facilities get included, costs will rise significantly.

Supply Disruptions Today But Chips With Everything In 2023

Feb 15, 2022 12:21:04 PM / by Cooley May posted in Chemicals, Inflation, Chemical Industry, Supply Chain, oversupply, downstream, chemical companies, demand, Supply, OEM, inventories, Michelin, semiconductor

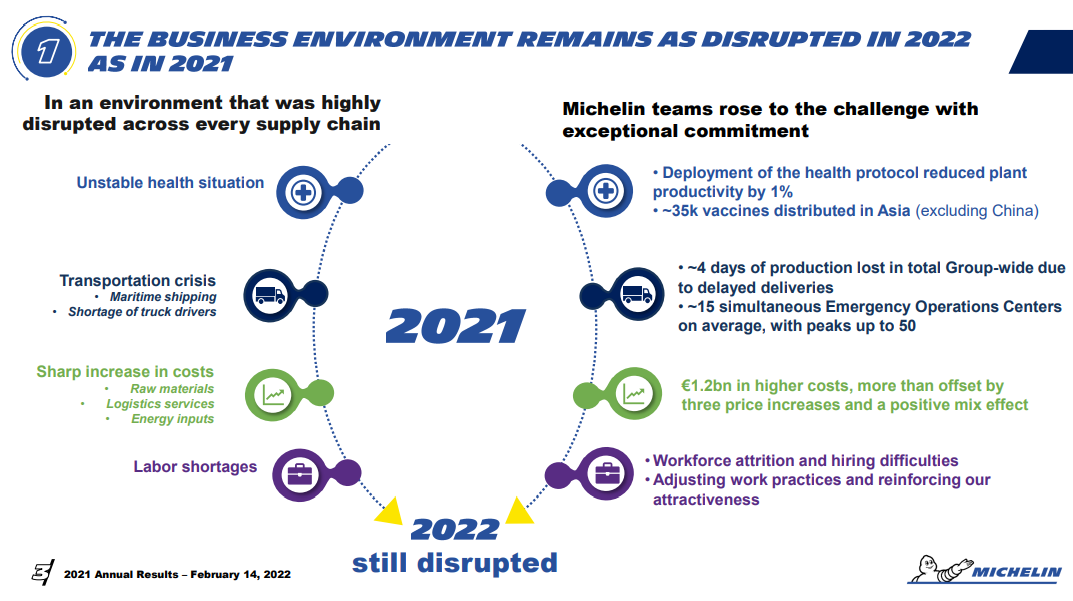

More earnings releases and more discussions of disruptions and higher costs! One thing that is clear from all the reports we have followed, whether from basic chemical companies or those downstream, is that no one has any expectation that the supply disruptions and inflationary drivers are going to end soon. In our Sunday Thematic, we talked about the possibility of demand remaining robust and possibly absorbing new supply in 2022 because of further inventory builds. The idea is that holding more working capital, while possibly less efficient financially, may be more prudent from a business continuity perspective, especially given the reputational risk of failing to fulfill customer orders. While there is appropriate concern that interest rates could rise significantly, lending rates are so low that the cost of holding more inventory would be immaterial for many companies. For many products in the chemical chains and across materials more broadly, global oversupply, where it exists, is not high, and a further upward swing in inventories in 2022 could easily keep tight markets tight and swing some more balanced markets to shortages.

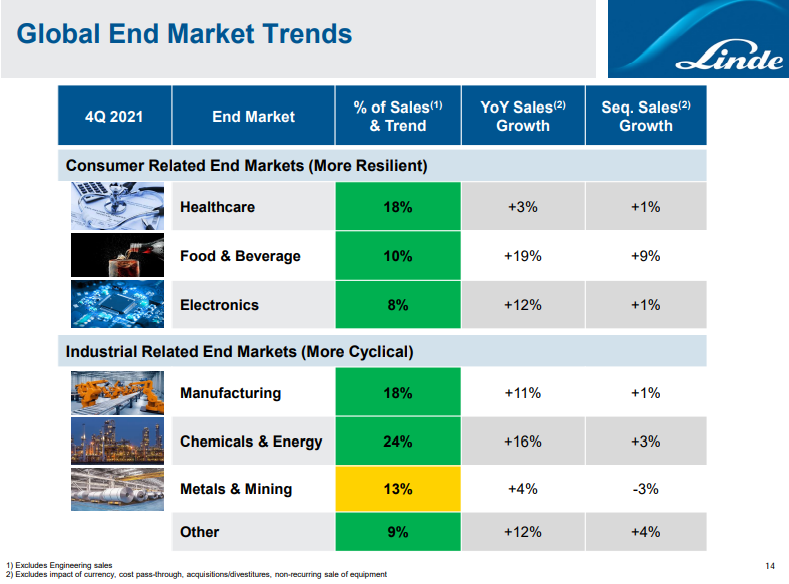

Linde: Always A Good Barometer For Industrial Activity

Feb 11, 2022 1:54:58 PM / by Cooley May posted in Hydrogen, Chemicals, Energy, Emissions, Air Products, Air Liquide, Industrial Gas, manufacturing, mining, electrolysis, Linde, raw material

While the Linde results were very strong and surprised to the upside, we also want to focus on what messages they send about the broader economy. As recently as 10 years ago all of the industrial gas companies' results provided a reasonable barometer on the state of the industrial and other parts of the global economy. Industrial gases are an enabling raw material or process gas for so many industries that their direct use is generally a function of operating rates for the industry that they serve. Over the last 10 years, Air Products has deviated from the traditional model, with some very large investments targeting specific projects in Asia and the Middle East and their results are a less useful measure of overall economic activity. While both Air Liquide and Linde continue to reflect the broad economic backdrop well, both could be dragged into large projects around hydrogen over the coming years, and depending on how they choose to report earnings, we could lose the tangential “information” in their reported results. For now, the Linde results are very supportive of the broader industrial-economic strength that is being reflected in earnings and guidance across many industries, including chemicals and refining. The company has added comparisons with 2019 to show how much underlying growth has happened over the two years. While inflation and interest rate increases could slow things down, the Linde numbers confirm that we have a very positive demand backdrop today, and the company’s guidance would suggest that they think it can continue.

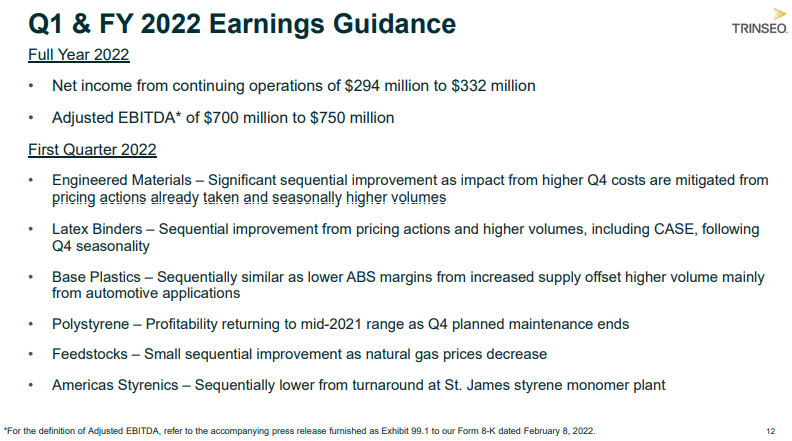

Chemical Sector Reports Suggest Inflation Is Here For A While

Feb 10, 2022 1:23:56 PM / by Cooley May posted in Chemicals, Polymers, Inflation, Supply Chain, feedstocks, Trinseo, Earnings, US chemical rail, demand strength, mega-cycle

Part of our confidence/concern that prices can continue to rise in the chemical space in general stems from what seems to be very strong demand – again confirmed in earnings reports overnight, as well as in the rail data from today's daily report, as well as inventory data that suggest we are below recent ratios to shipment trends. The inventory piece is the great unknown here because the supply chain shocks of the last 20 months will have reset expectations around “safe” levels of inventory and it is hard to judge whether the new “comfort” normal will be back to the trend in the chart or 50% higher! If the new comfort level is materially higher than in the past, demand growth will remain strong and price momentum could continue through 2022. Our expectations for a mega-cycle in basic chemicals and polymers – targeting late 2023 and 2024 could be dragged forward because of higher apparent demand the time to buy the equities could be now, on that basis.

Demand Strength Is Showing Through The Inflation Noise

Feb 9, 2022 12:36:45 PM / by Cooley May posted in Chemicals, Paint Companies, manufacturing, construction material, specialty chemicals, construction, OEM, AkzoNobel, paint, ICL, bromine, paint prices

Akzo Nobel is somewhat unusual among the more specialty chemical (in this case paint) producers, as the company has managed to raise prices fast enough to offset costs and produced strong positive results for 4Q 2021. Not having auto OEM exposure will have helped Akzo and the company is well-positioned to manage pricing through its stores in many cases. It is a relatively safe environment to push up paint prices as all of the competitors have the same cost pressure and need to do the same, and demand remains strong – consumers are buying paint.

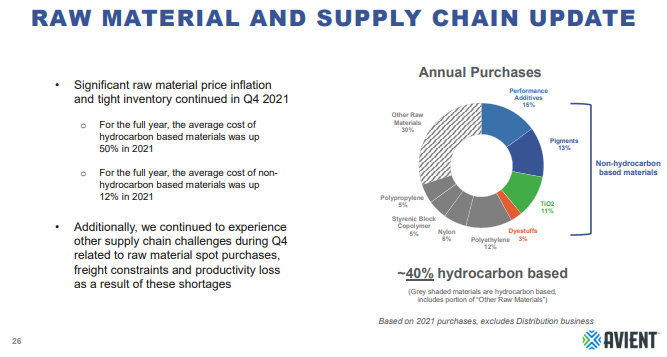

Raw Materials Inflation Not Over For Specialty Materials

Feb 8, 2022 3:04:30 PM / by Cooley May posted in Chemicals, Polymers, Plastics, Raw Materials, raw materials inflation, Chemical Industry, petrochemicals, US Chemicals, Avient, US Polymers, specialty chemicals, materials, DuPont, plasticsindustry, supply chain challenges, logistic inflation

As Avient and the linked paint article remind us, there are sectors of the US chemical industry that rely on imported products – in these cases pigments, and the supply chain challenges and logistic delays have caused production problems in the US and price increases in 2021. The automotive segment of the paint industry has seen lower demand because of the auto OEM production slowdown, and pigment shortages and price spikes would likely have been worse if automakers had been running at full rates. There is no sense of impending relief in the logistic issues as we go through 4Q earnings reports and we could continue to see issues for a while. This should be good for US-based pigment suppliers, but while Chemours, Venator, and Tronox all have capacity in the US, they also have capacity outside the US which likely faces some supply chain challenges.

Ashland's Results Provide Another Example of Materials Inflation

Feb 3, 2022 1:40:02 PM / by Cooley May posted in Chemicals, Materials Inflation, Inflation, Chemical Industry, Supply Chain, downstream, specialty chemicals, materials, downstream producers, Ashland, logistic constraints

With the linked Ashland release, we see another example of a downstream chemical maker struggling with higher input costs and general logistic constraints, and an inability to push through pricing quickly enough to avoid a margin squeeze. The opaqueness that Ashland discusses concerning some of the planning metrics for the near-term is impacting forecasts and estimates for many more companies than just Ashland but given the costs and the supply chain challenges, all are encouraged to push through pricing aggressively, and this suggests that we are far from done with the materials inflationary pressures that we have discussed at length in prior reports and the higher costs of some of these specialty chemicals will start to impact customer margins through 2022. Almost all the earnings reports that we see discuss strong end-market demand and whether this is final customer pull-through or a need to address chain inventory or both, it should support further price initiatives. For more on our inflation views see Inflation (Especially Energy Costs) – Biggest 2022 Wildcard.

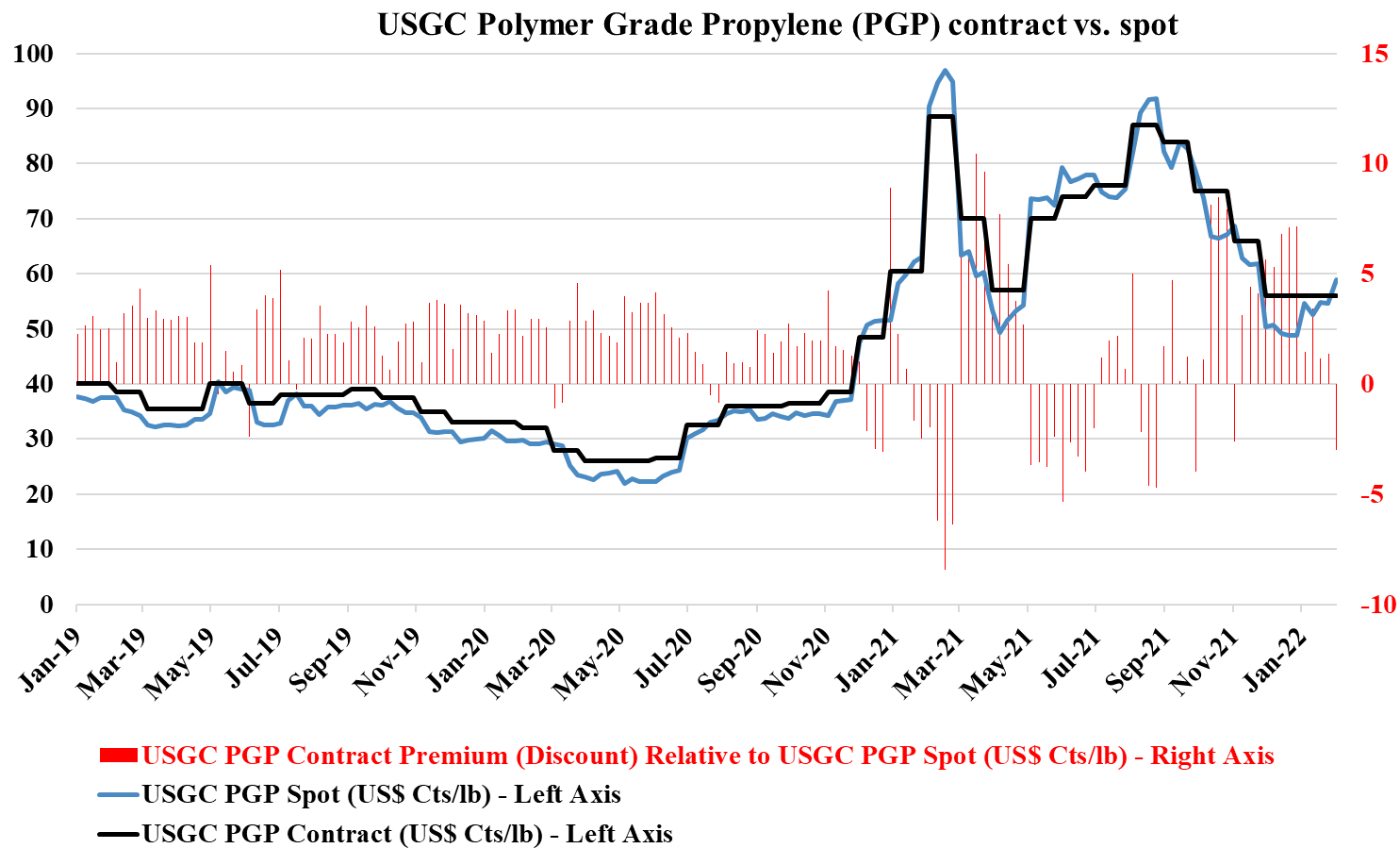

US Chemical Price Support Higher On Strong Demand

Feb 2, 2022 12:42:43 PM / by Cooley May posted in Chemicals, Polymers, Propylene, US Chemicals, Logistics, US propylene, propane prices, demand strength, propylene contract prices, propylene spot prices

In a recent report, we discussed the relative demand strength in the US, as well as the high costs of importing chemicals and polymers into the US and suggested that higher energy and feedstock costs could arrest price declines in the US at levels that still drive significant profitability for US producers. With that in mind, it is interesting to note the upward move in propylene spot prices in reaction to higher propane prices and the resulting flat settlement in propylene contract prices.